Economic slowdown: Massive Layoffs or Novel Job Opportunities

Present times mark the onset of the fourth industrial revolution. However, the economic slowdown experienced across the globe in the past is jeopardizing the esteemed progress towards the Sustainable Development Goals (SDGs). Although, the World Economic Situation and Prospects Report 2024, presents a sobering picture of the global economic landscape, backed by the outperformance of the global economic growth expectations in 2023, simmering geopolitical tensions and the growing intensity and frequency of extreme weather events are concerning the analysts and strategists.

Additionally, amongst the remarkable resilience demonstrated by several major economies, the tight financial conditions still pose a risk to global trade and industrial production. Furthermore, the deceleration in global GDP growth expectations from 2.7% in 2023 to 2.4% in 2024, is signaling a continuity of sluggish growth trends.

The US is expected to see a drop in GDP growth from 2.5% in 2023 to 1.4% in 2024, attributed to a drop in consumer spending due to escalating interest rates and a softening labor market. Meanwhile, China is projected to experience a moderate slowdown, with a GDP growth deceleration estimated at 4.7% in 2024, down from 5.3% in 2023. Europe and Japan also face significant economic headwinds, with growth rates forecasted at 1.2% for both regions in 2024.

The South Asian region exhibited considerable resilience to the economic slowdown. The regional GDP grew by 5.3% in 2023 and is projected to grow by 5.2% in 2024. This was driven by a robust expansion in India, which remains the fastest-growing large economy globally. India is projected to grow by 6.2% in 2024, owing to the rise in the domestic demand for manufacturing and services.

East Asia is projected to experience a moderate slowdown, with a growth decline of 6.12% in 2024. Also, the Latin America and the Caribbean region are expected to slow down, exhibiting a fall from 2.2% in 2023 to 1.6% in 2024. This is majorly attributed to the tighter financial conditions and reduced exports, in the region.

The economic slowdown has a huge impact on the global labor market, global inflation, global investment trends, international trade, international capital markets (finance and debt), and other macroeconomic factors.

A representative case of the effect of the economic downturn on the labor market was evident in the layoff announced by Google for approximately 12,000 roles. Google laid off its employees in the US, in January 2023. Furthermore, the CEO Sundar Pichai, mailed the employees about the prospective layoffs that are expected to take place in other countries. The primary reason for the delay in the layoffs in other countries is the compliance requirements with the local laws and practices.

The CEO added that the company hired the workforce to the company's requirements to match the dramatic growth witnessed by the sector. However, the economic realities have been different from the forecast, ushering the decision.

This is a trivial indication of the major problem. 2024 saw a layoff of at least 31,971 workers at the US-based technology companies. The number was over 93,000 in 2022, and reached the peak of more than 191,000 in 2023, making the year hazardous for the industry. 2023 marked some of the biggest workforce reductions in 2023, by some of the major MNCs. This included the layoff of 16,080 employees by Amazon, 11,158 by Microsoft, and 10,000 by Meta.

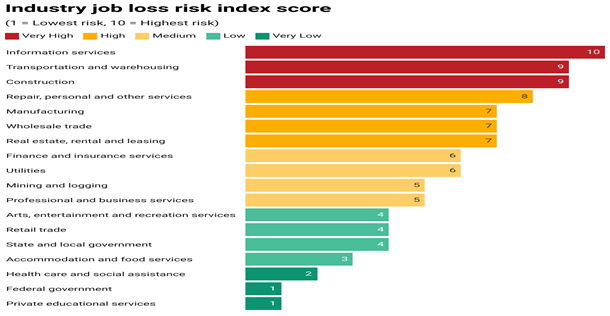

According to The Conference Board Report, the information services sector ranked the highest on the risk of job loss, amid the recession. This was directed by the increasing of interest rates by the federal government, in an attempt to control the rising inflation. This has resulted in a rise in the cost of borrowing and servicing debt, calling for the strategic decision of laying off by the companies. The departments that have been majorly impacted were the ones that saw a steep rise due to the COVID-19 circumstances. These include telework, e-commerce, distance learning, and more.

Additionally, the workers in the transportation & warehousing, construction, and repair, personal & other services are also at higher risk of job loss. The transportation & warehousing sector is cutting down on the workforce, as the preference for online shopping reduces in the post-COVID-19 era. Furthermore, job losses in the construction, repair, and maintenance industry have been due to the weakening of the housing market. However, the trend has not been uniform across industries. The accommodation & food services industry, Government, private education, and health and social assistance are not expected to face significant job losses.

Job Loss Risk Witnessed by Different Industries

Source: The Conference Board

The FMCG (Fast-Moving Consumer Goods) industry was also hard hit by the economic slowdown. The companies in the sector have also slowed down the investments in employees and diverted the funds toward advertisement expenses. Additionally, salaries and wages have witnessed a sharp decline in 2023, as against 2020. Further, the volume growth has been moderating in the sector leading to a lower variable pay and percent increment. This has also affected the FMCG majors in India. The downward surge in sales lies as the major challenge, faced by the industry. The companies are also refraining from new recruitment drives. The current industry condition is also degrading the investor’s confidence, resulting in a considerable erosion in the share prices of FMCG giants such as ITC and HUL.

The job losses can be a function of any one or a combination of the factors including exposure to labor shortages, sensitivity to monetary policy, job function and education, COVID-19 recovery, labor demand gauge, and age composition and experience. However, the impact of labor shortages has been considerably low during the current layoffs. This is explained by the rising challenges in recruitment and retention at the end of the employers. Hiring was expensive due to the larger compensation packages (wages, benefits, bonuses), which were necessary to both attract and retain employees. Some other factors include an aging population, tighter immigration laws, fewer multiple job holders, and residual effects of COVID-19.

Furthermore, the introduction of Artificial Intelligence (AI) and Machine Learning (ML) models have also been the major contributors to the current mass layoff drive. These have also impacted the finance industry in addition to the tech industry. The emergence of these technologies is posing a great challenge to white-collar jobs. A closer look at the scenario indicates that where the technologies are eliminating the traditional jobs they are introducing new job roles. Thus, it can be summarized that these technologies are not eliminating jobs but rather transforming them.

Thus, the economic slowdown was not as harsh for everybody. The same is evident in an increase in global employment by the US Multinational Enterprises (MNEs). According to the US Bureau of Economic Analysis (BEA), global employment by U.S. multinational enterprises (MNEs) increased by 1.1% to 43.3 million workers in 2021, from 42.9 million workers in 2020. The figures report the employment on the operations and finances of the US parent companies and their foreign affiliates. Employment abroad by majority-owned foreign affiliates was largest in India, Mexico, and the UK.

Additionally, the value added by U.S. parents, increased 27.7 % to $5.1 trillion, making them 24.4 % (by value) of the total US private-industry. The major contribution to the same was by the foreign affiliates, which accounted for an increase of 18.6% to $1.6 trillion. Value added by majority-owned foreign affiliates was largest in the UK, Canada, and Ireland. Similarly, the employment by US parents was largest in manufacturing and retail trade. Hence, it is evident that the economic slowdown has not impacted all the regions and sectors alike. On the contrary, it has created growth opportunities for some.

Note: US parents refer to the MNEs that have parent companies in the US and also operate through foreign affiliates globally

In a nutshell, the economic slowdown has been hard for a significant subset of the population, however, it has also presented opportunities for others. The slowdown has remarkably impacted the US, however, several sectors in the region have been resilient to ill effects. In fact, industries such as retail trade and economies such as India have reported growth even in the tough times. Further, the sufferings for sectors such as information services, transportation & warehousing, construction, and repair are the outcomes of the strategic decisions made during COVID-19 and the negative results of the COVID-19 era.

The stringent monetary and fiscal policies have also contributed to the slowdown, owing to the federal efforts to control inflation. These were further supported by the other macroeconomic factors, and the improvements in the big picture hold hope for a better future. The darkness is anticipated to come to an end, and 2024 holds high expectations on the end of analysts, strategists, and businesses.