Expansion of BRICS: Impact on Global South

In recent news, coming from the 15th BRICS summit happening in Johannesburg, South Africa, BRICS has invited six new countries to join including Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and UAE. There has been debate happening around the expansion of BRICS for quite some time now between Brazil, Russia, India, China, and South Africa and finally, all have agreed to the expansion. The new membership will be effective from January 1, 2024.

What Happened at the BRICS Summit?

Nearly 40 countries have expressed interest in joining BRICS out of which 22 formally applied to join the bloc, which represents a quarter of the global economy and more than three billion people. Out of which leading BRICS countries agreed to include Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and UAE.

All six new entrants have signed agreements to join China’s Belt and Road Initiative (BRI), which India has not become part of. The push for expansion was largely driven by China but had the backing of South Africa and Russia, which is grappling with its diplomatic isolation because of the Ukraine war.

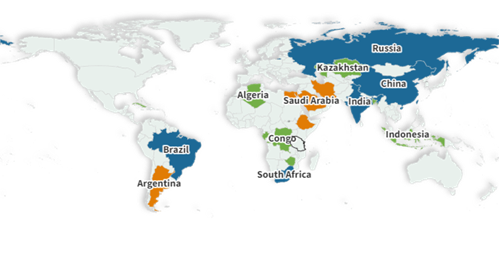

The new map of BRICS countries would look like this from 2024-

Effects on Various Industries in the Global South

Oil Industry

With the inclusion of Saudi Arabia and UAE in the BRICS, the oil prices in the Global South surely going to be impacted positively. Trade relations among existing and new BRICS countries for oil import and export will improve, providing a chance for other countries to flourish in different industries.

• The addition of Saudi, the UAE, and Iran would see the BRICS group make up almost 42% of global crude oil output. As for Saudi Arabia, it is the largest crude oil exporter. In 2022, the Kingdom exported around 7.3m b/d of crude oil, which makes up a little more than 17% of global crude oil exports.

Defence Industry

BRICS expansion can transform the Global South defense industry since the major exporters of defense supplies will be united with BRICS. The major aim of BRICS expansion is to promote peace, security, development, and cooperation and reduce the disbalance and dominance of other economies. BRICS will open the doors for private investors in the defense industry for the development of the Global South.

Moreover, China-India, China-Russia, Russia-Ukraine, and many more geographical dynamics can also be handled well on the BRICS platform, and with the expansion more collaborations and development are expected in the defense industry, especially for import.

Space Industry

The most talked about industry today, after Russia’s moon craft Luna-25’s crash, and India’s Chandrayaan-3’s success in space and both countries lie in BRICS. The third country that is consistently contributing and developing its space technology is China- also a part of BRICS. We can say these three countries can form multilateralism in Outer space.

There is no need to explain how much the Global South space industry is going to develop with new technology and innovation with the expansion and collaborations of all the countries of BRICS. It will strengthen the economy of each of the nation.

Currency Exchange

One of the most discussed topics around the BRICS expansion was to reduce the dependency on the US dollar called de-dollarisation and as a part of this initiative BRICS countries are pushing common currency for the trade and with this expansion, BRICS will have stronger and faster ground to achieve so.

• The dollar's share of the central bank's foreign exchange reserves has gone down, but it still has a strong presence in trade, assets, debt issuance, and the global currency market.

• The euro might seem like a contender, but it's only seen in Europe.

• In the BRICS countries, China's use of the renminbi swap line has helped the currency in trade and reserves, and Russia's aversion to the dollar has given the CNY an extra boost, but China's capital controls and low bond issuance are still a problem.

• The growing use of other currencies doesn't seem to be hurting the dollar, but it's just adding to the competition among regional currencies as the world's trade and capital flows become more fragmented.

• No other currency has challenged the dollar's status as the issuing currency of choice. It was a major factor in getting rid of Sterling's crown last century.

A common currency by BRICS can challenge the dollar for the inexorable decline in the use of the dollar