1,3-Butanediol Market

1,3-Butanediol Market Size, Share & Trends Analysis Report by Type Bio-Based, and Petro-Based). by Grade (Industrial Grade, and Cosmetic Grade). and by Application (Cosmetics, Polyester Resins, Plasticizers, Food and Beverages, and Others). Forecast Period (2024-2031).

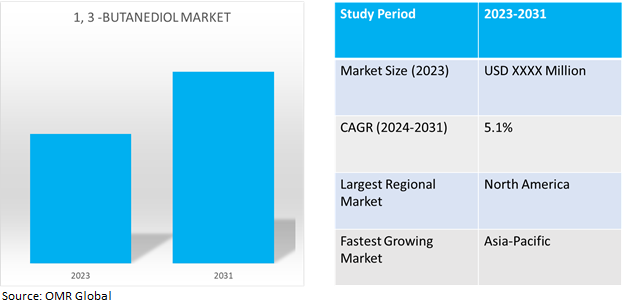

1,3-butanediol market is anticipated to grow at a CAGR of 5.1% during the forecast period (2024-2031). 1,3-butanediol is an organic compound and an important commercial chemical used as a solvent, de-icing agent, and co-comonomer in coatings, construction, rubber, food and beverages, and personal care, pharmaceutical, and other industries. It is majorly used in skin and personal care products due to its high solvability, safety,and conditioning features including lotions, moisturizers, shampoos, face masks, sunscreens, and many others.

Market Dynamics

Rising Raw Material Consumption of Coatings and Construction Industry

The 1,3-butanediol industry has seen a positive upward trend due to the rising consumption of raw materials in the coatings and constructionindustry. It serves as a solvent and co-monomer in the manufacturing of certain polyurethane and polyester resins. For paint, coatings, adhesive, and many others in the coating and construction industry. It is also used to manufacture non-metal surface treatment, putties, plasters, fillers, and sealants. As per the American Coatings Association 2022 report, the global coatings raw material market is estimated to be valued at approximately $63.5 billion on 34.3 million metric tons of materials. Raw materials used in the manufacturing of paints and coatings represent a relatively small (5.0%), but extremely important component of the $4.5 trillion global chemicals industry. All the world’s leading chemical producers are active in the coatings market, and many coatings raw materials are used in other industries as well, including plastics; synthetic lubricants; adhesives; sealants; household, industrial, and institutional cleaners (HI&I); personal care products; paper; plastics; water treatment and many others.

Growing Demand for Cosmetics and Personal Care Products

In recent decades, especially in post-2000s, the cosmetics and personal care industry has seen exceptional growth figures in several categories including skin care, hair care, babycare products, perfumes, body care, and others. 1,3-butanediol is mainly used in moisturizers, sheet masks, shampoos, conditioners, serums, sunscreens, and others as a conditioning agent and solvent. According to the Personal Care Products Council (PCPC) report in 2022, personal care industry grew in the US in nearly every category, generating a trade surplus of $2.6 billion in 2022, the second largest surplus in the manufacturing sector, and has generated a trade surplus every year between 1990 and 2022, whereas, employment in the US personal care products industry increased by 35.0% between 2001 and 2022, outpacing US private employment’s increase of 18.0%.

Market Segmentation

Our in-depth analysis of the global 1,3-butanediol market includes the following segments by type, grade, and application:

- Based on type, the market is bifurcated into bio-based and petro-based.

- Based on grade, the market is bifurcated into industrial grade and cosmetic grade.

- Based on application, the market is sub-segmented into cosmetics, polyester resins, plasticizers, food and beverages, and others.

Bio-Based To Remains to Become theLargest Segment

Based on the type, the global 1,3-butanediol market is sub-segmented into bio-based and petrol-based. The bio-based 1,3-butanediol market has a promising future. As environmental concerns grow, so does the demand for sustainable and bio-based chemicals in a variety of industries. The change in policies and regulations by several governments for the adoption of eco-friendly raw materials and the sustainable process is expected todrive the demand.

Industrial Grade Is To Be the largest Sub-Segment

Industrial grade 1,3-butanediol is largely utilized in the production of chemicals such as polyester resins, plasticizers, and solvents. It finds use in a variety of industries, including automotive, textile, and medicinal, coatings, construction, and aerospace. The implication of 1,3-butanediol has comparatively increased in recent years. For instance, polyester resins, produced using bio-based 1,3-butanediol, are widely used in industries like automotive and construction for their high strength and durability. Also, plasticizers made from this compound enhance the flexibility and workability of plastics.

Commercial is Expected to Dominate the 1,3-Butanediol Market

In the application sub-segment, cosmetics may dominate the market as major applicationsof 1,3-butanedio havebeen registered in the cosmetics and personal care industry due to the high utility of the industry. It is widely used in moisturizers, shampoos, sunscreen, conditioners, face masks, and other products as a solvent, conditioning agent, humectant, and viscosity controller. With demand for personal care products rising each year it is expected that the chemical will thrive in the cosmetics industry.

Regional Outlook

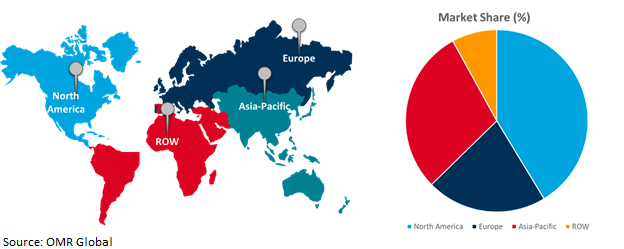

The global1,3-butanediol market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Holds Highest Share in Global 1,3-Butanediol Market

North America dominates the globe's 1,3 butanediol market due to the presence of modern technologies and manufacturing facilities in the region. Furthermore, this region has a high end-product consumption rate including pharmaceuticals, personal care products, polyester, and food and beverages. As per the National Institute of Health(NIH) in 2021, overall pharmaceutical expenditures in the US grew 7.7% compared to 2020, for a total of $576.9 billion. Whereas drug expenditures were $39.6 billion (an 8.4% increase) and $105.0 billion (a 7.7% increase) in nonfederal hospitals and clinics.

Global 1,3-Butanediol Market Growth by Region 2024-2031

Asia-pacific is the Fastest Growing in 1,3-Butanediol market

- Most end-user industries including pharmaceutical, personal care, polyester, and coatings industriesare rapidly growing in the Asia-Pacificregion.

- Ample support by the government for setting up manufacturing businesses in both end-user as well as raw material industries.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global 1,3-butanediol market include OQ Chemicals GmbH, KH Neuchem Co. Ltd, Daicel Corp., Biosynth Ltd., and Accela Chembio Co., Ltd. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in December 2023, Biosynth, a supplier of critical raw materials to the life science industry announced its acquisition of VIO Chemicals, a Zurich-based company with leading chemical R&D expertise and a global network of large-scale manufacturing partners.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.Key companies operating in the global 1,3-butanediol market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Accela Chembio Co., Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Biosynth Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Daicel Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. KH Neuchem Co. Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. OQ Chemicals Gmbh

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global 1, 3-Butanediol Market by Type

4.1.1. Bio-based

4.1.2. Petro-based

4.2. Global 1, 3-Butanediol Market by Grade

4.2.1. Industrial Grade

4.2.2. Cosmetic Grade

4.3. Global 1, 3-Butanediol Market by Application

4.3.1. Cosmetic

4.3.2. Polyester Resins

4.3.3. Plasticizers

4.3.4. Foods and Beverages

4.3.5. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. Alpha Chemika

6.2. Biosynth Ltd

6.3. Central Drug House

6.4. Daicel Corp

6.5. Genomatica, Inc.

6.6. Haihang Industry Co. Ltd.

6.7. Julius HoeschGmbh& Co. KG

6.8. KhNeochem Co., Ltd.

6.9. Oq Chemicals Gmbh

6.10. Shenzhen Starshine Technology Co., Ltd

6.11. Simson Pharma

6.12. Spectrum Chemical Mfg. Corp

6.13. Sunway Pharm Ltd.

6.14. SyskemChemieGmbh

6.15. Thermo Fisher Scientific Inc.

6.16. Tokyo Chemical Industry Pvt. Ltd.

1. GLOBAL 1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL BIO-BASED1, 3-BUTANEDIOLMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL PETRO-BASED1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL 1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSIS BY GRADE, 2023-2031 ($ MILLION)

5. GLOBAL INDUSTRIAL GRADE 1, 3-BUTANEDIOLMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBALCOSMETIC GRADE 1, 3-BUTANEDIOLMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL 1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

8. GLOBAL 1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSIS IN COSMETICS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL 1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSIS IN POLYMER RESINES BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL 1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSISIN PLASTICIZERS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL 1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSIS IN FOOD AND BEVERAGES BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL 1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSIS IN OTHER APPLICATION BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL 1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSISBY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN 1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN 1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

16. NORTH AMERICAN 1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSIS BY GRADE, 2023-2031 ($ MILLION)

17. NORTH AMERICAN 1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

18. EUROPEAN 1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN 1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

20. EUROPEAN 1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSIS BY GRADE, 2023-2031 ($ MILLION)

21. EUROPEAN 1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC 1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC 1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSIS BY GRADE, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC 1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

26. REST OF THE WORLD 1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD 1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

28. REST OF THE WORLD 1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSIS BY GRADE, 2023-2031 ($ MILLION)

29. REST OF THE WORLD 1, 3-BUTANEDIOL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL 1, 3-BUTANEDIOL MARKETSHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL BIO-BASED1, 3-BUTANEDIOLMARKETSHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL PETRO-BASED1, 3-BUTANEDIOLMARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL 1, 3-BUTANEDIOL MARKET SHARE BY GRADE, 2023 VS 2031 (%)

5. GLOBAL INDUSTRIAL GRADE 1, 3-BUTANEDIOL MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL COSMETIC GRADE 1, 3-BUTANEDIOL MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL 1, 3-BUTANEDIOL MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

8. GLOBAL 1, 3-BUTANEDIOL MARKET SHARE IN COSMETICS BY REGION, 2023 VS 2031 (%)

9. GLOBAL 1, 3-BUTANEDIOL MARKET SHARE IN POLYMER RESINS BY REGION, 2023 VS 2031 (%)

10. GLOBAL 1, 3-BUTANEDIOL MARKET SHARE IN PLASTICIZERS BY REGION, 2023 VS 2031 (%)

11. GLOBAL 1, 3-BUTANEDIOL MARKET SHARE IN FOOD AND BEVERAGES BY REGION, 2023 VS 2031 (%)

12. GLOBAL 1, 3-BUTANEDIOL MARKET SHARE IN OTHER APPLICATIONS BY REGION, 2023 VS 2031 (%)

13. GLOBAL 1, 3-BUTANEDIOL MARKETSHARE BY REGION, 2023 VS 2031 (%)

14. US 1, 3-BUTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA 1, 3-BUTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

16. UK 1, 3-BUTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE 1, 3-BUTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY 1, 3-BUTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY 1, 3-BUTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN 1, 3-BUTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE 1, 3-BUTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA 1, 3-BUTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA 1, 3-BUTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN 1, 3-BUTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA 1, 3-BUTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC 1, 3-BUTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA 1, 3-BUTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

28. THE MIDDLE EAST AND AFRICA 1, 3-BUTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)