1,4 Butanediol Market (BDO) Market

1, 4 Butanediol (BDO) Market Size, Share & Trends Analysis Report by Application (Gamma-Butyrolactone, Poly Butylenes Terephthalate (PBT), Polyurethane, and Tetrahydrofuran), by End-User (Automotive, Electrical & Electronic, Chemical Industry, Footwear Industry, and Sports Industry) Forecast Period (2024-2031)

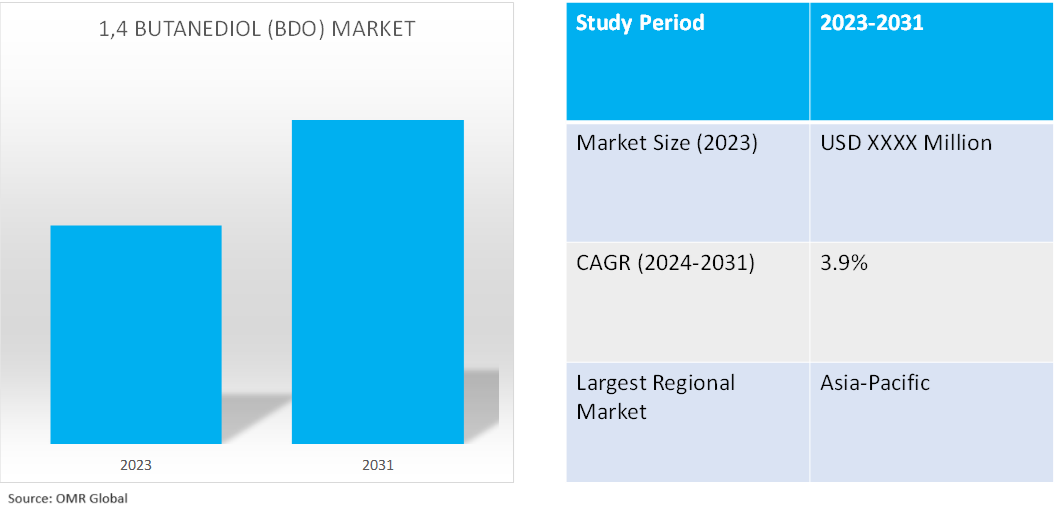

1, 4 Butanediol (BDO) market is anticipated to grow at a CAGR of 3.9% during the forecast period (2024-2031). BDO is a colorless, viscous, water-miscible liquid used to make many organic chemicals, including polymers, spandex, plastics, elastic fibers, and polyesters. The high demand for BDO in several end-user industries is a key factor driving the market growth. The development of sustainable BDO is offering lucrative opportunities for industyr growth.

Market Dynamics

Increasing Demand for Bio-based BDO

The growing demand for bio-based BDO is a key factor driving the growth of the global market. For instance, in April 2024, Hyosung spent $1.0 billion on a site in Vietnam that will use Genomatica’s fermentation technology to convert sugar into BDO, a spandex precursor that’s typically made from coal or natural gas. Hyosung plans to produce 50,000 metric tons (t) of biobased BDO per year by 2026 and 200,000 t annually by 2035.

Rising Demand from End-User Industry

BDO is one of the important raw materials used for basic organic chemicals and fine chemicals. It has applications in various industries including the medicine industry, textile industry, chemical industry, papermaking industry, and automobile industry. PBT is used as an insulator in electrical and electronics industries as it is a thermoplastic polymer. PBT resins and PBT compounds are the two derivatives of PBT.

Market Segmentation

- Based on the application, the market is segmented into gamma-butyrolactone, poly butylenes terephthalate (PBT), polyurethane, and tetrahydrofuran.

- Based on the distribution channel, the market is segmented into the automotive industry, electrical & electronic, chemical industry, footwear industry, and sports industry.

Tetrahydrofuran Holds Significant Market Share

Tetrahydrofuran is obtained by dehydration of BDO or hydrogenation of furan. The extensive usage of tetrahydrofuran in producing poly-tetramethylene glycol (PTMEG), which is a polymer extensively utilized for manufacturing urethane elastomers and fibers is making a significant contribution to the growth of the market segment. PTMEG demand has witnessed pace owing to superior properties, such as exceptional flexibility and elasticity. The high demand for PTMEG in the textile industry has promoted the growth of the market segment.

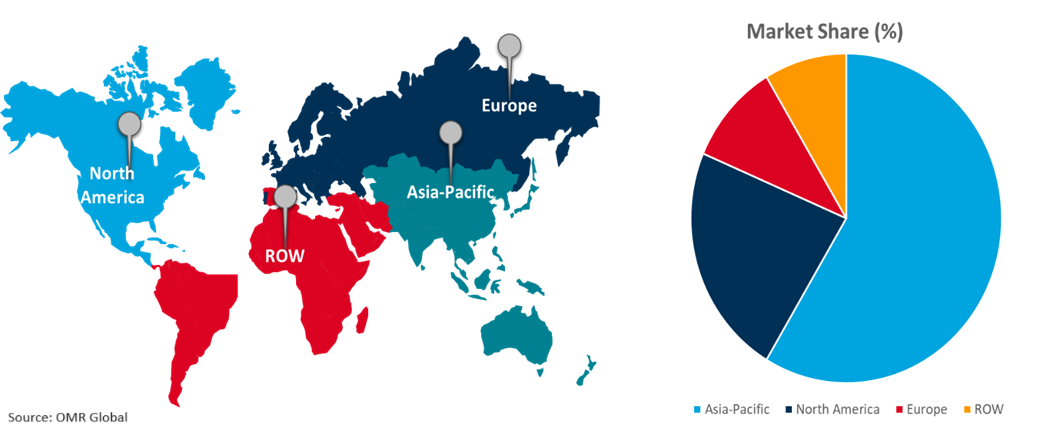

Regional Outlook

The global BDO market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global 1, 4 Butanediol (BDO) Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific region is anticipated to hold the major share during the forecast period, owing to its growing application in end-user industries such as electronics and leather, amongst others. The economic growth of emerging countries such as India, Japan, and other industries is also growing exponentially in the region creating a huge demand for BDO. China is the largest automotive producer across the globe and is also leading in electric vehicle manufacturing. Other than EVs, electronic products such as TVs, smartphones, cables, tablets, wires, and earphones have registered the highest growth in the electronics sector. The rise in disposable income of the middle-class population has fueled demand for electronic products in the region. As per JEITA data in Jan 2022 the total number of imports of consumer electronics amounted to $550.0 million.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the BDO market include Ashland Inc., BASF SE, Dairen Chemical Corp., Nan Ya Plastic Corp., and Mitsubishi Chemical Corp. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Development

- In September 2023, BASF announced obtaining long-term access to QIRA bio-based BDO from Qore LLC, a joint venture of Cargill and HELM AG. Qore will produce the bio-based BDO at Cargill’s biotechnology campus and corn refining operation in Eddyville, Iowa. The partnership will enable BASF to expand its existing offerings of BDO derivatives with bio-based variants of, for instance, polytetramethylene ether glycol (polytetrahydrofuran, PolyTHF) and tetrahydrofuran (THF).

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the 1, 4 butanediol (BDO) market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Ashland Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. BASF SE

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Nan Ya Plastic Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global 1,4 Butanediol Market by Application

4.1.1. Gamma-Butyrolactone

4.1.2. Poly Butylenes Terephthalate (PBT)

4.1.3. Polyurethane

4.1.4. Tetrahydrofuran

4.2. Global 1,4 Butanediol Market by End-User

4.2.1. Automotive Industry

4.2.2. Electrical & Electronic

4.2.3. Chemical Industry

4.2.4. Footwear Industry

4.2.5. Sports Industry

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Chongqing Jian Feng Chemical Industry Co. Ltd.

6.2. Dairen Chemical Corp.

6.3. Genomatica, Inc.

6.4. Koch Industries, Inc.

6.5. LyondellBasell Industries Holdings, B.V.

6.6. Mitsubishi Chemical Group Corp.

6.7. Mitsui & Co. Ltd.

6.8. Sahara International Petrochemical Company

6.9. Shanxi Sanwei Group Co., Ltd.

6.10. SK Innovation CO., Ltd.

6.11. Trisso LLC

1. Global 1,4 Butanediol Market Research And Analysis By Application, 2023-2031 ($ Million)

2. Global 1,4 Butanediol For Gamma-Butyrolactone Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global 1,4 Butanediol For Poly Butylenes Terephthalate (PBT) Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global 1,4 Butanediol For Polyurethane Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global 1,4 Butanediol For Tetrahydrofuran Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global 1,4 Butanediol Market Research And Analysis By End-User, 2023-2031 ($ Million)

7. Global 1,4 Butanediol For Automotive Industry Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global 1,4 Butanediol For Electrical & Electronic Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global 1,4 Butanediol For Chemical Industry Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global 1,4 Butanediol For Footwear Industry Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global 1,4 Butanediol For Sports Industry Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global 1,4 Butanediol Market Research And Analysis By Region, 2023-2031 ($ Million)

13. North American 1,4 Butanediol Market Research And Analysis By Country, 2023-2031 ($ Million)

14. North American 1,4 Butanediol Market Research And Analysis By Application, 2023-2031 ($ Million)

15. North American 1,4 Butanediol Market Research And Analysis By End-User, 2023-2031 ($ Million)

16. European 1,4 Butanediol Market Research And Analysis By Country, 2023-2031 ($ Million)

17. European 1,4 Butanediol Market Research And Analysis By Application, 2023-2031 ($ Million)

18. European 1,4 Butanediol Market Research And Analysis By End-User, 2023-2031 ($ Million)

19. Asia-Pacific 1,4 Butanediol Market Research And Analysis By Country, 2023-2031 ($ Million)

20. Asia-Pacific 1,4 Butanediol Market Research And Analysis By Application, 2023-2031 ($ Million)

21. Asia-Pacific 1,4 Butanediol Market Research And Analysis By End-User, 2023-2031 ($ Million)

22. Rest Of The World 1,4 Butanediol Market Research And Analysis By Region, 2023-2031 ($ Million)

23. Rest Of The World 1,4 Butanediol Market Research And Analysis By Application, 2023-2031 ($ Million)

24. Rest Of The World 1,4 Butanediol Market Research And Analysis By End-User, 2023-2031 ($ Million)

1. Global 1,4 Butanediol Market Share By Application, 2023 Vs 2031 (%)

2. Global 1,4 Butanediol For Gamma-Butyrolactone Market Share By Region, 2023 Vs 2031 (%)

3. Global 1,4 Butanediol For Poly Butylenes Terephthalate (PBT) Market Share By Region, 2023 Vs 2031 (%)

4. Global 1,4 Butanediol For Polyurethane Market Share By Region, 2023 Vs 2031 (%)

5. Global 1,4 Butanediol For Tetrahydrofuran Market Share By Region, 2023 Vs 2031 (%)

6. Global 1,4 Butanediol Market Share By End-User, 2023 Vs 2031 (%)

7. Global 1,4 Butanediol For Automotive Industry Market Share By Region, 2023 Vs 2031 (%)

8. Global 1,4 Butanediol For Electrical & Electronic Market Share By Region, 2023 Vs 2031 (%)

9. Global 1,4 Butanediol For Chemical Industry Market Share By Region, 2023 Vs 2031 (%)

10. Global 1,4 Butanediol For Footwear Industry Market Share By Region, 2023 Vs 2031 (%)

11. Global 1,4 Butanediol For Sports Industry Market Share By Region, 2023 Vs 2031 (%)

12. Global 1,4 Butanediol Market Share By Region, 2023 Vs 2031 (%)

13. US 1,4 Butanediol Market Size, 2023-2031 ($ Million)

14. Canada 1,4 Butanediol Market Size, 2023-2031 ($ Million)

15. UK 1,4 Butanediol Market Size, 2023-2031 ($ Million)

16. France 1,4 Butanediol Market Size, 2023-2031 ($ Million)

17. Germany 1,4 Butanediol Market Size, 2023-2031 ($ Million)

18. Italy 1,4 Butanediol Market Size, 2023-2031 ($ Million)

19. Spain 1,4 Butanediol Market Size, 2023-2031 ($ Million)

20. Rest Of Europe 1,4 Butanediol Market Size, 2023-2031 ($ Million)

21. India 1,4 Butanediol Market Size, 2023-2031 ($ Million)

22. China 1,4 Butanediol Market Size, 2023-2031 ($ Million)

23. Japan 1,4 Butanediol Market Size, 2023-2031 ($ Million)

24. South Korea 1,4 Butanediol Market Size, 2023-2031 ($ Million)

25. Rest Of Asia-Pacific 1,4 Butanediol Market Size, 2023-2031 ($ Million)

26. Rest Of The World 1,4 Butanediol Market Size, 2023-2031 ($ Million)

27. Latin America 1,4 Butanediol Market Size, 2023-2031 ($ Million)

28. Middle East And Africa 1,4 Butanediol Market Size, 2023-2031 ($ Million)