3D Secure Payment Authentication Market

3D Secure Payment Authentication Market Size, Share & Trends Analysis Report by Component (Access Control Server and Merchant Plug-in), and by Application (Banks and Merchants & Payment Gateway), Forecast Period (2023-2030) Update Available - Forecast 2025-2035

3D secure payment authentication market is anticipated to grow at a CAGR of 10.2% during the forecast period (2023-2030). Advancements in 3D secure (3DS) payment authentication technology to enhance customer experience are propelling the market growth. The growing adoption of strong customer authentication (SCA) requirements under the payment services directive 2 (PSD2) is the key factor supporting the growth of the market globally. As online transactions continue to increase, the need for security like 3D Secure is becoming more essential to help fight against fraud across all markets. 3D Secure solution enables businesses to make risk decisions to help identify fraud while also avoiding unnecessary friction for cardholders. Hence, the market players are also focusing on introducing 3D Secure (3DS) solution solutions that further bolster the market growth. For instance, in August 2020, Marqeta launched 3D Secure to reduce payment fraud. Marqeta’s 3D Secure solution is verified on Visa 2.2. Standards are designed to allow greater customization and control over fraud and authentication decisions.

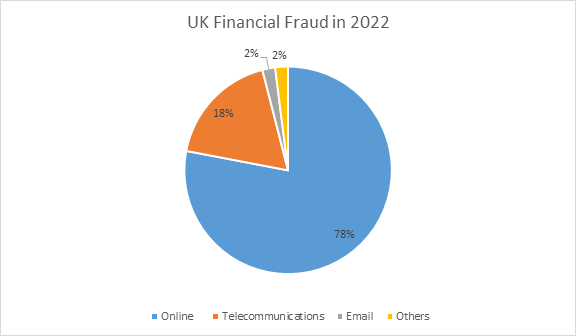

UK Financial Fraud in 2022

Source: UK Finance

The banking and finance industry spends billions of pounds each year fighting fraud and economic crime. However, the majority of fraud originates outside the banking sector and UK Finance has analyzed over 59,000 APP fraud cases to show the sources of fraud. The analysis showed that 78.0% of APP fraud cases originated online – these tend to include lower-value fraud such as purchase fraud and therefore account for 36.0% of losses. Social media platforms account for the greatest number of online fraud cases – around three-quarters of online fraud starts on social media. Meanwhile, 18.0% of fraud cases originate via telecommunications – these are usually higher-value cases, such as impersonation fraud, and account for 44.0% of losses.

Segmental Outlook

The global 3D secure payment authentication market is segmented on the components and applications. Based on the component, the market is sub-segmented into access control servers and merchant plug-ins. Further, based on application, the market is sub-segmented into banks and merchants & payment gateway.

The Merchants & Payment Gateway Sub-Segment is Anticipated to Hold a Considerable Share of the Global 3D Secure Payment Authentication Market

Among the applications, the merchants & payment gateway sub-segment is expected to hold a considerable share of the global 3D secure payment authentication market. The segmental growth is attributed to the growing influence of online shopping continuing to accelerate, merchants need to have the ability to mitigate fraud while providing frictionless experiences to consumers. 3DS 2, the next generation of 3-D Secure technology, is a powerful authentication tool that analyses multiple key data points, including the merchant’s contextual data, acting as an advanced layer of fraud protection. For instance, in November 2022, Network International launched its new 3D Secure authentication solution in collaboration with Mastercard. With this collaboration, authentication using Mastercard's Smart Interface will now be available for merchants in UAE and further using the N-Genius online payment gateway to effectively process eCommerce transactions.

Regional Outlook

The global 3D secure payment authentication market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America. Among these, Asia-Pacific is anticipated to grow at a considerable CAGR over the forecast period, owing to the increased number of online card transactions and increasing prevalence of Card-not-present (CNP) frauds in countries like China and India.

Global 3D Secure Payment Authentication Market Growth, by Region 2023-2030

The North American Region is Expected to Hold Prominent Market Share in the Global 3D Secure Payment Authentication Market

Among all regions, the North American region is anticipated to grow at a considerable CAGR over the forecast period. Regional growth is attributed to increasing technological advancement in payment authentication technology. The growing adoption of digital technologies for processing online payments, and a growing number of 3D secure payment authentication launches across regions are key reasons behind the significant growth of the global market. For instance, in January 2022, Everlink Payment Services Inc. launched a 3D secure payment authentication service via VISA Consumer Authentication Service (VCAS) for Visa and Mastercard card products.

The key market players include American Express Company, Discover Financial Services, Mastercard Inc., Stripe Inc., Visa Inc., and others. The shift in consumer preferences towards online shopping with the emergence of several online channels and the growing proliferation of smartphones, resulted in a high number of digital fraud activities. Thus, the demand for these types of solutions is gaining high traction for fraud prevention. For instance, in February 2022, the Federal Trade Commission (FTC), received fraud reports from more than 2.8 million consumers last year, with the most commonly reported category once again being imposter scams, followed by online shopping scams.

Market Players Outlook

The major companies serving the 3D secure payment authentication market include American Express Company, Mastercard Inc., Stripe, Inc., Visa Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in June 2023, Saudi Arabia’s PayTabs Group, the region’s award-winning payment solutions provider, had a strategic collaboration with Modirum a global brand with a track record of delivering effective 3D secure solutions for over 20 years.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global 3D secure payment authentication market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. American Express Company

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. MasterCard International Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Visa, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Other

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global 3D Secure Payment Authentication Market by Component

4.1.1. Access Control Server

4.1.2. Merchant Plug-in

4.2. Global 3D Secure Payment Authentication Market by Application

4.2.1. Banks

4.2.2. Merchants & Payment Gateway

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Bluefin Payment Systems

6.2. Broadcom Inc.

6.3. EMVCo, LLC

6.4. Entersekt Proprietary Ltd.

6.5. Fidelity National Information Services, Inc. (FIS)

6.6. GPayments Pty Ltd.

6.7. Marqeta, Inc.

6.8. Modirum MDpay

6.9. PAAY, LLC

6.10. PayPal Holdings, Inc

6.11. PayU

6.12. Stripe, Inc.

1. GLOBAL 3D SECURE PAYMENT AUTHENTICATION MARKET RESEARCH AND ANALYSIS BY COMPONENTS, 2022-2030 ($ MILLION)

2. GLOBAL 3D SECURE ACCESS CONTROL SERVER PAYMENT AUTHENTICATION MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

3. GLOBAL 3D SECURE MERCHANT PLUG-IN PAYMENT AUTHENTICATION MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

4. GLOBAL 3D SECURE PAYMENT AUTHENTICATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

5. GLOBAL 3D SECURE PAYMENT AUTHENTICATION FOR BANKS MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

6. GLOBAL 3D SECURE PAYMENT AUTHENTICATION FOR MERCHANTS & PAYMENT GATEWAY MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

7. GLOBAL 3D SECURE PAYMENT AUTHENTICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. NORTH AMERICAN 3D SECURE PAYMENT AUTHENTICATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

9. NORTH AMERICAN 3D SECURE PAYMENT AUTHENTICATION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

10. NORTH AMERICAN 3D SECURE PAYMENT AUTHENTICATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

11. EUROPEAN 3D SECURE PAYMENT AUTHENTICATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

12. EUROPEAN 3D SECURE PAYMENT AUTHENTICATION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

13. EUROPEAN 3D SECURE PAYMENT AUTHENTICATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

14. ASIA-PACIFIC 3D SECURE PAYMENT AUTHENTICATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

15. ASIA-PACIFIC 3D SECURE PAYMENT AUTHENTICATION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

16. ASIA-PACIFIC 3D SECURE PAYMENT AUTHENTICATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

17. REST OF THE WORLD 3D SECURE PAYMENT AUTHENTICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

18. REST OF THE WORLD 3D SECURE PAYMENT AUTHENTICATION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

19. REST OF THE WORLD 3D SECURE PAYMENT AUTHENTICATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

1. GLOBAL 3D SECURE PAYMENT AUTHENTICATION MARKET RESEARCH AND ANALYSIS BY COMPONENTS, 2022 VS 2030 (%)

2. GLOBAL 3D SECURE ACCESS CONTROL SERVER PAYMENT AUTHENTICATION MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL 3D SECURE MERCHANT PLUG-IN PAYMENT AUTHENTICATION MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL 3D SECURE PAYMENT AUTHENTICATION MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

5. GLOBAL 3D SECURE PAYMENT AUTHENTICATION FOR BANKS MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL 3D SECURE PAYMENT AUTHENTICATION FOR MERCHANTS & PAYMENT GATEWAY MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL 3D SECURE PAYMENT AUTHENTICATION MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. US 3D SECURE PAYMENT AUTHENTICATION MARKET SIZE, 2022-2030 ($ MILLION)

9. CANADA 3D SECURE PAYMENT AUTHENTICATION MARKET SIZE, 2022-2030 ($ MILLION)

10. UK 3D SECURE PAYMENT AUTHENTICATION MARKET SIZE, 2022-2030 ($ MILLION)

11. FRANCE 3D SECURE PAYMENT AUTHENTICATION MARKET SIZE, 2022-2030 ($ MILLION)

12. GERMANY 3D SECURE PAYMENT AUTHENTICATION MARKET SIZE, 2022-2030 ($ MILLION)

13. ITALY 3D SECURE PAYMENT AUTHENTICATION MARKET SIZE, 2022-2030 ($ MILLION)

14. SPAIN 3D SECURE PAYMENT AUTHENTICATION MARKET SIZE, 2022-2030 ($ MILLION)

15. REST OF EUROPE 3D SECURE PAYMENT AUTHENTICATION MARKET SIZE, 2022-2030 ($ MILLION)

16. INDIA 3D SECURE PAYMENT AUTHENTICATION MARKET SIZE, 2022-2030 ($ MILLION)

17. CHINA 3D SECURE PAYMENT AUTHENTICATION MARKET SIZE, 2022-2030 ($ MILLION)

18. JAPAN 3D SECURE PAYMENT AUTHENTICATION MARKET SIZE, 2022-2030 ($ MILLION)

19. SOUTH KOREA 3D SECURE PAYMENT AUTHENTICATION MARKET SIZE, 2022-2030 ($ MILLION)

20. REST OF ASIA-PACIFIC 3D SECURE PAYMENT AUTHENTICATION MARKET SIZE, 2022-2030 ($ MILLION)

21. LATIN AMERICA 3D SECURE PAYMENT AUTHENTICATION MARKET SIZE, 2022-2030 ($ MILLION)

22. MIDDLE EAST AND AFRICA 3D SECURE PAYMENT AUTHENTICATION MARKET SIZE, 2022-2030 ($ MILLION)