3D Stacking Market

3D Stacking Market Size, Share & Trends Analysis Report Market by Type (Stacked 3D and Monolithic 3D), by Component (Through-Silicon Via (TSV), Through Glass-Via (TGV), and Silicon interposer), by Application (Logic, Memory, Imaging and Optoelectronics, and Others), and by End-User (Consumer Electronics, Telecommunications, Medical Devices, Military and Aerospace, and Others), Forecast Period (2025-2035)

Industry Outlook

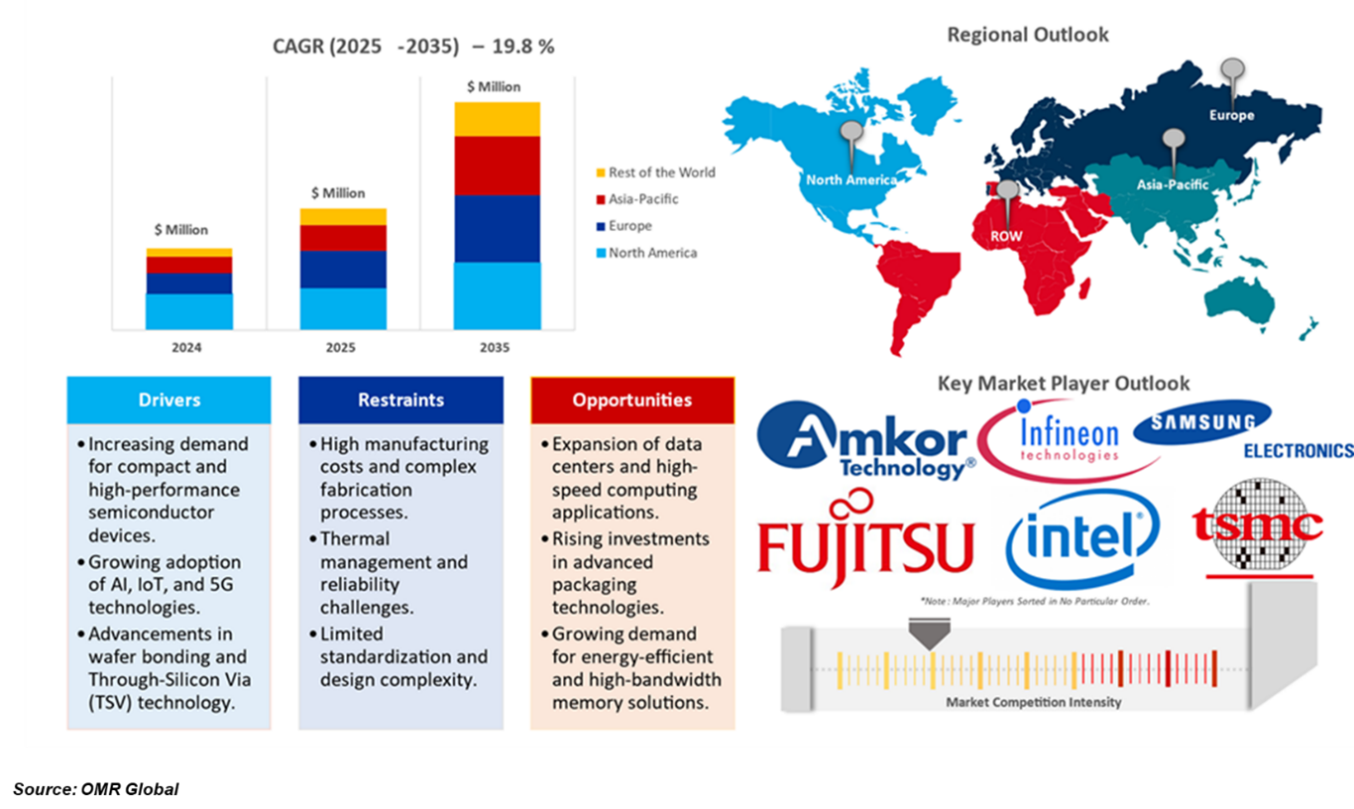

3D stacking market is expected to grow at a CAGR of 19.8% during the Forecast Period (2025-2035). The primary factor driving the development of 3D stacking is the increase in demand for electronic miniaturization. This breakthrough enables the delivery of chips in more compact and energy-efficient packages by stacking layers on a surface. According to the Semiconductor Industry Association, the US semiconductor showcase is anticipated to reach $1 trillion by 2030, underscoring the progressing application of 3D stacking and creating industry opportunities. By vertically combining many layers of semiconductor components, 3D stacking technology improves the high-speed data processing and efficient power consumption that are essential to artificial intelligence and machine learning systems.

Engineers at MIT have just created a novel technique for stacking electronic layers to create high-performance 3D chips, significantly raising transistor density and improving AI hardware capabilities. As they demonstrate new technologies are being utilized, these also help the 3D stacking market increase. As conventional semiconductor manufacturing approaches a limit on surface area transistor packing, the new technique focuses on increasing the number of transistor layers, similar to transforming a single-level structure into a high-rise.

Segmental Outlook

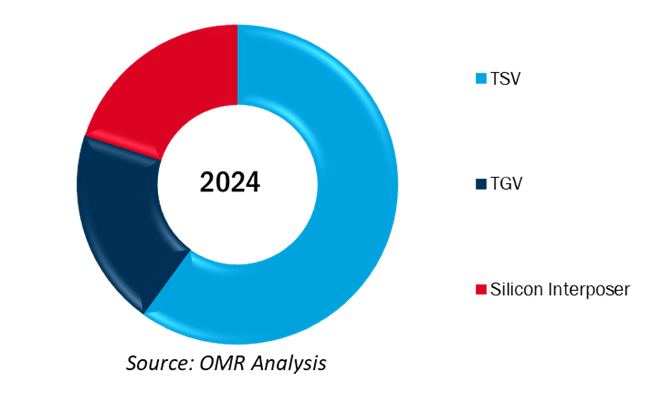

The global 3D stacking market is segmented based on type, component, application, and end-user. Based on type, the market is sub-segmented into stacked 3D and monolithic 3D. Based on components, the market is sub-segmented into TSV, TGV, and silicon interposer. Based on application, the market is sub-segmented into logic, memory, imaging, and optoelectronics, and others such as MEMS/ sensors, & LED. Furthermore, the market is categorized by end-user into consumer electronics, telecommunications, medical devices, military & aerospace, and others, including industrial and automotive.

TSV Sub-Segment to Hold a Major Share of the 3D Stacking Market:

TSV's improved data transfer speed and lower power consumption drive its growth in the 3D stacking market. Longer signal routes and higher latency are characteristics of traditional technologies such as wire bonding and flip-chip packaging. TSV has reduced interconnect distances, allowing stacked layers to communicate more quickly. Through the reduction of signal transmission losses, it also lowers power usage.

Thermal dissipation is a significant challenge owing to the higher transistor density and heat generation in stacked devices. While conventional wire bonding retains heat, 3D TSV technology allows for vertical vias, which improve heat dissipation; as this, TSV can be used with small, powerful devices like 5G base stations and edge AI processors. Additionally, it is essential for car ADAS chips, which need heat control and space constraints.

Global 3D Stacking Market Share By Component, 2024 (%)

Regional Outlook

The global 3D stacking market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, ASEAN economies, Australia and New Zealand and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific Market is Expected to Grow at a Significant CAGR in the Global 3D Stacking Market.

3D stacking in the Asia-Pacific is expanding owing to the expanding demand for high-performance computing, AI, and IoT-related applications. The region's robust semiconductor manufacturing ecosystem, dominated by Taiwan, South Korea, and China, is pushing the envelope on advanced packaging technologies. Also, government incentives and R&D investments are spurring the introduction of 3D stacking for enhanced chip performance and efficiency.

Market Players Outlook

The major companies serving the 3D stacking market include Amkor Technology, Infineon Technologies AG, Samsung Electronics Co., Ltd., Fujitsu Ltd., Intel Corp, and Taiwan Semiconductor Manufacturing Company (TSMC) Ltd., among others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, and new product launches, to stay competitive in the market.

Recent Development

- In February 2025, Micron Technology collaborated with TSMC to lay the foundation for a smooth introduction and integration into computer systems for AI and HPC design applications. Regarding its system-on-integrated chips (SoIC) 3D packaging technology, TSMC provided an update that the TSV connection pitch of the next generation seems to be less than 15 µm. Additionally, memory-focused developments like Micron's 232-layer 3D NAND and Samsung's 236-layer V-NAND are significant advances in storage technology. These innovations considerably enhance storage density in the same physical footprint by stacking memory cells vertically (3D) rather than horizontally.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global 3D stacking market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying 'who-stands-where' in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global 3D Stacking Market Sales Analysis –Type | Component |Application |End-User ($ Million)

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key 3D Stacking Industry Trends

2.2.2. Market Recommendations

2.2.3. Conclusion

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global 3D Stacking Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global 3D Stacking Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – 3D Stacking Market Revenue by Manufacturers

4.2. Key Company Analysis

4.2.1. Overview

4.2.2. Product Portfolio

4.2.3. Financial Analysis (Subject to Data Availability)

4.2.4. SWOT Analysis

4.2.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global 3D Stacking Market by Type ($ Million)

5.1. Stacked 3D

5.2. Monolithic 3D

6. Global 3D Stacking Market by Component ($ Million)

6.1. Through-Silicon Via (TSV)

6.2. Through Glass Via (TGV)

6.3. Silicon Interposer

7. Global 3D Stacking Market by Application ($ Million)

7.1. Logic

7.2. Memory

7.3. Imaging and Optoelectronics

7.4. Others (MEMS/ Sensors, LED)

8. Global 3D Stacking Market by End-User ($ Million)

8.1. Consumer Electronics

8.2. Telecommunications

8.3. Medical Devices

8.4. Military and Aerospace

8.5. Others (Industrial, Automotive)

9. Regional Analysis

9.1. North American 3D Stacking Market Sales Analysis –Type | Component| Application |End-Users ($ Million)

9.1.1. United States

9.1.2. Canada

9.2. European 3D Stacking Market Sales Analysis –Type |Component | Application |End-Users ($ Million)

9.2.1. UK

9.2.2. Germany

9.2.3. Italy

9.2.4. Spain

9.2.5. France

9.2.6. Russia

9.2.7. Rest of Europe

9.3. Asia-Pacific 3D Stacking Market Sales Analysis –Type |Component | Application |End-Users ($ Million)

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And others)

9.3.7. Rest of Asia-Pacific

10. Company Profiles

10.1. Advanced Micro Devices, Inc. (AMD)

10.2. Amkor Technology

10.3. Broadcom, Inc.

10.4. Fujitsu Ltd.

10.5. Infineon Technologies AG

10.6. Kioxia Singapore Pte. Ltd.

10.7. MediaTek Inc.

10.8. Microchip Technology Inc.

10.9. Micron Technology, Inc.

10.10. NVIDIA Corp.

10.11. NXP Semiconductors N.V.

10.12. Qualcomm Inc.

10.13. Renesas Electronics Corp.

10.14. Sony Corp.

10.15. GlobalFoundries Inc.

10.16. Texas Instruments Inc.

10.17. Toshiba Corp.

10.18. Western Digital Technologies, Inc.

10.19. Taiwan Semiconductor Manufacturing Company Limited

10.20. Samsung Electronics Co., Ltd.

1. Global 3D Stacking Market Research And Analysis By Type, 2024-2035 ($ Million)

2. Global Stacked 3D Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Monolithic 3D Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global 3D Stacking Market Research And Analysis By Component, 2024-2035 ($ Million)

5. Global 3D Stacking Through-Silicon Via (TSV) Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global 3D Stacking Through Glass Via (TGV) Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global 3D Stacking Silicon Interposer Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global 3D Stacking Market Research And Analysis By Application, 2024-2035 ($ Million)

9. Global 3D Stacking For Logic Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global 3D Stacking For Memory Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global 3D Stacking For Imaging And Optoelectronics Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global 3D Stacking For Other Applications Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global 3D Stacking Market Research And Analysis By End-User, 2024-2035 ($ Million)

14. Global 3D Stacking In Consumer Electronics Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global 3D Stacking In Telecommunications Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global 3D Stacking In Medical Devices Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global 3D Stacking In Military And Aerospace Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global 3D Stacking In Other End-Users Market Research And Analysis By Region, 2024-2035 ($ Million)

19. Global 3D Stacking Market Research And Analysis By Region, 2024-2035 ($ Million)

20. North American 3D Stacking Market Research And Analysis By Country, 2024-2035 ($ Million)

21. North American 3D Stacking Market Research And Analysis By Type, 2024-2035 ($ Million)

22. North American 3D Stacking Market Research And Analysis By Component, 2024-2035 ($ Million)

23. North American 3D Stacking Market Research And Analysis By Application, 2024-2035 ($ Million)

24. North American 3D Stacking Market Research And Analysis By End-User, 2024-2035 ($ Million)

25. European 3D Stacking Market Research And Analysis By Country, 2024-2035 ($ Million)

26. European 3D Stacking Market Research And Analysis By Type, 2024-2035 ($ Million)

27. European 3D Stacking Market Research And Analysis By Component, 2024-2035 ($ Million)

28. European 3D Stacking Market Research And Analysis By Application, 2024-2035 ($ Million)

29. European 3D Stacking Market Research And Analysis By End-User, 2024-2035 ($ Million)

30. Asia-Pacific 3D Stacking Market Research And Analysis By Country, 2024-2035 ($ Million)

31. Asia-Pacific 3D Stacking Market Research And Analysis By Type, 2024-2035 ($ Million)

32. Asia-Pacific 3D Stacking Market Research And Analysis By Component, 2024-2035 ($ Million)

33. Asia-Pacific 3D Stacking Market Research And Analysis By Application, 2024-2035 ($ Million)

34. Asia-Pacific 3D Stacking Market Research And Analysis By End-User, 2024-2035 ($ Million)

35. Rest Of The World 3D Stacking Market Research And Analysis By Region, 2024-2035 ($ Million)

36. Rest Of The World 3D Stacking Market Research And Analysis By Type, 2024-2035 ($ Million)

37. Rest Of The World 3D Stacking Market Research And Analysis By Component, 2024-2035 ($ Million)

38. Rest Of The World 3D Stacking Market Research And Analysis By Application, 2024-2035 ($ Million)

39. Rest Of The World 3D Stacking Market Research And Analysis By End-User, 2024-2035 ($ Million)

1. Global 3D Stacking Market Share By Type, 2024 Vs 2035 (%)

2. Global Stacked 3D Market Share By Region, 2024 Vs 2035 (%)

3. Global Monolithic 3D Market Share By Region, 2024 Vs 2035 (%)

4. Global 3D Stacking Market Share By Component, 2024 Vs 2035 (%)

5. Global 3D Stacking Through-Silicon Via (TSV) Market Share By Region, 2024 Vs 2035 (%)

6. Global 3D Stacking Through Glass Via (TGV) Market Share By Region, 2024 Vs 2035 (%)

7. Global 3D Stacking Silicon Interposer Market Share By Region, 2024 Vs 2035 (%)

8. Global 3D Stacking Market Share Analysis By Application, 2024-2035 ($ Million)

9. Global 3D Stacking For Logic Market Share By Region, 2024 Vs 2035 (%)

10. Global 3D Stacking For Memory Market Share By Region, 2024 Vs 2035 (%)

11. Global 3D Stacking For Imaging And Optoelectronics Market Share By Region, 2024 Vs 2035 (%)

12. Global 3D Stacking For Other Applications Market Share By Region, 2024 Vs 2035 (%)

13. Global 3D Stacking Market Share Analysis By End-User, 2024-2035 ($ Million)

14. Global 3D Stacking In Consumer Electronics Market Share By Region, 2024 Vs 2035 (%)

15. Global 3D Stacking In Telecommunications Market Share By Region, 2024 Vs 2035 (%)

16. Global 3D Stacking In Medical Devices Market Share By Region, 2024 Vs 2035 (%)

17. Global 3D Stacking In Military And Aerospace Market Share By Region, 2024 Vs 2035 (%)

18. Global 3D Stacking In Other End-Users Market Share By Region, 2024 Vs 2035 (%)

19. Global 3D Stacking Market Share By Region, 2024 Vs 2035 (%)

20. US 3D Stacking Market Size, 2024-2035 ($ Million)

21. Canada 3D Stacking Market Size, 2024-2035 ($ Million)

22. UK 3D Stacking Market Size, 2024-2035 ($ Million)

23. Russia 3D Stacking Market Size, 2024-2035 ($ Million)

24. France 3D Stacking Market Size, 2024-2035 ($ Million)

25. Germany 3D Stacking Market Size, 2024-2035 ($ Million)

26. Italy 3D Stacking Market Size, 2024-2035 ($ Million)

27. Spain 3D Stacking Market Size, 2024-2035 ($ Million)

28. Rest Of Europe 3D Stacking Market Size, 2024-2035 ($ Million)

29. India 3D Stacking Market Size, 2024-2035 ($ Million)

30. China 3D Stacking Market Size, 2024-2035 ($ Million)

31. Japan 3D Stacking Market Size, 2024-2035 ($ Million)

32. South Korea 3D Stacking Market Size, 2024-2035 ($ Million)

33. Australia & New Zealand 3D Stacking Market Size, 2024-2035 ($ Million)

34. ASEAN Countries 3D Stacking Market Size, 2024-2035 ($ Million)

35. Rest Of Asia-Pacific 3D Stacking Market Size, 2024-2035 ($ Million)

36. Rest Of The World 3D Stacking Market Size, 2024-2035 ($ Million)

FAQS

The size of the 3D Stacking market in 2024 is estimated to be around USD 1.8 billion.

Asia-Pacific holds the largest share in the 3D Stacking market.

Leading players in the 3D Stacking market include Amkor Technology, Infineon Technologies AG, Samsung Electronics Co., Ltd., Fujitsu Ltd., Intel Corp, and Taiwan Semiconductor Manufacturing Company (TSMC) Ltd., among others.

3D Stacking market is expected to grow at a CAGR of 19.8% from 2025 to 2035.

The 3D Stacking Market is experiencing growth due to the increasing demand for high-performance computing, proliferation of IoT devices, and advancements in semiconductor technologies.