5G Security Market

5G Security Market Size, Share & Trends Analysis Report by Offering (Solution and Services), by Network Security (Radio Access Network (RAN) Security and Core Security), by Architecture (5G NR Standalone and 5G NR Non-Standalone) and by End-User (Industries and Telecom Operators Forecast Period (2024-2031) Update Available - Forecast 2025-2031

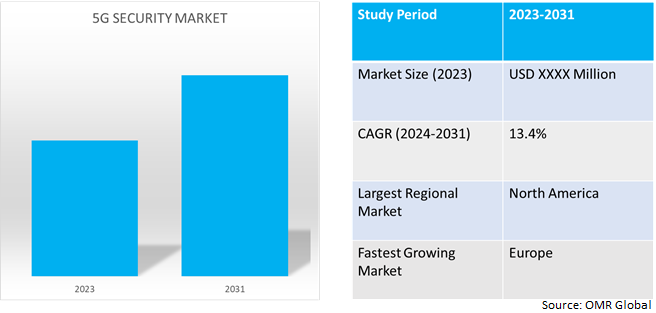

5G security market is anticipated to grow at a CAGR of 13.4% during the forecast period (2024-2031). The growing adoption of 5G security solutions is increasingly in demand owing to network slicing and significant security expansion over 4G and LTE with strict government laws aimed at preventing data thefts through the use of 5G applications is the key factor supporting the growth of the market globally. The 5G security is designed to address enhanced mobile broadband (eMBB), massive machine-type communication (mMTC) and ultra-reliable low-latency communications (URLLC).

Market Dynamics

Network slicing security for 5G and 5G advanced systems

Network Slicing Security for 5G allows operators to provide customized networks flexibly with different functionalities for diverse services or to serve groups of users with specific service requirements. 5G network slicing is a network architecture that provides a way to divide a network to provide independent logical networks over physical network resources and functionality. This can help operators provide differentiated services and more quickly deploy new cases. Additionally, 5G security enables new business model innovation across all industries. Network slicing enables service providers to offer innovative services to enter new markets and expand their business

Growing integration of artificial intelligence (AI) and machine learning (ML)

The design, modelling, and automation of effective security measures against a wide variety of threats can be aided by the application of artificial intelligence (AI) and machine learning (ML). AI and ML are beneficial in a variety of industries for accurate automation, identification, and classification. It will be challenging to combat a wide range of threats from diverse points using typical/traditional preventive measures considering the main selling point of 5G security has been increased data rates and speed. Virtualized network components and software that are heavily dependent on data can be safeguarded with the use of AI and ML. The application of AI and ML with even greater performance benefits at lower costs was made possible by self-organizing networks and intelligent and adaptive algorithms that were deployed in many portions of network design.

Market Segmentation

Our in-depth analysis of the global 5G security market includes the following segments by offering, network security, architecture and end-user:

- Based on offering, the market is sub-segmented into solutions and services.

- Based on network security, the market is sub-segmented into RAN security and core security.

- Based on architecture, the market is sub-segmented into 5G NR standalone and 5G NR non-standalone.

- Based on end-user, the market is sub-segmented into industries and telecom operators.

Solution is Projected to Emerge as the Largest Segment

Based on the offering, the global 5G security market is sub-segmented into solutions and services. Among these, the solutions sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the growing adoption of 5G security solutions by end-user firms to safeguard their private networks. Market players are focusing on creating 5G security solutions to further safeguard the enterprise network architecture to secure the networks. For instance, in October 2021, AT&T launched 5G managed advanced security capabilities to further protect enterprise network infrastructure. The key service provides capabilities for threat visibility, prevention of advanced attacks at the application layer, and security policy enforcement, specifically for 5G-enabled IoT, OT and IT use cases.

Radio Access Network (RAN) Security Sub-segment to Hold a Considerable Market Share

Based on network security, the global 5G security market is sub-segmented into radio access network (RAN) security and core security. Among these, the radio access network (RAN) security sub-segment is expected to hold a considerable market share. With its virtualization, disaggregation, automation, and intelligence, RAN is an additional component of 5G's larger advancement toward increased security. Open RAN industry projects, which acknowledge the advantages and attack surface of an open, disaggregated RAN design, prioritize security. For instance, in February 2024, CTOne, a Trend Micro™ company, introduced a new Open Radio Access Network (O-RAN) and end-to-end private 5G security solutions. The next-generation security solutions propel organizations to utilize the full potential of private 5G while effectively managing associated cyber risks. The new capabilities for protecting private 5G networks focus on supporting advanced wireless needs for the telecom industry, systems integrators, and private 5G network users.

Regional Outlook

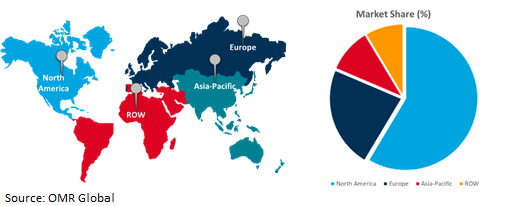

The global 5G security market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing investment in 5G Security in Europe

- The growing adoption of 5G security solutions in emerging economies such as Germany, UK, and France boosts regional growth.

- According to the GOV.UK, in December 2022, UK government invested £110 million ($ 115.918 million) in research and development on next-generation 5G and 6G wireless technology and telecoms security.

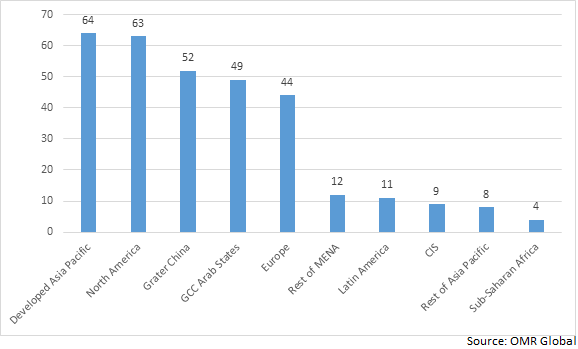

Region-Wise 5G Adoption in 2025 by Percent

Source: Information Systems Audit and Control Association (ISACA)

Global 5G Security Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the increasing use of 5G security solutions by manufacturing companies, to prevent potential threats on 5G networks, offering growth prospects for 5G solutions providers in the area, and supporting the market growth. For instance, in September 2022, NEC Corp. developed a North American 5G innovation unit in New Providence, New Jersey, to expand product development and cater to the growing global demand for Open RAN solutions. The RAN enables corporations and mobile network operators employing private 5G to offer network slicing solutions allocating capabilities to particular firms to separate network utilization inside a public mobile network.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global 5G security market include Broadcom Inc., Intel Corp., Palo Alto Networks, Inc., Telefonaktiebolaget LM Ericsson, and Thales Group., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance,

- In February 2024, Palo Alto Networks introduced end-to-end private 5G security solutions and services in collaboration with Private 5G partners. Bringing together Palo Alto Networks® enterprise-grade 5G security and private 5G partner integrations and services allows organizations to easily deploy, manage, and secure networks throughout their entire 5G journey.

- In February 2024, Wipro Ltd. announced a joint private wireless solution with Nokia to more secure 5G private wireless network solution integrated with their operation infrastructure. The solution will bring greater reliability, mobility, connectivity speed, real-time access to business insights, and the ability to process high volumes of data with low latency.

- In February 2023, Fujitsu Ltd. introduced a new 5G vRAN solution, contributing to the realization of flexible, open networks. The new solution was developed as part of the 5G Open RAN Ecosystem project promoted by NTT DOCOMO, which also supported performance verification and evaluation tests of the new solution.

- In June 2021, Nokia launched NetGuard XDR software and MDR services to strengthen 5G security, unlock new revenue for communication service providers (CSPs). NetGuard XDR provides CSPs with stronger network defences that rapidly prevent and stop threats before they materialize.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global 5G security market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Broadcom Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Telefonaktiebolaget LM Ericsson

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Thales Group

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global 5G Security Market by Offering

4.1.1. Solution

4.1.2. Services

4.2. Global 5G Security Market by Network Security

4.2.1. Radio Access Network (RAN) Security

4.2.2. Core Security

4.3. Global 5G Security Market by Architecture

4.3.1. 5G NR Standalone

4.3.2. 5G NR Non-Standalone

4.4. Global 5G Security Market by End-Users

4.4.1. Industries

4.4.2. Telecom Operators

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Akamai Technologies, Inc.

6.2. AO Kaspersky Lab

6.3. AT&T

6.4. Check Point Software Technologies Ltd.

6.5. Cisco Systems, Inc.

6.6. F5, Inc.

6.7. Fortinet, Inc.

6.8. Huawei Technologies Co., Ltd.

6.9. IBM Corp.

6.10. Intel Corp.

6.11. Intel Corp.

6.12. Juniper Networks, Inc.

6.13. Keysight Technologies, Inc.

6.14. McAfee, LLC

6.15. Nokia Corp.

6.16. Palo Alto Networks, Inc.

6.17. Qualcomm Technologies, Inc.

6.18. Samsung Electronics Co., Ltd.

6.19. Spirent Communications plc

6.20. Trend Micro Inc.

6.21. ZTE Corp.

1. GLOBAL 5G SECURITY MARKET RESEARCH AND ANALYSIS BY OFFERING, 2023-2031 ($ MILLION)

2. GLOBAL 5G SECURITY SOLUTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL 5G SECURITY SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL 5G SECURITY MARKET RESEARCH AND ANALYSIS BY NETWORK SECURITY, 2023-2031 ($ MILLION)

5. GLOBAL 5G RADIO ACCESS NETWORK (RAN) SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL 5G CORE SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL 5G SECURITY MARKET RESEARCH AND ANALYSIS BY ARCHITECTURE, 2023-2031 ($ MILLION)

8. GLOBAL 5G NR STANDALONE SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL 5G NR NON-STANDALONE SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL 5G SECURITY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

11. GLOBAL 5G SECURITY FOR INDUSTRIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL 5G SECURITY FOR TELECOM OPERATORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL 5G SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN 5G SECURITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN 5G SECURITY MARKET RESEARCH AND ANALYSIS BY OFFERING, 2023-2031 ($ MILLION)

16. NORTH AMERICAN 5G SECURITY MARKET RESEARCH AND ANALYSIS BY NETWORK SECURITY, 2023-2031 ($ MILLION)

17. NORTH AMERICAN 5G SECURITY MARKET RESEARCH AND ANALYSIS BY ARCHITECTURE, 2023-2031 ($ MILLION)

18. NORTH AMERICAN 5G SECURITY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

19. EUROPEAN 5G SECURITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. EUROPEAN 5G SECURITY MARKET RESEARCH AND ANALYSIS BY OFFERING, 2023-2031 ($ MILLION)

21. EUROPEAN 5G SECURITY MARKET RESEARCH AND ANALYSIS BY NETWORK SECURITY, 2023-2031 ($ MILLION)

22. EUROPEAN 5G SECURITY MARKET RESEARCH AND ANALYSIS BY ARCHITECTURE, 2023-2031 ($ MILLION)

23. EUROPEAN 5G SECURITY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC 5G SECURITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC 5G SECURITY MARKET RESEARCH AND ANALYSIS BY OFFERING, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC 5G SECURITY MARKET RESEARCH AND ANALYSIS BY NETWORK SECURITY, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC 5G SECURITY MARKET RESEARCH AND ANALYSIS BY ARCHITECTURE, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC 5G SECURITY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

29. REST OF THE WORLD 5G SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

30. REST OF THE WORLD 5G SECURITY MARKET RESEARCH AND ANALYSIS BY OFFERING, 2023-2031 ($ MILLION)

31. REST OF THE WORLD 5G SECURITY MARKET RESEARCH AND ANALYSIS BY NETWORK SECURITY, 2023-2031 ($ MILLION)

32. REST OF THE WORLD 5G SECURITY MARKET RESEARCH AND ANALYSIS BY ARCHITECTURE, 2023-2031 ($ MILLION)

33. REST OF THE WORLD 5G SECURITY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL 5G SECURITY MARKET SHARE BY OFFERING, 2023 VS 2031 (%)

2. GLOBAL 5G SECURITY SOLUTION MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL 5G SECURITY SERVICE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL 5G SECURITY MARKET SHARE BY Network Security, 2023 VS 2031 (%)

5. GLOBAL 5G RADIO ACCESS NETWORK (RAN) SECURITY MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL 5G CORE SECURITY MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL 5G SECURITY MARKET SHARE BY Architecture, 2023 VS 2031 (%)

8. GLOBAL 5G NR STANDALONE SECURITY MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL 5G NR Non-Standalone SECURITY MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL 5G SECURITY MARKET SHARE BY End-User, 2023 VS 2031 (%)

11. GLOBAL 5G SECURITY FOR Industries MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL 5G SECURITY FOR Telecom Operators MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL 5G SECURITY MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. US 5G SECURITY MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA 5G SECURITY MARKET SIZE, 2023-2031 ($ MILLION)

16. UK 5G SECURITY MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE 5G SECURITY MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY 5G SECURITY MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY 5G SECURITY MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN 5G SECURITY MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE 5G SECURITY MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA 5G SECURITY MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA 5G SECURITY MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN 5G SECURITY MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA 5G SECURITY MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC 5G SECURITY MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA 5G SECURITY MARKET SIZE, 2023-2031 ($ MILLION)

28. MIDDLE EAST AND AFRICA 5G SECURITY MARKET SIZE, 2023-2031 ($ MILLION)