6G Market

6G Market Size, Share & Trends Analysis Report by Deployment Device (Smartphones, Tablets, Wearables, IoT Devices, and Others), by Application (Distributed Sensing and Communication, Blockchain, Multisensory Extended Reality Systems, and Connected Robotics and Autonomous Systems), and by Industry Vertical (Agriculture, Healthcare, Education, Entertainment, Autonomous, Public Safety, Manufacturing, and Others), Forecast Period (2025-2035)

Industry Outlook

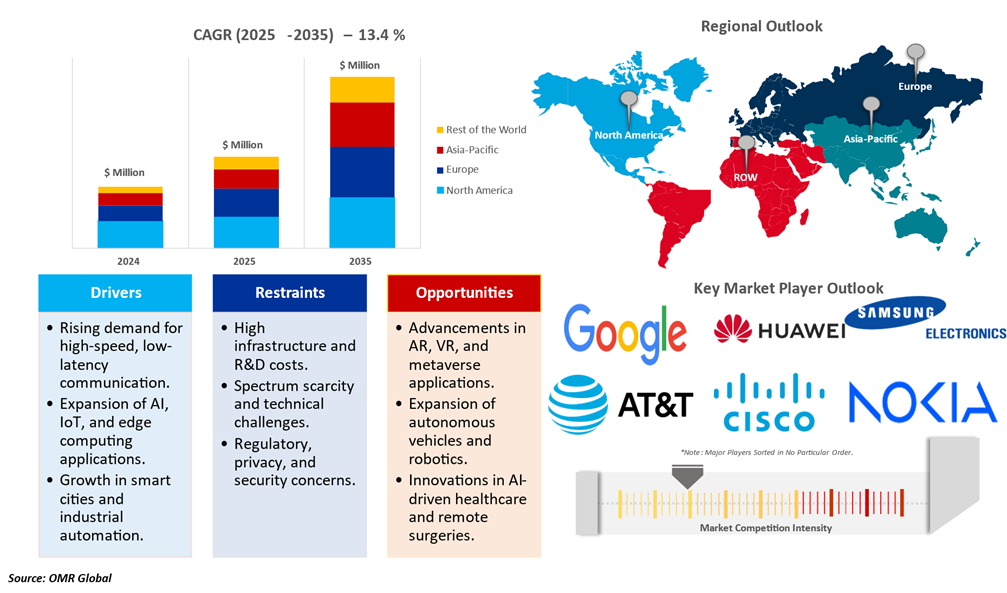

6G market is anticipated to grow at a CAGR of 13.4% during the forecasted period (2025-2035). The 6G market refers to the future of mobile networks and the opportunities related to 6G technology. It is the next step of wireless communication and is expected to launch around 2030. The market growth is driven by key factors such as the demand for faster internet & low latency, which makes the rise in devices such as AR & VR glasses, IoT devices, smart-wearables, metaverse, and others that support the overall growth of the market globally. It is expected to provide users with better data speeds, minimal delays, improved energy efficiency, and more suitable connectivity, transforming how people communicate and interact with technology. The countries are fighting for 6G leadership, where South Korea is the first country to deploy 6G services to ensure better connectivity in the mobile industry.

Segmental Outlook

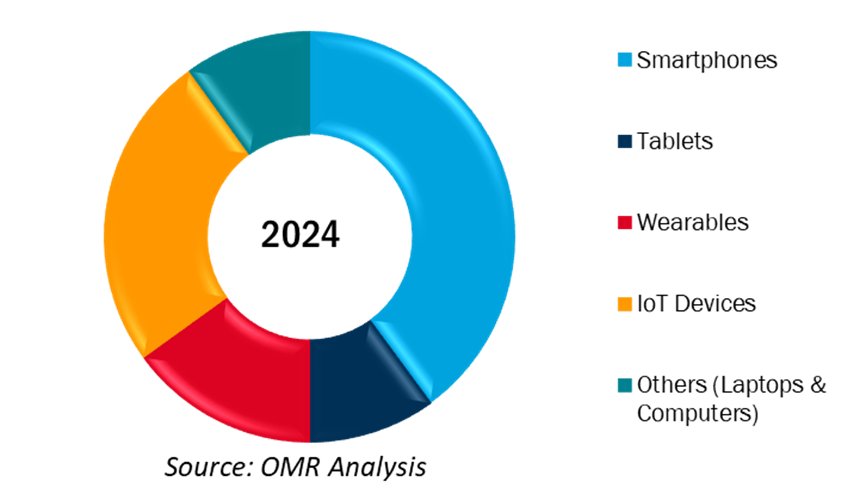

The global 6G market is segmented by deployment device, application, and industry verticals. Based on the deployment device mode, the market is sub-segmented into smartphones, tablets, wearables, IoT devices, and others (laptops & computers). Based on the application, the market is sub-segmented into distributed sensing and communication, blockchain, multisensory extended reality systems, and connected robotics and autonomous systems. Further, based on industry verticals, the market is sub-segmented into agriculture, healthcare, education, entertainment, automotive, public safety, manufacturing, and others. Among the deployment devices, the smartphone segment is growing at a stable rate and is expected to hold a substantial market share owing to a rise in connectivity and smartphone users, most of the work is completed through smartphones such as the fast downloading, dependency on connection with anticipated devices, building connections through social media, and others. This user base and work enables the company to reshape the smartphone industry into a hub for 6G market growth. By leveraging the 6G market with connected components such as smart wearables, IoT devices, and smartphones, 6G can expand significantly in the market.

The Manufacturing Sub-Segment is Anticipated to Hold a Considerable Share of the Global 6G Market

As seen in the rise of 6G technology, the manufacturing sub-segment goes through an evolution phase. The connectivity between the machines and sensors with 6G networks is completely transforming the production process by providing data distribution, machine automation, and communication. Compatibility between the machines, systems, and equipment is possible through this 6G market industry, where utilizing this network benefits the manufacturing industry by accessing real-time processes, thereby saving huge costs on product efficacy, cutting production time, and increasing overall productivity.

Global 6G Market Share By Deployment Device, 2024 (%)

Regional Outlook

The global 6G market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, ASEAN economies, Australia & New Zealand and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

The Asia-Pacific Region is Expected to Grow at a Significant CAGR in the Global 6G Market

Among all the regions, the Asia-Pacific region is estimated to lead the 6G global market, driven by rapid urbanization and significant government investments in smart infrastructure. Governments in these regions, such as Japan, India, South Korea, and Australia, and actively investing in R&D in 6G technology, creating vigorous regulatory frameworks to foster innovation and adoption across both public and private sectors. The strategy by countries aims to develop urban areas, strengthen public and data safety, and optimize resources through sensors and real-time data analytics.

Regional growth is also driven by technological advancement and the adoption of smartphones. A high acceptance of 3D display technologies is on the boom, including display in defense & entertainment, which is an important factor supporting the development of the regional industry. This demand is also driven by video games with internet 6G connectivity for the best gaming experience for gamers.

The rise of 6G technology in various industries, including healthcare, is boosting significant opportunities for the 3D display market with its high-speed connectivity and low latency, 6G enhances medical applications such as remote surgeries and procedures that contribute to better surgical precision, reducing operation times and efficient quick planning.

Market Players Outlook

The major companies serving the 6G market include Google LLC, Huawei Technologies Co. Ltd, Samsung Electronics, AT&T Inc., Cisco Systems, Inc., Nokia Corp., Qualcomm Technologies Inc., and others. These market players contribute to the market growth by using various strategies like investing in R&D, partnerships, mergers and acquisitions, and new product launches, to stay competitive in the market. For instance, In November 2022, NTT Docomo and SK Telecom came with a partnership to drive innovation in both 5G and future 6G technologies. Their collaboration aims to develop open and virtualized RAN solutions, paving the way for more advanced and efficient cellular networks.

In addition, during the same period, Ericsson Telecommunications Company announced its plan to strengthen its presence in the UK by investing in R&D, focusing on 6G technology. The company is committed to growing by 10 million over the next decade to support its initiative, highlighting its long-term vision for advancing next-generation wireless communication systems.

Recent Developments

- In January 2025, China achieved a significant milestone in satellite-to-ground laser communications, driving the realization of 6G internet. Chang Guang Satellite Technology, the operator of the Jilin-1 satellite constellation, conducted a test that reached a data transmission rate of 100 gigabits per second (Gbps). This speed was ten times faster than their previous record and exceeded the current capabilities of systems like Elon Musk's Starlink, which has yet to implement large-scale laser satellite-to-ground communication. The Jilin constellation aims to expand to 300 satellites by 2027, supporting the deployment of 6G internet and other advanced technologies.

- In November 2024, Telefonica Germany, in collaboration with Amazon Web Services (AWS), introduced a pilot project to test their quantum technologies within the 5 G mobile network. The project aims to optimize mobile tower replacement, enhance network security through quantum encryption, and apply these insights to the development of 6G networks. This initiative reflects a broader industry trend of exploiting quantum mechanics to achieve faster processing speeds and more secure communications.

The Report Covers

- Market value data analysis of 2025 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global 6G market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global 6G Market Sales Analysis – Deployment Device | Application | End User ($ Million)

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key 6G Industry Trends

2.2.2. Market Recommendations

2.2.3. Conclusion

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global 6G Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global 6G Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – 6G Market Revenue by Manufacturers

4.2. Key Company Analysis

4.2.1. Overview

4.2.2. Product Portfolio

4.2.3. Financial Analysis (Subject to Data Availability)

4.2.4. SWOT Analysis

4.2.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global 6G Market by Deployment Device ($ Million)

5.1. Smartphones

5.2. Tablets

5.3. Wearables

5.4. IoT Devices

5.5. Others (Laptop and Computer)

6. Global 6G Market by Application ($ Million)

6.1. Distributed Sensing and Communication

6.2. Blockchain

6.3. Multi-Sensory Extended Reality System

6.4. Connected Robotics and Autonomous

7. Global 6G Market by Industry Vertical ($ Million)

7.1. Agriculture

7.2. Healthcare

7.3. Education

7.4. Entertainment

7.5. Automotive

7.6. Public Safety

7.7. Manufacturing

7.8. Others (Aerospace & Defense, Transportation, Financial Services)

8. Regional Analysis

8.1. North American 6G Market Sales Analysis – Deployment Device | Application | End User | Country ($ Million)

8.1.1. United States

8.1.2. Canada

8.2. European 6G Market Sales Analysis – Deployment Device | Application | End User | Country ($ Million)

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific 6G Market Sales Analysis – Deployment Device | Application | End User | Country ($ Million)

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World 6G Market Sales Analysis – Deployment Device | Application | End User | Country ($ Million)

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. ANRITSU CORP.

9.2. Broadcom, Inc.

9.3. Cisco Systems, Inc.

9.4. Deutsche Telekom AG

9.5. Huawei Technologies Co. Ltd.

9.6. Infineon Technologies AG

9.7. Intel Corp.

9.8. LG Electronics Inc.

9.9. NVIDIA Corp.

9.10. Nokia Corp.

9.11. NTT DOCOMO, Inc.

9.12. Qualcomm Technologies, Inc.

9.13. Reliance Jio Infocomm Ltd.

9.14. Samsung Electronics Co. Ltd.

9.15. SK Telecom Co., Ltd.

9.16. SoftBank Group Corp.

9.17. Telefonaktiebolaget LM Ericsson

9.18. Verizon Communications Inc.

9.19. VIAVI Solutions Inc.

9.20. ZTE Corp.

1. Global 6G Market Research And Analysis By Deployment Device, 2024-2035 ($ Million)

2. Global 6G On Smartphones Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global 6G On Tablets Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global 6G On Wearables Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global 6G On Iot Devices Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global 6G On Other Deployment Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global 6G Market Research And Analysis By Application, 2024-2035 ($ Million)

8. Global 6G For Distributed Sensing And Communication Market Research And Analysis, 2024-2035 ($ Million)

9. Global 6G For Blockchain Market Research And Analysis, 2024-2035 ($ Million)

10. Global 6G For Multisensory Extended Reality System Market Research And Analysis, 2024-2035 ($ Million)

11. Global 6G For Connected Robotics And Autonomous Market Research And Analysis, 2024-2035 ($ Million)

12. Global 6G Market Research And Analysis By End-User 2024-2035 ($ Million)

13. Global 6G For Agriculture Market Research And Analysis, 2024-2035 ($ Million)

14. Global 6G For Healthcare Market Research And Analysis, 2024-2035 ($ Million)

15. Global 6G For Education Market Research And Analysis, 2024-2035 ($ Million)

16. Global 6G For Entertainment Market Research And Analysis, 2024-2035 ($ Million)

17. Global 6G For Automotive Market Research And Analysis, 2024-2035 ($ Million)

18. Global 6G For Public Safety Market Research And Analysis, 2024-2035 ($ Million)

19. Global 6G For Manufacturing Market Research And Analysis, 2024-2035 ($ Million)

20. Global 6G For Other End-Users Market Research And Analysis, 2024-2035 ($ Million)

21. Global 6G Market Research And Analysis By Region, 2024-2035 ($ Million)

22. North American 6G Market Research And Analysis By Country, 2024-2035 ($ Million)

23. North American 6G Market Research And Analysis By Deployment Devices, 2024-2035 ($ Million)

24. North American 6G Market Research And Analysis By Application, 2024-2035 ($ Million)

25. North American 6G Market Research And Analysis By End-User, 2024-2035 ($ Million)

26. European 6G Market Research And Analysis By Country, 2024-2035 ($ Million)

27. European 6G Market Research And Analysis By Deployment Devices, 2024-2035 ($ Million)

28. European 6G Market Research And Analysis By Application, 2024-2035 ($ Million)

29. European 6G Market Research And Analysis By End-User, 2024-2035 ($ Million)

30. Asia-Pacific 6G Market Research And Analysis By Country, 2024-2035 ($ Million)

31. Asia-Pacific 6G Market Research And Analysis By Deployment Device, 2024-2035 ($ Million)

32. Asia-Pacific 6G Market Research And Analysis By Application, 2024-2035 ($ Million)

33. Asia-Pacific 6G Market Research And Analysis By End-User, 2024-2035 ($ Million)

34. Rest Of The World 6G Market Research And Analysis By Country, 2024-2035 ($ Million)

35. Rest Of The World 6G Market Research And Analysis By Deployment Device, 2024-2035 ($ Million)

36. Rest Of The World 6G Market Research And Analysis By Application, 2024-2035 ($ Million)

37. Rest Of The World 6G Market Research And Analysis By End-User, 2024-2035 ($ Million)

1. Global 6G Market Share By Deployment Device, 2024 Vs 2035 (%)

2. Global 6G On Smartphones Market Share By Region, 2024 Vs 2035 (%)

3. Global 6G On Tablets Market Share By Region, 2024 Vs 2035 (%)

4. Global 6G On Wearables Market Share By Region, 2024 Vs 2035 (%)

5. Global 6G On Iot Devices Market Share By Region, 2024 Vs 2035 (%)

6. Global 6G On Other Deployment Market Share By Region, 2024 Vs 2035 (%)

7. Global 6G Market Share By Application, 2024 Vs 2035 (%)

8. Global 6G For Distributed Sensing And Communication Market Share By Region, 2024 Vs 2035 (%)

9. Global 6G For Blockchain Market Share By Region, 2024 Vs 2035 (%)

10. Global 6G For Multisensory Extended Reality System Market Share By Region, 2024 Vs 2035 (%)

11. Global For Connected Robotics And Autonomous Market Share By Region, 2024 Vs 2035 (%)

12. Global 6G Market Share Analysis By End-User, 2024-2035 ($ Million)

13. Global 6G For Agriculture Market Share By Region, 2024 Vs 2035 (%)

14. Global 6G For Healthcare Market Share By Region, 2024 Vs 2035 (%)

15. Global 6G For Education Market Share By Region, 2024 Vs 2035 (%)

16. Global 6G For Entertainment Market Share By Region, 2024 Vs 2035 (%)

17. Global 6G For Automotive Market Share By Region, 2024 Vs 2035 (%)

18. Global 6G For Public Safety Market Share By Region, 2024 Vs 2035 (%)

19. Global 6G For Manufacturing Market Share By Region, 2024 Vs 2035 (%)

20. Global 6G For Other End-Users Market Share By Region, 2024 Vs 2035 (%)

21. Global 6G Market Share By Region, 2024 Vs 2035 (%)

22. US 6G Market Size, 2024-2035 ($ Million)

23. Canada 6G Market Size, 2024-2035 ($ Million)

24. UK 6G Market Size, 2024-2035 ($ Million)

25. France 6G Market Size, 2024-2035 ($ Million)

26. Germany 6G Market Size, 2024-2035 ($ Million)

27. Italy 6G Market Size, 2024-2035 ($ Million)

28. Spain 6G Market Size, 2024-2035 ($ Million)

29. Russia 6G Market Size, 2024-2035 ($ Million)

30. Rest Of Europe 6G Market Size, 2024-2035 ($ Million)

31. India 6G Market Size, 2024-2035 ($ Million)

32. China 6G Market Size, 2024-2035 ($ Million)

33. Japan 6G Market Size, 2024-2035 ($ Million)

34. South Korea 6G Market Size, 2024-2035 ($ Million)

35. Australia & New Zealand 6G Market Size, 2024-2035 ($ Million)

36. ASEAN Economies 6G Market Size, 2024-2035 ($ Million)

37. Rest Of Asia-Pacific 6G Market Size, 2024-2035 ($ Million)

38. Rest Of The World 6G Market Size, 2024-2035 ($ Million)

FAQS

The size of the 6G market in 2024 is estimated to be around USD 6.70 billion.

Asia-Pacific holds the largest share in the 6G market.

Leading players in the 6G market include Google LLC, Huawei Technologies Co. Ltd, Samsung Electronics, AT&T Inc., Cisco Systems, Inc., Nokia Corp., Qualcomm Technologies Inc., and others.

6G market is expected to grow at a CAGR of 13.4% from 2025 to 2035.

The growth of the 6G market is driven by rising demand for ultra-fast connectivity, AI-driven networks, IoT expansion, edge computing, smart cities, and advancements in terahertz (THz) communication technology.