Photopolymer Market

Photopolymer Market Size, Share & Trends Analysis Report, By Application (Healthcare, 3D Printing, Electronic Component, and Others), By Form (Film/Sheet and Liquid), By Raw Material (Polymers, Oligomers, Monomers, and Other) and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global photopolymer market is estimated to grow at a CAGR of 15.2% during the forecast period. The major factors contributing to the growth of the market include the significant adoption of liquid photopolymer resin and emerging demand in 3D printing. Photopolymers are one of the materials used in 3D printing with the potential to make products with better properties. In 3D printing technologies, including Stereolithography, the objects are printed for stamps, medical, military and electronics industries. Stereolithography is a crucial method that involves the use of photopolymers.

Stereolithography (SLA) 3D printing has immense importance owing to its ability to produce high-accuracy, watertight and isotropic prototypes and components in multiple advanced materials with smooth surface finish and fine features. Stereolithography belongs to a family of additive manufacturing technologies, referred to as vat photopolymerization. Such machines are all developed approximately with the same principle, using a light source, including a laser or projector to cure liquid resin into hardened plastic which is expected to boost the photopolymer market in near future.

In 3D printing, the photopolymer is usually liquid plastic resins that toughen while introduced to a light source, including a lamp, light-emitting diodes (LEDs), or a projector. As compared to thermoplastics that are employed in material extrusion technologies, such as fused deposition modeling, photopolymers are thermosets that cannot be re-melted, once the chemical reaction occurs to harden the material. The major elements required for the photopolymerization process include oligomers and/or monomers and photo-initiators.

The advances in photopolymer materials motivates the development of strong photopolymers for several 3D printing applications, such as the production of shape-memory polymers for dental fillings and tissue growth. For instance, the researchers from the Technical University of Vienna in Austria (TU Wien) have developed a method to produce strong, high-resolution 3D printed polymers which could enable to overcome the current limitations for light-cured 3D printing materials. This comprises tailoring the methacrylate-based photopolymer production without affecting the curing process. Therefore, photopolymers are anticipated to gain widespread importance in 3D printing technology.

Segmentation

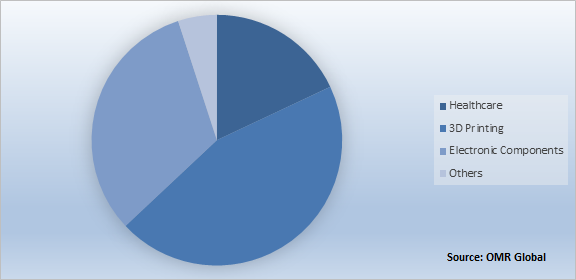

The global photopolymer market is segmented based on application, form and raw material. Based on application, the market is classified into healthcare, 3D printing, electronic component, and other applications. Based on form, the market is further classified into film/sheet and liquid. Based on raw material, the market is classified into polymers, oligomers, monomers, and other additives such as photoinitiators/photosensitizers and UV blockers.

Photopolymers finds its significant application in 3D printing

Among applications, 3D printing is anticipated to grow significantly during the forecast period owing to significant developments in 3D printing technology. In addition, some partnerships regarding the use of photopolymer resin in 3D printing have been reported. For instance, in May 2019, BASF SE and Paxis LLC collaborated to advance innovative materials for new 3D printing technology. Under the agreement, BASF will offer advanced additive manufacturing materials to Paxis LLC for their new WAV technology. The technology is under development and is aimed at meeting the needs of additive manufacturing users. Such kinds of collaborations for 3D printing technology are facilitating the demand for photopolymer resin coupled with advances in 3D printing technology. This, in turn, is accelerating the demand for photopolymer resins.

Global Photopolymer Market Share by Application, 2018 (%)

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global photopolymer market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Koninklijke DSM N.V.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Toray Industries, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. BASF SE

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Chemence, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Nova Polymers, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Photopolymer Market by Application

5.1.1. Healthcare

5.1.2. 3D Printing

5.1.3. Electronic Component

5.1.4. Other Applications (Automotive Holographic Display)

5.2. Global Photopolymer Market by Form

5.2.1. Film/Sheet

5.2.2. Liquid

5.3. Global Photopolymer Market by Raw Material

5.3.1. Polymers

5.3.2. Oligomers

5.3.3. Monomers

5.3.4. Other (Photoinitiators/Photosensitizers and UV Blockers)

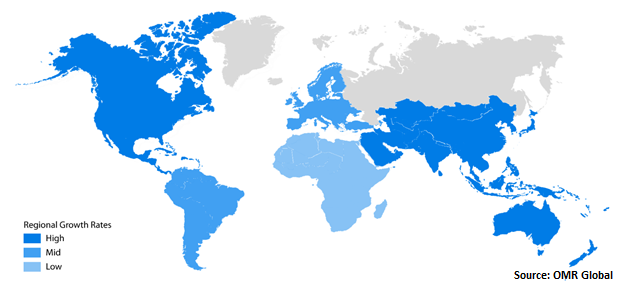

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Adaptive3D Technologies, LLC

7.2. Anderson & Vreeland, Inc.

7.3. BASF SE

7.4. Chemence, Inc.

7.5. DuPont de Nemours, Inc.

7.6. EnvisionTEC, Inc.

7.7. Flint Group

7.8. Formi 3DP, Inc.

7.9. Formlabs, Inc.

7.10. Huntsman Corp.

7.11. Inkcups Now Corp.

7.12. Koninklijke DSM N.V.

7.13. MacDermid, Inc.

7.14. Nanoscribe GmbH

7.15. Nitto Denko Corp.

7.16. Nova Polymers, Inc.

7.17. Photocentric, Ltd.

7.18. Prismlab China, Ltd.

7.19. Stratasys Direct, Inc.

7.20. Toray Industries, Inc.

1. GLOBAL PHOTOPOLYMER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

2. GLOBAL PHOTOPOLYMER IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL PHOTOPOLYMER IN 3D PRINTING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL PHOTOPOLYMER IN ELECTRONIC COMPONENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL PHOTOPOLYMER IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL PHOTOPOLYMER MARKET RESEARCH AND ANALYSIS BY FORM, 2018-2025 ($ MILLION)

7. GLOBAL FILM/SHEET PHOTOPOLYMER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL LIQUID PHOTOPOLYMER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL PHOTOPOLYMER MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2018-2025 ($ MILLION)

10. GLOBAL POLYMER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

11. GLOBAL OLIGOMERS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

12. GLOBAL MONOMERS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

13. GLOBAL OTHER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

14. NORTH AMERICAN PHOTOPOLYMER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. NORTH AMERICAN PHOTOPOLYMER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

16. NORTH AMERICAN PHOTOPOLYMER MARKET RESEARCH AND ANALYSIS BY FORM, 2018-2025 ($ MILLION)

17. NORTH AMERICAN PHOTOPOLYMER MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2018-2025 ($ MILLION)

EUROPEAN PHOTOPOLYMER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. EUROPEAN PHOTOPOLYMER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

19. EUROPEAN PHOTOPOLYMER MARKET RESEARCH AND ANALYSIS BY FORM, 2018-2025 ($ MILLION)

20. EUROPEAN PHOTOPOLYMER MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC PHOTOPOLYMER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

22. ASIA-PACIFIC PHOTOPOLYMER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

23. ASIA-PACIFIC PHOTOPOLYMER MARKET RESEARCH AND ANALYSIS BY FORM, 2018-2025 ($ MILLION)

24. ASIA-PACIFIC PHOTOPOLYMER MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2018-2025 ($ MILLION)

25. REST OF THE WORLD PHOTOPOLYMER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

26. REST OF THE WORLD PHOTOPOLYMER MARKET RESEARCH AND ANALYSIS BY FORM, 2018-2025 ($ MILLION)

27. REST OF THE WORLD PHOTOPOLYMER MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2018-2025 ($ MILLION)

1. GLOBAL PHOTOPOLYMER MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

2. GLOBAL PHOTOPOLYMER MARKET SHARE BY FORM, 2018 VS 2025 (%)

3. GLOBAL PHOTOPOLYMER MARKET SHARE BY RAW MATERIAL, 2018 VS 2025 (%)

4. GLOBAL PHOTOPOLYMER MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US PHOTOPOLYMER MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA PHOTOPOLYMER MARKET SIZE, 2018-2025 ($ MILLION)

7. UK PHOTOPOLYMER MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE PHOTOPOLYMER MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY PHOTOPOLYMER MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY PHOTOPOLYMER MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN PHOTOPOLYMER MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE PHOTOPOLYMER MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA PHOTOPOLYMER MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA PHOTOPOLYMER MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN PHOTOPOLYMER MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC PHOTOPOLYMER MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD PHOTOPOLYMER MARKET SIZE, 2018-2025 ($ MILLION)