ABR Screening Systems Market

Global ABR Screening Systems Market Size, Share & Trends Analysis Report, by Product (Fixed and Portable), by Patient (Pediatrics and Adults), by End-User (Hospitals & Specialty Clinics and Ambulatory Surgical Centers), and Forecast, 2019 – 2025 Update Available - Forecast 2025-2035

The global Auditory Brainstem Response (ABR) screening systems market is estimated to grow at a CAGR of 6.9% during the forecast period. The major factors contributing to the growth of the market include the rising incidences of hearing loss and a rapid increase in the number of newborn hearing screening programs. As per the data published by the World Health Organization (WHO) in March 2019, nearly 466 million people across the globe have disabling hearing loss, and 34 million of these are children. Nearly 1.1 billion young people (aged between 12-35) are at risk of hearing loss coupled with exposure to noise in recreational settings. This, in turn, is leading to increasing demand for hearing screening tests, including ABR tests among adults.

For adults, ABR is recommended to screen for certain kinds of tumors that can occur within the auditory system. This allows physicians to understand the status of the hearing nerve. In addition, increasing prevalence of congenital hearing loss has been reported, which in turn, is leading to an emerging focus on newborn screening tests that supports to identify babies with a permanent hearing loss much early. The ABR test measures the child’s hearing nerve’s response to sounds and is often recommended when a newborn fails the hearing screening test provided in the hospital after birth, or for older children if there is a doubt of hearing loss that was not confirmed using more conventional hearing tests. The ABR test is safe and does not hurt.

Segment Outlook

The global ABR screening systems market is classified into product, application, and end-user. Based on the product, the market is classified into fixed and portable. Based on application, the market is classified into pediatrics and adults. Based on end-user, the market is classified into hospitals & specialty clinics and ambulatory surgical centers.

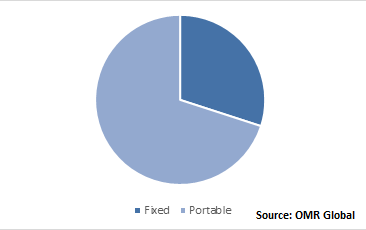

Global ABR Screening Systems Market: By Product

Portable ABR screening systems has witnessed a significant share in the market in 2018. Portable ABR screening system is a lightweight and portable alternative to larger cart-based systems. These devices allow to screen more babies in less duration and make available screening resources for other tasks. It is easy to learn and use and fits comfortably in the hand. It eliminates the need for the cost of high maintenance and training.

Global ABR Screening Systems Market Share by Product, 2018 (%)

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global ABR screening systems market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Natus Medical, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Vivosonic, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. MAICO Diagnostics GmbH

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. PATH MEDICAL GmbH

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Recent Developments

3.3.4.4. Recent Developments

3.3.5. Grason-Stadler, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global ABR Screening Systems Market by Product

5.1.1. Fixed

5.1.2. Portable

5.2. Global ABR Screening Systems Market by Patient

5.2.1. Pediatrics

5.2.2. Adults

5.3. Global ABR Screening Systems Market by End-User

5.3.1. Hospitals and Specialty Clinics

5.3.2. Ambulatory Surgical Centers

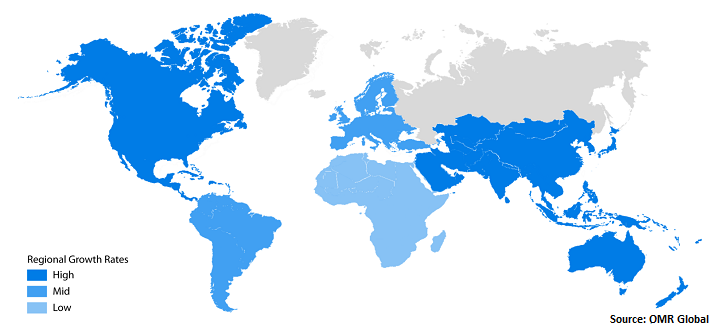

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. BioMed Jena GmbH

7.2. e3 Diagnostics

7.3. ECHODIA

7.4. Elkon Pvt. Ltd.

7.5. GAES

7.6. Grason-Stadler, Inc.

7.7. Hedera Biomedics srl

7.8. Homoth Medizinelektronik GmbH & Co. KG

7.9. Intelligent Hearing Systems

7.10. Interacoustics A/S

7.11. Inventis srl

7.12. MAICO Diagnostics GmbH

7.13. Natus Medical, Inc.

7.14. Neurosoft Co.

7.15. Otodynamics Ltd.

7.16. PATH MEDICAL GmbH

7.17. Pilot Blankenfelde GmbH

7.18. Tucker-Davis Technologies

7.19. Vivosonic, Inc.

1. GLOBAL ABR SCREENING SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

2. GLOBAL FIXED ABR SCREENING SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL PORTABLE ABR SCREENING SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL ABR SCREENING SYSTEMS MARKET RESEARCH AND ANALYSIS BY PATIENT, 2018-2025 ($ MILLION)

5. GLOBAL ABR SCREENING SYSTEMS FOR PEDIATRICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL ABR SCREENING SYSTEMS FOR ADULTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL ABR SCREENING SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

8. GLOBAL ABR SCREENING SYSTEMS IN HOSPITALS AND SPECIALTY CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL ABR SCREENING SYSTEMS IN AMBULATORY SURGICAL CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL ABR SCREENING SYSTEMS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

11. NORTH AMERICAN ABR SCREENING SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN ABR SCREENING SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

13. NORTH AMERICAN ABR SCREENING SYSTEMS MARKET RESEARCH AND ANALYSIS BY PATIENT, 2018-2025 ($ MILLION)

14. NORTH AMERICAN ABR SCREENING SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

15. EUROPEAN ABR SCREENING SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. EUROPEAN ABR SCREENING SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

17. EUROPEAN ABR SCREENING SYSTEMS MARKET RESEARCH AND ANALYSIS BY PATIENT, 2018-2025 ($ MILLION)

18. EUROPEAN ABR SCREENING SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC ABR SCREENING SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC ABR SCREENING SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC ABR SCREENING SYSTEMS MARKET RESEARCH AND ANALYSIS BY PATIENT, 2018-2025 ($ MILLION)

22. ASIA-PACIFIC ABR SCREENING SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

23. REST OF THE WORLD ABR SCREENING SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

24. REST OF THE WORLD ABR SCREENING SYSTEMS MARKET RESEARCH AND ANALYSIS BY PATIENT, 2018-2025 ($ MILLION)

25. REST OF THE WORLD ABR SCREENING SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL ABR SCREENING SYSTEMS MARKET SHARE BY PRODUCT, 2018 VS 2025 (%)

2. GLOBAL ABR SCREENING SYSTEMS MARKET SHARE BY PATIENT, 2018 VS 2025 (%)

3. GLOBAL ABR SCREENING SYSTEMS MARKET SHARE BY END-USER, 2018 VS 2025 (%)

4. GLOBAL ABR SCREENING SYSTEMS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US ABR SCREENING SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA ABR SCREENING SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

7. UK ABR SCREENING SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE ABR SCREENING SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY ABR SCREENING SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY ABR SCREENING SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN ABR SCREENING SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE ABR SCREENING SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA ABR SCREENING SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA ABR SCREENING SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN ABR SCREENING SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC ABR SCREENING SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD ABR SCREENING SYSTEMS MARKET SIZE, 2018-2025 ($ MILLION)