Automotive Anti-Lock Braking System (ABS) Market

Automotive Anti-Lock Braking System (ABS) Market Size, Share & Trends Analysis Report by Sub-System (Sensors, Electronic Control Unit (ECU), and hydraulic Unit), and by Vehicle Type (Two-Wheeler, Passenger Cars, and Commercial Vehicles) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

ABS market is anticipated to grow at a considerable CAGR of 9.6% during the forecast period. The primary factor contributing toward the market growth includes the rising incidence of road-accidents across the globe, which has increased the concerns related to road safety. According to the World Health Organization (WHO), around 1.3 million people loses life in road accidents every year, and about half of the casualties occur in middle and low-income economies that have less than 50% of the global total vehicles. Thus, to reduce cases of road accidents and provide improved enhanced safety, the automobile manufacturers are offering better ABS in vehicles, which in turn will bolster the market growth. ABS, are found in automobiles, trucks, buses, and motorcycles. It stops wheels from locking up and vehicles from slipping out of control. Additionally, the ABS reduces the distance on rough and dry roads, protecting cars from crashing in emergency situations.

Segmental Outlook

The global ABS market is segmented based on the sub-system type and vehicle type. Based on the sub-system type, the market is sub-segmented into sensors, ECU, and hydraulic unit. Based on the vehicle type, the market is sub-segmented into two-wheeler, passenger cars, and commercial vehicles. Among the sub-system type, the sensors sub-segment is anticipated to witness lucrative growth over the forecast period. An ABS sensor is a wheel speed sensor that assists the car's ABS system to know when to engage. The ABS system is designed to kick in during emergency braking situations to prevent wheels from locking up, which in turn, maintains control of a vehicle while avoiding accidents.

Among the vehicle type, the passenger cars sub-segment is expected to hold a significant share of the global ABS market. The primary factor supporting the segmental growth includes the rising introduction and implementation of various government regulations. The growing demand for vehicle safety and control systems in automotive industries such as ABS has pushed the government to introduce new safety regulations across the globe. For instance, in March 2021, the Indian Central Government announced to mandate of various safety features such as electronic stability control and autonomous emergency braking system in automobiles from 2022-2023 onwards. Some other features which will be made compulsory include ABS, a speed alert system, reverse parking sensors, driver & passenger seatbelt reminders, and manual override for a central locking system. Furthermore, earlier in 2021, the government mandated the provision of 6 airbags in passenger cars, in order to provide enhanced safety to the users.

Regional Outlooks

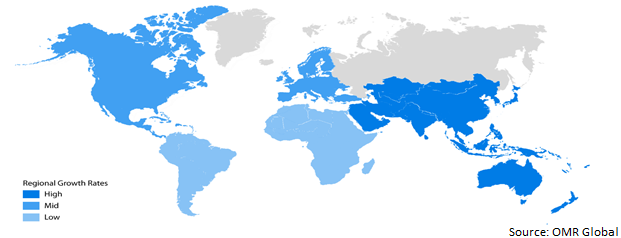

The global ABS market is further segmented based on geography including North America (the US, and , Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). Among these, the European region is expected to hold a prominent share of the global ABS market owing to the strong hold and presence in the market, followed by North America.

Global Automotive Anti-Lock Braking System (ABS) Market Growth, by Region 2022-2028

The Asia-Pacific Region is Expected to Grow at a Significant CAGR in the Global Automotive Anti-Lock Braking System (ABS) Market

The Asia-Pacific region is expected to grow at a significant CAGR over the forecast period, owing to the presence of growing economies such as China and India. China is the key manufacturing hub of various electronic equipment used in automobiles. In addition, several key market players are focusing on expanding their presence in the Asia-Pacific region by establishing manufacturing plants in countries including India, China, and others. For instance, in June 2022, several global car manufacturers including BMW, Honda, and Volkswagen announced to establish new factories in China with an aim to expand their production capacities. Additionally, in June 2022, BMW Brilliance's Plant Lydia was officially opened in Shenyang, Northeast China's Jilin Province. With an investment of $2.2 billion, the plant is the biggest single investment in BMW's history in China.

Market Players Outlook

The major companies serving the global ABS market include BWI Group, Continental AG, Delphi Technologies, Robert Bosch GmbH, KEMI Labs, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. Key players are investing in research and development to further grow the business. For instance, in March 2022, Haldex signed an agreement with KRONE Commercial Vehicle Group for the supply of 4th generation electronic brake system (EBS) platforms specifically for trailers. This new generation EBS, named EB+4.0 offers parking brake control integrated into electronic management along with a new modular and customizable approach to fulfill customer-specific requirements.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automotive anti-lock braking system (ABS) market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Automotive Anti-Lock Braking Systems (ABS) Market by Sub-System Type

4.1.1. Sensors

4.1.2. Electronic Control Unit (ECU)

4.1.3. Hydraulic Unit

4.2. Global Automotive Anti-Lock Braking Systems (ABS) Market by Vehicle Type

4.2.1. Two-Wheeler

4.2.2. Passenger Cars

4.2.3. Commercial Vehicle

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Advics Co., Ltd.

6.2. Autoliv Inc.

6.3. Beijing Automotive Group Co., Ltd.

6.4. BWI Group

6.5. Continental AG

6.6. Delphi Technologies

6.7. DENSO Corp.

6.8. Haldex AB

6.9. Hitachi, Ltd.

6.10. Jiaozuo Brake Co., Ltd.

6.11. JUNEN Enterprise Corp.

6.12. KEMI Lab

6.13. Knorr-Bremse Group

6.14. Robert Bosch GmbH

6.15. The Asia/Pacific Group

6.16. The Distance Education Accrediting Commission (DETC)

6.17. The Mando Corp.

6.18. ZF Friedrichshafen AG

1. GLOBAL AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET RESEARCH AND ANALYSIS BY SUB-SYSTEM TYPE, 2021-2028 ($ MILLION)

2. GLOBAL SENSORS IN AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL ECU IN AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL HYDRAULIC UNIT IN AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

6. GLOBAL AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) IN TWO-WHEELER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) IN PASSENGER CARS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) IN COMMERCIAL VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. NORTH AMERICAN AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

11. NORTH AMERICAN AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET RESEARCH AND ANALYSIS BY SUB-SYSTEM TYPE, 2021-2028 ($ MILLION)

12. NORTH AMERICAN AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

13. EUROPEAN AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. EUROPEAN AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET RESEARCH AND ANALYSIS BY SUB-SYSTEM TYPE, 2021-2028 ($ MILLION)

15. EUROPEAN AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

16. ASIA-PACIFIC AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET RESEARCH AND ANALYSIS BY SUB-SYSTEM TYPE, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

19. REST OF THE WORLD AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. REST OF THE WORLD AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET RESEARCH AND ANALYSIS BY SUB-SYSTEM TYPE, 2021-2028 ($ MILLION)

21. REST OF THE WORLD AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

1. GLOBAL AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET SHARE BY SUB-SYSTEM TYPE, 2021 VS 2028 (%)

2. GLOBAL SENSORS IN AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL ECU IN AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL HYDRAULIC UNIT AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET SHARE BY VEHICLE TYPE, 2021 VS 2028 (%)

6. GLOBAL ENGINE OIL AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) IN TWO-WHEELERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) IN PASSENGER CARS MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) IN COMMERCIAL VEHICLES MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. US AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET SIZE, 2021-2028 ($ MILLION)

12. CANADA AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET SIZE, 2021-2028 ($ MILLION)

13. UK AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET SIZE, 2021-2028 ($ MILLION)

14. FRANCE AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET SIZE, 2021-2028 ($ MILLION)

15. GERMANY AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET SIZE, 2021-2028 ($ MILLION)

16. ITALY AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET SIZE, 2021-2028 ($ MILLION)

17. SPAIN AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET SIZE, 2021-2028 ($ MILLION)

18. REST OF EUROPE AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET SIZE, 2021-2028 ($ MILLION)

19. INDIA AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET SIZE, 2021-2028 ($ MILLION)

20. CHINA AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET SIZE, 2021-2028 ($ MILLION)

21. JAPAN AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET SIZE, 2021-2028 ($ MILLION)

22. SOUTH KOREA AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF ASIA-PACIFIC AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF THE WORLD AUTOMOTIVE ANTI-LOCK BRAKING SYSTEM (ABS) MARKET SIZE, 2021-2028 ($ MILLION)