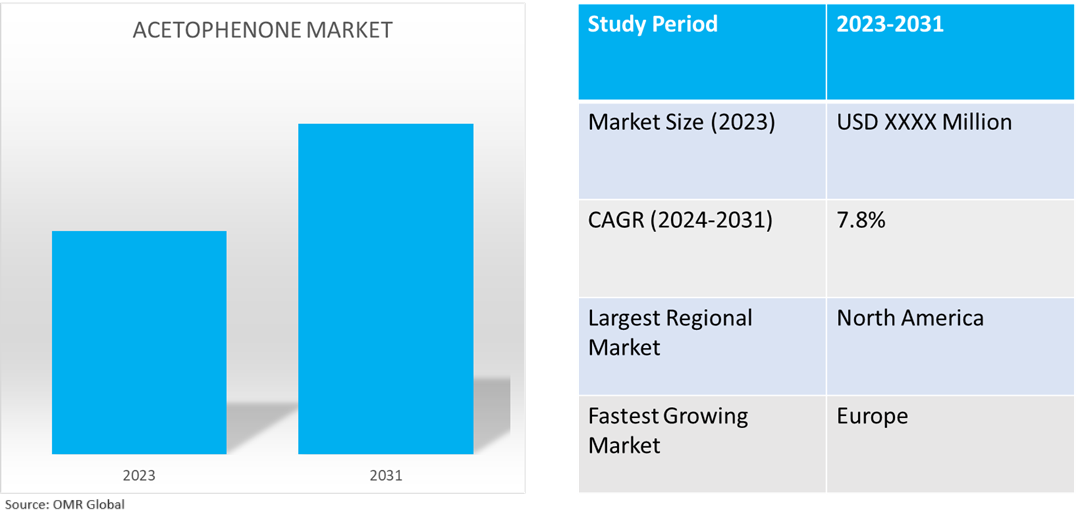

Acetophenone Market

Acetophenone Market Size, Share & Trends Analysis Report by Form (Solid, Liquid, and Others), and by Application (Industrial Solvents, Pharmaceuticals, Flavors, Fragrances, and Others) Forecast Period (2024-2031)

Acetophenone market is anticipated to grow at a significant CAGR of 7.8% during the forecast period (2024-2031). The market growth is attributed to growing demand for acetophenone in consumer goods, food and beverage, medicines, and resins globally. With recent technological advancements and ongoing research & development initiatives aimed at improving production processes and identifying new applications, acetophenone is growing considerably in demand across several industries.

Market Dynamics

Increasing Pharmaceutical and Fragrance Industries

The increasing trend of the pharmaceutical business to increase their reliance on acetophenone as a critical step in the drug-production process is creating huge demand for acetophenone. Acetophenone primary use as a scent ingredient in cosmetics and perfumes as well as a flavoring agent in the food and beverage sector is further aiding to its market demand. Agrochemicals, medicines, and other organic molecules are all synthesized using acetophenone as a precursor. The increasing growth of the healthcare industry and rising investments in R&D fuel the demand for pharmaceuticals, which will in turn increase the need for acetophenone as a precursor. Orange flower scent is added via acetophenone to lotions, soaps, detergents, and fragrances. Acetophenone concentrations in these items can be as low as 20–50 ppm in detergents and lotions, and as high as 2000 ppm in perfumes.

Increasing Uses of Acetophenone in Resins and Coatings

The utilization of acetophenone is on the rise owing to the rising demand for high-performance resins and polymers in the building and automotive sectors. 1-3 Acetophenone formaldehyde resins are used as cost-effective binders in coating materials and printing inks, in combination with other raw materials such as cellulose nitrate. They improve gloss, fullness, hiding power, solids content, adhesion, and drying. Dollmar S.p.A offer acetophenone which is used as an intermediate and in the preparation of alcohol-soluble resins. Acetophenone is used in industry as a photosensitizer in organic synthesis, a catalyst for olefin polymerization, and a specialized solvent for resins and plastics. Acetophenone has been used historically as a sedative, anesthetic, and a substance to produce analgesia.

Market Segmentation

- Based on the form, the market is segmented into solid, liquid, and others including solidified melt/ supercooled melt.

- Based on the application, the market is segmented into industrial solvents, pharmaceuticals, flavors, fragrances, and other including pesticides).

Liquid is Projected to Hold the Largest Segment

The liquid segment is expected to hold the largest share of the market. The primary factors supporting the growth include the growing use of liquid acetophenone as a food and beverage flavoring agent, and as a solvent for plastics and resins. The liquid acetophenone is also used as an ingredient in perfumes and as a chemical intermediate in manufacturing of pharmaceuticals, resins, flavoring agents, and a form of tear gas.

Pharmaceuticals Segment to Hold a Considerable Market Share

The pharmaceuticals segment is expected to hold a considerable share of the market. The high usage of acetophenone as an anesthetic agent to induce analgesia is a key contributor to the high share of this market segment.. Due to its chemical nature and reactivity, it is used as a precursors in heterocyclic synthesis and the ideal synthon for multicomponent reactions based on simple aldol condensations or the ?-functionalization strategy.

Regional Outlook

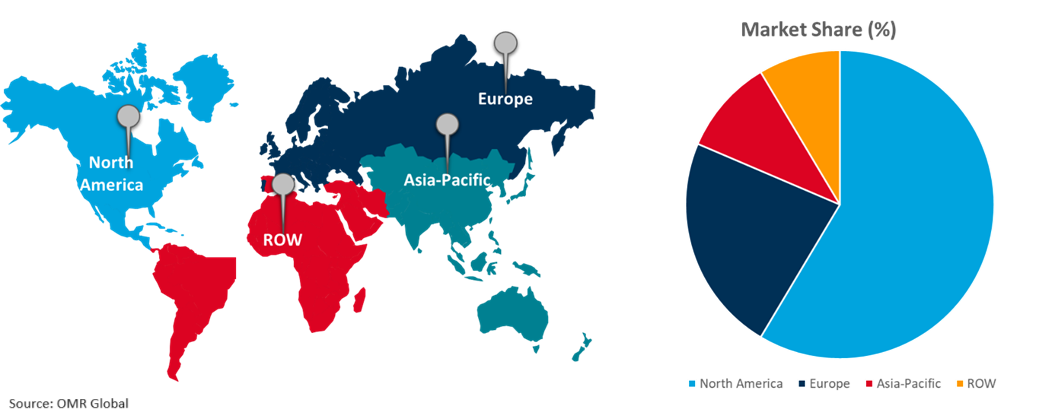

Global acetophenone market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Application of Acetophenone in Europe

- The regional growth is attributed to the increasing demand for Acetophenone in resins, pharmaceuticals, food and beverages, and consumer goods in countries such as Germany, the UK, and France. Acetophenone is gaining new applications in agrochemicals, dyes, and polymers which is offering growth opportunities for regional market growth. The regional companies have the potential to grow as acetophenone finds new uses in agrochemicals, dyes, and polymers. The acetophenone market may expand owing to the growing R&D spending, sustainability efforts, and environmentally friendly production methods.

Global Acetophenone Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds a significant share owing to numerous prominent acetophenone manufacturers and providers such as Actylis, Thermo Fisher Scientific Inc., Vigon International, Inc., in the region. The expansion of the market in the region is driven by the high adoption of acetophenone in consumer goods, food and beverage, pharmaceuticals, and resins. According to the National Center for Biotechnology Information (NCBI), in January 2023, natural and synthetic simple acetophenone derivatives were analyzed as promising agrochemicals and useful scaffolds for drug research and development. The market players in the region offer acetophenone as an active pharmaceutical ingredient. For instance, Thermo Fisher Scientific Inc. provide acetophenone, 99%, Thermo Scientific Chemicals. Acetophenone is used as a raw material in the synthesis of active pharmaceutical ingredients such as dextropropoxyphene and phenylpropanolamine.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the acetophenone market include FUJIFILM Corp., Merck KGaA, Solvay Group, Sumitomo Chemical Co Ltd., and Thermo Fisher Scientific Inc. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the acetophenone market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Alfa Aesar

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. CellMark USA LLC

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. INEOS Phenol

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Acetophenone Market by Form

4.1.1. Solid

4.1.2. Liquid

4.1.3. Others (Ethylbenzene Process Acetophenone)

4.2. Global Acetophenone Market by Application

4.2.1. Industrial Solvents

4.2.2. Pharmaceuticals

4.2.3. Flavors

4.2.4. Fragrances

4.2.5. Others (Pesticide)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Antares Chemical Pvt. Ltd.

6.2. Domo Chemicals

6.3. JK Chemicals

6.4. Ketan Chemical Corp.

6.5. Kind Chemical Inc.

6.6. Mitsui Chemicals, Inc.

6.7. Triveni Interchem

6.8. SAE Manufacturing Specialties Corp.

6.9. SI Group

6.10. Sigma-Aldrich

6.11. Solvay SA

6.12. Sun Industries

6.13. Supelco, Inc.

6.14. Tanfac Industries Ltd.

6.15. Triveni Interchem Pvt. Ltd.

6.16. Vigon International, Inc.

6.17. Wego Chemical Group Inc.

1. GLOBAL ACETOPHENONE MARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

2. GLOBAL SOLID ACETOPHENONE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL LIQUID ACETOPHENONE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL OTHER FORM ACETOPHENONE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL ACETOPHENONE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

6. GLOBAL ACETOPHENONE FOR INDUSTRIAL SOLVENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL ACETOPHENONE FOR PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL ACETOPHENONE FOR FLAVORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL ACETOPHENONE FOR FRAGRANCES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL ACETOPHENONE FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL ACETOPHENONE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN ACETOPHENONE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN ACETOPHENONE MARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

14. NORTH AMERICAN ACETOPHENONE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

15. EUROPEAN ACETOPHENONE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. EUROPEAN ACETOPHENONE MARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

17. EUROPEAN ACETOPHENONE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC ACETOPHENONE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC ACETOPHENONE MARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC ACETOPHENONE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. REST OF THE WORLD ACETOPHENONE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. REST OF THE WORLD ACETOPHENONE MARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

23. REST OF THE WORLD ACETOPHENONE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL ACETOPHENONE MARKET SHARE BY FORM, 2023 VS 2031 (%)

2. GLOBAL SOLID ACETOPHENONE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL LIQUID ACETOPHENONE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL OTHER FORM ACETOPHENONE MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL ACETOPHENONE MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

6. GLOBAL ACETOPHENONE FOR INDUSTRIAL SOLVENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL ACETOPHENONE FOR PHARMACEUTICALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL ACETOPHENONE FOR FLAVORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL ACETOPHENONE FOR FRAGRANCES MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL ACETOPHENONE FOR OTHER APPLICATIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL ACETOPHENONE MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. US ACETOPHENONE MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA ACETOPHENONE MARKET SIZE, 2023-2031 ($ MILLION)

14. UK ACETOPHENONE MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE ACETOPHENONE MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY ACETOPHENONE MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY ACETOPHENONE MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN ACETOPHENONE MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE ACETOPHENONE MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA ACETOPHENONE MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA ACETOPHENONE MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN ACETOPHENONE MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA ACETOPHENONE MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC ACETOPHENONE MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA ACETOPHENONE MARKET SIZE, 2023-2031 ($ MILLION)

26. MIDDLE EAST AND AFRICA ACETOPHENONE MARKET SIZE, 2023-2031 ($ MILLION)