Acidity Regulators Market

Acidity Regulators Market Size, Share & Trends Analysis Report by Product Type (Citric Acids, Acetic Acids, Phosphoric Acid, Malic Acid, and Lactic Acid), and by Application (Beverages, Proceeded Food, Bakery & Confectionery, Sauces, Condiments & Dressing, and Other), Forecast Period (2025-2035)

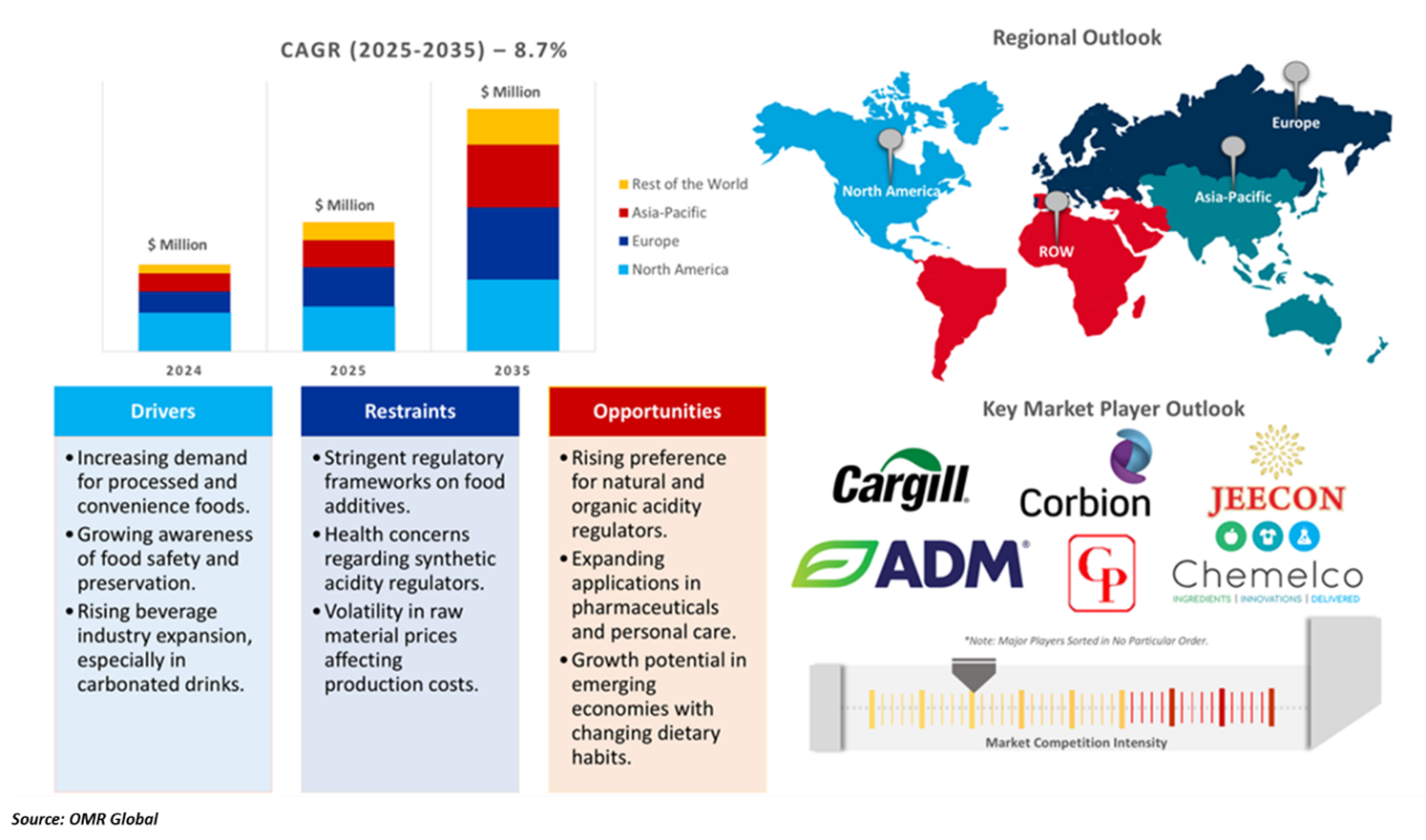

Industry Outlook

Acidity regulators market is anticipated to grow at a CAGR of 8.7% during the forecast period (2025-2035). Market growth is driven by increasing demand for processed and convenience food as well as expansion in the beverage industry. To sustain in the market, Acidity regulators are required to maintain the desired pH level in their food and beverages. PH control is important for the production of the desired taste, texture, and appearance of such products. Acidity regulators can improve food security by preventing regulatory microbial growth, increasing durability, and reducing the risk of foodborne diseases. The beverage industry is also an important contributor to the extension of the market, in which soft drinks, energy drinks, and alcoholic beverages depend on acidity regulators for better taste improvement and stability.

Segmental Outlook

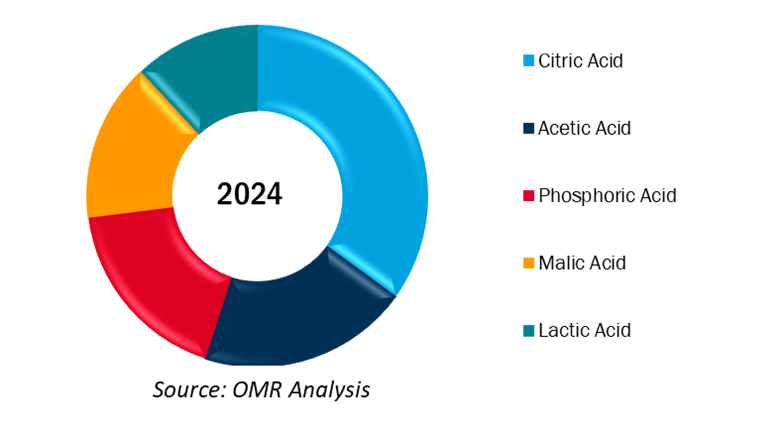

The global acidity regulators market is segmented by product type and application. Based on the product type, the market is sub-segmented into citric acids, acetic acids, phosphoric acid, malic acid, and lactic acid. Further, based on the application, the market is sub-segmented into beverages, processed food, bakery & confectionery, sauces, condiments & dressing, and others. Among the product types, the citric acid sub-segment is projected to keep a dominant share in the global acidity regulators market owing to its natural preservative properties, excessive solubility, and ability to enhance flavor. The increasing demand for carbonated soft drinks, energy drinks as beverages, and fruit juices has driven the consumption of citric acid as a key acidulant.

The Beverages sub-segment is anticipated to drive the Market Expansion of the Global Acidity Regulators Market.

In the applications sub-segment, the beverages industry is estimated to hold a significant share of the global acidity regulators market for the forecast period. Acidity regulators play an important role in stabilizing pH levels that improve the taste and shelf life of various beverages such as carbonated beverages, alcoholic beverages, sports energy drinks, and fruit juices. This expansion of the beverage industry has contributed significantly to the increase in consumption of functional drinks, which has contributed significantly to the increasing demand for acidity regulators. In November 2023, a report by the Indian Council for Research on International Economic Relations highlighted that over 44.0% of the total revenue of the beverages market was generated by the carbonated soft drinks sector (CSD), where India contributed to the overall generated revenue of $18.2 billion in 2022.

Global Acidity Regulators Market Share By Product Type, 2024 (%)

Regional Outlook

The global acidity regulators market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, ASEAN economies, Australia & New Zealand and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America.

The Asia-Pacific Region is Expected to Grow at a Significant CAGR in the Global Acidity Regulators Market

In all the regions, the Asia-Pacific region is estimated to increase considerably with the highest CAGR among other regional segments in the forecast period. The regional development is attributed to the increase in demand for the food and beverage industry with rapid urbanization and consumer preference for processed and convenience foods. The growing demand for carbonated drinks and energy drinks in emerging economies such as China and India is leading to the adoption of acidity regulators. The governments of various countries across the region are implementing favorable policies to support the food and beverage industry, which is increasing the demand for acidity regulators. The presence of major food and beverage manufacturers in the Asia-Pacific region with continuous product innovations is expected to create attractive growth opportunities for the market of acidity regulators in the upcoming years.

Market Players Outlook

The major companies serving the acidity regulators market include Cargill Inc., Corbion NV, Jeecon Foods Pvt. Ltd., ADM, Celrich Products, Chemelco, and others. These market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in November 2024, Tate & Lyle completed the acquisition of CP Kelco, which is a leading provider of pectin and specialty gums, for $1.8 billion. The company aims to create a global specialty food and beverage solutions business and to enhance its portfolio of market reach.

The Report Covers

- Market value data analysis of 2025 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global acidity regulators market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1 Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Acidity Regulators Market Sales Analysis –Product Type| Application ($ Million)

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Cargill, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Corbion NV

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Naturex SA

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Acidity Regulators Market by Product Type ($ Million)

4.1.1. Citric Acids

4.1.2. Acetic Acids

4.1.3. Phosphoric Acid

4.1.4. Malic Acid

4.1.5. Lactic Acid

4.2. Global Acidity Regulators Market by Application ($ Million)

4.2.1. Beverages

4.2.2. Proceeded Food

4.2.3. Bakery & Confectionery

4.2.4. Sauces, Condiments & Dressing

4.2.5. Others (Fruits and Vegetables tins, Diary Products)

5. Regional Analysis

5.1. North America Acidity Regulators Market Sales Analysis - Product Type| Application ($ Million)

5.1.1. United States

5.1.2. Canada

5.2. Europe Acidity Regulators Market Sales Analysis - Product Type| Application ($ Million)

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific Acidity Regulators Market Sales Analysis - Product Type| Application ($ Million)

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Australia & New Zealand

5.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

5.3.7. Rest of Asia-Pacific

5.4. Rest of the World Acidity Regulators Market Sales Analysis - Product Type| Application ($ Million)

5.4.1. Latin America

5.4.2. Middle East and Africa

6 Company Profiles

6.1 Archer Daniels Midland Co. (ADM)

6.2 Brenntag AG

6.3 Cargill Inc.

6.4 CD Formulation

6.5 Chemelco International B.V.

6.6 Corbion N.V.

6.7 Dow Inc.

6.8 F.B.C Industries

6.9 Foodchem International Corp.

6.10 Gadot Biochemical Industries Ltd.

6.11 Hawkins Watts Ltd.

6.12 Innophos Holdings, Inc.

6.13 Jeecon Foods Pvt. Ltd.

6.14 Jungbunzlauer Suisse AG

6.15 Merck KGaA

6.16 Prinova Group LLC.

6.17 Polynt Group

6.18 Seachem Laboratories, Inc.

6.19 Tate & Lyle Plc.

6.20 Univar Solutions Inc.

1. Global Acidity Regulators Market Research And Analysis By Product Type, 2024-2035 ($ Million)

2. Global Citric Acids Regulators Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Acetic Acids Regulators Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Phosphoric Acid Regulators Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Malic Acid Regulators Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Lactic Acid Regulators Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Acidity Regulators Market Research And Analysis By Application, 2024-2035 ($ Million)

8. Global Acidity Regulators For Beverages Market Research And Analysis, 2024-2035 ($ Million)

9. Global Acidity Regulators For Proceeded Food Market Research And Analysis, 2024-2035 ($ Million)

10. Global Acidity Regulators For Bakery & Confectionery Market Research And Analysis, 2024-2035 ($ Million)

11. Global Acidity Regulators For Sauces, Condiments & Dressing Market Research And Analysis, 2024-2035 ($ Million)

12. Global Acidity Regulators For Other Market Research And Analysis, 2024-2035 ($ Million)

13. Global Acidity Regulators Market Research And Analysis By Region, 2024-2035 ($ Million)

14. North American Acidity Regulators Market Research And Analysis By Country, 2024-2035 ($ Million)

15. North American Acidity Regulators Market Research And Analysis By Product Type, 2024-2035 ($ Million)

16. North American Acidity Regulators Market Research And Analysis By Application, 2024-2035 ($ Million)

17. European Acidity Regulators Market Research And Analysis By Country, 2024-2035 ($ Million)

18. European Acidity Regulators Market Research And Analysis By Product Type, 2024-2035 ($ Million)

19. European Acidity Regulators Market Research And Analysis By Application, 2024-2035 ($ Million)

20. Asia-Pacific Acidity Regulators Market Research And Analysis By Country, 2024-2035 ($ Million)

21. Asia-Pacific Acidity Regulators Market Research And Analysis By Product Type, 2024-2035 ($ Million)

22. Asia-Pacific Acidity Regulators Market Research And Analysis By Application, 2024-2035 ($ Million)

23. Rest Of The World Acidity Regulators Market Research And Analysis By Region, 2024-2035 ($ Million)

24. Rest Of The World Acidity Regulators Market Research And Analysis By Product Type, 2024-2035 ($ Million)

25. Rest Of The World Acidity Regulators Market Research And Analysis By Application, 2024-2035 ($ Million)

1. Global Acidity Regulators Market Share By Product Type, 2024 Vs 2035 (%)

2. Global Citric Acids Regulators Market Share By Region, 2024 Vs 2035 (%)

3. Global Acetic Acids Regulators Market Share By Region, 2024 Vs 2035 (%)

4. Global Phosphoric Acid Regulators Market Share By Region, 2024 Vs 2035 (%)

5. Global Malic Acids Regulators Market Share By Region, 2024 Vs 2035 (%)

6. Global Lactic Acids Regulators Market Share By Region, 2024 Vs 2035 (%)

7. Global Acidity Regulators Market Share By Application, 2024 Vs 2035 ($ Million)

8. Global Acidity Regulators For Beverages Market Share By Region, 2024 Vs 2035 (%)

9. Global Acidity Regulators For Proceeded Food Market Share By Region, 2024 Vs 2035 (%)

10. Global Acidity Regulators For Bakery & Confectionery Market Share By Region, 2024 Vs 2035 (%)

11. Global Acidity Regulators For Sauces, Condiments & Dressing Market Share By Region, 2024 Vs 2035 (%)

12. Global Acidity Regulators For Other Market Share By Region, 2024 Vs 2035 (%)

13. Global Acidity Regulators Market Share By Region, 2024 Vs 2035 (%)

14. US Acidity Regulators Market Size, 2024-2035 ($ Million)

15. Canada Acidity Regulators Market Size, 2024-2035 ($ Million)

16. UK Acidity Regulators Market Size, 2024-2035 ($ Million)

17. France Acidity Regulators Market Size, 2024-2035 ($ Million)

18. Germany Acidity Regulators Market Size, 2024-2035 ($ Million)

19. Italy Acidity Regulators Market Size, 2024-2035 ($ Million)

20. Spain Acidity Regulators Market Size, 2024-2035 ($ Million)

21. Russia Acidity Regulators Market Size, 2024-2035 ($ Million)

22. Rest Of Europe Acidity Regulators Market Size, 2024-2035 ($ Million)

23. India Acidity Regulators Market Size, 2024-2035 ($ Million)

24. Australia & New Zealand Acidity Regulators Market Size, 2024-2035 ($ Million)

25. ASEAN Economies Acidity Regulators Market Size, 2024-2035 ($ Million)

26. China Acidity Regulators Market Size, 2024-2035 ($ Million)

27. Japan Acidity Regulators Market Size, 2024-2035 ($ Million)

28. South Korea Acidity Regulators Market Size, 2024-2035 ($ Million)

29. Rest Of Asia-Pacific Acidity Regulators Market Size, 2024-2035 ($ Million)

30. Rest Of The World Acidity Regulators Market Size, 2024-2035 ($ Million)

FAQS

The size of the Acidity Regulators market in 2024 is estimated to be around USD 7.0 billion.

Asia-Pacific holds the largest share in the Acidity Regulators market.

Leading players in the Acidity Regulators market include Cargill Inc., Corbion NV, Jeecon Foods Pvt. Ltd., ADM, Celrich Products, Chemelco, and others.

Acidity Regulators market is expected to grow at a CAGR of 8.7% from 2025 to 2035.

The growth of the acidity regulators market is driven by increasing demand for processed foods, expanding beverage consumption, rising health awareness, and the growing use of acidity regulators in pharmaceuticals and personal care products.