Active Insulation Market

Global Active Insulation Market Size, Share & Trends Analysis Report, By Product (Building and Construction (Mineral Wool, EPS, Glass Wool, and Others), Textile (Polyester, Cotton, Nylon, and Wool)), By Application (Building and Construction (Commercial and Residential), Textile (Active wear, Sportswear, and Others)) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global active insulation market is estimated to grow at a CAGR of 5.8% during the forecast period. Rising application in the building and construction industry and rising demand for sportswear is primarily contributing to the growth of the market. The increasing demand for the energy-efficient building is one of the major factors driving the demand for insulation materials in the building and construction sector. As per the Alliance to Save Energy (ASE), buildings including stores, homes, and offices, use 70% of its electricity and 40% of its energy. Buildings also emit more than one-third of the US greenhouse gas emissions, which is higher than in other sectors.

The thermal performance of external walls enables to decrease greenhouse gas emissions and enhance the energy efficiency of the construction sector. Thermal insulation is considered as one of the suitable techniques to decrease energy consumption. Thermal insulation decreases the building energy expenses by 50% on average, which prevents extreme heat in the living spaces in summer and ensure more heating with less consumption of energy in winter. Thermal insulation decreases vapor condensation and heat movements. Thermal insulation at external building contributes positively to human health by avoiding factors including moisture, dust, mold, humidity, fungus, air, and noise pollution that may have an adverse impact on human health.

Therefore, thermal insulation acts as a protective layer to avoid such kinds of conditions. Further, rising government focus on energy-efficient buildings is contributing to the demand for thermal insulation materials. For instance, in May 2017, the Govt. of India launched the Energy Efficient Buildings Programme (EESL) to invest nearly $155 million by 2020 under the program of the building. Energy Efficiency Services Limited (EESL) implemented the scheme, a joint venture under the administration of the Ministry of Power, Government of India. These kinds of government initiatives are expected to offer an opportunity for market growth.

Market Segmentation

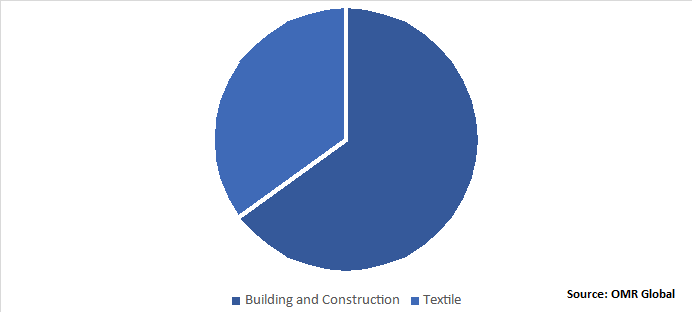

The market is segmented into product and application, which is classified based on its applications, such as building and construction and textile. Based on product, building and construction insulation materials include mineral wool, EPS, glass wool, and others. Textile insulation materials include polyester, cotton, nylon, and wool. Based on application, active insulation material applications in the building and construction industry include commercial and residential. Its applications in the textile industry include sportswear, activewear, and others.

Active Insulation Products Find Potential Application in the Building and Construction Industry

Active insulation products have a significant share in the building and construction industry. Mineral wool is often utilized as an insulation material owing to its suitable material properties. It is benefitting the construction industry owing to its properties of exhibiting high performance, safety, being noise proof, and more. Mineral wool products are easy to handle and cost-effective in the construction industry. Further, glass wool is primarily utilized as an indoor acoustic and thermal insulation material. These are most commonly applied on wooden floors, internal walls, or on underneath pitched roofs. Rising consumer awareness regarding the energy-efficient building and government initiatives for green buildings are some major factors accelerating the adoption of active insulation products.

Global Active Insulation Market Share by Product, 2019 (%)

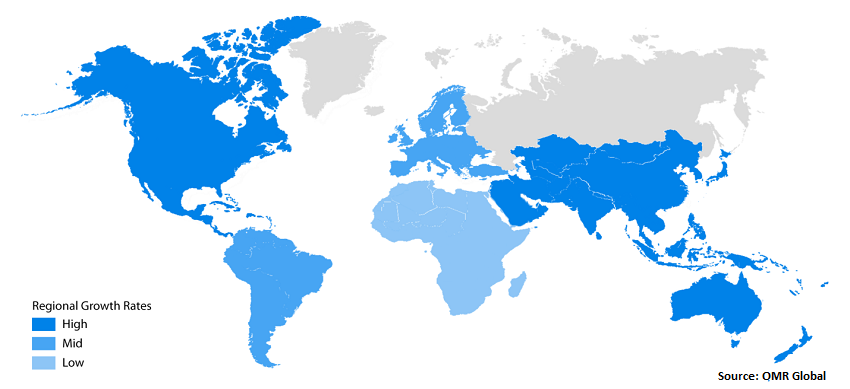

Regional Outlook

Geographically, in 2019, Asia-Pacific is estimated to witness a substantial share in the market, owing to the increasing government focus towards energy-efficient buildings and the rising textile industry in the region. In the 2015 United Nations Paris climate, China committed that green building standards will be met by 50% of all new buildings in urban areas by 2020, mostly by focusing on efficiency. Building owners lacked incentives for investment in efficiency measures, therefore Natural Resources Defense Council Action (NRDC) started supporting put those incentives in place. Further, the significant presence of the millennial population is accelerating sportswear manufacturing in the region, which has been supporting the growth of the market.

Global Active Insulation Market Growth, by Region 2020-2026

Market Players Outlook

Some crucial players in the market include INVISTA, 3M Co., Saint-Gobain Group, Wacker Chemie AG, and Rockwool International A/S. Product launches are considered as a crucial strategy adopted by the market players to expand market share and gain a competitive advantage. For instance, in August 2020, Armacell declared the launch of ArmaGel DT, a next-generation flexible aerogel blanket for dual-temperature and cryogenic applications. It offers extremely low thermal conductivity, better thermal performance, and a decrease in insulation thicknesses than other insulation products. Its flexibility and hydrophobicity can offer protection against corrosion under insulation extending asset lifetime. It offers faster installation and more choice to the customer, as this product is launched with 5, 10, 15, and 20 mm thicknesses of aerogel blankets.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global active insulation market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Active Insulation Market by Product

5.1.1. Building and Construction

5.1.1.1. Mineral Wool

5.1.1.2. Expanded Polystyrene (EPS)

5.1.1.3. Glass Wool

5.1.1.4. Others

5.1.2. Textile

5.1.2.1. Polyester

5.1.2.2. Cotton

5.1.2.3. Nylon

5.1.2.4. Wool

5.2. Global Active Insulation Market by Application

5.2.1. Building and Construction

5.2.1.1. Commercial

5.2.1.2. Residential

5.2.2. Textile

5.2.2.1. Activewear

5.2.2.2. Sportswear

5.2.2.3. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 3M Co.

7.2. ACTIS Insulation, Ltd.

7.3. Armacell International S.A.

7.4. Autex Industries, Ltd.

7.5. Freudenberg SE

7.6. H.Dawson Sons and Company (HDWool) Ltd.

7.7. INVISTA (Koch Industries, Inc.)

7.8. Johns Manville

7.9. Knauf Gips KG

7.10. Marves Industries

7.11. MITI Spa

7.12. Owens Corning

7.13. Polartec, LLC

7.14. PrimaLoft,Inc.

7.15. Remmers (UK), Ltd.

7.16. Rockwool International A/S

7.17. Saint-Gobain Group

7.18. Sintex Plastics Technology, Ltd.

7.19. UdiDÄMMSYSTEME GmbH

7.20. W. L. Gore & Associates, Inc.

7.21. Wacker Chemie AG

1. GLOBAL ACTIVE INSULATION MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

2. GLOBAL MINERAL WOOL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL EPS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL GLASS WOOL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL OTHER ACTIVE INSULATION FOR BUILDING AND CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL POLYESTER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL COTTON MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL NYLONMARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL WOOL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL ACTIVE INSULATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

11. GLOBAL ACTIVE INSULATION IN COMMERCIAL BUILDING AND CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL ACTIVE INSULATION IN RESIDENTIAL BUILDING AND CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL ACTIVE INSULATION IN ACTIVEWEAR MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL ACTIVE INSULATION IN SPORTSWEAR MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

15. GLOBAL ACTIVE INSULATION IN OTHER TEXTILE APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

16. GLOBAL ACTIVE INSULATION MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

17. NORTH AMERICAN ACTIVE INSULATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. NORTH AMERICAN ACTIVE INSULATION MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

19. NORTH AMERICAN ACTIVE INSULATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

20. EUROPEAN ACTIVE INSULATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. EUROPEAN ACTIVE INSULATION MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

22. EUROPEAN ACTIVE INSULATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC ACTIVE INSULATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC ACTIVE INSULATION MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

25. ASIA-PACIFIC ACTIVE INSULATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

26. REST OF THE WORLD ACTIVE INSULATION MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

27. REST OF THE WORLD ACTIVE INSULATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL ACTIVE INSULATION MARKET SHARE BY PRODUCT, 2019 VS 2026 (%)

2. GLOBAL ACTIVE INSULATION MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL ACTIVE INSULATION MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US ACTIVE INSULATION MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA ACTIVE INSULATION MARKET SIZE, 2019-2026 ($ MILLION)

6. UK ACTIVE INSULATION MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE ACTIVE INSULATION MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY ACTIVE INSULATION MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY ACTIVE INSULATION MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN ACTIVE INSULATION MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE ACTIVE INSULATION MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA ACTIVE INSULATION MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA ACTIVE INSULATION MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN ACTIVE INSULATION MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC ACTIVE INSULATION MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD ACTIVE INSULATION MARKET SIZE, 2019-2026 ($ MILLION)