Aerial Imaging Market

Global Aerial Imaging Market Size, Share & Trends Analysis Report By Camera Orientation (Oblique, Vertical), By Platform (Fixed-Wing Aircraft, Helicopter, UAV/Drones), By End-Use Industry (Government, Energy Sector, Defense, Forestry and Agriculture, Real Estate, Civil Engineering, Insurance) Forecast 2022-2028 Update Available - Forecast 2025-2035

The global aerial imaging market is anticipated to grow at a considerable CAGR of 3.8% during the forecast period. Aerial imaging has benefitted many industries, such as construction, forestry and agriculture, real estate, and others. The construction sector, civil engineering have augmented the benefit of aerial imaging for contracted surveying, onsite inspection, and design planning applications. Moreover, climate change and scarcity of natural resources have led to a challenge for the agriculture sector, the use of aerial imagery in production agriculture has continued to grow and evolve over the last several years since its debut on the market. The agriculture sector has been benefitted by using various aerial imaging options such as UAVs, and fixed-wing aircraft, as these components assess various advantages to agriculture such as these tools are easy to operate, provide instantaneous feedback for scouting, and can cover more acres of agricultural land. Such a trend and plenty of applications are generating opportunities for the global aerial imaging market.

Other driving factors that fueled the growth of the market, are the rising number of natural disasters, which includes floods, tornados, and hurricanes. Aerial imaging is a crucial tool to determine the extent of the damage inflicted by flooding and is also used to compare the baseline coastal areas to assess the damage to major ports and waterways. The aerial imaging provides a cost-effective way to better understand the damage sustained to both property and the environment. With this major feature, the aerial imaging market is expected to s witness significant growth over the forecast period.

Impact of COVID-19 Pandemic on Global Aerial imaging Market

The COVID-19 pandemic has had a disastrous effect on the global aerial imaging market, owing to two major challenges that are, revenue crunch and rising maintenance cost. Furthermore, the reduction in the gross domestic product (GDP), of major economies such as the US, China, UK, France, and others, resulted in a reduction in investment in the growing technologies, and infrastructure. The reduction in the aerospace investment limit the unmanned aircraft development, and unmanned aerial vehicles (UAVs), which thereby limited the availability of aerial imaging services across the globe during COVID-19 pandemic.

Segmental Outlook

The global aerial imaging market is segmented based on camera orientation, platform, and end-user. Based on camera orientation the market is segmented into, oblique, and vertical. Based on platform, the market is sub-segmented into fixed-wing aircraft, helicopter, and UAV/drones. Based on camera orientation, oblique imagery is expected to grow at a significant rate, owing to various range of application, as it provide the best vantage for assessing and reviewing changes to the local government tax base, property valuation assessment, buying & selling of residential/ commercial property for better decisions in a more timely manner. Oblique imagery is also used for infrastructure monitoring making sure safe operations of transportation, utilities, and facilities. Based on end-user, the market is sub-divided into government, energy sector, defense, forestry and agriculture, real estate, civil engineering, and insurance.

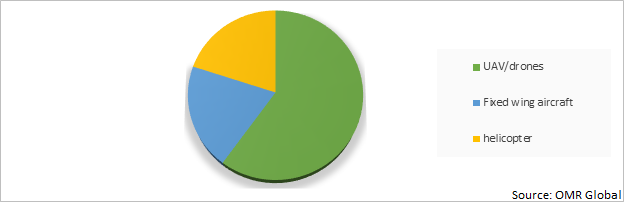

Global Aerial Imaging Market Share by Platform, 2022 (%)

The UAV Holds the Major Share in the Global Aerial imaging Market

The rapid development of unmanned aerial vehicle (UAV) technology has enabled greater use of UAVs as remote platform to complement satellite and manned aerial remote sensing systems. UAVs have emerged as portable, scalable, high-resolution imaging platforms that augment satellite imagery. Moreover, it has also become an effective tool for targeted remote sensing operations in those areas that are inaccessible to conventional manned aerial platform due to logistics and human constraints. Additionally, increasing number of disaster damages in coastal regions, the need for UAV has been emerged for estimating the damage assessment after disaster, and monitoring of wetland ecosystem. These shows the benefits of bird’s eye view for UAV of global aerial imaging market across the globe.

Regional Outlooks

The global aerial imaging market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). North America accounted for the largest share of revenue in 2022 and is expected to maintain its presence over the forecast period, due to the growing applications of UAVs in the government and agriculture sector in the countries such as the US and Canada. Moreover, the rising number of crimes and growing threats of terrorist activities, lead to an upsurge usage of aerial imaging in the North America region.

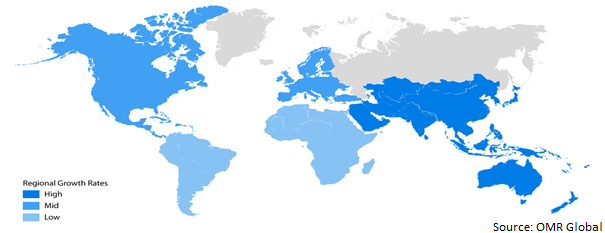

Global Aerial imaging Market Growth, by Region 2022-2028

The North-America Region Holds the Major Share in the Global Aerial imaging Market

Geographically, North-America region is expected to hold the largest revenue share of global aerial imaging marketduring forecast period. The growth is credited to the acceptance of commercial drones majorly in defense, agriculture, and disaster management, which contributes to improving the accuracy of the aerial imaging t and will effectively stimulate the regional demand. Moreover, the growing usage of aerial imagery for monitoring the natural vegetation, increasing developments in the imagery technology solutions, and the aerial imagery helps the farmers to identify their crops and take the decisions accordingly, that whether to increase the water supply to the crops or not, hence increases the demand for the global aerial imaging market in the North-America region.

Market Players Outlook

The major companies serving the global aerial imaging market are, Aerial Imaging Productions, LLC, Blom Norway AS, Cooper Aerial Surveys Co., Digital Aerial Solutions (DAS), LLC, EagleView Technologies, Inc., Fugro N.V., Global UAV Technologies Ltd. and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in January 2019, Multivista announced a partnership with Drone Deploy to expand its project management capabilities. Through this partnership, the customers can access Multivista-captured orthomosaic maps of their project sites. Moreover, the users can annotate these high-definition aerial maps to determine distance, area, volume, and elevation. Further, this first-of-its-kind combination of professional UAV services and integrated software is currently available to multivista clients across 50 countries which include North America, South-America, and Europe.

The Report Covers

- Market value data analysis of 2022 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global aerial imaging market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Aerial Imaging Market

• Recovery Scenario of Global Aerial Imaging Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Furgo N.V.,

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Aerial Imaging Productions, LLC

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Nearmap Ltd.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Cooper Aerial Surveys Co.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Digital Aerial Solutions (DAS), LLC

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Aerial Imaging Market, by Camera Oreintation

5.1.1. Oblique

5.1.2. Vertical

5.2. Global Aerial Imaging Market, by Platform

5.2.1. Fixed-wing aircraft

5.2.2. Helicopter

5.2.3. UAV/drones

5.3. Global Aerial Imaging Market, by End-User

5.3.1. Government

5.3.2. Energy sector

5.3.3. Defense

5.3.4. Forestry & agriculture

5.3.5. Real estate

5.3.6. Civil engineering

5.3.7. Insurance

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 3D Robotics Inc.

7.2. Aerial Imaging Productions LLC

7.3. Blom Norway AS

7.4. Cooper Aerial Surveys Co.

7.5. Cyberhawk Innovations

7.6. Drone Deploy

7.7. Eagle View Technologies Inc.

7.8. High Eye

7.9. Hoverfly Technologies

7.10. Keystone Aerial Surveys Inc.

7.11. Kucera International

7.12. Landiscor

7.13. NV5 Global Inc.

7.14. Precision Hawk Inc.

7.15. Sanborn Mao Co. inc.

7.16. Sky Watch

7.17. SZ Dji Technology Co. Ltd.

7.18. Verisk

7.19. Yuneec Holding Ltd. Co.

1. GLOBAL AERIAL IMAGING MARKET RESEARCH AND ANALYSIS BY CAMERA ORIENTATION, 2022-2028($ MILLION)

2. GLOBAL OBLIQUE AERIAL IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

3. GLOBAL VERTICAL AERIAL IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

4. GLOBAL AERIAL IMAGING MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2022-2028 ($ MILLION)

5. GLOBAL FIXED-WING AIRCRAFT AERIAL IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

6. GLOBAL HELICOPTER AERIAL IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

7. GLOBAL UAV/DRONES AERIAL IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

8. GLOBAL AERIAL IMAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2028 ($ MILLION)

9. GLOBAL AERIAL IMAGING FOR GOVERNMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

10. GLOBAL AERIAL IMAGING FOR ENERGY SECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

11. GLOBAL AERIAL IMAGING FOR DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

12. GLOBAL AERIAL IMAGING FOR FORESTRY & AGRICULTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

13. GLOBAL AERIAL IMAGING FOR REAL ESTATE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

14. GLOBAL AERIAL IMAGING FOR CIVIL ENGINEERING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

15. GLOBAL AERIAL IMAGING FOR INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

16. GLOBAL AERIAL IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2028 ($ MILLION)

17. NORTH AMERICAN AERIAL IMAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2028 ($ MILLION)

18. NORTH AMERICAN AERIAL IMAGING MARKET RESEARCH AND ANALYSIS BY CAMERA ORIENTATION, 2022-2028 ($ MILLION)

19. NORTH AMERICAN AERIAL IMAGING MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2022-2028 ($ MILLION)

20. NORTH AMERICAN AERIAL IMAGING MARKET RESEARCH AND ANALYSIS BY END-USER , 2022-2028 ($ MILLION)

21. EUROPEAN AERIAL IMAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2028 ($ MILLION)

22. EUROPEAN AERIAL IMAGING MARKET RESEARCH AND ANALYSIS BY CAMERA ORIENTATION , 2022-2028 ($ MILLION)

23. EUROPEAN AERIAL IMAGING MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2022-2028 ($ MILLION)

24. EUROPEAN AERIAL IMAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2028 ($ MILLION)

25. ASIA-PACIFIC AERIAL IMAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2028 ($ MILLION)

26. ASIA-PACIFIC AERIAL IMAGING MARKET RESEARCH AND ANALYSIS BY CAMERA ORIENTATION , 2022-2028 ($ MILLION)

27. ASIA-PACIFIC AERIAL IMAGING MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2022-2028 ($ MILLION)

28. ASIA-PACIFIC AERIAL IMAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2028 ($ MILLION)

29. REST OF THE WORLD AERIAL IMAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2028 ($ MILLION)

30. REST OF THE WORLD AERIAL IMAGING MARKET RESEARCH AND ANALYSIS BY CAMERA ORIENTATION, 2022-2028 ($ MILLION)

31. REST OF THE WORLD AERIAL IMAGING MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2022-2028 ($ MILLION)

32. REST OF THE WORLD AERIAL IMAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL AERIAL IMAGING MARKET, 2022-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL AERIAL IMAGING MARKET BY SEGMENT, 2022-2028 ($ MILLION)

3. RECOVERY OF GLOBAL AERIAL IMAGING MARKET, 2022-2028 (%)

4. GLOBAL AERIAL IMAGING MARKET SHARE BY CAMERA ORIENTATION, 2022 VS 2028 (%)

5. GLOBAL OBLIQUE AERIAL IMAGING MARKET SHARE BY GEOGRAPHY, 2022 VS 2028 (%)

6. GLOBAL VERTICAL AERIAL IMAGING MARKET SHARE BY GEOGRAPHY, 2022 VS 2028 (%)

7. GLOBAL AERIAL IMAGING MARKET SHARE BY PLATFORM, 2022 VS 2028 (%)

8. GLOBAL FIXED-WING AIRCRAFT AERIAL IMAGING MARKET SHARE BY GEOGRAPHY, 2022 VS 2028 (%)

9. GLOBAL HELICOPTER AERIAL IMAGING MARKET SHARE BY GEOGRAPHY, 2022 VS 2028 (%)

10. GLOBAL UAV/DRONES AERIAL IMAGING MARKET SHARE BY GEOGRAPHY, 2022 VS 2028 (%)

11. GLOBAL AERIAL IMAGING MARKET SHARE BY END-USER, 2022 VS 2028 (%)

12. GLOBAL GOVERNMENT AERIAL IMAGING MARKET SHARE BY GEOGRAPHY, 2022 VS 2028 (%)

13. GLOBAL ENERGY SECTOR AERIAL IMAGING MARKET SHARE BY GEOGRAPHY, 2022 VS 2028 (%)

14. GLOBAL DEFENSE AERIAL IMAGING MARKET SHARE BY GEOGRAPHY, 2022 VS 2028 (%)

15. GLOBAL FORESTRY & AGRICULTURE AERIAL IMAGING MARKET SHARE BY GEOGRAPHY, 2022 VS 2028 (%)

16. GLOBAL REAL ESTATE AERIAL IMAGING MARKET SHARE BY GEOGRAPHY, 2022 VS 2028 (%)

17. GLOBAL CIVIL ENGINEERING AERIAL IMAGING MARKET SHARE BY GEOGRAPHY, 2022 VS 2028 (%)

18. GLOBAL INSURANCE AERIAL IMAGING MARKET SHARE BY GEOGRAPHY, 2022 VS 2028 (%)

19. US AERIAL IMAGING MARKET SIZE, 2022-2028 ($ MILLION)

20. CANADA AERIAL IMAGING MARKET SIZE, 2022-2028 ($ MILLION)

21. UK AERIAL IMAGING MARKET SIZE, 2022-2028 ($ MILLION)

22. FRANCE AERIAL IMAGING MARKET SIZE, 2022-2028 ($ MILLION)

23. GERMANY AERIAL IMAGING MARKET SIZE, 2022-2028 ($ MILLION)

24. ITALY AERIAL IMAGING MARKET SIZE, 2022-2028 ($ MILLION)

25. SPAIN AERIAL IMAGING MARKET SIZE, 2022-2028 ($ MILLION)

26. REST OF EUROPE AERIAL IMAGING MARKET SIZE, 2022-2028 ($ MILLION)

27. INDIA AERIAL IMAGING MARKET SIZE, 2022-2028 ($ MILLION)

28. CHINA AERIAL IMAGING MARKET SIZE, 2022-2028 ($ MILLION)

29. JAPAN AERIAL IMAGING MARKET SIZE, 2022-2028 ($ MILLION)

30. SOUTH KOREA AERIAL IMAGING MARKET SIZE, 2022-2028 ($ MILLION)

31. REST OF ASIA-PACIFIC AERIAL IMAGING MARKET SIZE, 2022-2028 ($ MILLION)

32. REST OF THE WORLD AERIAL IMAGING MARKET SIZE, 2022-2028 ($ MILLION)