Aerospace Carbon Fiber Market

Global Aerospace Carbon Fiber Market Size, Share & Trends Analysis Report by Raw Material (Polyacrylonitrile (PAN) and Petroleum Pitch & Rayon), By Fiber Type (Virgin Carbon Fiber and Recycled Carbon Fiber), By Application (Commercial Aviation, Military Aviation, and Rotorcrafts), and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global market for aerospace carbon fiber is projected to exhibit a considerable CAGR of around 8.2% during the forecast period. The market is mainly driven by the increasing application of carbon fiber materials in the aerospace sector coupled with the growing g adoption of lightweight aircraft across the globe. Carbon fibers have significant applications in the aerospace and space industries due to demanding thermo-structural fulfillment. It offers strength to planes keeping the weight very low compared to other materials. Lightweight and stiffness make it ideal to make fuel-efficient planes and other machines. In the aerospace & defense industry, carbon fiber is also used to make lighter and stronger equipment and parts of planes that can achieve much more than their metal alloy counterparts. Many companies and OEMs that are involved in the production of spacecraft, private aircraft, and commercial military aircraft prefer carbon fiber owing to its attractive properties and characteristics, therefore, creating significant growth in the market.

However, the downfall in the demand for aircraft due to COVID-19 pandemic across the globe has impacted the market growth. Due to the pandemic, the aircraft manufacturing companies have decreased their production, owing to which, a downfall of 39.5% is estimated in the aircraft manufacturing industry in 2020, as per OMR analysis. According to the Airbus SE, in the First Quarter of 2020, the company had booked 290 net commercial aircraft orders and made the delivery of 122 commercial aircraft. In the first quarter of 2020, the company accounted for a loss of around $522 million in comparison to the profit of nearly $56.5 million in the same quarter last year. The revenues were 15.2% less in the first quarter reflecting the company strongly impacted by the pandemic.

Segmental Outlook

The global aerospace carbon fiber market is segmented based on raw material, fiber type, and application. On the basis of raw material, the market is bifurcated into PAN and petroleum pitch & rayon. Among these PAN segment is estimated to hold a significant share in the global aerospace carbon fiber market. The low cost and high productivity of the PAN as a precursor for the production of carbon fiber is a key factor for the high share of the PAN in the raw material segment. Based on the fiber type, the market is further classified into virgin carbon fiber and recycled carbon fiber. On the basis of application, the market is further segregated into commercial aviation, military aviation, and rotorcrafts.

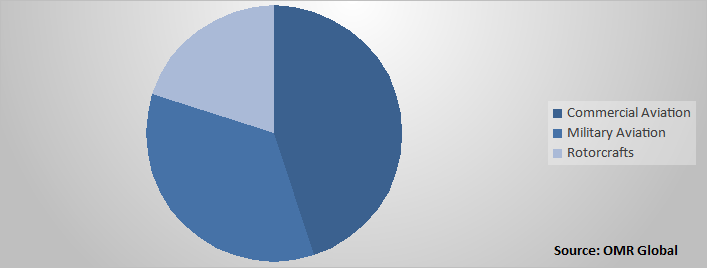

Global Aerospace Carbon Fiber Market Share by Application, 2019 (%)

Global Aerospace Carbon Fiber Market to be Driven by Commercial Aviation

Among applications, the commercial aviation segment held a considerable share in the market owing to significant growth and a rise in the production of commercial aircraft coupled with q`2the growing number of passengers across the globe. Further, there has been a wide acceptance of carbon fiber amongst the key players, as they are substituting their traditional metal and other elements with carbon fiber. For instance, The Boeing Co.’s 787 and the Airbus A350 XWB and A380 widebody platforms accelerated composites use in aircraft. These two major players in the aerospace industry, Airbus and Boeing combined delivered 1,243 commercial aircraft in 2019, which were made up of composite materials, thus, the increasing utilization of composite materials with each new generation of aircraft is, in turn, contributing to the growth of the market.

Regional Outlook

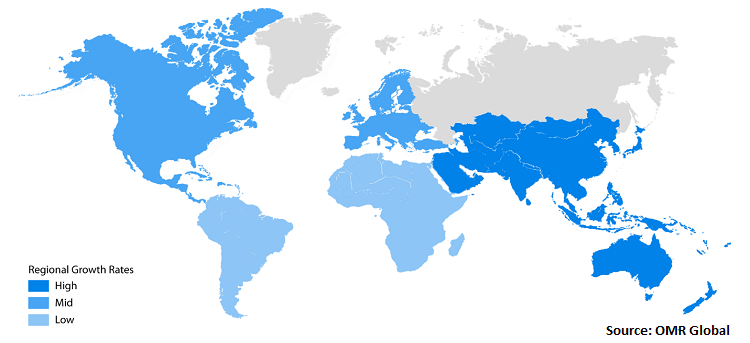

Geographically, the global aerospace carbon fiber market is further classified into North America, Europe, Asia-Pacific, and the Rest of the World. Asia-Pacific is projected to hold significant market growth in the global aerospace carbon fiber market during the forecast period. Major economies that are anticipated to contribute to the Asia-Pacific aerospace carbon fiber market include China, India Japan, and others. The major factors contributing to the regional growth of the market include the rising demand for light weight vehicles in the aerospace industry and the growing commercial aerospace industry in the region.

Global Aerospace Carbon Fiber Market Growth by Region, 2020-2026

North America to Hold a Considerable Share in the Global Aerospace Carbon Fiber Market

Geographically, North America has a significant share in the global aerospace carbon fiber market. The advancement in the material used for the aerospace industry in major economies of North America such as the US and Canada coupled with significant adoption of carbon fiber in the aerospace sector is further making a considerable contribution to the regional growth of the market. The market growth is primarily driven by the increasing government spending, high production of aircraft parts, and high manufacturing capital on aerospace & defense, coupled with the presence of several small-to-large players in the region. According to the Aerospace Industries Association (AIA), the total sales revenue of the aerospace and defense industry in 2018 exceeded $929 billion, an increase of around 4.2% compared to 2017.

Market Players Outlook

Some of the key players in the aerospace carbon fiber market contributing significantly by providing different types of products and increasing their geographical presence across the globe include Hexcel Corp., Teijin Ltd., SGL Carbon SE, Toray Industries, Inc., Solvay SA, and others. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. In July 2020, Teijin announced that it has got an approval for its carbon fiber materials Tenax Dry Reinforcements (DR) for the Airbus A320neo wing spoilers using a Resin Transfer Molding (RTM) process developed by Spirit AeroSystems. With the approval, Teijin is accelerating its development of applications for aircraft including cost-effective carbon fibers with higher-tensile modulus.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global aerospace carbon fiber market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Hexcel Corp.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Teijin Ltd.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Solvay SA

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. SGL Cabon SE

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Toray Industries, Inc.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Aerospace Carbon Fiber Market by Raw Material

5.1.1. Polyacrylonitrile (PAN)

5.1.2. Petroleum Pitch & Rayon

5.2. Global Aerospace Carbon Fiber Market by Fiber Type

5.2.1. Virgin Carbon Fiber

5.2.2. Recycled Carbon fiber

5.3. Global Aerospace Carbon Fiber Market by Application

5.3.1. Commercial Aviation

5.3.2. Military Aviation

5.3.3. Rotorcrafts

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. BGF Industries, Inc.

7.2. ELG Carbon Fibre Ltd.

7.3. Formosa Plastics Corp.

7.4. Hexcel Corp.

7.5. Hyosung Corp.

7.6. Jiangsu Hengshen Co. Ltd.

7.7. Mitsubishi Chemical Holdings Corp.

7.8. Muhr Und Bender KG

7.9. Nippon Carbon Co. Ltd.

7.10. Polar Manufacturing Ltd.

7.11. RTP Co.

7.12. Solvay SA

7.13. SGL Carbon SE

7.14. Sigmatex Ltd.

7.15. Taekwang Industrial Co. Ltd.

7.16. Toray Industries, Inc.

7.17. Teijin Ltd.

7.18. UMATEX, ROSATOM State Corp.

7.19. Weihai Guangwei Composites Co., Ltd.

7.20. ZHONGFU SHENYING CARBON FIBER CO., LTD.

1. GLOBAL AEROSPACE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2019-2026 ($ MILLION)

2. GLOBAL POLYACRYLONITRILE (PAN) FOR AEROSPACE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL PETROLEUM PITCH & RAYON FOR AEROSPACE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL AEROSPACE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY FIBER TYPE, 2019-2026 ($ MILLION)

5. GLOBAL VIRGIN CARBON FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL RECYCLED CARBON FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL AEROSPACE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

8. GLOBAL COMMERCIAL AVIATION CARBON FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL MILITARY AEROSPACE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBALROTORCRAFT CARBON FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL AEROSPACE CARBON FIBER IN OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL AEROSPACE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN AEROSPACE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN AEROSPACE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2019-2026 ($ MILLION)

15. NORTH AMERICAN AEROSPACE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY FIBER TYPE, 2019-2026 ($ MILLION)

16. NORTH AMERICAN AEROSPACE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

17. EUROPEAN AEROSPACE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. EUROPEAN AEROSPACE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2019-2026 ($ MILLION)

19. EUROPEAN AEROSPACE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY FIBER TYPE, 2019-2026 ($ MILLION)

20. EUROPEAN AEROSPACE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC AEROSPACE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC AEROSPACE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC AEROSPACE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY FIBER TYPE, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC AEROSPACE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

25. REST OF THE WORLD AEROSPACE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2019-2026 ($ MILLION)

26. REST OF THE WORLD AEROSPACE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY FIBER TYPE, 2019-2026 ($ MILLION)

27. REST OF THE WORLD AEROSPACE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL AEROSPACE CARBON FIBER MARKET SHARE BY RAW MATERIAL, 2019 VS 2026 (%)

2. GLOBAL AEROSPACE CARBON FIBER MARKET SHARE BY FIBER TYPE, 2019 VS 2026 (%)

3. GLOBAL AEROSPACE CARBON FIBER MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

4. GLOBAL AEROSPACE CARBON FIBER MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US AEROSPACE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA AEROSPACE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)

7. UK AEROSPACE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE AEROSPACE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY AEROSPACE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY AEROSPACE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN AEROSPACE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE AEROSPACE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA AEROSPACE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA AEROSPACE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN AEROSPACE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC AEROSPACE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD AEROSPACE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)