Aerospace Composites Market

Global Aerospace Composites Market Size, Share & Trends Analysis Report by Resin Type (Ceramic Fiber, Carbon Fiber, Glass Fiber, and Others), By Aircraft Type (General Aviation, Commercial Aviation, Military Aviation, and Space) and Forecast 2020-2026 Update Available - Forecast 2025-2031

The global market for aerospace composites is projected to have considerable CAGR of around 10.5% during the forecast period. The market growth mainly driven by the growing demand of composites material in the aviation industry. With the aim of reducing the weight of aircraft, there are several research activities going across the globe. For instance, Rolls-Royce PLC collaborated with Oak Ridge National Laboratory (ORNL) and developed a virtual sandbox that has the capability to lift gas turbine engines of aircraft and power plants to higher efficiencies. Along with this, General Electric Co. is working to explore the application of ceramic composites in helicopter engines, compressor power plants and gas turbines. For instance, the new GE9X engine, the world’s largest jet engine developed by General Electric Co. for next-gen Boeing 777X wide-body plane have core parts produced from ceramic composites. Moreover, growing demand of composites in the fuel efficient aircraft further provide significant opportunity to the market.

Segmental Outlook

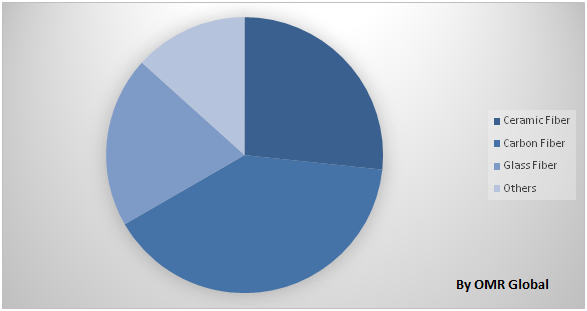

The global aerospace composites market is segmented based on resin type and aircraft type. Based on the resin type, the market is further classified into ceramic fiber, carbon fiber, glass fiber, and others. On the basis of aircraft type the market is further segregated into general aviation, commercial aviation, military aviation, and space. Among aircraft type, the commercial aviation is projected to hold significant share in the global aerospace composites market. This owing to increasing demand of light weight aircraft in commercial aviation coupled with significant growth in the commercial aircraft industry.

Global Aerospace Composites Market Share by Resin Type, 2019 (%)

Global Aerospace Composites Market to be Driven by Ceramic Fiber

Among resin type, the ceramic fiber segment held a considerable share in the market owing to demanding thermo-structural requirements. Ceramic composites are key enabling technologies for efficient gas turbines for the aerospace industry and marine propulsion systems primarily in submarines. The technology for manufacturing ceramic composites is growing to the point where domestic and global companies, as well as the government, are making large investments to boost development and production across the globe. Aerospace structures encounter diverse environments that include extreme temperature and moisture. The structures are also subjected to have a connection with deicing fluid, jet fuel, and hydraulic fluid. These extreme environmental conditions are compelling aircraft manufacturers to adopt lightweight materials including ceramic fiber which are stronger than traditional nickel super-alloy and can withstand higher temperatures than them. Therefore due to these properties ceramic fiber is gaining application in the aerospace industry.

Regional Outlook

Geographically, the global aerospace composites market is further classified into North America, Europe, Asia-Pacific and the Rest of the World. Asia-Pacific is projected to hold a significant market growth in the global aerospace composites market during the forecast period. Major economies which are anticipated to contribute to Asia-Pacific aerospace composites market include China, India Japan and others. The major factors contributing to the growth of the market in the region include the rising demand of composites materials in aviation coupled with the growing aviation sector in the region.

Global Aerospace Composites Market Growth, by Region 2020-2026

North America to hold a considerable share in the global aerospace composites market

Geographically, North America have significant share in the global aerospace composites market. The advancement of technological infrastructure of aviation industry in major economies of North America such as the US and Canada coupled with significant adoption of ceramic composites in military aviation are further making a considerable contribution towards the market in the region. Moreover, this dominance of North America is primarily accredited to the high production of aircrafts in the region. Along with this, the presence of some of the key market players, such as General Electric Co., further drives the regional growth in the global market. For instance, General Electric announced in August 2018, that it is working on the development of ceramic composites for its new LEAP gas turbine engine. The aircraft industry is anticipated to save $1 million per engine by using ceramic composites. GE Aviation considers ceramic composites to be critical material that meets the demand for greater fuel efficiency in aviation propulsion.

Market Players Outlook

The key players in the aerospace composites market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include Hexcel Corp., Teijin Ltd., Mitsubishi Chemical Holdings Corp., Solvay Group, Toray Industries, Inc., and others. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global aerospace composites market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Hexcel Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Teijin Ltd.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Mitsubishi Chemical Holdings Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Solvay Group

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Toray Industries, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Aerospace Composites Market by Fiber Type

5.1.1. Ceramic Fiber

5.1.2. Carbon Fiber

5.1.3. Glass Fiber

5.1.4. Others( Aramid)

5.2. Global Aerospace Composites Market by Aircraft Type

5.2.1. General Aviation

5.2.2. Commercial Aviation

5.2.3. Military Aviation

5.2.4. Space

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Albany International Corp.

7.2. Bally Ribbon Mills

7.3. DuPont de Nemours, Inc.

7.4. Gurit

7.5. General Electric Co.

7.6. Hexcel Corp.

7.7. Hyosung Advanced Materials

7.8. Kineco Kaman Composites India Pvt. Ltd.

7.9. Lee Aerospace, Inc.

7.10. Mitsubishi Chemical Holdings Corp.

7.11. Materion Corp.

7.12. Nippon Graphite Fiber Co., Ltd.

7.13. Owens Corning

7.14. Plastic Reinforcement Fabrics Ltd.

7.15. Rolls-Royce plc

7.16. Solvay Group

7.17. SGL Carbon SE

7.18. Toray Industries, Inc.

7.19. Teijin Ltd.

7.20. Victrex plc

1. GLOBAL AEROSPACE COMPOSITES MARKET RESEARCH AND ANALYSIS BY FIBER TYPE, 2019-2026 ($ MILLION)

2. GLOBAL CERAMIC FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL CARBON FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL GLASS FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL AEROSPACE COMPOSITES MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE, 2019-2026 ($ MILLION)

6. GLOBAL AEROSPACE COMPOSITES IN GENERAL AVIATION TAGS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL AEROSPACE COMPOSITES IN COMMERCIAL AVIATION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL AEROSPACE COMPOSITES IN MILITARY AVIATION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL AEROSPACE COMPOSITES IN SPACE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL AEROSPACE COMPOSITES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN AEROSPACE COMPOSITES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN AEROSPACE COMPOSITES MARKET RESEARCH AND ANALYSIS BY FIBER TYPE, 2019-2026 ($ MILLION)

13. NORTH AMERICAN AEROSPACE COMPOSITES MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE, 2019-2026 ($ MILLION)

14. EUROPEAN AEROSPACE COMPOSITES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. EUROPEAN AEROSPACE COMPOSITES MARKET RESEARCH AND ANALYSIS BY FIBER TYPE, 2019-2026 ($ MILLION)

16. EUROPEAN AEROSPACE COMPOSITES MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC AEROSPACE COMPOSITES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC AEROSPACE COMPOSITES MARKET RESEARCH AND ANALYSIS BY FIBER TYPE, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC AEROSPACE COMPOSITES MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE, 2019-2026 ($ MILLION)

20. REST OF THE WORLD AEROSPACE COMPOSITES MARKET RESEARCH AND ANALYSIS BY FIBER TYPE, 2019-2026 ($ MILLION)

21. REST OF THE WORLD AEROSPACE COMPOSITES MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE, 2019-2026 ($ MILLION)

1. GLOBAL AEROSPACE COMPOSITES MARKET SHARE BY FIBER TYPE, 2019 VS 2026 (%)

2. GLOBAL AEROSPACE COMPOSITES MARKET SHARE BY AIRCRAFT TYPE, 2019 VS 2026 (%)

3. GLOBAL AEROSPACE COMPOSITES MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US AEROSPACE COMPOSITES MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA AEROSPACE COMPOSITES MARKET SIZE, 2019-2026 ($ MILLION)

6. UK AEROSPACE COMPOSITES MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE AEROSPACE COMPOSITES MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY AEROSPACE COMPOSITES MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY AEROSPACE COMPOSITES MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN AEROSPACE COMPOSITES MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE AEROSPACE COMPOSITES MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA AEROSPACE COMPOSITES MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA AEROSPACE COMPOSITES MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN AEROSPACE COMPOSITES MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC AEROSPACE COMPOSITES MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD AEROSPACE COMPOSITES MARKET SIZE, 2019-2026 ($ MILLION)