Aerospace Cyber Security Market

Aerospace Cyber Security Market Size, Share & Trends Analysis Report by Type (Network Security, Wireless security, Cloud security and Content security), by Deployment (On-Premise and Cloud), by Application (Aircraft, Drones and Satellite), and by Component (Services and Solutions) Forecast Period (2024-2031)

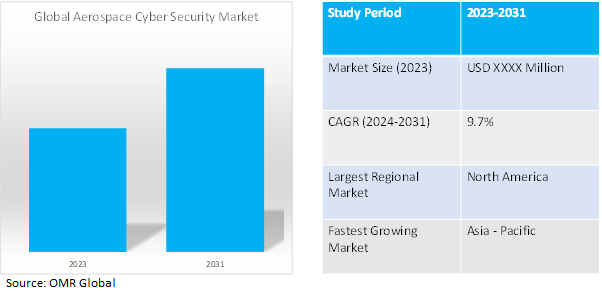

Aerospace cyber security market is anticipated to grow at a considerable CAGR of 9.7% during the forecast period (2024-2031). Aerospace Cyber Security refers to the protection of aerospace systems, networks, and data from unauthorized access, manipulation, or disruption, ensuring secure and reliable operations in aviation and space exploration.

Market Dynamics

Escalating Cyberattacks: A Pressing Threat to Aerospace, Government, and Defense Sectors

The aerospace industry, alongside government agencies and defense organizations, has witnessed a disturbing trend in recent years with a significant rise in cyberattacks. For instance, in November 2023, Boeing, a major aerospace company, faced a cyber incident after being listed on the LockBit ransomware gang's leak site. Attackers targeted elements of its parts and distribution business. The Russia-linked gang threatened to publish sensitive data if ransom demands weren't met by November 2. Boeing awaits contact from LockBit regarding the ransom and details on stolen data remain unspecified. This surge in malicious activity underscores the urgent imperative for these sectors to fortify their cybersecurity defenses. The interconnected nature of modern technology engenders a vast attack surface, rendering aerospace systems, government networks, and defense infrastructure particularly susceptible. Cybercriminals are increasingly exploiting these vulnerabilities to pilfer sensitive data, disrupt operations, or even inflict physical harm. The ramifications of a successful cyberattack in these sectors can be catastrophic, ranging from financial losses to breaches of national security. Recognizing this escalating threat, these critical industries must prioritize cybersecurity investments and deploy robust defensive measures to shield themselves from increasingly sophisticated cyber threats.

Navigating Cybersecurity Challenges in Modern Aerospace Innovations

The integration of Unmanned Aerial Vehicles (UAVs) and next-generation aircraft systems presents novel cybersecurity complexities in the aerospace industry.In February 2024, reports revealed that two El Al flights from Thailand to Israel faced attempted communications hijacking while traversing the Middle East. Suspected to be orchestrated by unidentified hostile elements, the incidents took place over regions with Houthis activity or potentially involving a group from Somaliland. Due to pilots' vigilance and strict adherence to protocols, any diversion was prevented, underscoring the critical significance of aviation cybersecurity measures, recently bolstered by EASA's revised regulations. Despite operational advantages, UAVs often lack robust security measures and possess limited on board processing capabilities, heightening susceptibility to hacking. Furthermore, advanced features like autonomous flight and complex sensor systems in next-gen aircraft create new avenues for cyberattacks, potentially compromising flight control or data integrity. To ensure safe operations, the aerospace sector must prioritize tailored cybersecurity solutions to address these unique vulnerabilities.

Market Segmentation

Our in-depth analysis of global aerospace cyber security market includes the following segments by type,by deployment, by application and by components:

- Based on type, the market is sub-segmented into network security, wireless security, cloud security and content security.

- Based on deployment, the market is bifurcated into on-premise and cloud.

- Based on application, the market is split into aircraft, drones and satellites.

- Based on components,the market is augmented into services and solutions.

Cloud Command: The Rise of Cloud Security in Aerospace Cyber Defense

The cloud security segment of the aerospace cyber security market is set for notable expansion. As the aerospace industry increasingly adopts cloud-based solutions, the need for robust security measures grows. For instance, in May 2023, The U.S. Department of the Air Force plans to migrate hundreds of applications to the cloud this year, utilizing its Cloud One program. Over 100 apps have already transitioned, with nearly 200 more in progress. This shift aims to enhance digital durability and portability, crucial for the dispersed Air and Space forces with bases globally. Cloud adoption emphasizes data accessibility and actionability while reducing vulnerabilities and outdated hardware. Cloud platforms offer scalability and flexibility, aiding in adapting security to evolving threats. Cost-effectiveness, innovation by cloud providers, and regulatory compliance further drive this growth. With a larger attack surface, aerospace firms prioritize safeguarding sensitive data and critical systems, making cloud security solutions indispensable. This confluence of factors propels significant growth, ensuring aerospace companies can navigate cybersecurity challenges effectively.

Unmanned and Unbreachable: The Surge of Drone Security in Aerospace Cyber Defense

The drone segment within the aerospace cyber security market is poised for explosive growth, driven by several converging factors. Firstly, the rapid expansion of the drone market expands the attack surface for cyber threats, necessitating robust cybersecurity measures.For instance, in February 2024 Ukraine's GUR announced a successful cyber operation on February 8, 2024, causing widespread failures in Russian drone control software. The operation targeted software used to reflash DJI brand drones, denying access and forcing manual control. This follows a previous operation on January 30, disrupting information exchange between Russian Ministry of Defense units.Secondly, evolving drone regulations emphasize security for successful integration into airspace. Finally, diverse drone applications, from infrastructure inspection to military operations, highlight the need for stringent cybersecurity to protect sensitive data. These dynamics fuel significant growth in the drone segment, aligning with the increasing importance of cybersecurity in the expanding drone industry.

Regional Outlook

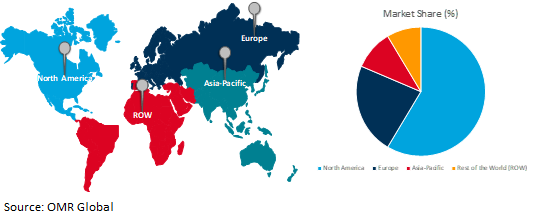

The global aerospace cyber security market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Double Threat: Why North America Leads in Aerospace Cyber Defense

North America's dominance in the Aerospace Cyber Defense market stems from a two-pronged challenge. Firstly, the region boasts a long-standing and well-developed aerospace industry. This translates to a vast network of critical infrastructure, encompassing everything from communication satellites and air traffic control systems to commercial airliners and military jets. Safeguarding this extensive infrastructure necessitates robust cyber defense measures. Secondly, North America is unfortunately a frequent target for sophisticated cyber attacks. These attacks can target any point within the aerospace ecosystem, potentially disrupting air traffic control, manipulating sensitive data, or even compromising military operations. For instance, in June 2023, Cybersecurity experts warn of potential Chinese cyber attacks on the US critical infrastructure amid tensions over Taiwan. If China invades Taiwan, experts anticipate attacks on civilian systems like power grids and transportation networks, akin to Russian attacks on Ukrainian infrastructure. Microsoft cites Chinese hacker group Volt Typhoon targeting critical US infrastructure, prompting advisories from CISA and international partners. Collaboration between government and private sectors is crucial for protecting critical infrastructure sectors.Therefore, to counter these advanced threats and ensure the continued safety and security of its aerospace infrastructure, North American companies are driven to invest heavily in cutting-edge cyber defense solutions.

Global Aerospace Cyber Security Market Growth by Region 2024-2031

Asia-Pacific to Exhibit the Highest CAGR

The Asia Pacific region is witnessing a surge in military spending by many nations. This translates into significant investments in advanced aerospace technologies like drones, fighter jets, and communication satellites.For instance, in November 2023,India is set to procure 31 MQ-9B Predator Drones for both the Indian Navy and Air Force, confirmed by Chief of Naval Staff Admiral R Hari Kumar. The acquisition aims to enhance India's surveillance capabilities, with the Predator MQ-9B known for its efficiency in surveillance operations. The government has approved the purchase, signaling a significant advancement in India's defense capabilities. However, alongside these advancements comes a growing need for robust cybersecurity solutions. As these sophisticated aerospace platforms become more integrated into defense networks, they create a larger attack surface for potential cyber threats. To safeguard sensitive military data, ensure mission integrity, and prevent potential disruptions, robust cyber defense solutions become paramount. In essence, the increasing military spending in Asia-Pacific acts as a double-edged sword, driving innovation in aerospace technologies while simultaneously demanding robust cybersecurity measures to protect these advancements.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global aerospace cyber security market include Airbus Defence and Space Cyber, Cisco Systems Inc., Collins Aerospace (RTX Corporation), Lockheed Martin Corporation, The Raytheon Company among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance,inJuly 2023, Honeywell has announced the acquisition of SCADAfence, a prominent provider of cybersecurity solutions for monitoring large-scale networks. This acquisition aims to enhance Honeywell's OT cybersecurity portfolio by integrating SCADAfence's asset discovery, threat detection, and security governance capabilities into the Honeywell Forge Cybersecurity+ suite. The move strengthens Honeywell's ability to provide end-to-end enterprise OT cybersecurity solutions, fostering secure and efficient operations for its customers.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global aerospace cyber security market based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Airbus SE

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Cisco Systems Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Collins Aerospace (RTX Corp.)

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Lockheed Martin Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. The Raytheon Company

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Aerospace Cyber Security Market byType

4.1.1. Network security

4.1.2. Wireless security

4.1.3. Cloud Security

4.1.4. Content Security

4.2. Global Aerospace Cyber Security Market by Deployment

4.2.1. On-Premise

4.2.2. Cloud

4.3. Global Aerospace Cyber Security Market by Application

4.3.1. Aircraft

4.3.2. Drones

4.3.3. Satellite

4.4. Global Aerospace Cyber Security Market by Component

4.4.1. Services

4.4.2. Solutions

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. Astronautics Corporation of America

6.2. BAE Systems plc

6.3. CyViation

6.4. General Dynamics Mission Systems, Inc.

6.5. Honeywell International Inc.

6.6. Israel Aerospace Industries

6.7. Northrop Grumman Corp.

6.8. Satcom Direct, Inc.

6.9. Thales Group

6.10. The Aerospace Corp.

1. GLOBAL AEROSPACE CYBER SECURITY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL AEROSPACE CYBER SECURITY MARKET FOR NETWORK SECURITYRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBALAEROSPACE CYBER SECURITY MARKETFOR WIRELESS SECURITYRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL AEROSPACE CYBER SECURITY MARKET FOR CLOUD SECURITYRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL AEROSPACE CYBER SECURITY MARKET FOR CONTENT SECURITYRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL AEROSPACE CYBER SECURITY MARKET RESEARCH AND ANALYSIS BYDEPLOYMENT, 2023-2031 ($ MILLION)

7. GLOBAL ON-PREMISEAEROSPACE CYBER SECURITY MARKETRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL CLOUDAEROSPACE CYBER SECURITYMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL AEROSPACE CYBER SECURITY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

10. GLOBALAIRCRAFTAEROSPACE CYBER SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL DRONESAEROSPACE CYBER SECURITYMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL SATELLITE AEROSPACE CYBER SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL AEROSPACE CYBER SECURITY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

14. GLOBAL AEROSPACE CYBER SECURITYSERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL AEROSPACE CYBER SECURITYSOLUTIONSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBALAEROSPACE CYBER SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. NORTH AMERICAN AEROSPACE CYBER SECURITY RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. NORTH AMERICAN AEROSPACE CYBER SECURITY RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

19. NORTH AMERICAN AEROSPACE CYBER SECURITY RESEARCH AND ANALYSIS BYDEPLOYMENT 2023-2031 ($ MILLION)

20. NORTH AMERICAN AEROSPACE CYBER SECURITY RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. NORTH AMERICAN AEROSPACE CYBER SECURITY RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

22. EUROPEAN AEROSPACE CYBER SECURITY RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. EUROPEAN AEROSPACE CYBER SECURITY RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

24. EUROPEAN AEROSPACE CYBER SECURITY RESEARCH AND ANALYSIS BYDEPLOYMENT2023-2031 ($ MILLION)

25. EUROPEAN AEROSPACE CYBER SECURITY RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

26. EUROPEAN AEROSPACE CYBER SECURITY RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC AEROSPACE CYBER SECURITY RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

28. ASIA- PACIFIC AEROSPACE CYBER SECURITY RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

29. ASIA-PACIFICAEROSPACE CYBER SECURITY RESEARCH AND ANALYSIS BYDEPLOYMENT, 2023-2031 ($ MILLION)

30. ASIA-PACIFICAEROSPACE CYBER SECURITY RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC AEROSPACE CYBER SECURITY RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

32. REST OF THE WORLD AEROSPACE CYBER SECURITY RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

33. REST OF THE WORLD AEROSPACE CYBER SECURITY RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

34. REST OF THE WORLD AEROSPACE CYBER SECURITY RESEARCH AND ANALYSIS BYDEPLOYMENT, 2023-2031 ($ MILLION)

35. REST OF THE WORLD AEROSPACE CYBER SECURITY RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

36. REST OF THE WORLD AEROSPACE CYBER SECURITY RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

1. GLOBAL AEROSPACE CYBER SECURITYMARKET RESEARCH AND ANALYSIS BYTYPE, 2023 VS 2031 (%)

2. GLOBALAEROSPACE CYBER SECURITYMARKET FOR NETWORK SECURITY RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBALAEROSPACE CYBER SECURITYMARKET FOR WIRELESS SECURITY RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBALAEROSPACE CYBER SECURITY MARKET FOR CLOUD SECURITY RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL AEROSPACE CYBER SECURITY MARKET FOR CONTENT SECURITY RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

6. GLOBAL AEROSPACE CYBER SECURITY RESEARCH AND ANALYSIS BY DEPLOYMENT, 2023 VS 2031 (%)

7. GLOBALON-PREMISEAEROSPACE CYBER SECURITYRESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBALCLOUDAEROSPACE CYBER SECURITYRESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBAL AEROSPACE CYBER SECURITY RESEARCH AND ANALYSIS BY APPLICATION, 2023 VS 2031 (%)

10. GLOBAL AIRCRAFTAEROSPACE CYBER SECURITYMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

11. GLOBAL DRONESAEROSPACE CYBER SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

12. GLOBAL SATELLITE AEROSPACE CYBER SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

13. GLOBAL AEROSPACE CYBER SECURITY RESEARCH AND ANALYSIS BY COMPONENT, 2023 VS 2031 (%)

14. GLOBAL AEROSPACE CYBER SECURITYSERVICESMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

15. GLOBAL AEROSPACE CYBER SECURITYSOLUTIONSMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

16. GLOBAL AEROSPACE CYBER SECURITY RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

17. US AEROSPACE CYBER SECURITY MARKET SIZE, 2023-2031 ($ MILLION)

18. CANADA AEROSPACE CYBER SECURITYMARKET SIZE, 2023-2031 ($ MILLION)

19. UK AEROSPACE CYBER SECURITY MARKET SIZE, 2023-2031 ($ MILLION)

20. FRANCE AEROSPACE CYBER SECURITY MARKET SIZE, 2023-2031 ($ MILLION)

21. GERMANY AEROSPACE CYBER SECURITYMARKET SIZE, 2023-2031 ($ MILLION)

22. ITALY AEROSPACE CYBER SECURITY MARKET SIZE, 2023-2031 ($ MILLION)

23. SPAIN AEROSPACE CYBER SECURITYMARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF EUROPE AEROSPACE CYBER SECURITY MARKET SIZE, 2023-2031 ($ MILLION)

25. INDIA AEROSPACE CYBER SECURITYMARKET SIZE, 2023-2031 ($ MILLION)

26. CHINA AEROSPACE CYBER SECURITY MARKET SIZE, 2023-2031 ($ MILLION)

27. JAPAN AEROSPACE CYBER SECURITY MARKET SIZE, 2023-2031 ($ MILLION)

28. SOUTH KOREA AEROSPACE CYBER SECURITY SIZE, 2023-2031 ($ MILLION)

29. REST OF ASIA-PACIFIC AEROSPACE CYBER SECURITY SIZE, 2023-2031 ($ MILLION)

30. LATIN AMERICA AEROSPACE CYBER SECURITY SIZE, 2023-2031 ($ MILLION)

31. THE MIDDLE EAST & AFRICA AEROSPACE CYBER SECURITY SIZE, 2023-2031 ($ MILLION)