Aerospace & Defense Contract Manufacturing Market

Global Aerospace & Defense Contract Manufacturing Market Size, Share & Trends Analysis Report by Services (Aerospace & Defense Design & Engineering, Aerospace & Defenses Assembly, Aerospace & Defense Manufacturing and Others), and by End-Users (Commercial and Government) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

The global aerospace & defense contract manufacturing market is anticipated to grow at a significant CAGR of 17.3% during the forecast period. The contract manufacturing in aerospace & defense is intended to offer various services, such as manufacturing, engineering, modification & maintenance, assembly, and supply chain management. In addition, it involves bringing advanced solutions to defense, commercial and space customers. The contracts are awarded by both government and commercials to the contract manufacturers. One of the major factors driving the growth of global aerospace & defense contract manufacturing market includes surging demand for commercial airplanes. For instance, in July 2021, Sintavia, LLC unveiled its patented copper 3D printing method for the GRCop-42 rocket thrust chamber assembly utilised by NASA and other space travel companies.

Impact of COVID-19 Pandemic on Global Aerospace & Defense Contract Manufacturing Market

The COVID-19 pandemic had impacted most of the industries in the market. The spread of the virus led most governments across the globe to impose a lockdown that strictly restricted the uses of the vehicle and shut down most of the transportation services for a while. All this led to a decrease in the demand, and production activities in the Aerospace & Defense Contract Manufacturing market. It caused market players a resistance in their regular sales.

Segmental Outlook

The global aerospace & defense contract manufacturing market is segmented based on services and end-users. Based on the services, the market is sub-segmented into aerospace & defense design & engineering, aerospace & defense assembly, aerospace & defense manufacturing, and others. Based on end-users, the market is classified as commercials and government. Further, the government segment comprises the army, air force, navy, and coast guard.

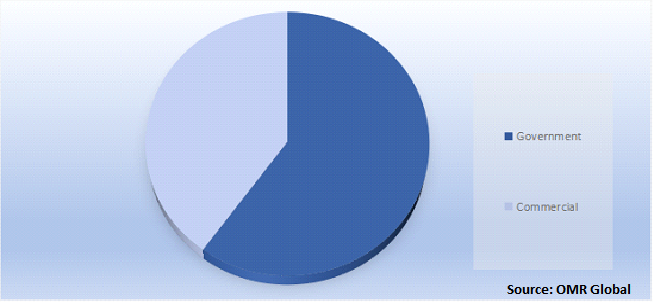

Global Aerospace & Defense Contract Manufacturing Market Share by End-Users, 2021 (%)

The Government Segment is Expected to hold a Prominent Share in the Global Aerospace & Defense Contract Manufacturing Market

The government segment is expected to hold a prominent share in the market owing to the rise in R&D activities within the aerospace & defense sector. The government is majorly focusing on establishing an aero-engine complex for civil and military applications along with developing core technologies for aero-engines contributing to the growth of the market. For instance, in November 2021, the Indian government in collaboration with the Cabinet Committee on Security (CCS) sanctioned $2036.6 crores on project Kaveri for developing jet engines for aircraft.

Regional Outlooks

The global aerospace & defense contract manufacturing market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East &Africa, and Latin America. Asia-Pacific region is anticipated to grow at a considerable CAGR over the forecast period, owing to the rapidly rising defense industry in Asian countries, including Japan, China, India, Indonesia, and others. Asia-Pacific grow significantly over the forecast period, owing to the presence of highly industrialized countries in the region, which is expected to increase the demand for advanced aerospace & defense contract manufacturing followed by Europe.

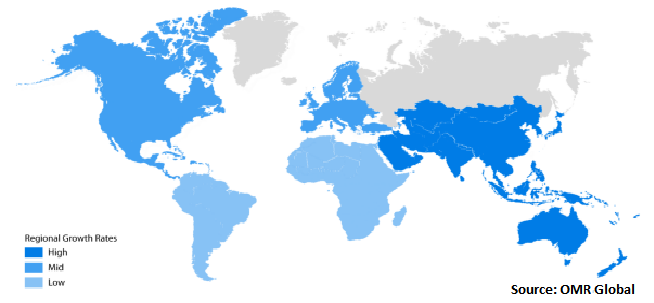

Global Aerospace & Defense Contract Manufacturing Market Growth, by Region 2022-2028

The Asia-Pacific Region is Expected to Cater Significant CAGR in the Global Aerospace & Defense Contract Manufacturing Market

Asia-Pacific region is anticipated to grow at a considerable CAGR over the forecast period, owing to the rapidly rising defense industry in Asian countries, including Japan, China, India, Indonesia, and others. These countries are highly industrialized, which is expected to increase the demand for advanced aerospace & defense contract manufacturing. Furthermore, increasing expenditure of these countries on the aerospace & defense industry is another factor to fuel the market growth. According to the WorldBank, the defense expenditure constituted 2.9% of India’s total GDP with approximately $72.9 billion spent on defense in 2020.

Market Players Outlook

The competitive landscape includes key strategies of leading players, recent developments, and key company analysis. The major players that contribute to the growth of the market include Boeing Company, BAE Systems PLC, Lockheed Martin Corp., General Dynamics Corp., Northrop Grumman Corp., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in January 2019, Airbus initiated the construction of its A220 manufacturing facility in Alabama.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global aerospace & defense contract manufacturing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1.Report Summary

- Current Industry Analysis and Growth Potential Outlook

- Impact of COVID-19 on the Global Aerospace & Defense Contract Manufacturing Market

- Recovery Scenario of Global Aerospace & Defense Contract Manufacturing Market

1.1.Research Methods and Tools

1.2.Market Breakdown

1.2.1.By Segments

1.2.2.By Region

2.Market Overview and Insights

2.1.Scope of the Report

2.2.Analyst Insight & Current Market Trends

2.2.1.Key Findings

2.2.2.Recommendations

2.2.3.Conclusion

3.Competitive Landscape

3.1.Key Company Analysis

3.1.1.Bae Systems PLC

3.1.1.1.Overview

3.1.1.2.Financial Analysis

3.1.1.3.SWOT Analysis

3.1.1.4.Recent Developments

3.1.2.General Dynamic Corp.

3.1.2.1.Overview

3.1.2.2.Financial Analysis

3.1.2.3.SWOT Analysis

3.1.2.4.Recent Developments

3.1.3.Lockheed Martin Corp.

3.1.3.1.Overview

3.1.3.2.Financial Analysis

3.1.3.3.SWOT Analysis

3.1.3.4.Recent Developments

3.1.4.Northrop Grumman Corp.

3.1.4.1.Overview

3.1.4.2.Financial Analysis

3.1.4.3.SWOT Analysis

3.1.4.4.Recent Developments

3.1.5.The Boeing Co.

3.1.5.1.Overview

3.1.5.2.Financial Analysis

3.1.5.3.SWOT Analysis

3.1.5.4.Recent Developments

3.2.Key Strategy Analysis

3.3.Impact of COVID-19 on Key Players

4.Market Segmentation

4.1.Global Aerospace & Defense Contract Manufacturing Market by Services

4.1.1.Aerospace & Defence Design & Engineering

4.1.2.Aerospace & Defence Assembly

4.1.3.Aerospace & Defence Manufacturing

4.1.4.Others (Commercialization and Supply Chain)

4.2.Global Aerospace & Defense Contract Manufacturing Market by End-Users

4.2.1.Commercial

4.2.2.Government

4.2.2.1.Army

4.2.2.2.Air force

4.2.2.3.Navy

4.2.2.4.Coast Guard

5.Regional Analysis

5.1.North America

5.1.1.US

5.1.2.Canada

5.2.Europe

5.2.1.UK

5.2.2.Germany

5.2.3.Italy

5.2.4.Spain

5.2.5.France

5.2.6.Rest of Europe

5.3.Asia-Pacific

5.3.1.China

5.3.2.India

5.3.3.Japan

5.3.4.South Korea

5.3.5.Rest of Asia-Pacific

5.4.Rest of the World

6.Company Profiles

6.1.A&S Mold and Die Corp.

6.2.ABX Engineering, Inc.

6.3.Accelerated Machine Design & Engineering LLC

6.4.Alpha Design Technologies Pvt. Ltd.

6.5.Avion Technology, Inc.

6.6.Axian Technologies, Inc.

6.5. Bharat Electronics Ltd.

6.8.Blue Origin, LLC

6.9.CAE, Inc.

6.10.Captor Corp.

6.11.China Aerospace Science and Technology Corp.

6.12.Commercial Aircraft Corporation of China, Ltd.

6.13.General Dynamics Corp.

6.14.Genser Aerospace & IT Pvt. Ltd.

6.15.Hindustan Aeronautics Ltd.

6.16.Kawasaki Heavy Industries, Ltd.

6.17.L3 Technologies, Inc.

6.16.Magellan Aerospace Corp.

6.19.Mahindra Aerospace Pvt. Ltd.

6.20.MAN Group PLC

6.21.Merc Aerospace Ltd.

6.22.Metro Tool & Die Ltd.

6.23.Mitsubishi Heavy Industries, Ltd.

6.24.Northstar Aerospace, Inc.

6.25.Nova-Tech Engineering, Inc.

6.26.Pratt & Whitney Canada Corp.

6.27.Precision Aerospace Component Engineering Ltd.

6.28.Pryme Group Holdings Ltd.

6.29.Raghu Vamsi Machine Tools Pvt. Ltd.

6.30.Ratheon Company

6.31.Sanmina Corp.

6.32.Sierra Nevada Corp.

6.33.Space Exploration Technologies Corp.

6.34.Sparton Corp.

6.35.Subaru Corp.

6.36.Denis Ferranti Group Ltd.

6.37.Unitech Aerospace Co.

6.38.United Technologies Corp.

6.39.Vaupell Holdings, Inc.

6.40.Vermont Aerospace Industries, LLC

6.41.Woolf Aircraft Products, Inc.

6.42. Zoller UK Ltd.

1.GLOBAL AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICES, 2021-2028 ($ MILLION)

GLOBAL AEROSPACE & DEFENSE DESIGN AND ENGINEERING CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3.GLOBAL AEROSPACE & DEFENSE ASSEMBLY CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4.GLOBAL AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5.GLOBAL OTHER AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6.GLOBAL AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END-USERS, 2021-2028 ($ MILLION)

7.GLOBAL AEROSPACE & DEFENSE CONTRACT MANUFACTURING IN COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8.GLOBAL AEROSPACE & DEFENSE CONTRACT MANUFACTURING IN GOVERNMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

GLOBAL AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

10.NORTH AMERICAN AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

11.NORTH AMERICAN AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICES, 2021-2028 ($ MILLION)

12.NORTH AMERICAN AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END-USERS, 2021-2028 ($ MILLION)

EUROPEAN AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14.EUROPEAN AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICES, 2021-2028 ($ MILLION)

15.EUROPEAN AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END-USERS, 2021-2028 ($ MILLION)

ASIA-PACIFIC AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17.ASIA-PACIFIC AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICES, 2021-2028 ($ MILLION)

18.ASIA-PACIFIC AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END-USERS, 2021-2028 ($ MILLION)

REST OF THE WORLD AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICES, 2021-2028 ($ MILLION)

20.REST OF THE WORLD AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END-USERS, 2021-2028 ($ MILLION)

LIST OF FIGURES

1.IMPACT OF COVID-19 ON GLOBAL AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET, 2021-2028 ($ MILLION)

2.IMPACT OF COVID-19 ON GLOBAL AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3.RECOVERY OF GLOBAL AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET, 2022-2028 (%)

GLOBAL AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET SHARE BY SERVICES, 2021 VS 2028 (%)

5.GLOBAL AEROSPACE & DEFENSE DESIGN AND ENGINEERING CONTARCT MANAUFACTTURING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6.GLOBAL AEROSPACE & DEFENSE ASSEMBLY CONTRACT MANUFACTURING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7.GLOBAL AEROSPACE & DEFENSE MANUFACTURING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8.GLOBAL OTHERS AEROSPACE & DEFENSE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9.GLOBAL AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET SHARE BY END-USERS, 2021 VS 2028 (%)

10.GLOBAL AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET IN COMMERCIAL SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11.GLOBAL AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET IN GOVERNMENT SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12.GLOBAL AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13.US AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET SIZE, 2021-2028 ($ MILLION)

14.CANADA AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET SIZE, 2021-2028 ($ MILLION)

15.UK AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET SIZE, 2021-2028 ($ MILLION)

16.FRANCE AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET SIZE, 2021-2028 ($ MILLION)

17.GERMANY AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET SIZE, 2021-2028 ($ MILLION)

18.ITALY AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET SIZE, 2021-2028 ($ MILLION)

19.SPAIN AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET SIZE, 2021-2028 ($ MILLION)

20.REST OF EUROPE AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET SIZE, 2021-2028 ($ MILLION)

21.INDIA AEROSPACE & DEFENSE CONTRACT MANUFACTURING MARKET SIZE, 2021-2028 ($ MILLION)