Aerospace Plastics Market

Global Aerospace Plastics Market Size, Share & Trends Analysis Report by Plastic Type (Polyetheretherketone (PEEK), Thermosetting Polyimide, Polyamide-imide (PAI), Polychlorotrifluoroethylene (PCTFE), and Polytetrafluoroethylene (PTFE), By Aircraft Type (Commercial Aircraft, Military Aircraft, Rotary Aircraft, and Others), By Application (Airframe and Fuselage, Windows & Wind Shields, Cabin Areas, and Others), Forecast 2019-2025 Update Available - Forecast 2025-2035

The global aerospace plastics market is expected to grow at a CAGR of over 7% during the forecast period. Plastics can be utilized as an alternative to many metals such as aluminum and other steel components as they are light weighted and are highly durable. Reduced weight of the aircraft enhances the overall performance of the aircraft. The increased demands for lightweight materials in the aerospace industry in order to reduce the overall weight of the aircraft is the primary factor flourishing the growth of the global aerospace plastics market during the forecast period. The increased demand for plastic in applications such as airframe, cabin areas, wings, flight deck, and cockpit, among others are also enhancing the market growth. However, higher costs may negatively affect market growth.

Further, the incorporation of advanced manufacturing technologies such as 3D printing of parts is projected to create ample opportunities for market growth in the near future. In order to reduce the manufacturing costs, the manufacturers may shift towards 3D manufacturing techniques. For instance, aerospace company Lockheed Martin, one of the largest defense contractors of the globe, has become a prominent user of 3D printing. Its 3D printed innovations include propulsion tanks and parts for spacecraft and missiles, and recently in 2018, it completed its largest 3D printed components. The company’s work with 3D printing will be expanding with a new $5.8 million contract with the Office of Naval Research. The company received a contract in 2018 to further develop 3D printing for aerospace manufacturing.

Segmental Outlook

The global aerospace plastics market is segmented into plastic type, aircraft type, and applications. Based on the plastic type, the market is segmented into Polyetheretherketone (PEEK), Thermosetting Polyimide, Polyamide-imide (PAI), Polychlorotrifluoroethylene (PCTFE), and Polytetrafluoroethylene (PTFE). Based on the aircraft type, the market is segmented into commercial aircraft, military aircraft, rotary aircraft, and others such as spacecraft. Whereas, based on the applications, the market is segmented into airframe and fuselage, windows & windshields, cabin areas, and others including the propulsion system.

Thermosetting Polyimide and Polyamide-imide to be the Significant Share-Holding Segments

Amongst the plastic type segment of the global aerospace plastic market, thermosetting polyimide and polyamide-imide segments hold a significant share in the market. The growth is accredited to the various features possessed by the plastic types. PAI acts as an alternative for metal components in the aerospace industry as it is resistant to most chemicals and radiation at room temperature and is flame retardant. PAI possesses superior mechanical properties and doesn’t give smoke while burning. Whereas, thermosetting polyimides are preferred in the insulators and electrical spacers for threaded nuts and other components. Thermosetting polyimides possess superior mechanical properties and are highly resistant to chemicals. Moreover, thermosetting polyimides are highly ductile as compared to ceramics and have less weight than metals.

Regional Outlook

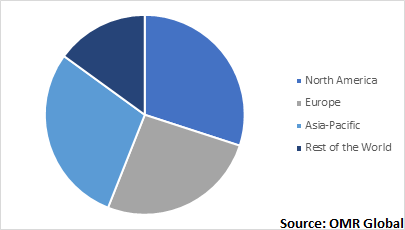

The global aerospace plastics market is geographically segmented into North America, Europe, Asia-Pacific and the Rest of the World. North America is expected to hold a significant share in the global market during the forecast period. This is attributed to the presence of the key players in the region coupled with the high R&D spending capability in the region. The market growth is also attributed to the high production of aircraft engines and high manufacturing capital in aerospace & defense in the region. Further, the presence of major aircraft players in the region creates the demand for light-weighted plastics and therefore, contributes to the regional growth of the market. Along with the presence of major aircraft players, the region marks the huge defense expenditure which as a result, is supporting the regional growth of the market.

Global Aerospace Plastics Market by Region, 2018 (%)

Market Players Outlook

The prominent players operating in the global aerospace plastics market include Sabic, BASF SE, Solvay SA, Mitsubishi Heavy Industries Ltd., Huntsman Internal LLC, Kaman Corp., Evonik Industries AG, and many others. These are the key companies adopting several organic and inorganic growth strategies such as product launches & developments, partnerships, agreements, and acquisitions to strengthen their product portfolios and maintain a competitive position in the global aerospace plastics market. For instance, in March 2018, Hexcel and Arkema signed a strategic alliance for the development of thermoplastic composite solutions for the aerospace sector combining the expertise of Hexcel in carbon fiber and that of Arkema in PEKK.

The partnership is aimed at developing carbon fiber-reinforced thermoplastic tapes for producing lightweight parts for future generations of aircraft. In addition to light-weighting, these new composites would provide lower cost and faster production speeds for customers in the aerospace and space and defense sectors.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global aerospace plastics market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Strategy Analysis

3.2. Key Company Analysis

3.2.1. BASF SE

3.2.1.1. Overview

3.2.1.2. Financial Analysis

3.2.1.3. SWOT Analysis

3.2.1.4. Recent Developments

3.2.2. Kaman Corp.

3.2.2.1. Overview

3.2.2.2. Financial Analysis

3.2.2.3. SWOT Analysis

3.2.2.4. Recent Developments

3.2.3. Solvay SA

3.2.3.1. Overview

3.2.3.2. Financial Analysis

3.2.3.3. SWOT Analysis

3.2.3.4. Recent Developments

3.2.4. Huntsman International LLC

3.2.4.1. Overview

3.2.4.2. Financial Analysis

3.2.4.3. SWOT Analysis

3.2.4.4. Recent Developments

3.2.5. Mitsubishi Heavy Industries Ltd.

3.2.5.1. Overview

3.2.5.2. Financial Analysis

3.2.5.3. SWOT Analysis

3.2.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Aerospace plastics Market by Plastic Type

5.1.1. Polyetheretherketone (PEEK)

5.1.2. Thermosetting Polyimide

5.1.3. Polyamide-imide (PAI)

5.1.4. Polychlorotrifluoroethylene (PCTFE)

5.1.5. Polytetrafluoroethylene (PTFE)

5.2. Global Aerospace plastics Market by Aircraft Type

5.2.1. Commercial Aircraft

5.2.2. Military Aircraft

5.2.3. Rotary Aircraft

5.2.4. Others (Spacecrafts)

5.3. Global Aerospace plastics Market by Application

5.3.1. Airframe and Fuselage

5.3.2. Windows and Wind Shields

5.3.3. Cabin Areas

5.3.4. Others (Propulsion System, Wing Box)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 3P Performance Plastics Products

7.2. BASF SE

7.3. Big Bear Plastics Products Ltd.

7.4. Drake Plastics Ltd.

7.5. Ensinger Inc.

7.6. Evonik Industries AG

7.7. Hexcel Corp.

7.8. Huntsman International LLC

7.9. Kaman Corp.

7.10. Loar Group

7.11. Mitsubishi Heavy Industries Ltd.

7.12. PACO Plastics Inc.

7.13. SABIC

7.14. Solvay SA

7.15. Toray Industries Inc.

7.16. Vantage Associates, Inc.

7.17. Victrex Plc

1. GLOBAL AEROSPACE PLASTICS MARKET RESEARCH AND ANALYSIS BY PLASTIC TYPE, 2018-2025 ($ MILLION)

2. GLOBAL POLYETHERETHERKETONE (PEEK) FOR AEROSPACE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL THERMOSETTING POLYIMIDE FOR AEROSPACE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL POLYAMIDE-IMIDE (PAI) FOR AEROSPACE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL POLYCHLOROTRIFLUOROETHYLENE (PCTFE) FOR AEROSPACE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL POLYTETRAFLUOROETHYLENE (PTFE) FOR AEROSPACE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL AEROSPACE PLASTICS MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE, 2018-2025 ($ MILLION)

8. GLOBAL AEROSPACE PLASTICS FOR COMMERCIAL AIRCRAFT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL AEROSPACE PLASTICS FOR MILITARY AIRCRAFT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL AEROSPACE PLASTICS FOR ROTARY AIRCRAFT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL AEROSPACE PLASTICS FOR OTHER AIRCRAFTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL AEROSPACE PLASTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

13. GLOBAL AEROSPACE PLASTICS FOR AIRFRAME AND FUSELAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL AEROSPACE PLASTICS FOR WINDOWS AND WINDSHIELDS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

15. GLOBAL AEROSPACE PLASTICS FOR CABIN AREAS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

16. GLOBAL AEROSPACE PLASTICS FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

17. GLOBAL AEROSPACE PLASTICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

18. NORTH AMERICAN AEROSPACE PLASTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

19. NORTH AMERICAN AEROSPACE PLASTICS MARKET RESEARCH AND ANALYSIS BY PLASTIC TYPE, 2018-2025 ($ MILLION)

20. NORTH AMERICAN AEROSPACE PLASTICS MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE, 2018-2025 ($ MILLION)

21. NORTH AMERICAN AEROSPACE PLASTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

22. EUROPEAN AEROSPACE PLASTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

23. EUROPEAN AEROSPACE PLASTICS MARKET RESEARCH AND ANALYSIS BY PLASTIC TYPE, 2018-2025 ($ MILLION)

24. EUROPEAN AEROSPACE PLASTICS MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE, 2018-2025 ($ MILLION)

25. EUROPEAN AEROSPACE PLASTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

26. ASIA-PACIFIC AEROSPACE PLASTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

27. ASIA-PACIFIC AEROSPACE PLASTICS MARKET RESEARCH AND ANALYSIS BY PLASTIC TYPE, 2018-2025 ($ MILLION)

28. ASIA-PACIFIC AEROSPACE PLASTICS MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE, 2018-2025 ($ MILLION)

29. ASIA-PACIFIC AEROSPACE PLASTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

30. REST OF THE WORLD AEROSPACE PLASTICS MARKET RESEARCH AND ANALYSIS BY PLASTIC TYPE, 2018-2025 ($ MILLION)

31. REST OF THE WORLD AEROSPACE PLASTICS MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE, 2018-2025 ($ MILLION)

32. REST OF THE WORLD AEROSPACE PLASTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL AEROSPACE PLASTICS MARKET SHARE BY PLASTIC TYPE, 2018 VS 2025 (%)

2. GLOBAL AEROSPACE PLASTICS MARKET SHARE BY AIRCRAFT TYPE, 2018 VS 2025 (%)

3. GLOBAL AEROSPACE PLASTICS MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

4. GLOBAL AEROSPACE PLASTICS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US AEROSPACE PLASTICS MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA AEROSPACE PLASTICS MARKET SIZE, 2018-2025 ($ MILLION)

7. UK AEROSPACE PLASTICS MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE AEROSPACE PLASTICS MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY AEROSPACE PLASTICS MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY AEROSPACE PLASTICS MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN AEROSPACE PLASTICS MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE AEROSPACE PLASTICS MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA AEROSPACE PLASTICS MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA AEROSPACE PLASTICS MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN AEROSPACE PLASTICS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC AEROSPACE PLASTICS MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD AEROSPACE PLASTICS MARKET SIZE, 2018-2025 ($ MILLION)