Agricultural Biologicals Market

Agricultural Biologicals Market Size, Share & Trends Analysis Report by Product (Biopesticides, Biostimulants, and Biofertilizers), by Application (Foliar Spray, Seed Treatment, Soil Treatment, and Post Harvest), and by Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Others), Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Agricultural biological market is anticipated to grow at a significant CAGR of 8.9% during the forecast period. The rising awareness about organic food products is boosting the demand for agricultural biological is increasing across the globe. According to Food and Agriculture Organization of the United Nations (FAO) data, the global sales of organic food and drink reached more than $109 billion in 2019. Organic agriculture is practiced in 187 countries, and 72.3 million hectares of agricultural land were managed organically by at least 3.1 million farmers. Further, organic farmland increased by 1.1 Million hectares or 1.6% in 2019. In 2019 the countries with the largest organic markets were the US, Germany, and France. The largest single market was the US (42% of the global market), followed by the European Union (39%) and China (8%) with the highest per capita consumption in 2019 was Denmark. Hence the increasing demand for organic products and increasing organic farming is boosting the demand for agricultural biological as these are topical or seed treatment products made from natural materials such as naturally occurring microorganisms, plant extracts, beneficial insects or other organic matter, which are majorly used to replace chemicals used in agriculture farming. These biological are used to protect crops from pests, weeds, and diseases, thereby maintaining crops healthy.

Segmental Outlook

The global agricultural biological market is segmented based on product, application and crop type. Based on product, the market is segmented into biopesticides, biostimulants, and biofertilizers. Based on application, the market is sub-segmented into foliar spray, seed treatment, soil treatment, and post harvest. Based on crop type the market is sub-segmented into cereals & grains, oilseeds & pulses, fruits & vegetables, and others. The above mentioned segments can be customized as per the requirements. Among the product segment the biopesticides sub-segment is anticipated to hold a prominent market share, while the biofertilizers sub segment is anticipated to witness the fastest growth. The biopesticides contains biochemical, and microbial. Microbial pesticides, however, contain active ingredients such as bacterium, fungus, virus or protozoan, which control several types of pests. The highly utilized microbial pesticide includes strains of Bacillus thuringiensis, which forms a protein mix to kill the pests. Hence these factors are growing the biopesticides sub-segment during the forecast period.

Among the application segment, the seed treatment sub-segment is anticipated to hold a prominent market share over the forecast period owing to the widespread demand for agricultural biological in advancing seed properties to increase crop yield. Biofertilizers are majorly used in seed treatment as well as soil treatment applications. Increased consumption of synthetic fertilizers and a host of other crop care chemicals, such as pesticides and insecticides, over the past couple of years, has led to a substantial worsening of soil quality across the globe. Biological seed treatment has all-round positive effects on the growth rate, immunity of the seeds to biotic and abiotic stress, the development of the root system and therefore its ability to assimilate nutrients. Hence these factors are growing the seed treatment segment during the forecast period.

Regional Outlooks

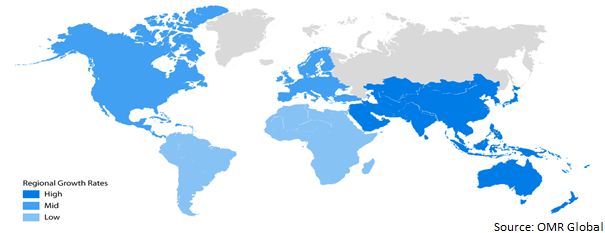

The global agricultural biological market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these the North America is anticipated to hold a prominent market share, however the Asia-Pacific is expected to grow at a considerable rate in the agricultural biological market.

Global Agricultural Biologicals Market Growth, by Region 2022-2028

The North America is expected to hold the Prominent Share in the Global Agricultural Biologicals Market during the Forecast Period.

The North America is expected to hold the prominent share in the global agricultural biologicals market during the forecast period. Owing to the presence of global agricultural product manufacturing companies in the North America, with the constantly evolving agricultural practices in the region with respect to farming techniques, merger, collaboration, acquisitions, is growing the demand in the market. For instance, in April 2022 Bayer CropScience LLC created Ag Biologicals Powerhouse Partnership with Ginkgo Bioworks, advancing Joyn Bio Technology Platforms. It is an agreement whereby Ginkgo Bioworks will acquire Bayer’s West Sacramento Biologics Research & Development (R&D) site and internal discovery and lead optimization platform. This acquisition will help in expansion of a diversified portfolio of high-quality microbial-based solutions for growers across the globe by further enhancing Bayer’s biologics strategy of tapping into the open innovation ecosystem / biologics segment.

Market Players Outlook

The major companies serving the global agricultural biologicals market include BASF SE, Bayer AG, Lallemand Inc., Novozymes A/S, Syngenta AG and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in May 2020 UPL collaborated with Croda International Plc on the product development of BANZAI TM, the first proven chemical biostimulant foliar spray, specifically designed for cocoa. BANZAI actively promotes the production and retention of pods, is environmentally non-toxic and benign, eliminating concerns about product residues for production of cocoa paste and, ultimately, chocolate.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global agricultural biological market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. BASF SE

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Bayer AG

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Lallemand Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Novozymes A/S

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Syngenta AG

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Agricultural Biologicals Market by Product

4.1.1. Biopesticides

4.1.1.1. Biochemicals

4.1.1.2. Microbials

4.1.2. Biostimulants

4.1.2.1. Acid based

4.1.2.2. Seaweed extract

4.1.2.3. Microbials

4.1.2.4. Others

4.1.3. Biofertilizers

4.1.3.1. Nitrogen Fixation

4.1.3.2. Phosphate Solubilizing

4.1.3.3. Others

4.2. Global Agricultural Biologicals Market by Application

4.2.1. Foliar Spray

4.2.2. Seed Treatment

4.2.3. Soil Treatment

4.2.4. Post Harvest

4.3. Global Agricultural Biologicals Market by Crop Type

4.3.1. Cereals & Grains

4.3.2. Oilseeds & Pulses

4.3.3. Fruits & Vegetables

4.3.4. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Biolchim S.p.A.

6.2. Biovert, SL

6.3. GOWAN CO.

6.4. Koppert B.V.

6.5. Marrone Bio Innovation

6.6. PI Industries Ltd.

6.7. Rizobacter Argentina SA

6.8. SEIPASA, S.A.

6.9. STK bio-ag technologies

6.10. SYMBORG CORPORATE, SL.

6.11. TRADE CORPORATION INTERNATIONAL, S.A. UNIPERSONAL

6.12. UPL Ltd.

6.13. Valent BioSciences LLC

6.14. Vegalab SA

6.15. Verdesian Life Sciences

1. GLOBAL AGRICULTURAL BIOLOGICALS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

2. GLOBAL AGRICULTURAL BIOPESTICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL AGRICULTURAL BIOSTIMULANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL AGRICULTURAL BIOFERTILIZERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL AGRICULTURAL BIOLOGICALS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

6. GLOBAL AGRICULTURAL BIOLOGICALS FOR FOLIAR SPRAY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL 5 AGRICULTURAL BIOLOGICALS FOR SEED TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL AGRICULTURAL BIOLOGICALS FOR SOIL TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL AGRICULTURAL BIOLOGICALS FOR POST HARVEST MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL AGRICULTURAL BIOLOGICALS MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2021-2028 ($ MILLION)

11. GLOBAL AGRICULTURAL BIOLOGICALS FOR CEREALS & GRAINS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL AGRICULTURAL BIOLOGICALS FOR OILSEEDS & PULSES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL AGRICULTURAL BIOLOGICALS FOR FRUITS & VEGETABLES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL AGRICULTURAL BIOLOGICALS FOR OTHER CROP TYPES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL AGRICULTURAL BIOLOGICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. NORTH AMERICAN AGRICULTURAL BIOLOGICALS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. NORTH AMERICAN AGRICULTURAL BIOLOGICALS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

18. NORTH AMERICAN AGRICULTURAL BIOLOGICALS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

19. NORTH AMERICAN AGRICULTURAL BIOLOGICALS MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2021-2028 ($ MILLION)

20. EUROPEAN AGRICULTURAL BIOLOGICALS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. EUROPEAN AGRICULTURAL BIOLOGICALS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

22. EUROPEAN AGRICULTURAL BIOLOGICALS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

23. EUROPEAN AGRICULTURAL BIOLOGICALS MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC AGRICULTURAL BIOLOGICALS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC AGRICULTURAL BIOLOGICALS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC AGRICULTURAL BIOLOGICALS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

27. ASIA-PACIFIC AGRICULTURAL BIOLOGICALS MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2021-2028 ($ MILLION)

28. REST OF THE WORLD AGRICULTURAL BIOLOGICALS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

29. REST OF THE WORLD AGRICULTURAL BIOLOGICALS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

30. REST OF THE WORLD AGRICULTURAL BIOLOGICALS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

31. REST OF THE WORLD AGRICULTURAL BIOLOGICALS MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2021-2028 ($ MILLION)

1. GLOBAL AGRICULTURAL BIOLOGICALS MARKET SHARE BY PRODUCT, 2021 VS 2028 (%)

2. GLOBAL AGRICULTURAL BIOPESTICIDES MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL AGRICULTURAL BIOSTIMULANTS MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL AGRICULTURAL BIOFERTILIZERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL AGRICULTURAL BIOLOGICALS MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

6. GLOBAL AGRICULTURAL BIOLOGICALS FOR FOLIAR SPRAY MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL AGRICULTURAL BIOLOGICALS FOR SEED TREATMENT MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL AGRICULTURAL BIOLOGICALS FOR SOIL TREATMENT MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL AGRICULTURAL BIOLOGICALS FOR POST HARVEST MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL AGRICULTURAL BIOLOGICALS MARKET SHARE BY CROP TYPE, 2021 VS 2028 (%)

11. GLOBAL AGRICULTURAL BIOLOGICALS FOR CEREALS & GRAINS MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL AGRICULTURAL BIOLOGICALS FOR OILSEEDS & PULSES MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL AGRICULTURAL BIOLOGICALS FOR FRUITS & VEGETABLES MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. GLOBAL AGRICULTURAL BIOLOGICALS FOR OTHER CROP TYPES MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. GLOBAL AGRICULTURAL BIOLOGICALS MARKET SHARE BY REGION, 2021 VS 2028 (%)

16. US AGRICULTURAL BIOLOGICALS MARKET SIZE, 2021-2028 ($ MILLION)

17. CANADA AGRICULTURAL BIOLOGICALS MARKET SIZE, 2021-2028 ($ MILLION)

18. UK AGRICULTURAL BIOLOGICALS MARKET SIZE, 2021-2028 ($ MILLION)

19. FRANCE AGRICULTURAL BIOLOGICALS MARKET SIZE, 2021-2028 ($ MILLION)

20. GERMANY AGRICULTURAL BIOLOGICALS MARKET SIZE, 2021-2028 ($ MILLION)

21. ITALY AGRICULTURAL BIOLOGICALS MARKET SIZE, 2021-2028 ($ MILLION)

22. SPAIN AGRICULTURAL BIOLOGICALS MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF EUROPE AGRICULTURAL BIOLOGICALS MARKET SIZE, 2021-2028 ($ MILLION)

24. INDIA AGRICULTURAL BIOLOGICALS MARKET SIZE, 2021-2028 ($ MILLION)

25. CHINA AGRICULTURAL BIOLOGICALS MARKET SIZE, 2021-2028 ($ MILLION)

26. JAPAN AGRICULTURAL BIOLOGICALS MARKET SIZE, 2021-2028 ($ MILLION)

27. SOUTH KOREA AGRICULTURAL BIOLOGICALS MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF ASIA-PACIFIC AGRICULTURAL BIOLOGICALS MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF THE WORLD AGRICULTURAL BIOLOGICALS MARKET SIZE, 2021-2028 ($ MILLION)