Agricultural Disinfectants Market

Global Agricultural Disinfectants Market Size, Share & Trends Analysis Report, By Application (Surface, Water Sanitizing, and Aerial), By Type (Quaternary Ammonium Compounds & Phenols, Hypochlorites & Hallogens, Oxidizing Agents & Aldehydes, and Others), By End-User (Livestock Farms and Agricultural Farms), By Form (Liquid, Powder, and Others) and Forecast, 2020-2026 Update Available - Forecast 2025-2031

The global agricultural disinfectants market is estimated to grow at a CAGR of nearly 4.0% during the forecast period. Increasing livestock farming and rising awareness regarding animal health has led to the demand for agricultural disinfectants. As per the Eurostat, in EU-28, there were 5.7 million agricultural holdings (farms) with livestock in 2016 than the total 10.5 million farms. This represents that nearly 54.8% of EU farms were keeping livestock. Increasing animal production coupled with the rising demand for meat is the major factor for significant focus on livestock farming across regions. The EU countries have a substantial livestock population, which accounted for 98 million sheep and goats, 148 million pigs, and 87 million bovine animals in 2018.

In 2018, 7.9 million tons of bovine meat (beef and veal) was produced by the EU in 2018, moderate growth of 1.7% over 2017. With the growing livestock population, the increasing prevalence of livestock diseases has been witnessed across the countries. Lack of hygiene is one of the factors for the rising livestock diseases. As a result, the livestock producers are focusing on animal health by vaccination and hygiene measures which support to mitigate the effects of livestock diseases. Preventative biosecurity has been gaining significance in livestock agriculture as a result of the recent disease outbreaks. The use of farm biosecurity facilitates eliminating pathogenic organisms from the farm settings and serves to protect livestock and the human food supply.

Good farm hygiene practices along with cleaners and disinfectants enable to control the transmission of pathogens which acts a cost-effective and potential preventative tool for management and prevention of infectious diseases in farm animals. Under the Biosecurity Program, the use of disinfectants is crucial to eradicate disease-causing pathogens in livestock farms and prevent re-infection on animals. In livestock farms, disinfectants are used in drinking water, on surface, and yards which allows to prevent the attack of harmful diseases. Regular manure removal and frequent cleanliness lead to a better health outcome of the livestock population. This, in turn, is leading to the increasing demand for disinfectants in livestock farming.

Market Segmentation

The global agricultural disinfectants market is segmented into application, type, end-user, and form. Based on application, the market is classified into the surface, water sanitizing, and aerial. Based on type, the market is classified into quaternary ammonium compounds & phenols, hypochlorites & hallogens, oxidizing agents & aldehydes, and others. Based on end-user, the market is classified into livestock farms and agricultural farms. Based on form, the market is classified into liquid, powder, and others.

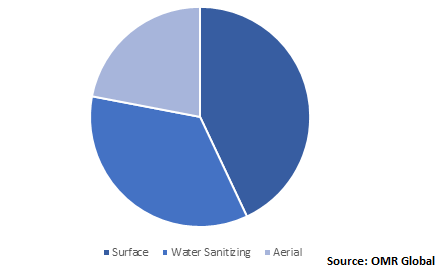

Surface disinfectants held the largest share in the application segment

In 2019, surface disinfectants accounted for the largest share in the application segment owing to its considerable application in livestock farms and agricultural farms. Fresh from the field, fruits and vegetables have a significant risk of contamination with all kinds of microbes including mould, bacteria, fungi spores, and yeasts. If the microbial contamination is successfully decreased earlier storage commences, the losses resulted due to rot and mould can be cut substantially while increases storage periods enormously. Regular cleaning and disinfecting the surfaces of storage rooms, containers, machines and so on through an agricultural disinfectant enables to protect contamination of freshly harvested agricultural products. This widens the storage life and storage periods. Additionally, in livestock farming, there is an increased need for surface cleaning to remove manure from the field and afterwards surface disinfectants are used to kill harmful pathogens in the area.

Global Agricultural Disinfectants Market Share by Application, 2019 (%)

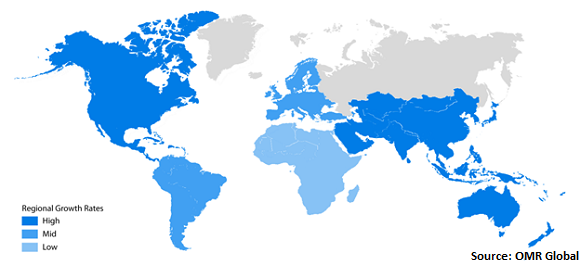

Regional Outlook

Geographically, the global agricultural disinfectants market is segmented into four major regions, including North America, Europe, Asia-Pacific, and Rest of the World. Asia-Pacific is anticipated to hold a considerable share in the market owing to the increasing livestock population and significant focus on animal disease management. As per the National Dairy Development Board, in India, the total livestock population increased from 512.1 million in 2012 to 535.8 million in 2019. Increasing dairy farming is the major factor in the increasing focus on livestock farming in the country. As per the National Institute of Veterinary Epidemiology and Disease Informatics (NIVEDI), during 2016-2017, among screened livestock species in India, high prevalence of diseases in livestock animals was reported in pig (40.19%), followed by sheep (20.82%), cattle (2.73%) goat (2.18%) and buffalo (1.11%). This results in the emerging focus of the country’s livestock farmers towards regular cleaning and disinfecting of livestock sites that supports to prevent such kinds of infections in animals.

Global Agricultural Disinfectants Market Growth, by Region 2020-2026

Market Players Outlook

The major players in the market include LANXESS AG, Nufarm Ltd., Neogen Corp., Stepan Co., and Laboratoire M2. The strategies adopted by the market players include mergers and acquisitions, product launches, and partnerships and collaborations to expand market share and gain a competitive advantage. Due to the rising incidences of livestock diseases, the companies are focusing on launching new disinfectants for protection against harmful viruses. For instance, in May 2020, LANXESS submitted their premium livestock animal disinfectants, Virkon LSP and Virkon S, for independent evaluation against the virus.

In the Centre for Animal Health Research (CISA) Spain, the testing for the efficacy of both the disinfectants was conducted, according to the EN 14675 test method, which was modified to support testing against the African Swine Fever (ASF) virus. The test results of both the products shown complete inactivation of ASF and killing the pathogen in just 10 minutes. As African Swine Fever (ASF) has been continuously spreading across Southeast Asia, China, and Europe and there is no medical treatment or vaccine available for the treatment of ASF, these disinfectants can help to control the spread of the infection in animals. This, in turn, will support to accelerate the LANXESS market share.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global agricultural disinfectants market. Based on the availability of data, pipeline analysis and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. LANXESS AG

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Nufarm Ltd.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Neogen Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Stepan Co.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Laboratoire M2

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Agricultural Disinfectants Market by Application

5.1.1. Surface

5.1.2. Water Sanitizing

5.1.3. Aerial

5.2. Global Agricultural Disinfectants Market by Type

5.2.1. Quaternary Ammonium Compounds & Phenols

5.2.2. Hypochlorites & Halogens

5.2.3. Oxidizing Agents & Aldehydes

5.2.4. Others

5.3. Global Agricultural Disinfectants Market by End-User

5.3.1. Livestock Farms

5.3.2. Agricultural Farms

5.4. Global Agricultural Disinfectants Market by Form

5.4.1. Liquid

5.4.2. Powder

5.4.3. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Ceva Santé Animale

7.2. Corteva Agriscience

7.3. Ecolab Inc.

7.4. Entaco NV

7.5. Fink Tec GmbH

7.6. Guybro Animal Health Pvt Ltd.

7.7. Kersia Group

7.8. Laboratoire M2

7.9. Laboratoires CEETAL

7.10. LANXESS AG

7.11. Medentech Ltd.

7.12. Neogen Corp.

7.13. Nufarm Ltd.

7.14. Sanosil AG

7.15. Shandong Daming Disinfection Technology Co., Ltd

7.16. Stepan Co.

7.17. Virox Technologies Inc.

7.18. Wynnstay Group plc

7.19. Zoetis Inc.

1. GLOBAL AGRICULTURAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

2. GLOBAL SURFACE DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL WATER SANITIZING DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL AERIAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL AGRICULTURAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

6. GLOBAL QUATERNARY AMMONIUM COMPOUNDS & PHENOLS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL HYPOCHLORITES & HALLOGENS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL OXIDIZING AGENTS & ALDEHYDES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL OTHER AGRICULTURAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL AGRICULTURAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

11. GLOBAL AGRICULTURAL DISINFECTANTS IN LIVESTOCK FARMS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL AGRICULTURAL DISINFECTANTS IN AGRICULTURAL FARMS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL AGRICULTURAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

14. GLOBAL AGRICULTURAL DISINFECTANTS IN LIQUID FORM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

15. GLOBAL AGRICULTURAL DISINFECTANTS IN POWDER FORM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

16. GLOBAL AGRICULTURAL DISINFECTANTS IN OTHER FORMS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

17. GLOBAL AGRICULTURAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

18. NORTH AMERICAN AGRICULTURAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

19. NORTH AMERICAN AGRICULTURAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

20. NORTH AMERICAN AGRICULTURAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

21. NORTH AMERICAN AGRICULTURAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

22. NORTH AMERICAN AGRICULTURAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

23. EUROPEAN AGRICULTURAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

24. EUROPEAN AGRICULTURAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

25. EUROPEAN AGRICULTURAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

26. EUROPEAN AGRICULTURAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

27. EUROPEAN AGRICULTURAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

28. ASIA-PACIFIC AGRICULTURAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

29. ASIA-PACIFIC AGRICULTURAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

30. ASIA-PACIFIC AGRICULTURAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

31. ASIA-PACIFIC AGRICULTURAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

32. ASIA-PACIFIC AGRICULTURAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

33. REST OF THE WORLD AGRICULTURAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

34. REST OF THE WORLD AGRICULTURAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

35. REST OF THE WORLD AGRICULTURAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

36. REST OF THE WORLD AGRICULTURAL DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

1. GLOBAL AGRICULTURAL DISINFECTANTS MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

2. GLOBAL AGRICULTURAL DISINFECTANTS MARKET SHARE BY TYPE, 2019 VS 2026 (%)

3. GLOBAL AGRICULTURAL DISINFECTANTS MARKET SHARE BY END-USER, 2019 VS 2026 (%)

4. GLOBAL AGRICULTURAL DISINFECTANTS MARKET SHARE BY FORM, 2019 VS 2026 (%)

5. GLOBAL AGRICULTURAL DISINFECTANTS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

6. US AGRICULTURAL DISINFECTANTS MARKET SIZE, 2019-2026 ($ MILLION)

7. CANADA AGRICULTURAL DISINFECTANTS MARKET SIZE, 2019-2026 ($ MILLION)

8. UK AGRICULTURAL DISINFECTANTS MARKET SIZE, 2019-2026 ($ MILLION)

9. FRANCE AGRICULTURAL DISINFECTANTS MARKET SIZE, 2019-2026 ($ MILLION)

10. GERMANY AGRICULTURAL DISINFECTANTS MARKET SIZE, 2019-2026 ($ MILLION)

11. ITALY AGRICULTURAL DISINFECTANTS MARKET SIZE, 2019-2026 ($ MILLION)

12. SPAIN AGRICULTURAL DISINFECTANTS MARKET SIZE, 2019-2026 ($ MILLION)

13. ROE AGRICULTURAL DISINFECTANTS MARKET SIZE, 2019-2026 ($ MILLION)

14. INDIA AGRICULTURAL DISINFECTANTS MARKET SIZE, 2019-2026 ($ MILLION)

15. CHINA AGRICULTURAL DISINFECTANTS MARKET SIZE, 2019-2026 ($ MILLION)

16. JAPAN AGRICULTURAL DISINFECTANTS MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF ASIA-PACIFIC AGRICULTURAL DISINFECTANTS MARKET SIZE, 2019-2026 ($ MILLION)

18. REST OF THE WORLD AGRICULTURAL DISINFECTANTS MARKET SIZE, 2019-2026 ($ MILLION)