Agricultural Enzymes Market

Agricultural Enzymes Market Size, Share & Trends Analysis Report Market by Enzyme Type (Proteases, Amylases, Lipases, Cellulases, Dehydrogenases, and Others), Crop Type (Cereals and grains, Oilseeds and Pulses, Fruits and vegetables, Turf and ornamentals, and Others) Forecast Period (2025-2035)

Industry Outlook

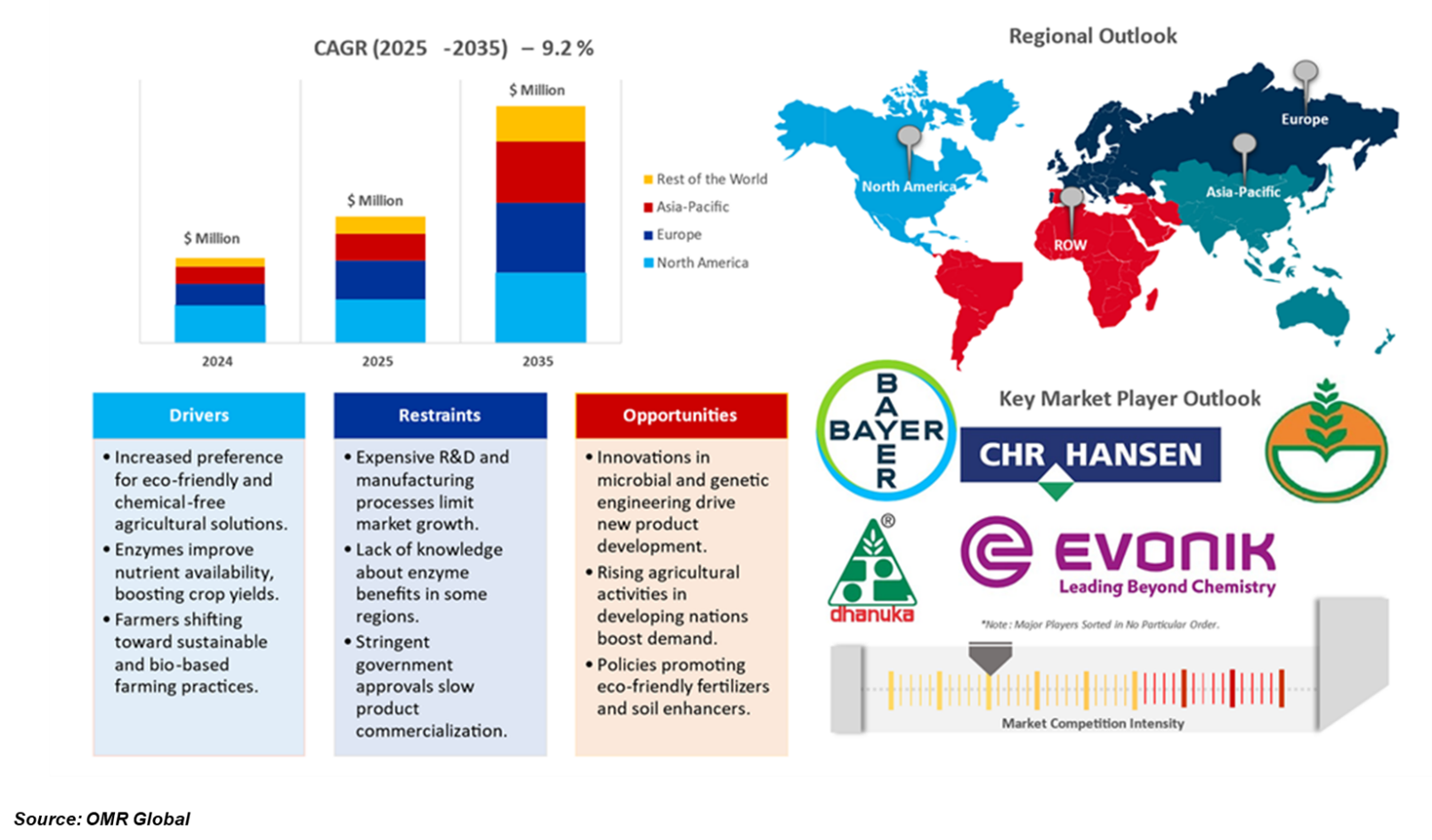

Agricultural enzyme market is anticipated to grow at a CAGR of 9.2% during the forecast period (2025-2035). The growing consumer preference for organic food products and the rising awareness regarding sustainable agricultural practices are driving the demand for agricultural enzymes. These enzymes are used to enhance crop productivity by improving soil fertility, nutrient uptake, and pest resistance without the harmful effects associated with chemical fertilizers and pesticides. Additionally, government initiatives promoting eco-friendly farming techniques further boost market growth. According to the Government of India Ministry of Agriculture & Farmers Welfare, in September 2024, The Union Cabinet approved Digital Agriculture with an outlay of ?2,817 Crore ($338.0 million), including the central share of ?1940 Crore ($232.8 million). The Mission is conceived as an umbrella scheme to support digital agriculture initiatives, such as creating Digital Public Infrastructure, implementing the Digital General Crop Estimation Survey (DGCES), and taking up other IT initiatives by the Central Government, State Governments, and Academic and Research Institutions. Clean Plant Programme (CPP) with an outlay of ?1,765.67 crore ($211.8 million).

Segmental Outlook

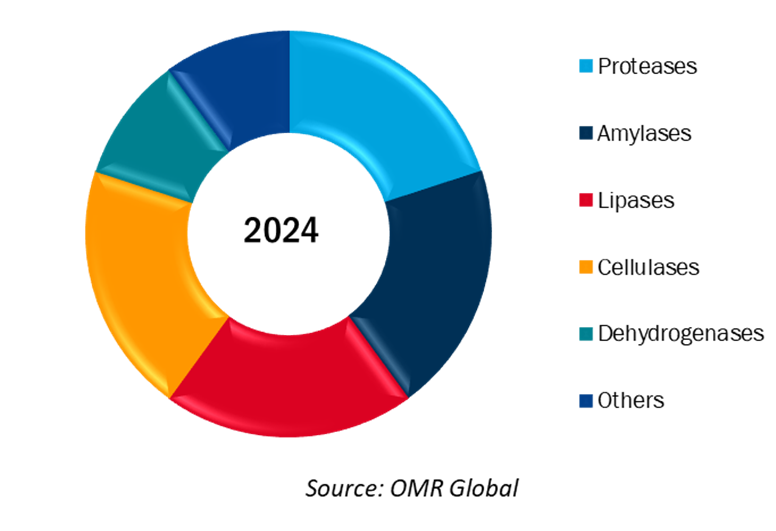

The global agricultural enzymes market is segmented based on enzyme type, and crop type. Based on enzyme type, the market is sub-segmented into proteases, amylases, lipases, cellulases, dehydrogenases, and others (phosphatases, ureases). Based on crop type, the market is sub-segmented into cereals and grains, oilseeds and pulses, fruits and vegetables, turf and ornamentals, and others (legumes, forage crops). The government is making available 28 grades of P&K fertilizers to farmers at subsidized prices through fertilizer manufacturers/importers. By its farmer-friendly approach, the Government is committed to ensuring the availability of P&K fertilizers to the farmers at affordable prices.

The Cereals and Grains Segment Holds A Major Market Share

The crop type segment showed a major hold of the market globally. In the crop type segment, the cereals and grains segment holds the largest market share in the global agricultural enzymes market. Cereals and grains are essential for day-to-day life, and it is rapidly covering the market. Cereals, including those used for breakfast, are primarily made from grains like corn, wheat, rice, and oats. And expected to grow rapidly owing to high global consumption and the use of enzymes to enhance digestibility and nutrient utilization.

Global Agricultural Enzymes Market Share By Enzyme Type, 2024 (%)

Regional Outlook

The global agricultural enzyme market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, ASEAN economies, Australia and New Zealand and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

European Union Strategy on Fertilizer Practices

The European Green Deal’s Farm to Fork strategy is fostering a transition toward sustainable fertilizer practices, significantly influencing market trends. In alignment with this initiative, the government has emphasized that balanced plant nutrition is a fundamental component of sustainable crops and soil management. The importance of balanced nutrition is clear with phosphorus, to its importance for root development. Crop phosphorus nutrition depends on the ability of the soil to replenish the soil solution with phosphorus as the crop takes it up. It also depends on the ability of the plant to produce a healthy and extensive root system that has access to the maximum amount of soil phosphorus. Young seedlings can suffer from phosphorus deficiency even in soil with high available phosphorus levels as they have very limited root systems that are growing very slowly in cold, wet, early-season conditions or high pH soils. Some crops need additional phosphorus application from mineral sources during planting in starter fertilizers, even in relatively high phosphorus soils. The growing emphasis on reducing chemical fertilizer use under the Farm to Fork strategy is encouraging farmers to adopt enzyme-based solutions.

Market Players Outlook

The major companies serving the global agricultural enzymes market include Bayer AG, Chr. Hansen, Deepak Fertilisers and Petrochemicals Corporation Ltd. (DFPCL), Dhanuka Agritech Limited, Elemental Enzymes, Enzyme Development Corp, Evonik Industries AG. These companies provide the required. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market.

Recent Development

- In February 2021, Novozymes, in biological solutions, entered the biocontrol segment of agriculture with promising enzyme-based technology, expanding beyond its current base of microbial products and innovation. The new technology has broad potential to control major pests that impact the agricultural industry and are responsible for billions of dollars of damage each year.

The Report Covers

- Market value data analysis of 2025 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global agricultural enzymes market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Agricultural Enzymes Market Sales Analysis - Crop Type |Enzyme Type ($ Million)

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Global Agricultural Enzymes Industry Trends

2.2.2. Market Recommendations

2.2.3. Conclusion

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Agricultural Enzymes Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Agricultural Enzymes Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard –Global Agricultural Enzymes Market Revenue by Manufacturers

4.2. Key Company Analysis

4.2.1. Overview

4.2.2. Product Portfolio

4.2.3. Financial Analysis (Subject to Data Availability)

4.2.4. SWOT Analysis

4.2.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Agricultural Enzymes Market by Crop Type ($ Million)

5.1. Cereals and grains

5.2. Oilseeds and pulses

5.3. Fruits and vegetables

5.4. Turf and ornamentals

5.5. Others

5.6. Global Agricultural Enzymes Market by Enzyme Type ($ Million)

5.6.1. Proteases

5.6.2. Amylases

5.6.3. Lipases

5.6.4. Cellulases

5.6.5. Dehydrogenases

5.6.6. Others (Phosphatases, Ureases)

6. Regional Analysis

6.1. North American Agricultural Enzyme Market Sales Analysis – Crop Type | Enzyme Type | Country ($ Million)

6.1.1. United States

6.1.2. Canada

6.2. European Agricultural Enzymes Market Sales Analysis – Crop Type | Enzyme Type | Country ($ Million)

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Russia

6.2.7. Rest of Europe

6.3. Asia-Pacific Agricultural Enzymes Sales Analysis – Crop Type | Enzyme Type | Country ($ Million)

6.3.1. China

6.3.2. Japan

6.3.3. South Korea

6.3.4. India

6.3.5. Australia & New Zealand

6.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

6.3.7. Rest of Asia-Pacific

6.4. Rest of the World Agricultural Enzymes Sales Analysis – Crop Type | Enzyme Type | Country ($ Million)

6.4.1. Latin America

6.4.2. Middle East and Africa

7. Company Profiles

7.1 AB Enzymes GmbH

7.2 American Biosystems, Inc.

7.3 Alfanzyme Group

7.4 Ashland Inc.

7.5 Bayer AG

7.6 Cargill, Inc.

7.7 Chr. Hansen A/S (Novonesis)

7.8 Corteva Agriscience

7.9 Creative Enzymes

7.10 Elemental Enzymes

7.11 Enzyme Development Corp.

7.12 Evonik Industries AG

7.13 Kerry Group plc

7.14 Meihua Biotechnology Group Co., Ltd

7.15 Nagase & Co., Ltd

7.16 Novozymes A/S

7.17 Rizobacter BioSolucoes

7.18 Syngenta Crop Protection AG

7.19 Syngenta AG.

7.20 Yara International

1. Global Agricultural Enzymes Market Research And Analysis By Enzyme Type, 2024-2035 ($ Million)

2. Global Agricultural Proteases Enzymes Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Agricultural Amylases Enzymes Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Agricultural Lipases Enzymes Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Agricultural Cellulase Enzymes Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Agricultural Dehydrogenases Enzymes Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Other Agricultural Enzymes Type Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Agricultural Enzymes Market Research And Analysis By Crop Type, 2024-2035 ($ Million)

9. Global Agricultural Enzymes For Cereals And Grains Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Agricultural Enzymes For Oilseeds And Pulses Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Agricultural Enzymes For Fruits And Vegetables Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Agricultural Enzymes For Turf And Ornamentals Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Agricultural Enzymes For Other Crop Type Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Agricultural Enzymes Market Research And Analysis By Region, 2024-2035 ($ Million)

15. North American Agricultural Enzymes Market Research And Analysis By Country, 2024-2035 ($ Million)

16. North American Agricultural Enzymes Market Research And Analysis By Enzyme Type, 2024-2035 ($ Million)

17. North American Agricultural Enzymes Market Research And Analysis By Crop Type, 2024-2035 ($ Million)

18. European Agricultural Enzymes Market Research And Analysis By Country, 2024-2035 ($ Million)

19. European Agricultural Enzymes Market Research And Analysis By Enzyme Type, 2024-2035 ($ Million)

20. European Agricultural Enzymes Market Research And Analysis By Crop Type, 2024-2035 ($ Million)

21. Asia-Pacific Agricultural Enzymes Market Research And Analysis By Country, 2024-2035 ($ Million)

22. Asia-Pacific Agricultural Enzymes Market Research And Analysis By Enzyme Type, 2024-2035 ($ Million)

23. Asia-Pacific Agricultural Enzymes Market Research And Analysis By Crop Type, 2024-2035 ($ Million)

24. Rest Of The World Agricultural Enzymes Market Research And Analysis By Region, 2024-2035 ($ Million)

25. Rest Of The World Agricultural Enzymes Market Research And Analysis By Enzyme Type, 2024-2035 ($ Million)

26. Rest Of The World Agricultural Enzymes Market Research And Analysis By Crop Type, 2024-2035 ($ Million)

1. Global Agricultural Enzymes Market Share By Enzyme Type, 2024 Vs 2035 (%)

2. Global Agricultural Proteases Enzymes Market Share By Region, 2024 Vs 2035 (%)

3. Global Agricultural Amylases Enzymes Market Share By Region, 2024 Vs 2035 (%)

4. Global Agricultural Lipases Enzymes Market Share By Region, 2024 Vs 2035 (%)

5. Global Agricultural Cellulases Enzymes Market Share By Region, 2024 Vs 2035 (%)

6. Global Agricultural Dehydrogenases Enzymes Market Share By Region, 2024 Vs 2035 (%)

7. Global Other Agricultural Enzymes Market Share By Region, 2024 Vs 2035 (%)

8. Global Agricultural Enzymes Market Share By Crop Type, 2024 Vs 2035 (%)

9. Global Agricultural Enzymes For Cereals And Grains Market Share By Region, 2024 Vs 2035 (%)

10. Global Agricultural Enzymes For Oilseeds And Pulses Market Share By Region, 2024 Vs 2035 (%)

11. Global Agricultural Enzymes For Fruits And Vegetables Market Share By Region, 2024 Vs 2035 (%)

12. Global Agricultural Enzymes For Turf And Ornamentals Market Share By Region, 2024 Vs 2035 (%)

13. Global Agricultural Enzymes For Other Crop Type Market Share By Region, 2024 Vs 2035 (%)

14. Global Agricultural Enzymes Market Share By Region, 2024 Vs 2035 (%)

15. US Agricultural Enzymes Market Size, 2024-2035 ($ Million)

16. Canada Agricultural Enzymes Market Size, 2024-2035 ($ Million)

17. UK Agricultural Enzymes Market Size, 2024-2035 ($ Million)

18. France Agricultural Enzymes Market Size, 2024-2035 ($ Million)

19. Germany Agricultural Enzymes Market Size, 2024-2035 ($ Million)

20. Italy Agricultural Enzymes Market Size, 2024-2035 ($ Million)

21. Spain Agricultural Enzymes Market Size, 2024-2035 ($ Million)

22. Russia Agricultural Enzymes Market Size, 2024-2035 ($ Million)

23. Rest Of Europe Agricultural Enzymes Market Size, 2024-2035 ($ Million)

24. India Agricultural Enzymes Market Size, 2024-2035 ($ Million)

25. China Agricultural Enzymes Market Size, 2024-2035 ($ Million)

26. Japan Agricultural Enzymes Market Size, 2024-2035 ($ Million)

27. South Korea Agricultural Enzymes Market Size, 2024-2035 ($ Million)

28. Australia & New Zealand Agricultural Enzymes Market Size, 2024-2035 ($ Million)

29. ASEAN Agricultural Enzymes Market Size, 2024-2035 ($ Million)

30. Rest Of Asia-Pacific Agricultural Enzymes Market Size, 2024-2035 ($ Million)

31. Rest Of The World Agricultural Enzymes Market Size, 2024-2035 ($ Million)

FAQS

The size of the Agricultural Enzymes market in 2024 is estimated to be around USD 335.67 million.

North America holds the largest share in the Agricultural Enzymes market.

Leading players in the Agricultural Enzymes market include Bayer AG, Chr. Hansen, Deepak Fertilisers and Petrochemicals Corporation Ltd. (DFPCL), Dhanuka Agritech Limited, Elemental Enzymes, Enzyme Development Corp, Evonik Industries AG.

Agricultural Enzymes market is expected to grow at a CAGR of 9.2% from 2025 to 2035.

The Agricultural Enzymes Market is growing due to increasing demand for sustainable farming practices, rising adoption of organic farming, and the need to enhance crop yields on limited arable land.