Agricultural Micronutrients Market

Global Agricultural Micronutrients Market Size, Share & Trends Analysis Report By Micronutrients (Zinc, Boron, Iron, Manganese, and Others), By Crop Type (Pulses and Oilseeds, Fruits and Vegetables, Cereals, and Others), By Application (Seed Treatment, Soil, Fertigation, Foliar, and Others), Forecast 2019-2025 Update Available - Forecast 2025-2031

The global agricultural micronutrients market is growing at a significant CAGR of more than 8.4% during the forecast period (2019-2025). Crop improvement is being considered as a flourishing area in the agriculture industry due to the shift towards a scientific approach in the agriculture technologies, rising concerns of poor crop yield and irregular reaping process of flowers and vegetables. Agricultural micronutrients play a role in improving the crop yield and enhancing the nutrients content of the crops. The substantial growth in funding the US and other countries is propelling the market of the global agricultural micronutrients market during the forecast period. Additionally, the market is being supported by products and research projects developed by companies operating in the agriculture industry. Companies such as BASF SE are procuring license agreements to develop micronutrients for agriculture products.

In addition, some other pivotal factors that drive the agricultural micronutrients market growth include increasing deficiency of micronutrients in the crops, supportive government policies, and rising focus for escalating crop production and quality. With the development of biodegradable chelates, the market for agricultural micronutrients is further expected to grow in the near future. However, the lack of awareness regarding the advantages of micronutrients for crops and booming organic fertilizer industry are some factors that are restarting the growth of the market across the globe.

Segmental Outlook

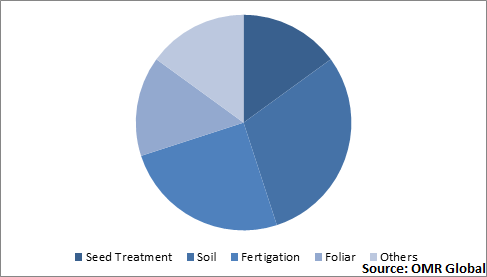

The agricultural micronutrients market is classified on the basis of micronutrients, crop type, and application. Based on micronutrients, the market is segmented into zinc, boron, iron, manganese, and others. Based on the crop type, the market is segmented into pulses and oilseeds, fruits and vegetables, cereals, and others. Based on the application, the market is segmented into seed treatment, soil, fertigation, foliar, and others. Among these applications, the agricultural micronutrients find their significant application in soil. The process of enhancing the nutrient content of the crops involves the application of agricultural micronutrients in the soil. The increasing demand for highly nutrient crops is offering growth to the agricultural micronutrients market for soil application.

Global Agricultural Micronutrients Market Share by Application, 2018 (%)

Regional Outlook

The global agricultural micronutrients market is classified on the basis of geography, which includes North America, Europe, Asia-Pacific, and Rest of the World. North America and Europe are estimated to project a considerable CAGR during the forecast period. Major economies that will contribute to the North American agricultural micronutrient market are the US and Canada, whereas, the major economies in the European agricultural micronutrients market include UK, Germany, France, Spain, and Italy. The favorable government support in the US related to the use of technology in agriculture is again supporting the market growth. In addition, in Europe, the researchers are making efforts to create more productive yields which help farmers and food companies to attract more investment.

Asia-Pacific is estimated to hold a significant share in the global market

Asia-Pacific contributes a significant share in the global agricultural micronutrients market. This is backed by the rise in the adoption of agricultural technologies in China, India, and Japan, growing concerns over the low yield of crop harvests, substantial opportunities in farming. China and India are the most populated country globally and concern over food security will drive the market in these economies. India has few major industries, with which the country drives its greater part of the economy, which includes textile, agriculture, and manufacturing. According to the India Brand Equity Foundation (IBEF), an estimated 283.37 million tons of food grain production recorded during 2018-2019. In addition, the total exports of agricultural products from India grew at a CAGR of 16.45% during 2010-2018. The country fulfills the food demand for various countries, including Russia, the US, and China. Such large production has led to the significant use of agricultural micronutrients in order to treat plant deficiencies.

Market Players Outlook

The key players in the agricultural micronutrients market are contributing significantly by providing advanced technology-based products and expanding their geographical presence across the globe. The key players operating in the global agricultural micronutrients market include BASF SE, Akzo Nobel N.V., The Mosaic Co., Coromandel International Ltd., Compass Minerals International, Inc., and Balchem Corp. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. For instance, in December 2019, Compass Minerals International, Inc. launched Rocket Seeds Moly Shine seed finisher. The solution is suited for legumes and soybeans, which has added micronutrients. This will offer significant benefits to the growers, which in turn, will enhance the company’s portfolio in the global agricultural micronutrients market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global agricultural micronutrients market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. BASF SE

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Akzo Nobel N.V.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. The Mosaic Co.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Coromandel International Ltd.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Balchem Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Agricultural Micronutrients Market by Micronutrients

5.1.1. Zinc

5.1.2. Boron

5.1.3. Iron

5.1.4. Manganese

5.1.5. Others (Copper and Molybdenum)

5.2. Global Agricultural Micronutrients Market by Crop Type

5.2.1. Pulses and Oilseeds

5.2.2. Fruits and Vegetables

5.2.3. Cereals

5.2.4. Others (Floriculture)

5.3. Global Agricultural Micronutrients Market by Application

5.3.1. Seed Treatment

5.3.2. Soil

5.3.3. Fertigation

5.3.4. Foliar

5.3.5. Others (Hydroponics)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AgroLiquid

7.2. AgXplore International, LLC

7.3. Akzo Nobel N.V.

7.4. Aries Agro Ltd.

7.5. ATP Nutrition Ltd.

7.6. Balchem Corp.

7.7. BASF SE

7.8. BMS Micro-Nutrients NV

7.9. Compass Minerals International, Inc.

7.10. COMPO EXPERT GmbH

7.11. Coromandel International Ltd.

7.12. Haifa Group

7.13. Helena Agri-Enterprises, LLC

7.14. Israel Chemicals Ltd.

7.15. Nufarm Ltd.

7.16. Plant Food Company, Inc.

7.17. Stoller Group

7.18. The Mosaic Co.

7.19. VALAGRO S.P.A.

7.20. Yara International ASA

7.21. Zuari Agro Chemicals Ltd.

1. GLOBAL AGRICULTURAL MICRONUTRIENTS MARKET RESEARCH AND ANALYSIS BY MICRONUTRIENTS, 2018-2025 ($ MILLION)

2. GLOBAL ZINC AGRICULTURAL MICRONUTRIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL BORON AGRICULTURAL MICRONUTRIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL IRON AGRICULTURAL MICRONUTRIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL MANGANESE AGRICULTURAL MICRONUTRIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL OTHER AGRICULTURAL MICRONUTRIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL AGRICULTURAL MICRONUTRIENTS MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2018-2025 ($ MILLION)

8. GLOBAL AGRICULTURAL MICRONUTRIENTS FOR PULSES AND OILSEEDS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL AGRICULTURAL MICRONUTRIENTS FOR FRUIT AND VEGETABLES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL AGRICULTURAL MICRONUTRIENTS FOR CEREALS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL AGRICULTURAL MICRONUTRIENTS FOR OTHER CROPS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL AGRICULTURAL MICRONUTRIENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

13. GLOBAL AGRICULTURAL MICRONUTRIENTS FOR SEED TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL AGRICULTURAL MICRONUTRIENTS FOR SOIL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

15. GLOBAL AGRICULTURAL MICRONUTRIENTS FOR FERTIGATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

16. GLOBAL AGRICULTURAL MICRONUTRIENTS FOR FOILAR MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

17. GLOBAL AGRICULTURAL MICRONUTRIENTS FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

18. GLOBAL AGRICULTURAL MICRONUTRIENTS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

19. NORTH AMERICAN AGRICULTURAL MICRONUTRIENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

20. NORTH AMERICAN AGRICULTURAL MICRONUTRIENTS MARKET RESEARCH AND ANALYSIS BY MICRONUTRIENTS, 2018-2025 ($ MILLION)

21. NORTH AMERICAN AGRICULTURAL MICRONUTRIENTS MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2018-2025 ($ MILLION)

22. NORTH AMERICAN AGRICULTURAL MICRONUTRIENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

23. EUROPEAN AGRICULTURAL MICRONUTRIENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

24. EUROPEAN AGRICULTURAL MICRONUTRIENTS MARKET RESEARCH AND ANALYSIS BY MICRONUTRIENTS, 2018-2025 ($ MILLION)

25. EUROPEAN AGRICULTURAL MICRONUTRIENTS MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2018-2025 ($ MILLION)

26. EUROPEAN AGRICULTURAL MICRONUTRIENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

27. ASIA-PACIFIC AGRICULTURAL MICRONUTRIENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

28. ASIA-PACIFIC AGRICULTURAL MICRONUTRIENTS MARKET RESEARCH AND ANALYSIS BY MICRONUTRIENTS, 2018-2025 ($ MILLION)

29. ASIA-PACIFIC AGRICULTURAL MICRONUTRIENTS MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2018-2025 ($ MILLION)

30. ASIA-PACIFIC AGRICULTURAL MICRONUTRIENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

31. REST OF THE WORLD AGRICULTURAL MICRONUTRIENTS MARKET RESEARCH AND ANALYSIS BY MICRONUTRIENTS, 2018-2025 ($ MILLION)

32. REST OF THE WORLD AGRICULTURAL MICRONUTRIENTS MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2018-2025 ($ MILLION)

33. REST OF THE WORLD AGRICULTURAL MICRONUTRIENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL AGRICULTURAL MICRONUTRIENTS MARKET SHARE BY MICRONUTRIENTS, 2018 VS 2025 (%)

2. GLOBAL AGRICULTURAL MICRONUTRIENTS MARKET SHARE BY CROP TYPE, 2018 VS 2025 (%)

3. GLOBAL AGRICULTURAL MICRONUTRIENTS MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

4. GLOBAL AGRICULTURAL MICRONUTRIENTS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US AGRICULTURAL MICRONUTRIENTS MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA AGRICULTURAL MICRONUTRIENTS MARKET SIZE, 2018-2025 ($ MILLION)

7. UK AGRICULTURAL MICRONUTRIENTS MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE AGRICULTURAL MICRONUTRIENTS MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY AGRICULTURAL MICRONUTRIENTS MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY AGRICULTURAL MICRONUTRIENTS MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN AGRICULTURAL MICRONUTRIENTS MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE AGRICULTURAL MICRONUTRIENTS MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA AGRICULTURAL MICRONUTRIENTS MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA AGRICULTURAL MICRONUTRIENTS MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN AGRICULTURAL MICRONUTRIENTS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC AGRICULTURAL MICRONUTRIENTS MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD AGRICULTURAL MICRONUTRIENTS MARKET SIZE, 2018-2025 ($ MILLION)