Agriculture Technologies Market

Agriculture Technologies Market Size, Share & Trends Analysis Report by Offering (Hardware, Software, and Services), and by Application (Precision Farming, Precision Aquaculture, Livestock Monitoring, Smart Greenhouse, Precision Forestry, and Others (Connected Farming)), Forecast Period (2025-2035)

Industry Outlook

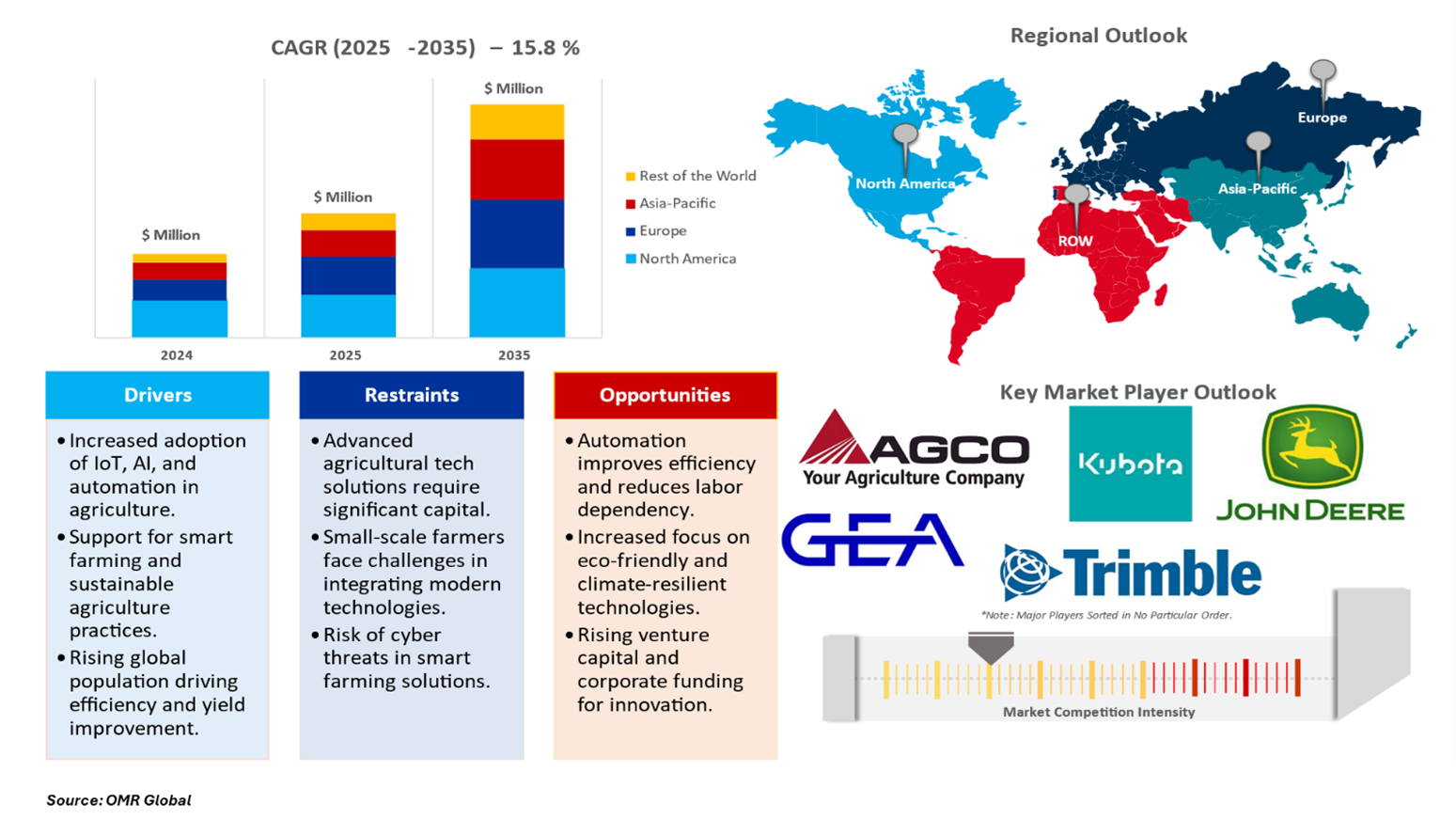

Agriculture technologies market is projected to grow at a CAGR of 15.8% during the forecast period (2025-2035). The market expansion is mainly driven by increasing automation, accurate agricultural techniques, and permanent agriculture practices that aim to increase productivity and efficiency. The demand for advanced agricultural machines such as AI-operated robot harvesters, automated irrigation systems, and accurate sprayers aims to optimize crop yield by reducing resource consumption by farmers. Similarly, integrating climate-resilient seeds, sensor-based soil monitoring, and data-operated farm management solutions are changing the industry. These innovations help to remove key major challenges, including unpredictable climatic conditions, soil degradation, and the need for efficient water use.

Segmental Outlook

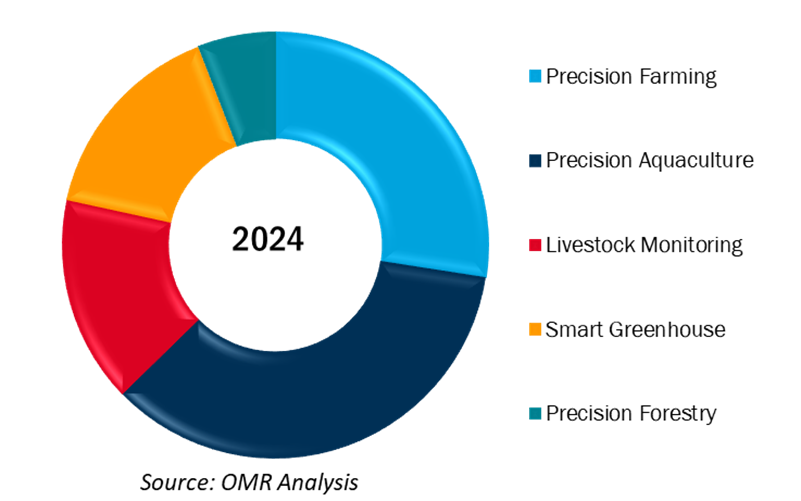

The global agriculture technologies market is segmented by the offering, agriculture type, and application. Based on the offering, the market is sub-segmented into hardware, software, and services. Based on the agriculture type, the market is sub-segmented into precision farming, precision aquaculture, livestock monitoring, smart greenhouse, precision forestry, and others (connected farming. Based on offerings, the software segment is projected to maintain a significant market share owing to the growing demand for advanced crop management solutions. These provided software tools can enable real-time monitoring growth of crops with the soil conditions and climate patterns, facilitating data-driven decision-making for improved agricultural productivity and efficiency.

The Precision Farming Sub-Segment is Anticipated to Drive Market Expansion of the Global Agriculture Technologies Market

The precision agricultural industry estimates that global agricultural technologies play an important part in the growth of the market in the forecast period. Precision farming technologies such as GPS-based tractor guidance systems, soil and yield mapping, and Variable Input Applications (VRT), play an important role in increasing agricultural efficiency by enabling data-operating decisions. These advancements in agriculture technology help farmers monitor the changing area conditions and adapt to resource use that improves overall productivity. Automation in agriculture and the increasing integration of IoT-based solutions have further increased the demand for accurate agricultural technologies. In January 2025, during the Consumer Electronics Show (CES) in Las Vegas, John Dere unveiled several autonomous machines, designed to help farmers resolve challenges such as a lack of labor and increased efficiency. These innovations include advanced computer vision, artificial intelligence, and autonomous tractors equipped with many cameras to navigate complex agricultural environments without human intervention.

Global Agriculture Technologies Market Share By Application, 2024 (%)

Regional Outlook

The global agriculture technologies market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, ASEAN countries, Australia & New Zealand and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America). In the regional outlook, North America is expected to dominate the market for global agriculture technologies due to the widespread adoption of advanced solutions like RFID, biometrics, and GPS for real-time livestock monitoring, where these technologies enable farmers to efficiently track and manage livestock data, enhancing productivity and decision-making.

The Asia-Pacific Region is Expected to Grow at a Significant CAGR in the Global Agriculture Technologies Market

The Asia-Pacific region is expected to see sufficient growth with the highest CAGR among other regional segments for the forecast period. The regional expansion is inspired by the increasing composite productivity and efficiency, increasing accurate agricultural techniques, smart irrigation systems, and AI-operated agricultural solutions. The increasing focus on livestock automation and aquaculture management in emerging economies such as China, India, and Australia is further enhancing the demand for advanced agriculture technologies. Additionally, supportive government policies and increasing investments in agritech innovations are accelerating market growth.

Market Players Outlook

The major companies serving the agriculture technologies market include AGCO Corp., Kubota, Corp., John Deere, GEA Group AG, Trimble Inc., Yara International ASA, and others. These market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market.

Recent Development

- In September 2024, AGCO Corp. acquired an 85% stake in Trimble Inc.'s portfolio of agricultural assets and technologies for around $2 billion, aiming to expand its precision agriculture business.

- In August 2024, Rotor Technologies introduced the Sprayhawk, an automated crop-dusting unmanned aerial vehicle (UAV). This autonomous helicopter is based on the Robinson R44 model and is designed to enhance safety and efficiency in agricultural applications, such as crop spraying. Rotor Technologies plans to deliver the first batch of production Sprayhawks to early-access partners throughout spring 2025.

The Report Covers

- Market value data analysis of 2025 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global agriculture technologies market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1 Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Agriculture Technologies Market Sales Analysis –Offering| Application ($ Million)

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. AGCO Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Syngenta AG

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Trimble Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Agriculture Technologies Market by Offering ($ Million)

4.1.1. Hardware

4.1.2. Software

4.1.3. Services

4.2. Global Agriculture Technologies Market by Application ($ Million)

4.2.1. Precision Farming

4.2.2. Precision Aquaculture

4.2.3. Livestock Monitoring

4.2.4. Smart Greenhouse

4.2.5. Precision Forestry

4.2.6. Others (Connected Farming)

5. Regional Analysis

5.1. North America Agriculture Technologies Market Sales Analysis - Offering| Application ($ Million)

5.1.1. United States

5.1.2. Canada

5.2. Europe Agriculture Technologies Market Sales Analysis – Offering | Application ($ Million)

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific Agriculture Technologies Market Sales Analysis - Offering | Application ($ Million)

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Australia & New Zealand

5.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

5.3.7. Rest of Asia-Pacific

5.4. Rest of the World Agriculture Technologies Market Sales Analysis - Offering | Application ($ Million)

5.4.1. Latin America

5.4.2. Middle East and Africa

6 Company Profiles

6.1 AGCO Corp.

6.2 AG Leader Technology

6.3 Kubota Corp.

6.4 Argus Control Systems Ltd.

6.5 Autonomous Solutions, Inc. (ASI Robots)

6.6 CLAAS KGaA mbH

6.7 CNH Industrial N.V.

6.8 Corteva Agriscience

6.9 Dickey-John Corp.

6.10 DroneDeploy, Inc.

6.11 Farmers Edge Inc.

6.12 Gamaya Ltd.

6.13 GEA Group AG

6.14 John Deere Deere & Company

6.15 Precision Planting, Inc.

6.16 Raven Industries

6.17 Syngenta AG

6.18 Topcon Positioning Systems, Inc.

6.19 Trimble Inc.

6.20 YARA International ASA

1. Global Agriculture Technologies Market Research And Analysis By Offering, 2024-2035 ($ Million)

2. Global Agriculture Technologies Hardware Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Agriculture Technologies Software Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Agriculture Technologies Services Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Agriculture Technologies Market Research And Analysis By Application, 2024-2035 ($ Million)

6. Global Agriculture Technologies For Precision Farming Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Agriculture Technologies For Livestock Monitoring Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Agriculture Technologies For Other Types Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Agriculture Technologies Market Research And Analysis By Application, 2024-2035 ($ Million)

10. Global Agriculture Technologies For Fish Farming Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Agriculture Technologies For Smart Green House Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Agriculture Technologies For Precision Farming Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Agriculture Technologies For Livestock Monitoring Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Agriculture Technologies For Others Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Agriculture Technologies Market Research And Analysis By Region, 2024-2035 ($ Million)

16. North American Agriculture Technologies Market Research And Analysis By Country, 2024-2035 ($ Million)

17. North American Agriculture Technologies Market Research And Analysis By Offering, 2024-2035 ($ Million)

18. North American Agriculture Technologies Market Research And Analysis By Application, 2024-2035 ($ Million)

19. North American Agriculture Technologies Market Research And Analysis By Application, 2024-2035 ($ Million)

20. European Agriculture Technologies Market Research And Analysis By Country, 2024-2035 ($ Million)

21. European Agriculture Technologies Market Research And Analysis By Offering, 2024-2035 ($ Million)

22. European Agriculture Technologies Market Research And Analysis By Application, 2024-2035 ($ Million)

23. European Agriculture Technologies Market Research And Analysis By Application, 2024-2035 ($ Million)

24. Asia-Pacific Agriculture Technologies Market Research And Analysis By Country, 2024-2035 ($ Million)

25. Asia-Pacific Agriculture Technologies Market Research And Analysis By Offering, 2024-2035 ($ Million)

26. Asia-Pacific Agriculture Technologies Market Research And Analysis By Application, 2024-2035 ($ Million)

27. Asia-Pacific Agriculture Technologies Market Research And Analysis By Application, 2024-2035 ($ Million)

28. Rest Of The World Agriculture Technologies Market Research And Analysis By Country, 2024-2035 ($ Million)

29. Rest Of The World Agriculture Technologies Market Research And Analysis By Offering, 2024-2035 ($ Million)

30. Rest Of The World Agriculture Technologies Market Research And Analysis By Application, 2024-2035 ($ Million)

31. Rest Of The World Agriculture Technologies Market Research And Analysis By Application, 2024-2035 ($ Million)

1. Global Agriculture Technologies Market Research And Analysis By Offering, 2024 Vs 2035 (%)

2. Global Agriculture Technologies Hardware Market Research And Analysis By Region, 2024 Vs 2035 (%)

3. Global Agriculture Technologies Software Market Research And Analysis By Region, 2024 Vs 2035 (%)

4. Global Agriculture Technologies Services Market Research And Analysis By Region, 2024 Vs 2035 (%)

5. Global Agriculture Technologies Market Research And Analysis By Application, 2024 Vs 2035 (%)

6. Global Agriculture Precision Farming Technologies Market Research And Analysis By Region, 2024 Vs 2035 (%)

7. Global Agriculture Livestock Monitoring Technologies Market Research And Analysis By Region, 2024 Vs 2035 (%)

8. Global Other Agriculture Technologies Market Research And Analysis By Region, 2024 Vs 2035 (%)

9. Global Agriculture Technologies Market Research And Analysis By Application, 2024 Vs 2035 (%)

10. Global Agriculture Technologies For Fish Farming Market Research And Analysis By Region, 2024 Vs 2035 (%)

11. Global Agriculture Technologies For Smart Green House Market Research And Analysis By Region, 2024 Vs 2035 (%)

12. Global Agriculture Technologies For Precision Farming Market Research And Analysis By Region, 2024 Vs 2035 (%)

13. Global Agriculture Technologies For Livestock Monitoring Market Research And Analysis By Region, 2024 Vs 2035 (%)

14. Global Agriculture Technologies For Others Market Research And Analysis By Region, 2024 Vs 2035 (%)

15. Global Agriculture Technologies Market Research And Analysis By Region, 2024 Vs 2035 (%)

16. US Agriculture Technologies Market Size, 2024-2035 ($ Million)

17. Canada Agriculture Technologies Market Size, 2024-2035 ($ Million)

18. UK Agriculture Technologies Market Size, 2024-2035 ($ Million)

19. France Agriculture Technologies Market Size, 2024-2035 ($ Million)

20. Germany Agriculture Technologies Market Size, 2024-2035 ($ Million)

21. Italy Agriculture Technologies Market Size, 2024-2035 ($ Million)

22. Spain Agriculture Technologies Market Size, 2024-2035 ($ Million)

23. Russia Agriculture Technologies Market Size, 2024-2035 ($ Million)

24. Rest Of Europe Agriculture Technologies Market Size, 2024-2035 ($ Million)

25. India Agriculture Technologies Market Size, 2024-2035 ($ Million)

26. Australia & New Zealand Agriculture Technologies Market Size, 2024-2035 ($ Million)

27. Asean Countries Agriculture Technologies Market Size, 2024-2035 ($ Million)

28. China Agriculture Technologies Market Size, 2024-2035 ($ Million)

29. Japan Agriculture Technologies Market Size, 2024-2035 ($ Million)

30. South Korea Agriculture Technologies Market Size, 2024-2035 ($ Million)

31. Rest Of Asia-Pacific Agriculture Technologies Market Size, 2024-2035 ($ Million)

32. Rest Of The World Agriculture Technologies Market Size, 2024-2035 ($ Million)

FAQS

The size of the Agriculture Technologies market in 2024 is estimated to be around USD 18.24 billion.

Asia-Pacific holds the largest share in the Agriculture Technologies market.

Leading players in the Agriculture Technologies market include AGCO Corp., Kubota, Corp., John Deere, GEA Group AG, Trimble Inc., Yara International ASA, and others.

Agriculture Technologies market is expected to grow at a CAGR of 15.8% from 2025 to 2035.

The growth of the agriculture technologies market is driven by increasing demand for precision farming, automation, IoT-based smart farming, AI-driven analytics, sustainable agricultural practices, climate change adaptation, and government support for agr