Agrochemicals Market

Global Agrochemicals Market Research By Product Type (Fertilizers and Pesticides), By Crop Type (Fruits & Vegetables, Oilseeds & Pulses, Cereals & Grains and Other) Forecast 2021-2027 Update Available - Forecast 2025-2035

The global agrochemicals market is growing at a considerable CAGR of 3.2% during the forecast period. Rising demand in food production is one of the prime factors affecting and driving the market. Additionally, increasing application in the protection of crops against fungi, insects, and weeds among others is also estimated to be the key factors that are contributing significantly towards the growth of the market. However, effects on the natural fertility of the soil and emerging demand for organic fertilizers along with pesticides are major factors constraints that are hindering the growth of the global agrochemicals market across the globe.

Moreover, the growing adoption of agrochemicals in various applications is also demanded as one of the key factors that are creating opportunities for the market. New product launches in the market are likely to drive the growth of the global agrochemicals market. For instance, in May 2020, BASF SE had come up with Melyra fungicide for its customers in China. This fungicide provides strong performance against diseases along with following and maintaining all the regular standards for its product.

Impact of COVID-19 Pandemic on the Global Agrochemicals Market

The global agrochemicals market is hardly hit by the COVID-19 pandemic since December 2019. The COVID-19 pandemic had brought a lot of disruption across the globe. Due to the COVID-19 pandemic, the agricultural sector across the globe had suffered supply chain disruption. As a result of which certain problems are being faced that include unavailability of labor for work, transportation hurdles along with insufficient inventories in different regions across the globe that had adversely impacted the market.

Segmental Outlook

The market is segmented based on product type and crop type. Based on product type, the market is segmented into fertilizers and pesticides. By crop type, the market is segmented into fruits & vegetables, oilseeds & pulses, cereals & grains, and other.

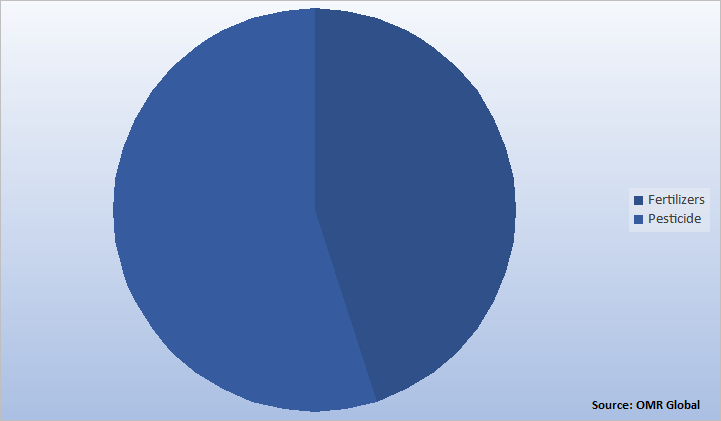

Global Agrochemicals Market Share by Product Type 2020 (%)

Based on the product type, the demand for pesticides holds a significant share in the agrochemicals market. The demand related to pesticides is mainly driven through widespread usage in agriculture for the purpose of eliminating weeds along with unwanted vegetation in order to protect the crop. Pesticides include herbicides, insecticides, fungicides, disinfectants along with different sorts of compounds. Insecticides are generally being used for managing various types of insects and fungicides are preferred for preventing the growth against molds along with mildew. Additionally, in order to prevent the spread of bacteria, disinfectants are used for this purpose and various compounds are also being demanded in order to control mice and rats.

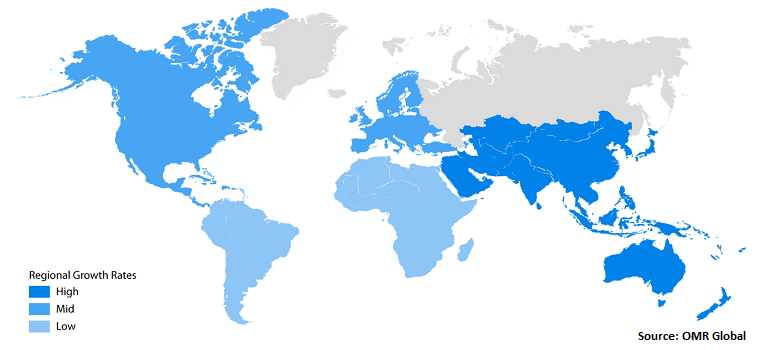

Regional Outlooks

The global agrochemicals market is analyzed based on the geographical regions that are contributing significantly towards the growth of the market. Based on the geography, the market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World. North America held a considerable share in 2020 in the global agrochemicals market. Some factors that are boosting the market growth in North America are raising eco-friendly methods of production in the agrochemicals market. Additionally, all the pesticides that are being offered in the US are registered under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) by the Environmental Protection Agency (EPA) for protecting the environment along with the health of humans. Moreover, in Europe, increasing investment in agricultural sectors is boosting the demand for the market in that region.

Global Agrochemicals Market, by Region 2021-2027

Asia-Pacific will have considerable growth in the Global Agrochemicals Market

Asia-Pacific region is expected to witness significant growth opportunities for the market. Increasing usage of agrochemicals in applications related to agriculture is likely to drive the growth of the regional market. Additionally, favorable policies of the government include subsidies especially in South Korea, China, and India for increasing activity is also supporting the growth of the market.

Market Player Outlook

Key players of the global agrochemicals market are AMVAC Chemical Corp., BASF SE, Bayer AG, Dow Chemical Co., and Yara. To survive in the market, these players adopt different marketing strategies such as product launches and mergers and acquisitions. For instance, in May 2021, approval was given from the Italian regulators for Cedroz pesticide that was been achieved by Eden Research plc for the purpose of offering this pesticide in the country. Cedroz pesticide will support in protecting damage against nematodes, parasitic worms to crop against fields and greenhouses.

In October 2020, Bayer AG had put forward the Roundup brand Power MAX 3 herbicide. This herbicide contains a proprietary surfactant blend that supports fast absorption along with consistent control over weeds which enables the growth of the plant.

In September 2020, A joint acquisition was been done of Bharat Insecticide Ltd. by Nippon Soda Co., Ltd. along with Mitsui & Co., Ltd. This acquisition was completed in order to contribute expansion of Bharat Insecticide Ltd.’s business in India by bringing new products into its portfolio.

In March 2020, Sumitomo Chemical Co., Ltd. had launched a new fungicide named Kaname Flowable for customers in Japan. This fungicide contains INDIFLINTM (inpyrfluxam) for diseases in vegetables along with fruit trees.

In May 2019, Nissan Chemical Corp. had started offering Gracia Emulsion in japan that is its new insecticide which was been registered in January 2019. This insecticide contains Fluxametamide for vegetables along with tea.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the global agrochemicals market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market-entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Agrochemicals Market Industry

• Recovery Scenario of Global Agrochemicals Market Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Agrochemicals Market by Product Type

5.1.1. Fertilizers

5.1.2. Pesticides

5.2. GlobalAgrochemicals Market by Crop Type

5.2.1. Fruits & Vegetables

5.2.2. Oilseeds & Pulses

5.2.3. Cereals & Grains

5.2.4. Other

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AMVAC Chemical Corp.

7.2. BASF SE

7.3. Bayer AG

7.4. BUNGE, LTD.

7.5. Conquest Crop Protection

7.6. Coromandal Agrico.

7.7. Dow Chemical Co.

7.8. Drexel Chemical Co.

7.9. Eden Research plc,

7.10. Gowan Co.

7.11. IFFCO-MC Crop Science Pvt. Ltd.

7.12. ISHIHARA SANGYO KAISHA, LTD.

7.13. K+S Aktiengesellschaft

7.14. NATIONAL FERTILIZERS LTD.

7.15. NIPPON SODA CO., LTD.

7.16. Nissan Chemical Corp.

7.17. Nutrien Ag Solutions, Inc.

7.18. Qatar Petroleum

7.19. ROTAM

7.20. Sumitomo Chemical Co., Ltd.

7.21. The Mosaic Co.

7.22. UPL

7.23. Yara

1. GLOBAL AGROCHEMICALS MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

2. GLOBAL AGROCHEMICALS MARKET BY PRODUCT TYPE, 2020-2027 ($ MILLION)

3. GLOBAL FERTILIZERS MARKET BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL PESTICIDES MARKET BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL AGROCHEMICALS MARKET BY CROP TYPE, 2020-2027 ($ MILLION)

6. GLOBAL FRUITS & VEGETABLES MARKET BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL OIL SEEDS & PULSES MARKET BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL CEREALS & GRAINS MARKET BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL OTHER MARKET BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL AGROCHEMICALS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

11. NORTH AMERICAN AGROCHEMICALS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

12. NORTH AMERICAN AGROCHEMICALS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

13. NORTH AMERICAN AGROCHEMICALS MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2020-2027 ($ MILLION)

14. EUROPEAN AGROCHEMICALS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

15. EUROPEAN AGROCHEMICALS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

16. EUROPEAN AGROCHEMICALS MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2020-2027 ($ MILLION)

17. ASIA-PACIFIC AGROCHEMICALS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

18. ASIA-PACIFIC AGROCHEMICALS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

19. ASIA-PACIFIC AGROCHEMICALS MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2020-2027 ($ MILLION)

20. REST OF THE WORLD AGROCHEMICALS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

21. REST OF THE WORLD AGROCHEMICALS MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL AGROCHEMICALS MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL AGROCHEMICALS MARKET SHARE BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL AGROCHEMICALS MARKET, 2021-2027 (%)

4. GLOBAL AGROCHEMICALS MARKET SHARE BY PRODUCT TYPE, 2020 VS 2027 (%)

5. GLOBAL AGROCHEMICALS MARKET SHARE BY CROP TYPE, 2020 VS 2027 (%)

6. GLOBAL AGROCHEMICALS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL FERTILIZERS MARKET BY REGION, 2020 VS 2027 (%)

8. GLOBAL PESTICIDES MARKET BY REGION, 2020 VS 2027 (%)

9. GLOBAL FRUITS & VEGETABLES MARKET BY REGION, 2020 VS 2027 (%)

10. GLOBAL OIL SEEDS & PULSES MARKET BY REGION, 2020 VS 2027 (%)

11. GLOBAL CEREALS & GRAINS MARKET BY REGION, 2020 VS 2027 (%)

12. GLOBAL OTHER MARKET BY REGION, 2020 VS 2027 (%)

13. US AGROCHEMICALS MARKET SIZE, 2020-2027 ($ MILLION)

14. CANADA AGROCHEMICALS MARKET SIZE, 2020-2027 ($ MILLION)

15. UK AGROCHEMICALS MARKET SIZE, 2020-2027 ($ MILLION)

16. FRANCE AGROCHEMICALS MARKET SIZE, 2020-2027 ($ MILLION)

17. GERMANY AGROCHEMICALS MARKET SIZE, 2020-2027 ($ MILLION)

18. ITALY AGROCHEMICALS MARKET SIZE, 2020-2027 ($ MILLION)

19. SPAIN AGROCHEMICALS MARKET SIZE, 2020-2027 ($ MILLION)

20. REST OF EUROPE AGROCHEMICALS MARKET SIZE, 2020-2027 ($ MILLION)

21. INDIA AGROCHEMICALS MARKET SIZE, 2020-2027 ($ MILLION)

22. CHINA AGROCHEMICALS MARKET SIZE, 2020-2027 ($ MILLION)

23. JAPAN AGROCHEMICALS MARKET SIZE, 2020-2027 ($ MILLION)

24. SOUTH KOREA AGROCHEMICALS MARKET SIZE, 2020-2027 ($ MILLION)

25. REST OF ASIA-PACIFIC AGROCHEMICALS MARKET SIZE, 2020-2027 ($ MILLION)

26. REST OF THE WORLD AGROCHEMICALS MARKET SIZE, 2020-2027 ($ MILLION)