AI Accelerator Market

AI Accelerator Market Size, Share & Trends Analysis Report by Type (Graphics Processing Units (GPUs), Tensor Processing Units (TPUs), Application-Specific Integrated Circuits (ASICs), Central Processing Units (CPUs), Field-Programmable Gate Arrays (FPGAs)), and by Technology Integration (Cloud-Based AI Accelerators, and Edge AI Accelerators) and by End-User (IT & Telecom, Healthcare, Automotive, Finance, Retail, and Others) Forecast Period (2025-2035)

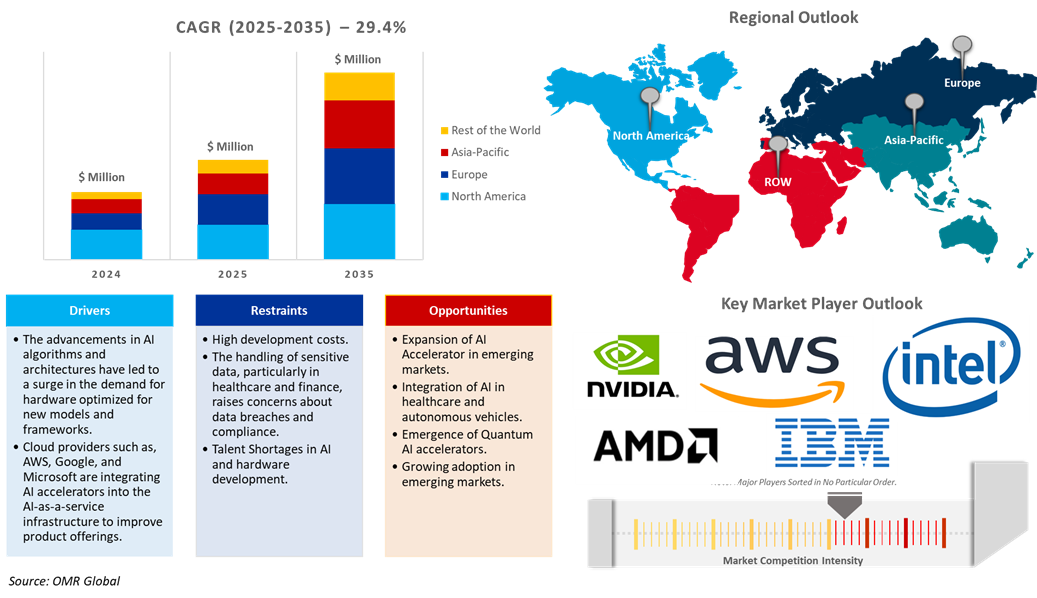

AI accelerator market is anticipated to reach $395.2 billion in 2035 from $23.6 billion in 2024, growing at a CAGR of 29.4% during the forecast period (2025-2035). The demand for AI and machine learning is growing in healthcare, finance, automotive, and retail industries. Large datasets necessitate AI accelerators since more sophisticated models demand AI evolution and specific hardware for quick executions. Major cloud service providers such as Amazon, Microsoft, and Google are integrating AI accelerators into cloud computing and edge computing to meet real-time processing demands. Government initiatives, in addition to direct investment, are accelerating AI development, driving the demand for AI accelerators. Several cloud service providers, including AWS, Microsoft Azure, Google Cloud, and more, are providing acceleration services for AI workloads that will help increase performance.

Market Dynamics

Integrations with AI Platforms & Cloud services

AI accelerators are used in cloud computing to expedite AI workloads, enabling faster training and inference of machine learning models. AI accelerators offer improved performance and efficiency when integrating AI into the cloud environment, for computationally intensive tasks such as deep learning. In November 2024, IBM and AMD collaborated to offer the AMD Instinct MI300X accelerators as a service on IBM Cloud, with performance and power efficiency as priorities for Gen AI models and high-performance computing applications. The collaboration supported AMD Instinct MI300X accelerators within IBM's Watson AI and data platform and Red Hat Enterprise Linux AI inferencing.

Expansion of Edge Computing

The global AI accelerator market is involved in advancing edge computing by supplying the hardware and processing power required for AI-based applications. Devices such as GPUs, TPUs, and FPGAs facilitate effective AI processing on-site, decreasing reliance on cloud resources and cutting down latency. The demand for AI accelerators is rising as a result of large expenditures in AI infrastructure in areas such as autonomous systems, IoT, and smart city initiatives. Edge computing, allows real-time data analysis in applications such as autonomous vehicles and smart cities, driving market growth owing to its closer processing of data. In May 2024, Couchbase released a survey of 500 senior IT decision makers estimating the investment in IT modernization to rise by 27% in 2024 as companies aim to leverage emerging technologies such as AI and edge computing to meet increasing productivity demands.

Market Segmentation

- Based on the type, the market is segmented into Graphics Processing Units (GPUs), Tensor Processing Units (TPUs), Application-Specific Integrated Circuits (ASICs), Central Processing Units (CPUs), and Field-Programmable Gate Arrays (FPGAs).

- Based on the technology integration, the market is segmented into cloud-based AI accelerators and edge AI accelerators.

- Based on the end user, the market is segmented into IT & telecom, healthcare, automotive, finance, retail, and others (government and defense).

IT & Telecom Segment to Hold a Considerable Market Share

AI is being utilized in the IT and telecom industries to enhance performance, efficiency, and customer service. In these sectors, AI is applied for network optimization, customer support, predictive maintenance, cybersecurity, and analytics. It aids in network management, boosts customer service, and streamlines operations, while additionally offering real-time threat detection, data security, and personalized marketing strategies. The AI accelerator market, incorporating hardware and software solutions, enhances AI workload performance. Its key components include GPUs and TPUs that are vital for data processing and edge computing in telecom.

Regional Outlook

The global AI accelerator market is segmented based on geography including North America (the US, and Canada), Europe (the UK, Germany, France, Italy, Spain, Germany, France, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific Holds Major Market Share

Asia-Pacific holds a significant share owing to governments and organizations promoting AI adoption through funding for startups, public-private partnerships, and investment in AI education and workforce development. For instance, in September 2024, AWS selected seven Indian Gen AI startups for its Global Generative AI Accelerator program, which was the largest number from any single country in the Asia-Pacific region. The Indian companies are some of the 80 picked around the globe based on advanced AI usage and global growth intentions. AWS invested $230 million in startups to accelerate the generative AI applications. Indian AI and ML companies attracted $82 billion in 2024, while Asia-Pacific-based companies could raise $2.5 billion.

Market Players Outlook

The major companies serving the AI accelerator market include Advanced Micro Devices, Inc., IBM Corp., Intel Corp., NVIDIA Corp., Samsung Electronics Co., Ltd., and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Developments

- In December 2024, MemryX showcased its MX3 AI Accelerator at CES 2025, showcasing its industry-leading performance, efficiency, and versatility in real-world Edge AI applications. Demos include 100 Simultaneous Video Streams, Industry 4.0, Yolo-World, and GPU comparison, showcasing the MX3 Edge AI performance advantage while using less power than mainstream NVIDIA GPU.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global AI accelerator market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global AI Accelerator Market Sales Analysis – Type| Technology Integration | Application| End-User ($ Million)

• AI Accelerator Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key AI Accelerator Industry Trends

2.2.2. Market Recommendations

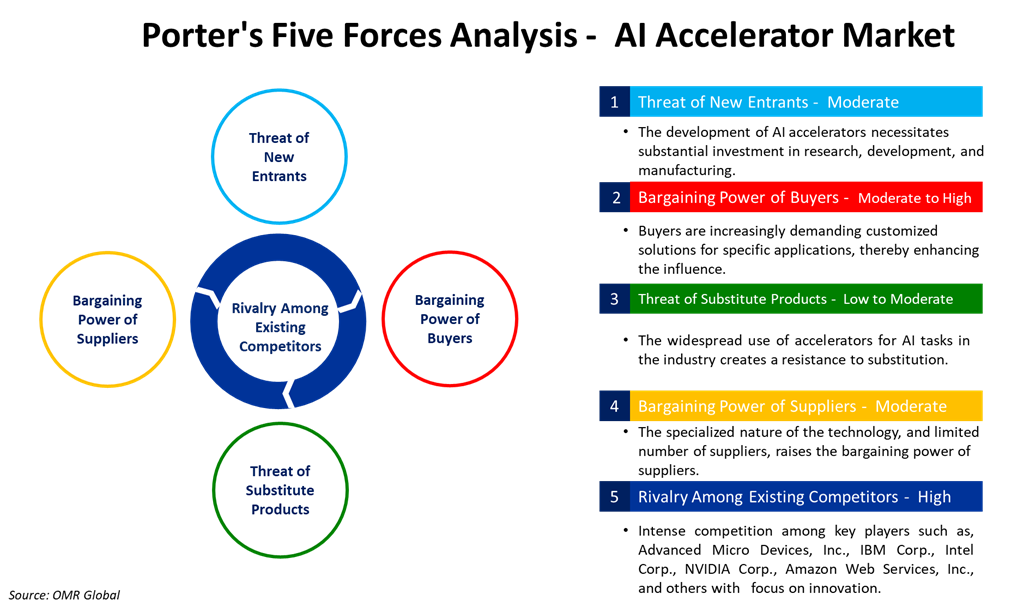

2.3. Porter's Five Forces Analysis for the AI Accelerator Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global AI Accelerator Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global AI Accelerator Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – AI Accelerator Market Revenue and Share by Manufacturers

• AI Accelerator Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.3. Advanced Micro Devices, Inc.

4.3.1. Overview

4.3.2. Product Portfolio

4.3.3. Financial Analysis (Subject to Data Availability)

4.3.4. SWOT Analysis

4.3.5. Business Strategy

4.4. IBM Corp.

4.4.1. Overview

4.4.2. Product Portfolio

4.4.3. Financial Analysis (Subject to Data Availability)

4.4.4. SWOT Analysis

4.4.5. Business Strategy

4.5. Intel Corp.

4.5.1. Overview

4.5.2. Product Portfolio

4.5.3. Financial Analysis (Subject to Data Availability)

4.5.4. SWOT Analysis

4.5.5. Business Strategy

4.6. NVIDIA Corp.

4.6.1. Overview

4.6.2. Product Portfolio

4.6.3. Financial Analysis (Subject to Data Availability)

4.6.4. SWOT Analysis

4.6.5. Business Strategy

4.7. Top Winning Strategies by Market Players

4.7.1. Merger and Acquisition

4.7.2. Product Launch

4.7.3. Partnership And Collaboration

5. Global AI Accelerator Market by Type ($ Million)

5.1. Graphics Processing Units (GPUs)

5.2. Tensor Processing Units (TPUs)

5.3. Application-Specific Integrated Circuits (ASICs)

5.4. Central Processing Units (CPUs)

5.5. Field-Programmable Gate Arrays (FPGAs)

6. Global AI Accelerator Market by Technology Integration ($ Million)

6.1. Cloud-Based AI Accelerators

6.2. Edge AI Accelerators

7. Global AI Accelerator Market by End-User ($ Million)

7.1. IT & Telecom

7.2. Healthcare

7.3. Automotive

7.4. Finance

7.5. Retail

7.6. Others (Government and Defense)

8. Regional Analysis

8.1. North American AI Accelerator Market Sales Analysis – Type| Technology Integration | End-User | Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European AI Accelerator Market Sales Analysis Type| Technology Integration | End-User | Country ($ Million)

• Macroeconomic Factors for European

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific AI Accelerator Market Sales Analysis – Type| Technology Integration | End-User | Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World AI Accelerator Market Sales Analysis – Type| Technology Integration | End-User | Country ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. Alibaba Group

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. Advanced Micro Devices, Inc.

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. Amazon Web Services, Inc.

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. Apple, Inc.

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. Arm Ltd.

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. Cerebras Systems, Inc.

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. Fujitsu, Ltd.

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. Google, LLC

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Graphcore (SoftBank)

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. Groq, Inc.

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Huawei Technologies Co., Ltd.

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. IBM Corp.

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. Intel Corp.

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Lightmatter

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Marvell Technology, Inc.

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. Micron Technology, Inc.

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. NeuroBlade

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. NVIDIA Corp.

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. NXP Semiconductors N.V.

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. Samsung Electronics Co., Ltd.

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

9.21. Tenstorrent

9.21.1. Quick Facts

9.21.2. Company Overview

9.21.3. Product Portfolio

9.21.4. Business Strategies

1. Global AI Accelerator Market Research And Analysis By Type, 2024-2035 ($ Million)

2. Global Graphics Processing Units (GPUs) In AI Accelerator Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Tensor Processing Units (TPUs) In AI Accelerator Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Application-Specific Integrated Circuits (ASICs) In AI Accelerator Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Central Processing Units (CPUs) In AI Accelerator Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Field-Programmable Gate Arrays (FPGAs) In AI Accelerator Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Tensor Processing Units (TPUs) In AI Accelerator Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global AI Accelerator Market Research And Analysis By Technology Integration, 2024-2035 ($ Million)

9. Global Cloud-Based AI Accelerator Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Edge AI Accelerator Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global AI Accelerator Market Research And Analysis By End-User, 2024-2035 ($ Million)

12. Global AI Accelerator For IT & Telecom Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global AI Accelerator For Healthcare Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global AI Accelerator For Automotive Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global AI Accelerator For Finance Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global AI Accelerator For Retail Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global AI Accelerator For Other End-User Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global AI Accelerator Market Research And Analysis By Region, 2024-2035 ($ Million)

19. North American AI Accelerator Market Research And Analysis By Country, 2024-2035 ($ Million)

20. North American AI Accelerator Market Research And Analysis By Type, 2024-2035 ($ Million)

21. North American AI Accelerator Market Research And Analysis By Technology Integration, 2024-2035 ($ Million)

22. North American AI Accelerator Market Research And Analysis By End-User, 2024-2035 ($ Million)

23. European AI Accelerator Market Research And Analysis By Country, 2024-2035 ($ Million)

24. European AI Accelerator Market Research And Analysis By Type, 2024-2035 ($ Million)

25. European AI Accelerator Market Research And Analysis By Technology Integration, 2024-2035 ($ Million)

26. European AI Accelerator Market Research And Analysis By End-User, 2024-2035 ($ Million)

27. Asia-Pacific AI Accelerator Market Research And Analysis By Country, 2024-2035 ($ Million)

28. Asia-Pacific AI Accelerator Market Research And Analysis By Type, 2024-2035 ($ Million)

29. Asia-Pacific AI Accelerator Market Research And Analysis By Technology Integration, 2024-2035 ($ Million)

30. Asia-Pacific AI Accelerator Market Research And Analysis By End-User, 2024-2035 ($ Million)

31. Rest Of The World AI Accelerator Market Research And Analysis By Region, 2024-2035 ($ Million)

32. Rest Of The World AI Accelerator Market Research And Analysis By Type, 2024-2035 ($ Million)

33. Rest Of The World AI Accelerator Market Research And Analysis By Technology Integration, 2024-2035 ($ Million)

34. Rest Of The World AI Accelerator Market Research And Analysis By End-User, 2024-2035 ($ Million)

1. Global AI Accelerator Market Share By Type, 2024 Vs 2035 (%)

2. Global Graphics Processing Units (GPUs) In AI Accelerator Market Share By Region, 2024 Vs 2035 (%)

3. Global Tensor Processing Units (TPUs) In AI Accelerator Market Share By Region, 2024 Vs 2035 (%)

4. Global Application-Specific Integrated Circuits (ASICs) In AI Accelerator Market Share By Region, 2024 Vs 2035 (%)

5. Global Central Processing Units (CPUs) In AI Accelerator Market Share By Region, 2024 Vs 2035 (%)

6. Global Field-Programmable Gate Arrays (FPGAs) In AI Accelerator Market Share By Region, 2024 Vs 2035 (%)

7. Global AI Accelerator Market Share By Technology Integration, 2024 Vs 2035 (%)

8. Global Cloud-Based AI Accelerator Market Share By Region, 2024 Vs 2035 (%)

9. Global Edge AI Accelerator Market Share By Region, 2024 Vs 2035 (%)

10. Global AI Accelerator Market Share By End-user, 2024 Vs 2035 (%)

11. Global AI Accelerator For IT & Telecom Market Share By Region, 2024 Vs 2035 (%)

12. Global AI Accelerator For Healthcare Market Share By Region, 2024 Vs 2035 (%)

13. Global AI Accelerator For Automotive Market Share By Region, 2024 Vs 2035 (%)

14. Global AI Accelerator For Finance Market Share By Region, 2024 Vs 2035 (%)

15. Global AI Accelerator For Retail Market Share By Region, 2024 Vs 2035 (%)

16. Global AI Accelerator For Other End User Market Share By Region, 2024 Vs 2035 (%)

17. Global AI Accelerator Market Share By Region, 2024 Vs 2035 (%)

18. US AI Accelerator Market Size, 2024-2035 ($ Million)

19. Canada AI Accelerator Market Size, 2024-2035 ($ Million)

20. UK AI Accelerator Market Size, 2024-2035 ($ Million)

21. France AI Accelerator Market Size, 2024-2035 ($ Million)

22. Germany AI Accelerator Market Size, 2024-2035 ($ Million)

23. Italy AI Accelerator Market Size, 2024-2035 ($ Million)

24. Spain AI Accelerator Market Size, 2024-2035 ($ Million)

25. Russia AI Accelerator Market Size, 2024-2035 ($ Million)

26. Rest Of Europe AI Accelerator Market Size, 2024-2035 ($ Million)

27. India AI Accelerator Market Size, 2024-2035 ($ Million)

28. China AI Accelerator Market Size, 2024-2035 ($ Million)

29. Japan AI Accelerator Market Size, 2024-2035 ($ Million)

30. South Korea AI Accelerator Market Size, 2024-2035 ($ Million)

31. Australia & New Zealand AI Accelerator Market Size, 2024-2035 ($ Million)

32. ASEAN Countries AI Accelerator Market Size, 2024-2035 ($ Million)

33. Rest Of Asia-Pacific AI Accelerator Market Size, 2024-2035 ($ Million)

34. Latin America AI Accelerator Market Size, 2024-2035 ($ Million)

35. Middle East And Africa AI Accelerator Market Size, 2024-2035 ($ Million)