AI-Enabled Imaging Modalities Market

AI-Enabled Imaging Modalities Market Size, Share & Trends Analysis Report by Product Type (Computed Tomography (CT), Magnetic Resonance Imaging (MRI), X-ray, Ultrasound, Positron Emission Tomography (PET), Single-Photon Emission Computed Tomography (SPECT), and Others, by End-User (Hospitals, Diagnostic Centers, and Research Institutions), and by Application (Cardiology, Oncology, Neurology, Orthopedics, and Gastroenterology) Forecast Period (2025-2035)

Industry Outlook

AI-enabled imaging modalities are expected to grow at a strong CAGR of 14.3% over the forecast period. The major factors that are pushing the market for imaging technologies powered by AI. Advancements in imaging processes and artificial intelligence have enhanced diagnostic accuracy, these tools are more beneficial in clinical settings. Furthermore, the growing incidence of chronic diseases is heightening the demand for better and more accurate diagnostic tools. The healthcare industry is facing the huge impact of the rapid implementation of AI & ML, the use of imaging techniques and scanning techniques has grown rapidly, and with the help of AI, patient care and safety are being improved by providing them with accurate diagnoses.

AI integration in images enhances interpretation accuracy, minimizes human error, and enables faster medical action. For instance, AI assistance can distinguish between benign and malignant cancers, enabling physicians to make more informed treatment choices. The increasing number of cancer cases across the globe is being detected early, and getting accurate diagnoses remains essential for improved patient outcomes.

Segmental Outlook

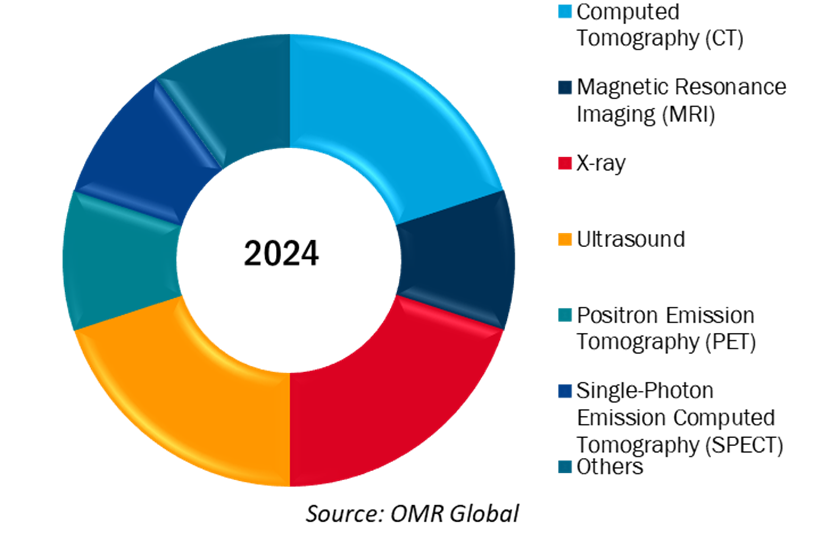

The global AI-enabled imaging modalities market is divided into three segments: product types, end users, and applications. The market covers the following product types: computed tomography (CT), magnetic resonance imaging (MRI), x-ray, ultrasound, positron emission tomography (PET), single-photon emission computed tomography (SPECT), and others. The end-user market is divided into three categories: hospitals, diagnostic centers, and research institutions. In terms of applications, the market is divided into five categories: cardiology, oncology, neurology, orthopedics, and gastrointestinal.

The Healthcare segment is projected to hold a significant share of the Global AI-enabled imaging Modalities Market

The market for AI-powered imaging modalities is growing rapidly owing to the progress in healthcare technology. The growth in the prevalence of chronic conditions and the need for precise and early diagnosis are major drivers for market growth. Integration with AI improves imaging accuracy, minimizing errors in diagnosis and enhancing patient outcomes. The increased use of AI in radiology, cardiology, and oncology also helps drive market growth. Government investment and AI-driven healthcare solution initiatives are spurring technological progression. Moreover, the increasing proportion of geriatric populations enhances the demand for higher-end imaging solutions. The blend of deep learning and machine learning algorithms is redefining medical imaging. Generally, AI-capable imaging modalities are rewriting the future of diagnostic healthcare.

Global AI-Enabled Imaging Modalities Market Share By Product Type, 2024 (%)

Regional Outlook

The global AI-enabled imaging modalities market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, ASEAN countries, Australia & New Zealand and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America). In the regional outlook, The Asia Pacific market is expected to grow significantly in the coming years, owing to having major market players that contribute more to the market growth and have high potential to implement a high level of advancements in AI technology.

North America Region Dominates the Market for AI-Enabled Imaging Modalities Market

The North America region is dominant owing to its superior capabilities in a variety of areas. Furthermore, the existence of various market competitors and supporting government laws contribute to the region's market growth. The existence of well-established healthcare facilities, early adoption of innovative medical technologies, and favorable reimbursement rules are among the primary drivers of growth in this region.

Market Players Outlook

The major companies that offer AI-enabled imaging modalities include Agfa-Gevaert Group, Butterfly Network Inc., Carestream Health, Esaote S.p.A., FUJIFILM Corp., Hitachi Medical Systems, Hologic, Inc., and IBM Watson Health. These companies are playing a major role in driving market growth through various strategies like mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to compete effectively and cater to the increasing demand for AI-enabled imaging modalities.

Recent Development

- In February 2024, Hartford HealthCare launched its new Center for AI Innovation in Healthcare. These centers will control the revolutionary powers of AI to enhance health care as well as solidify its commitment.

The Report Covers:

- Market value data analysis of 2025 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global AI-enabled imaging modalities market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global AI-Enabled Imaging Modalities Market Sales Analysis – Product Type | End-User |Application ($ Million)

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Global AI-Enabled Imaging Modalities Trends

2.2.2. Market Recommendations

2.2.3. Conclusion

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global AI-Enabled Imaging Modalities Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global AI-Enabled Imaging Modalities Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard –Global AI-Enabled Imaging Modalities: Revenue by Manufacturers

4.2. Key Company Analysis

4.2.1. Overview

4.2.2. Product Portfolio

4.2.3. Financial Analysis (Subject to Data Availability)

4.2.4. SWOT Analysis

4.2.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global AI-Enabled Imaging Modalities Market by Product Type ($ Million)

5.1. Computed Tomography (CT)

5.2. Magnetic Resonance Imaging (MRI)

5.3. X-Ray

5.4. Ultrasound

5.5. Positron Emission Tomography (PET)

5.6. Single-Photon Emission Computed Tomography (SPECT)

5.7. Others (Hybrid Imaging Modalities, Optical Coherence Tomography (OCT))

6. Global AI-Enabled Imaging Modalities Market by End-User ($ Million)

6.1. Hospitals

6.2. Diagnostic Centers

6.3. Research Institutions

7. Global AI-Enabled Imaging Modalities Market by Application

7.1. Cardiology

7.2. Oncology

7.3. Neurology

7.4. Orthopedics

7.5. Gastroenterology

8. Regional Analysis

8.1. North American AI-Enabled Imaging Modalities Market Sales Analysis – Product Type | End-User |Application ($ Million)

8.1.1. United States

8.1.2. Canada

8.2. European AI-Enabled Imaging Modalities Market Sales Analysis – Product Type | End-User |Application ($ Million)

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific AI-Enabled Imaging Modalities Market Sales Analysis – Product Type | End-User |Application ($ Million)

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World AI-Enabled Imaging Modalities Market Sales Analysis – Product Type | End-User |Application ($ Million)

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. Agfa-Gevaert Group

9.2. Analogic Corp.

9.3. Bruker Corp.

9.4. Canon Medical Systems Corp.

9.5. Carestream Health

9.6. Esaote S.p.A.

9.7. Fujifilm Holdings Corp.

9.8. GE HealthCare

9.9. Hitachi Medical Systems

9.10. Hologic Inc.

9.11. Koninklijke Philips N.V.

9.12. Mindray Medical India Pvt Ltd.

9.13. Neusoft Medical Systems Co., Ltd.

9.14. PerkinElmer Inc.

9.15. Samsung Electronics Co., Ltd.

9.16. Shimadzu Corp.

9.17. Siemens Healthineers

9.18. Spectral AI, Inc.

9.19. Toshiba Corp.

9.20. Varian Medical Systems, Inc.

1. Global AI-Enabled Imaging Modalities Market Research And Analysis By Product Type, 2024-2035 ($ Million)

2. Global AI-Enabled Computed Tomography (CT) Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global AI-Enabled Magnetic Resonance Imaging (MRI) Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global AI-Enabled X-Ray Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global AI-Enabled Ultrasound Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global AI-Enabled Positron Emission Tomography (PET) Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global AI-Enabled Single-Photon Emission Computed Tomography (SPECT) Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Other AI-Enabled Imaging Modalities Product Type Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global AI-Enabled Imaging Modalities Market Research And Analysis By End-User, 2024-2035 ($ Million)

10. Global AI-Enabled Imaging Modalities In Hospitals Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global AI-Enabled Imaging Modalities In Diagnostic Centers Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global AI-Enabled Imaging Modalities In Research Institutions Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global AI-Enabled Imaging Modalities Market Research And Analysis By Application, 2024-2035 ($ Million)

14. Global AI-Enabled Imaging Modalities For Cardiology Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global AI-Enabled Imaging Modalities For Oncology Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global AI-Enabled Imaging Modalities For Neurology Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global AI-Enabled Imaging Modalities For Orthopedics Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global AI-Enabled Imaging Modalities For Gastroenterology Market Research And Analysis By Region, 2024-2035 ($ Million)

19. Global AI-Enabled Imaging Modalities Market Research And Analysis By Region, 2024-2035 ($ Million)

20. North American AI-Enabled Imaging Modalities Market Research And Analysis By Country, 2024-2035 ($ Million)

21. North American AI-Enabled Imaging Modalities Market Research And Analysis By Product Type, 2024-2035 ($ Million)

22. North American AI-Enabled Imaging Modalities Market Research And Analysis By End-User, 2024-2035 ($ Million)

23. North American AI-Enabled Imaging Modalities Market Research And Analysis By Application, 2024-2035 ($ Million)

24. European AI-Enabled Imaging Modalities Market Research And Analysis By Country, 2024-2035 ($ Million)

25. European AI-Enabled Imaging Modalities Market Research And Analysis By Product Type, 2024-2035 ($ Million)

26. European AI-Enabled Imaging Modalities Market Research And Analysis By End-User, 2024-2035 ($ Million)

27. European AI-Enabled Imaging Modalities Market Research And Analysis By Application, 2024-2035 ($ Million)

28. Asia-Pacific AI-Enabled Imaging Modalities Market Research And Analysis By Country, 2024-2035 ($ Million)

29. Asia-Pacific AI-Enabled Imaging Modalities Market Research And Analysis By Product Type, 2024-2035 ($ Million)

30. Asia-Pacific AI-Enabled Imaging Modalities Market Research And Analysis By End-User, 2024-2035 ($ Million)

31. Asia-Pacific AI-Enabled Imaging Modalities Market Research And Analysis By Application, 2024-2035 ($ Million)

32. Rest Of The World AI-Enabled Imaging Modalities Market Research And Analysis By Country, 2024-2035 ($ Million)

33. Rest Of The World AI-Enabled Imaging Modalities Market Research And Analysis By Product Type, 2024-2035 ($ Million)

34. Rest Of The World AI-Enabled Imaging Modalities Market Research And Analysis By End-User, 2024-2035 ($ Million)

35. Rest Of The World AI-Enabled Imaging Modalities Market Research And Analysis By Application, 2024-2035 ($ Million)

1. Global AI-Enabled Imaging Modalities Market Share By Product Type, 2024 Vs 2035 (%)

2. Global AI-Enabled Computed Tomography (CT) Market Share By Region, 2024 Vs 2035 (%)

3. Global AI-Enabled Magnetic Resonance Imaging (MRI) Market Share By Region, 2024 Vs 2035 (%)

4. Global AI-Enabled X-Ray By Market Share Region, 2024 Vs 2035 (%)

5. Global AI-Enabled Ultrasound By Market Share Region, 2024 Vs 2035 (%)

6. Global AI-Enabled Positron Emission Tomography (PET) By Market Share Region, 2024 Vs 2035 (%)

7. Global AI-Enabled Single-Photon Emission Computed Tomography (SPECT) By Market Share Region, 2024 Vs 2035 (%)

8. Global AI-Enabled Other Imaging Modalities By Market Share Region, 2024 Vs 2035 (%)

9. Global AI-Enabled Imaging Modalities Market Share By End-User, 2024 Vs 2035 (%)

10. Global AI-Enabled Imaging Modalities In Hospitals Market Share By Region, 2024 Vs 2035 (%)

11. Global AI-Enabled Imaging Modalities In Diagnostic Centers Market Share By Region, 2024 Vs 2035 (%)

12. Global AI-Enabled Imaging Modalities In Research Institutions Market Share By Region, 2024 Vs 2035 (%)

13. Global AI-Enabled Imaging Modalities Market Share By Application, 2024 Vs 2035 (%)

14. Global AI-Enabled Imaging Modalities For Cardiology Market Share By Region, 2024 Vs 2035 (%)

15. Global AI-Enabled Imaging Modalities For Oncology Market Share By Region, 2024 Vs 2035 (%)

16. Global AI-Enabled Imaging Modalities For Neurology Market Share By Region, 2024 Vs 2035 (%)

17. Global AI-Enabled Imaging Modalities For Orthopedics Market Share By Region, 2024 Vs 2035 (%)

18. Global AI-Enabled Imaging Modalities For Gastroenterology Market Share By Region, 2024 Vs 2035 (%)

19. Global AI-Enabled Imaging Modalities For Oncology Market Share By Region, 2024 Vs 2035 (%)

20. Global AI-Enabled Imaging Modalities Market Share By Region, 2024 Vs 2035 (%)

21. US AI-Enabled Imaging Modalities Market Size, 2024-2035 ($ Million)

22. Canada AI-Enabled Imaging Modalities Market Size, 2024-2035 ($ Million)

23. UK AI-Enabled Imaging Modalities Market Size, 2024-2035 ($ Million)

24. France AI-Enabled Imaging Modalities Market Size, 2024-2035 ($ Million)

25. Germany AI-Enabled Imaging Modalities Market Size, 2024-2035 ($ Million)

26. Italy AI-Enabled Imaging Modalities Market Size, 2024-2035 ($ Million)

27. Spain AI-Enabled Imaging Modalities Market Size, 2024-2035 ($ Million)

28. Rest Of Europe AI-Enabled Imaging Modalities Market Size, 2024-2035 ($ Million)

29. India AI-Enabled Imaging Modalities Market Size, 2024-2035 ($ Million)

30. China AI-Enabled Imaging Modalities Market Size, 2024-2035 ($ Million)

31. Japan AI-Enabled Imaging Modalities Market Size, 2024-2035 ($ Million)

32. South Korea AI-Enabled Imaging Modalities Market Size, 2024-2035 ($ Million)

33. Australia & New Zealand AI-Enabled Imaging Modalities Market Size, 2024-2035 ($ Million)

34. ASEAN AI-Enabled Imaging Modalities Market Size, 2024-2035 ($ Million)

35. Rest Of Asia-Pacific AI-Enabled Imaging Modalities Market Size, 2024-2035 ($ Million)

36. Rest Of The World AI-Enabled Imaging Modalities Market Size, 2024-2035 ($ Million)

FAQS

The size of the AI-Enabled Imaging Modalities market in 2024 is estimated to be around USD 1.28 billion.

North American holds the largest share in the AI-Enabled Imaging Modalities market.

Leading players in the AI-Enabled Imaging Modalities market include Agfa-Gevaert Group, Butterfly Network Inc., Carestream Health, Esaote S.p.A., FUJIFILM Corp., Hitachi Medical Systems, Hologic, Inc., and IBM Watson Health.

AI-Enabled Imaging Modalities market is expected to grow at a CAGR of 14.3% from 2025 to 2035.

The AI-enabled imaging modalities market is driven by rising chronic diseases, demand for early diagnosis, and advancements in AI-powered diagnostic technologies.