Artificial Intelligence (AI) In Asset Management Market

Artificial Intelligence (AI) In Asset Management Market Size, Share & Trends Analysis Report by Technology (Machine Learning, Natural Language Processing (NLP), and Others), by Deployment Mode (On-Premises, and Cloud) and by Application (Portfolio Optimization, Conversational Platform, Risk & Compliance, Data Analysis, Process Automation, and Others) Forecast Period (2024-2031)

AI in asset management market is anticipated to grow at a CAGR of 38.1% during the forecast period (2024-2031). AI in asset management is gaining popularity owing to its ability to process large amounts of data, predict market trends, optimize portfolios, and provide personalized investment solutions. AI aids in portfolio optimization, risk management, compliance monitoring, and reporting, ensuring cost efficiency and scalability.

Market Dynamics

Growing demand for digitalization

The increasing adoption of digital technology, the complexity of data, and the demand for sustainable, efficient practices particularly in offshore operations are all driving substantial changes in the global AI asset management market. For instance, in March 2024, Imrandd launched an AI-powered asset management solution for offshore operators. The AI-powered asset management solution, ALERT, reduces inspection time and costs for offshore operators. The £1 million ($1.3 million) investment, supported by funding from the Net Zero Technology Centre, allows real-time monitoring of corrosion threats and provides real-time insights into asset performance.

Increasing demand for specialized investment solutions

The widespread adoption of AI in asset management is being driven by the growing demand for personalized and sustainable investment solutions that align with investors' values. AI's ability to generate vast numbers of investment strategies has the potential to revolutionize asset management. For instance, in September 2021, Arabesque introduced autonomous asset management (AutoCIO), powered by its proprietary AI Engine. This technology allows for the creation of highly customized active equity strategies tailored to investors' sustainability objectives and values. It can forecast stock performance on 25,000 equities daily and generate millions of active equity investment strategies. Over $400million of investment strategies are successfully powered by AutoCIO.

Market Segmentation

- Based on technology, the market is segmented into machine learning, natural language processing (NLP), and others (deep learning, and robotic process automation (RPA)).

- Based on deployment mode, the market is segmented into on-premises and cloud.

- Based on application, the market is segmented into portfolio optimization, conversational platform, risk & compliance, data analysis, process automation, and others (alternative data analysis, and smart data management).

Machine Learning is Projected to Emerge as the Largest Segment

The primary factor supporting the segment's growth includes the advancements in machine learning. The adoption of machine learning-integrated next-generation asset management solutions offers enhanced comprehension of asset performance and foster efficiency and innovation which in turn drives the growth of this market segment. For instance, in February 2023, EagleView launched next-generation asset management solutions, combining high-resolution aerial imagery with machine learning. These solutions help local governments and commercial organizations manage assets accurately, automate data collection and analysis, and identify trends in asset performance, enabling prioritization of maintenance and repair work.

Risk & Compliance Sub-segment to Hold a Considerable Market Share

Management firms are adopting AI risk policies to uphold regulatory compliance, safeguard retail clients, and maintain the integrity of financial markets. To integrate AI in asset management for risk & compliance, key players are introducing advanced products. For instance, in February 2024, Behavox expanded its AI risk policies for wealth and asset management firms with retail client bases. The enhanced policies detect compliance issues like sales suitability, unfair communications, window dressing, and cherry-picking. The company additionally enhanced detection capabilities for customer complaints, money laundering, personal financial dealings, sub-optimal execution, churning, misappropriation of client assets, unauthorized trading in client accounts, and tax evasion.

Regional Outlook

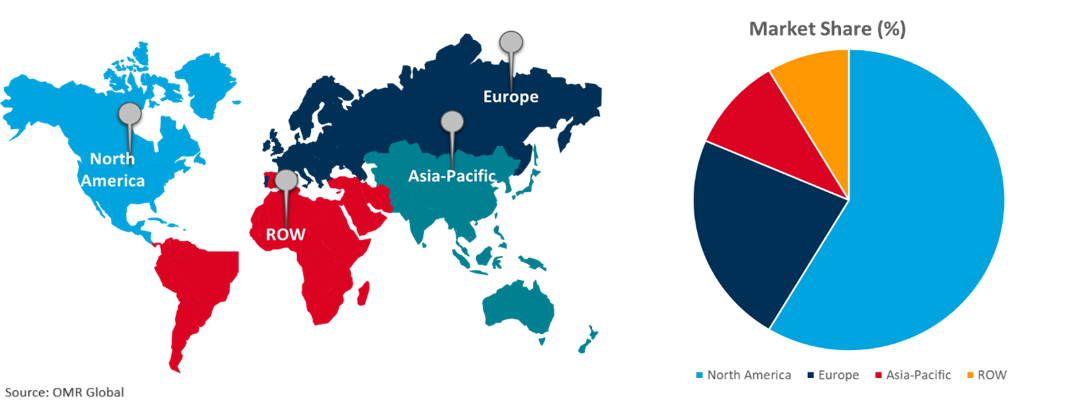

The Artificial intelligence (AI) in the asset management market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Investments in AI In the Asia-Pacific Region

The expansion in asset management has been attributed to the significant rise in investments in AI. For instance, in March 2023, Accenture acquired Bangalore-based industrial AI company Flutura, aiming to enhance its services in various industries, including energy, chemicals, metals, mining, and pharmaceuticals, to achieve net zero goals.

Artificial Intelligence (AI) In Asset Management Market Growth by Region 2024-2031

North America Holds Major Market Share

The use of AI in asset management is increasing across the region due to the increasing demand of US investors for innovative techniques for better results while utilizing investments in assets in competitive markets. For instance, in February 2024, Vanguard Group integrated AI into its active equity funds, including four-factor funds with 13 billion assets under management. These funds, which include the Vanguard Global Minimum Volatility Fund, Vanguard Global Value Factor Fund, Vanguard Global Momentum Factor Fund, and Vanguard Global Liquidity Factor Fund, combine various factors with variable weightings.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving AI in asset management market include IBM Corp., Infosys Ltd., Microsoft Corp., S&P Global Inc., and State Street Corp. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market. For instance, in February 2023, TIFIN, partnered with Morningstar to provide real-time industry trend information for its asset manager platform (AMP). This enabled asset managers to modernize the distribution to non-institutional and retail audiences, enabling them to better understand the consumption of investment products and generate new insights.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global artificial intelligence (AI) asset management market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. IBM Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Infosys Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Microsoft Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global AI In Asset Management Market by Deployment Mode

4.1.1. Machine Learning

4.1.2. Natural Language Processing (NLP)

4.1.3. Others (Deep Learning, and Robotic Process Automation (RPA))

4.2. Global AI In Asset Management Market by Deployment Mode

4.2.1. On-Premises

4.2.2. Cloud

4.3. Global AI In Asset Management Market by Application

4.3.1. Portfolio Optimization

4.3.2. Conversational Platform

4.3.3. Risk & Compliance

4.3.4. Data Analysis

4.3.5. Process Automation

4.3.6. Others(Alternative Data Analysis, and Smart Data Management)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Amazon Web Services, Inc.

6.2. Amelia US LLC

6.3. BlackRock, Inc.

6.4. CapitalG Management Company LLC

6.5. Charles Schwab Corp.

6.6. D. E. SHAW & CO., L.P.

6.7. Genpact

6.8. Kensho Technologies, LLC.

6.9. Lexalytics

6.10. Next Group

6.11. Palantir Technologies Inc.

6.12. PIMCO

6.13. Salesforce, Inc.

6.14. State Street Corp.

6.15. TIAA Co.

6.16. Vanguard Group, Inc.

1. Global AI in Asset Management Market Research And Analysis By Technology, 2023-2031 ($ Million)

2. Global Machine Learning For AI in Asset Management Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Natural Language Processing For AI in Asset Management Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Other Technology Processing For AI in Asset Management Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global AI in Asset Management Market Research And Analysis By Deployment Mode 2023-2031 ($ Million)

6. Global On-Premises AI in Asset Management Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Cloud-Based AI in Asset Management Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global AI in Asset Management Market Research And Analysis By Application, 2023-2031 ($ Million)

9. Global AI in Asset Management For Portfolio Optimization Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global AI in Asset Management For Conversational Platform Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global AI in Asset Management For Risk & Compliance Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global AI in Asset Management For Data Analysis Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global AI in Asset Management For Process Automation Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Global AI in Asset Management For Other Applications Market Research And Analysis By Region, 2023-2031 ($ Million)

15. Global AI in Asset Management Market Research And Analysis By Region, 2023-2031 ($ Million)

16. North American AI in Asset Management Market Research And Analysis By Country, 2023-2031 ($ Million)

17. North American AI in Asset Management Market Research And Analysis By Technology, 2023-2031 ($ Million)

18. North American AI in Asset Management Market Research And Analysis By Deployment Mode, 2023-2031 ($ Million)

19. North American AI in Asset Management Market Research And Analysis By Application, 2023-2031 ($ Million)

20. European AI in Asset Management Market Research And Analysis By Country, 2023-2031 ($ Million)

21. European AI in Asset Management Market Research And Analysis By Technology, 2023-2031 ($ Million)

22. European AI in Asset Management Market Research And Analysis By Deployment Mode, 2023-2031 ($ Million)

23. European AI in Asset Management Market Research And Analysis By Application, 2023-2031 ($ Million)

24. Asia-Pacific AI in Asset Management Market Research And Analysis By Country, 2023-2031 ($ Million)

25. Asia-Pacific AI in Asset Management Market Research And Analysis By Technology, 2023-2031 ($ Million)

26. Asia-Pacific AI in Asset Management Market Research And Analysis By Deployment Mode, 2023-2031 ($ Million)

27. Asia-Pacific AI in Asset Management Market Research And Analysis By Application, 2023-2031 ($ Million)

28. Rest Of The World AI in Asset Management Market Research And Analysis By Region, 2023-2031 ($ Million)

29. Rest Of The World AI in Asset Management Market Research And Analysis By Technology, 2023-2031 ($ Million)

30. Rest Of The World AI in Asset Management Market Research And Analysis By Deployment Mode ,2023-2031 ($ Million)

31. Rest Of The World AI in Asset Management Market Research And Analysis By Application, 2023-2031 ($ Million)

1. Global AI in Asset Management Market Share By Technology, 2023 Vs 2031 (%)

2. Global Machine Learning For AI in Asset Management Market Share By Region, 2023 Vs 2031 (%)

3. Global Natural Language Processing For AI in Asset Management Market Share By Region, 2023 Vs 2031 (%)

4. Global Other Technology For AI in Asset Management Market Share By Region, 2023 Vs 2031 (%)

5. Global AI in Asset Management Market Share By Deployment Mode 2023 Vs 2031 (%)

6. Global On-Premises AI in Asset Management Market Share By Region, 2023 Vs 2031 (%)

7. Global Cloud-Based AI in Asset Management Market Share By Region, 2023 Vs 2031 (%)

8. Global AI in Asset Management Market Share By Application, 2023 Vs 2031 (%)

9. Global AI in Asset Management For Portfolio Optimization Market Share By Region, 2023 Vs 2031 (%)

10. Global AI in Asset Management For Conversational Platform Market Share By Region, 2023 Vs 2031 (%)

11. Global AI in Asset Management For Risk & Compliance Market Share By Region, 2023 Vs 2031 (%)

12. Global AI in Asset Management For Data Analysis Market Share By Region, 2023 Vs 2031 (%)

13. Global AI in Asset Management For Process Automation Market Share By Region, 2023 Vs 2031 (%)

14. Global AI in Asset Management For Other Application Market Share By Region, 2023 Vs 2031 (%)

15. Global AI in Asset Management Market Share By Region, 2023 Vs 2031 (%)

16. US AI in Asset Management Market Size, 2023-2031 ($ Million)

17. Canada AI in Asset Management Market Size, 2023-2031 ($ Million)

18. UK AI in Asset Management Market Size, 2023-2031 ($ Million)

19. France AI in Asset Management Market Size, 2023-2031 ($ Million)

20. Germany AI in Asset Management Market Size, 2023-2031 ($ Million)

21. Italy AI in Asset Management Market Size, 2023-2031 ($ Million)

22. Spain AI in Asset Management Market Size, 2023-2031 ($ Million)

23. Rest Of Europe AI in Asset Management Market Size, 2023-2031 ($ Million)

24. India AI in Asset Management Market Size, 2023-2031 ($ Million)

25. China AI in Asset Management Market Size, 2023-2031 ($ Million)

26. Japan AI in Asset Management Market Size, 2023-2031 ($ Million)

27. South Korea AI in Asset Management Market Size, 2023-2031 ($ Million)

28. Rest Of Asia-Pacific AI in Asset Management Market Size, 2023-2031 ($ Million)

29. Latin America AI in Asset Management Market Size, 2023-2031 ($ Million)

30. Middle East And Africa AI in Asset Management Market Size, 2023-2031 ($ Million)