AI in BFSI Market

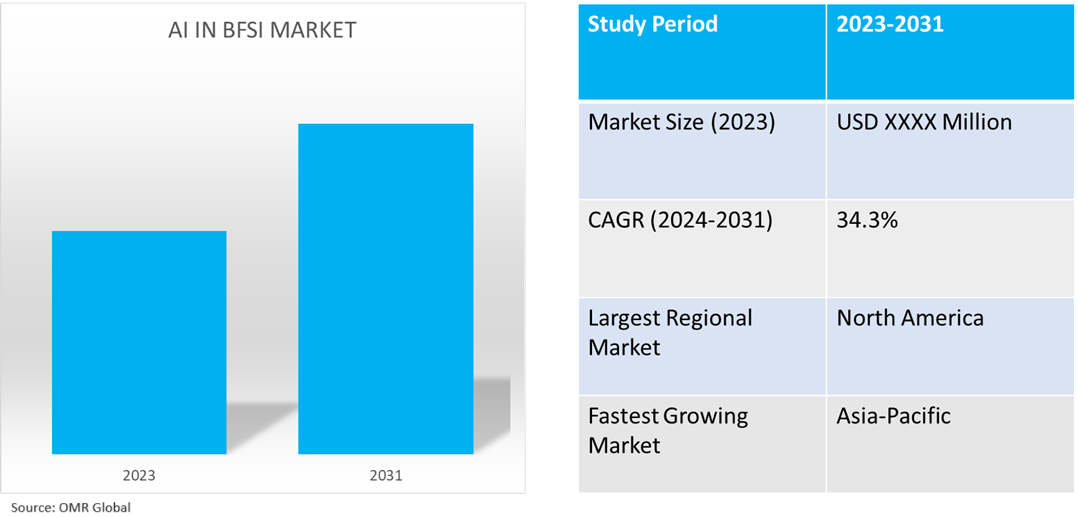

AI in BFSI Market Size, Share & Trends Analysis Report by Component (Hardware, Software, and Services), by Technology (Machine Learning (ML), Natural Language Processing (NLP) and Computer Vision), and by Application (Chatbots, Fraud Detection and Prevention, Anti-Money Laundering, Customer Relationship Management, Data Analytics and Prediction, Automating Risk Management and Others), Forecast Period (2024-2031)

AI in BFSI market is anticipated to grow at an exponential CAGR of 34.3% during the forecast period (2024-2031). The market growth is attributed to growing technological advancements such as chatbots, robo-advisors for financial products, and smart wallets with digitalization of banking services to enhance customer engagement and AI-powered virtual assistants to automate services to customers globally. According to the Organization for Economic Cooperation and Development (OECD), in 2021, growth in the deployment of AI applications is evidenced by increased global spending on AI in the private sector, coupled with increased research activity on AI technology. Global spending on AI is forecast to double over the next four years, growing from $50.1 billion in 2020 to more than $110.0 billion in 2024.

Market Dynamics

Increasing Growing Demand Advanced Tools for Fraud Detection

The BFSI industry is always facing the possibility of fraud, and Al has shown to be an effective tool in addressing this issue. Al algorithms that rely on machine learning (ML) are quite effective at detecting abnormalities and trends in enormous volumes of data that could indicate fraud. Al is also capable of real-time transaction monitoring, notifying users of questionable activity based on characteristics including transaction size, frequency, location, and timing. Anomalies in consumer behavior that could point to identity theft or account takeover can also be identified by it. Furthermore, machine learning (ML) models can continuously improve their detection skills by learning from every fraudulent incident. The capacity to identify and notify about possible fraud quickly reduces financial losses, safeguards consumers, and helps to keep the institution's credibility intact.

Increasing Integration of AI-Based Offering for Customer Experience

For BFSI companies to stand out in a competitive industry, improved customer experience is essential. Al is essential to accomplishing this goal, chatbots and virtual assistants provide individualized, round-the-clock customer care by responding to questions and addressing problems instantly. These tools provide a personalized experience by understanding and responding to natural language questions, learning from previous encounters, and even anticipating client demands. Al plays a crucial role in the creation of customized financial services and solutions. Al systems can recommend appropriate goods, forecast future needs, and offer customized financial advice based on extensive data analysis of consumer behavior, preferences, and financial history. In addition to increasing customer satisfaction, this high level of customization encourages engagement and loyalty.

Market Segmentation

- Based on the components, the market is segmented into hardware, software, and services.

- Based on the technology, the market is segmented into machine learning (ML), natural language processing (NLP), and computer vision.

- Based on the application, the market is segmented into chatbots, fraud detection and prevention, anti-money laundering, customer relationship management, data analytics and prediction, automating risk management, and others (managing investment portfolios).

Software is Projected to Hold the Largest Segment

The software segment is expected to hold the largest share of the market. The primary factors supporting the growth include rising demand for Al-powered software solutions to improve operational efficiency, customer service, risk management, and compliance. Examples of these solutions include chatbots, predictive analytics systems, robotic process automation (RPA) tools, and customer relationship management (CRM) systems. Market players delivering a cost-effective and rapid time-to-market solution for banks seeking a full end-to-end banking platform (‘front-to-back’). It helps provide an improved experience for both customers and employees, allowing a sharp focus on efficiency and productivity. For instance, in October 2023, Sopra Banking Software introduced its next-generation, modular, real-time, fully cloud-native core banking platform, marking a significant leap in the evolution of business-critical banking systems. The most comprehensive range of banking services available, the SBP Core Platform, includes key domains, including deposits, payments, lending, compliance, and regulatory reporting.

Chatbots Segment to Hold a Considerable Market Share

The chatbot segment is expected to hold a considerable share of the market. The factors supporting segment growth include an AI chatbot in BFSI offering 24/7 customer support, responding to inquiries, fixing problems, and delivering information, all of which increase consumer satisfaction and engagement. Additionally, they help boost operational efficiency by automating monotonous jobs like answering frequently asked customer questions, supplying account details, and supporting transactions. This frees up human individuals to work on more intricate and valuable tasks, which boosts output and reduces expenses. Furthermore, through the analysis of client data, comprehension of unique desires, and provision of individualized counsel or product recommendations, chatbots can offer personalized experiences. For instance, IBM Corp. offers the ultimate AI-powered banking chatbot for banking institutions to minimize pressure for digital transformation. Watson Assistant uses natural language processing (NLP) to help answer the call. Build AI-powered chatbots that deliver fast, accurate answers.

Regional Outlook

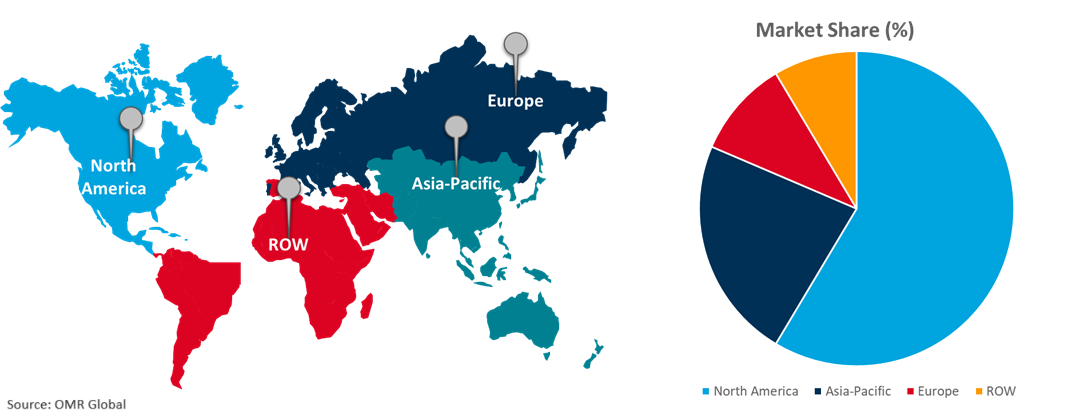

Global AI in BFSI market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Digitalization of the Banking Sector with AI Solutions in Asia-Pacific

- The regional growth is attributed to the existence of numerous multinational IT giants and innovative startups that are driving the advancement and use of Al technologies. As early users of technology, the banks and financial institutions in the region have embraced Al with an initiative to increase risk management, lower operating costs, improve services, and keep a competitive edge.

- The BFSI industry in Asia-Pacific is well established and highly digitalized, creating a favorable environment for the integration and use of Al solutions. Furthermore, regional regulatory organizations have shown that they are open to working with Al in the BFSI sector, recognizing that it enhances customer service and operational efficiency while upholding the integrity of the financial system.

Global AI in BFSI Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds a significant share owing to numerous prominent AI in BFSI companies and providers such as IBM Corp., Intel Corp., Microsoft Corp., and NVIDIA Corp. in the region. The market growth is attributed to the increasing adoption of new technologies such as chatbots, big data, and blockchain, which are predicted to revolutionize artificial intelligence in the BFSI industry, banks are constantly investing in the development of their artificial intelligence in BFSI applications. To ensure the security of online transactions, sophisticated cybersecurity safeguards, and fraud prevention systems within artificial intelligence have been developed for BFSI apps in response to the growth in digital transactions. Furthermore, financial institutions that have already made the transition to the cloud would be at an advantage when it comes to securely and safely utilizing AI technology. For instance, in October 2023, Visa Inc. announced a new $100.0 million generative AI ventures initiative to invest in the next generation of companies focused on developing generative AI technologies and applications that influence the future of commerce and payments.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the AI in BFSI market include Amazon Web Services, Inc., Google LLC, IBM Corp., Microsoft Corp., and NVIDIA Corp., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in April 2024, Odyssey Therapeutics, Inc., a biotechnology company pioneering next-generation precision medicines, announced it entered into a strategic research collaboration with Janssen Global Services, LLC, a Johnson & Johnson company, to jointly discover and optimize small molecule medicines against select therapeutic targets. The companies will combine their expertise in artificial intelligence (AI), machine learning (ML), computational chemistry, and drug discovery to unlock difficult-to-drug targets.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the AI in BFSI market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Amazon Web Services, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Google LLC

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. IBM Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Microsoft Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. NVIDIA Corp.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global AI in BFSI Market by Component

4.1.1. Hardware

4.1.2. Software

4.1.3. Services

4.2. Global AI in BFSI Market by Technology

4.2.1. Machine Learning (ML)

4.2.2. Natural Language Processing (NLP)

4.2.3. Computer Vision

4.3. Global AI in BFSI Market by Application

4.3.1. Chatbots

4.3.2. Fraud Detection and Prevention

4.3.3. Anti-Money Laundering

4.3.4. Customer Relationship Management

4.3.5. Data Analytics and Prediction

4.3.6. Automating Risk Management

4.3.7. Others (Managing investment portfolios)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Accenture PLC

6.2. Avaamo, Inc.

6.3. Boston Consulting Group, Inc.

6.4. Brighterion Inc.

6.5. Capgemini SE

6.6. DataRobot, Inc.

6.7. Finastra

6.8. HCLTech Ltd.

6.9. HighRadius Corporation

6.10. Inbenta Technologies Inc.

6.11. Intel Corporation

6.12. Kasisto, Inc.

6.13. Ocrolus Inc.

6.14. Palantir Technologies Inc.

6.15. Persistent Systems Ltd.

6.16. SAP SE

6.17. Signifyd, Inc.

6.18. Simplifai AS

6.19. Temenos AG

6.20. Upstart Network, Inc.

6.21. ZestFinance Inc.

1. GLOBAL AI IN BFSI MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

2. GLOBAL AI HARDWARE IN BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL AI SOFTWARE IN BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL AI SERVICES IN BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL AI IN BFSI MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

6. GLOBAL MACHINE LEARNING (ML) IN BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL NATURAL LANGUAGE PROCESSING (NLP) IN BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL COMPUTER VISION IN BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL AI IN BFSI MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

10. GLOBAL AI IN BFSI CHATBOTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL AI IN BFSI FRAUD DETECTION AND PREVENTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL AI IN BFSI ANTI-MONEY LAUNDERING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL AI IN BFSI CUSTOMER RELATIONSHIP MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL AI IN BFSI DATA ANALYTICS AND PREDICTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL AI IN BFSI AUTOMATING RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL AI IN BFSI FOR OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL AI IN BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. NORTH AMERICAN AI IN BFSI MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. NORTH AMERICAN AI IN BFSI MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

20. NORTH AMERICAN AI IN BFSI MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

21. NORTH AMERICAN AI IN BFSI MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

22. EUROPEAN AI IN BFSI MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. EUROPEAN AI IN BFSI MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

24. EUROPEAN AI IN BFSI MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

25. EUROPEAN AI IN BFSI MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC AI IN BFSI MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC AI IN BFSI MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC AI IN BFSI MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC AI IN BFSI MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

30. REST OF THE WORLD AI IN BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

31. REST OF THE WORLD AI IN BFSI MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

32. REST OF THE WORLD AI IN BFSI MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

33. REST OF THE WORLD AI IN BFSI MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL AI IN BFSI MARKET SHARE BY COMPONENT, 2023 VS 2031 (%)

2. GLOBAL AI HARDWARE IN BFSI MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL AI SOFTWARE IN BFSI MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL AI SERVICES IN BFSI MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL AI IN BFSI MARKET SHARE BY TECHNOLOGY, 2023 VS 2031 (%)

6. GLOBAL MACHINE LEARNING (ML) IN BFSI MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL COMPUTER VISION IN BFSI MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL MACHINE LEARNING (ML) IN BFSI MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL AI IN BFSI MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

10. GLOBAL AI IN BFSI CHATBOTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL AI IN BFSI FRAUD DETECTION AND PREVENTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

12. GLOBAL AI IN BFSI ANTI-MONEY LAUNDERING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

13. GLOBAL AI IN BFSI CUSTOMER RELATIONSHIP MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

14. GLOBAL AI IN BFSI DATA ANALYTICS AND PREDICTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

15. GLOBAL AI IN BFSI AUTOMATING RISK MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

16. GLOBAL AI IN BFSI FOR OTHERS APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

17. GLOBAL AI IN BFSI MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. US AI IN BFSI MARKET SIZE, 2023-2031 ($ MILLION)

19. CANADA AI IN BFSI MARKET SIZE, 2023-2031 ($ MILLION)

20. UK AI IN BFSI MARKET SIZE, 2023-2031 ($ MILLION)

21. FRANCE AI IN BFSI MARKET SIZE, 2023-2031 ($ MILLION)

22. GERMANY AI IN BFSI MARKET SIZE, 2023-2031 ($ MILLION)

23. ITALY AI IN BFSI MARKET SIZE, 2023-2031 ($ MILLION)

24. SPAIN AI IN BFSI MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF EUROPE AI IN BFSI MARKET SIZE, 2023-2031 ($ MILLION)

26. INDIA AI IN BFSI MARKET SIZE, 2023-2031 ($ MILLION)

27. CHINA AI IN BFSI MARKET SIZE, 2023-2031 ($ MILLION)

28. JAPAN AI IN BFSI MARKET SIZE, 2023-2031 ($ MILLION)

29. SOUTH KOREA AI IN BFSI MARKET SIZE, 2023-2031 ($ MILLION)

30. REST OF ASIA-PACIFIC AI IN BFSI MARKET SIZE, 2023-2031 ($ MILLION)

31. REST OF THE WORLD AI IN BFSI MARKET SIZE, 2023-2031 ($ MILLION)

32. LATIN AMERICA AI IN BFSI MARKET SIZE, 2023-2031 ($ MILLION)

33. MIDDLE EAST AND AFRICA AI IN BFSI MARKET SIZE, 2023-2031 ($ MILLION)