AI in Defense Market

AI in Defense Market Size, Share & Trends Analysis Report by Component (Hardware, Software, and Services), by Platform (Air, Land, Naval, and Space), and by Application (Cyber Security, Logistics & Transportation, Simulation & Training, Battlefield Healthcare, Threat Monitoring, Surveillance and Situational Awareness, Command & Control, Simulation & Training, Threat/Target Tracking and Monitoring, Information Processing, and Others), Forecast Period (2024-2031)

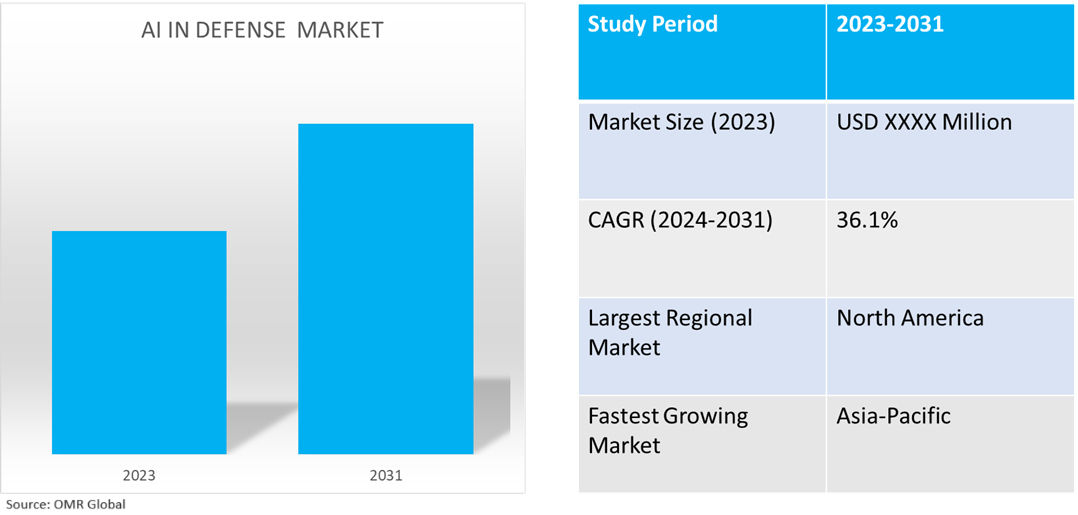

AI in defense market is anticipated to grow at an exponential CAGR of 36.1% during the forecast period (2024-2031). The market growth is attributed to the increasing adoption of modern Al-enabled systems that improve military systems' effectiveness and fortify their capabilities in areas of warfare globally. Emerging countries leverage AI across various domains, revolutionizing threat assessment, logistics optimization, cybersecurity, and surveillance with AI-powered UAVs with investment in AI in defense. For instance, in January 2024, according to the Observer Research Foundation (ORF), the Ministry of Defence (MoD) committed an annual budget of INR 100.0 crore ($12.0 million) for the next five years to the Defence Artificial Intelligence Project Agency (DAIPA).

Market Dynamics

Development of Advanced and Sophisticated Defense Equipment

To effectively tackle emerging threats to national security, militaries concentrate on developing and implementing innovative and complex equipment. The development of directed energy weaponry, space militarization, and hypersonic travel are a few recent instances. International military agencies are spending money on electrification methods for the battlefield. The value of electronic warfare systems has increased as a result. As a result, more goods are being introduced into the defense military market, such as RF jammers and anti-drone systems. In these circumstances, AI-enabled drones can also be useful. They can keep an eye on border regions, identify dangers, and notify response teams. They can also improve the defenses of military installations and make soldiers safer during conflict.

Artificial Intelligence in the Surveillance, Intelligence, and Reconnaissance Mission

Artificial Intelligence enhanced computational military reasoning for surveillance, intelligence, and reconnaissance (IS) missions. Machine learning aids in the analysis of new military product iterations and provides military equipment and other asset upkeep that is intuitive. The acceptance of self-organizing intelligence systems is one of the key new developments in defense strategy and policy. As a result, these systems can cooperate to achieve a strategic defense objective. The Portable Ground Surveillance Radar by Shoghi is a defense communications equipment that makes use of AI-powered multi-sensor integration software. It has a user-friendly interface and an adjustable alarm system that promptly detects, categorizes, and assesses the locations of potential threats.

Market Segmentation

- Based on the components, the market is segmented into hardware, software, and services.

- Based on the platform, the market is segmented into air, land, naval, and space.

- Based on the application, the market is segmented into cyber security, logistics & transportation, simulation & training, battlefield healthcare, threat monitoring, surveillance and situational awareness, command & control, simulation & training, threat/target tracking and monitoring, information processing, and other (warfare platforms).

Software is Projected to Hold the Largest Segment

The software segment is expected to hold the largest share of the market. The primary factors supporting the growth include the increasing demand for Al-powered software solutions to develop modern Al applications and related software development kits. To provide an intelligent response, the software gathers information from hardware systems and Al systems' processes. Voice and speech recognition, virtual assistant, and machine learning are all included in the Al software. These technologies enable operators in the field to leverage AI insights to make decisions across many fused domains. For instance, in July 2022, the US Army Research Lab expanded its artificial intelligence and machine learning contract with Palantir for $99.9 million. Palantir’s platform has supported the integration, management, and deployment of relevant data and AI model training to all of the Armed Services, COCOMs, and special operators. This extension grows Palantir’s operational RDT&E work to more users globally.

Cyber Security Segment to Hold a Considerable Market Share

The cyber security segment is expected to hold a considerable share of the market. The factors supporting segment growth include increasing adoption of AI-based support incident response, swiftly assessing assaults, making remedial recommendations, and automating damage-minimization solutions. Machine learning algorithms that examine email content, sender behavior, and software features to identify and stop risks, and enhance the detection of malware and phishing attempts. Market players upgrading their AI-based offering to proactively defend against advanced attacks and stay ahead of emerging threats. For instance, in August 2023, BlackBerry Ltd., announced a major update to its patented Cylance® AI engine, marking a significant leap forward in predicting cyberattacks for proactive cyber defense. Predictive cybersecurity is necessary for emerging cyber risks and is seen as the future of cybersecurity. BlackBerry's Cylance AI has unfailingly protected businesses and governments globally from cyberattacks since its inception, with a multi-year predictive advantage.

Regional Outlook

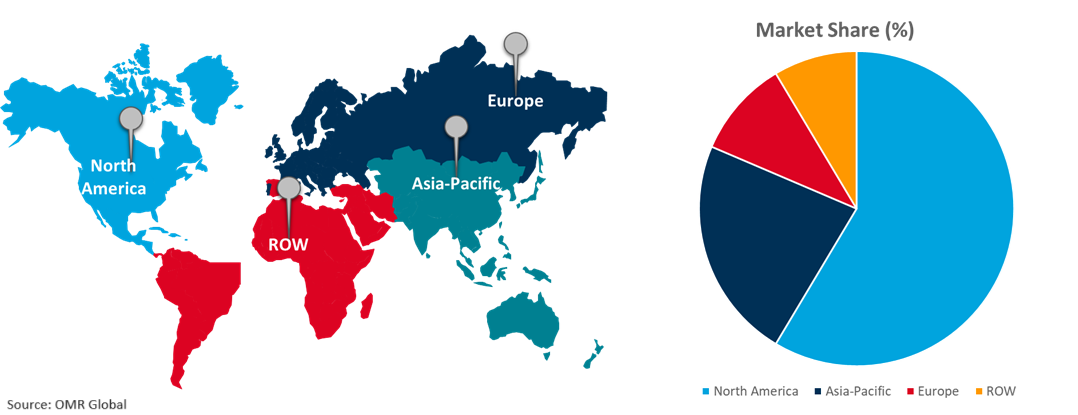

Global AI in the defense market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Adoption of AI in the Defense Sector in Asia-Pacific

- The regional growth is attributed to countries such as China, South Korea, and India are known to be developing capabilities to weaponize AI by investing more in their defense budget. For instance, in March 2023, the State Council Information Office (SCIO) of the People's Republic of China, China's 2023 defense budget to increase by 7.2%. The planned defense spending is 1.6 trillion yuan (about $224.8 billion) in 2023. Its increased defense expenditure helps provide Chinese forces with better training and more advanced equipment. It also supports the military in tackling non-conventional security threats such as major pandemics and natural disasters, extending helping hands to people in need in and outside of China.

- In July 2022, the Ministry of Defence (Government of India) introduced 75 newly developed artificial intelligence (AI) products/technologies during the first-ever ‘AI in Defence’ (AIDef) symposium and exhibition. These include AI platform automation, autonomous/unmanned/robotics systems, blockchain-based automation, command, control, communication, computer & intelligence, surveillance & reconnaissance, cyber security, human behavioral analysis, intelligent monitoring systems, lethal autonomous weapon systems, logistics, and supply chain management, operational data analytics, manufacturing and maintenance, simulators/test equipment and speech/voice analysis using natural language processing.

Global AI in Defense Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds a significant share owing to numerous prominent AI in defense companies and providers such as General Dynamics Mission Systems, Inc., IBM Corp., L3Harris Technologies, Inc., and Lockheed Martin Corp. in the region. The expansion of the market in the region is driven by rising US Department of Defense spending on R&D for advanced defense equipment and rising purchases of Al-enabled gadgets for defense operations. For instance, in May 2023, NSF announced seven new National Artificial Intelligence Research Institutes. The US National Science Foundation, in collaboration with other federal agencies, higher education institutions, and other stakeholders, announced a $140.0 million investment to establish seven new National Artificial Intelligence Research Institutes. The team of researchers works with experts in security operations to develop a revolutionary approach to cybersecurity, in which AI-enabled intelligent security agents cooperate with humans across the cyber defense life cycle to jointly, improve the resilience of security of computer systems over time.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the AI in defense market include BAE Systems Plc., IBM Corporation, L3Harris Technologies, Inc., Lockheed Martin Corporation, and Thales Group, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in August 2023, the Department of Defense (DoD) announced the establishment of a generative artificial intelligence (AI) task force, an initiative that reflects the DoD's commitment to harnessing the power of artificial intelligence responsibly and strategically. The adoption of generative AI models while identifying proper protective measures and mitigating national security risks that may result from issues such as poorly managed training data.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the AI in defense market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. BAE Systems Plc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. IBM Corporation

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. L3Harris Technologies, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Lockheed Martin Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Thales Group

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global AI in Defense Market by Component

4.1.1. Hardware

4.1.2. Software

4.1.3. Services

4.2. Global AI in Defense Market by Platform

4.2.1. Air

4.2.2. Land

4.2.3. Naval

4.2.4. Space

4.3. Global AI in Defense Market by Application

4.3.1. Cyber Security

4.3.2. Logistics & Transportation

4.3.3. Simulation & Training

4.3.4. Battlefield Healthcare

4.3.5. Threat Monitoring

4.3.6. Surveillance and Situational Awareness

4.3.7. Command & Control

4.3.8. Simulation & Training

4.3.9. Threat/Target Tracking and Monitoring

4.3.10. Information Processing

4.3.11. Other (Warfare Platforms)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Airbus SE

6.2. Anduril Industries, Inc.

6.3. AURORA FLIGHT SCIENCES

6.4. Axon Vision

6.5. C3.ai, Inc.

6.6. Epirus Inc.

6.7. General Dynamics Mission Systems, Inc.

6.8. HERMEUS CORPORATION

6.9. Honeybee Robotics

6.10. Kratos Defense & Security Solutions, Inc.

6.11. Leidos, Inc.

6.12. Northrop Grumman Corporation

6.13. Planet Labs PBC

6.14. Rebellion Defense, Inc.

6.15. RTX Corporation

6.16. SAIC

6.17. Shoghi Communications Ltd.

6.18. The Boeing Company

6.19. The General Electric Company

1. GLOBAL AI IN DEFENSE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

2. GLOBAL AI HARDWARE IN DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL AI SOFTWARE IN DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL AI SERVICES IN DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL AI IN DEFENSE MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2023-2031 ($ MILLION)

6. GLOBAL AI IN AIR DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL AI IN LAND DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL AI IN NAVAL DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL AI IN SPACE DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL AI IN DEFENSE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

11. GLOBAL AI IN DEFENSE CYBER SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL AI IN DEFENSE LOGISTICS & TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL AI IN DEFENSE SIMULATION & TRAINING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL AI IN DEFENSE BATTLEFIELD HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL AI IN DEFENSE THREAT MONITORING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL AI IN DEFENSE SURVEILLANCE AND SITUATIONAL AWARENESS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL AI IN DEFENSE COMMAND & CONTROL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL AI IN DEFENSE THREAT/TARGET TRACKING AND MONITORING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL AI IN DEFENSE INFORMATION PROCESSING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. GLOBAL AI IN DEFENSE FOR OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. GLOBAL AI IN DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. NORTH AMERICAN AI IN DEFENSE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. NORTH AMERICAN AI IN DEFENSE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

24. NORTH AMERICAN AI IN DEFENSE MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2023-2031 ($ MILLION)

25. NORTH AMERICAN AI IN DEFENSE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

26. EUROPEAN AI IN DEFENSE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

27. EUROPEAN AI IN DEFENSE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

28. EUROPEAN AI IN DEFENSE MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2023-2031 ($ MILLION)

29. EUROPEAN AI IN DEFENSE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC AI IN DEFENSE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC AI IN DEFENSE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

32. ASIA-PACIFIC AI IN DEFENSE MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2023-2031 ($ MILLION)

33. ASIA-PACIFIC AI IN DEFENSE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

34. REST OF THE WORLD AI IN DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

35. REST OF THE WORLD AI IN DEFENSE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

36. REST OF THE WORLD AI IN DEFENSE MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2023-2031 ($ MILLION)

37. REST OF THE WORLD AI IN DEFENSE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL AI IN DEFENSE MARKET SHARE BY COMPONENT, 2023 VS 2031 (%)

2. GLOBAL AI HARDWARE IN DEFENSE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL AI SOFTWARE IN DEFENSE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL AI SERVICES IN DEFENSE MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL AI IN DEFENSE MARKET SHARE BY PLATFORM, 2023 VS 2031 (%)

6. GLOBAL AI IN AIR DEFENSE MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL AI IN LAND DEFENSE MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL AI IN NAVAL DEFENSE MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL AI IN SPACE DEFENSE MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL AI IN DEFENSE MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

11. GLOBAL AI IN DEFENSE CYBER SECURITY MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL AI IN DEFENSE LOGISTICS & TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

13. GLOBAL AI IN DEFENSE SIMULATION & TRAINING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

14. GLOBAL AI IN DEFENSE BATTLEFIELD HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

15. GLOBAL AI IN DEFENSE THREAT MONITORING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

16. GLOBAL AI IN DEFENSE SURVEILLANCE AND SITUATIONAL AWARENESS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

17. GLOBAL AI IN DEFENSE COMMAND & CONTROL MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

18. GLOBAL AI IN DEFENSE THREAT/TARGET TRACKING AND MONITORING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

19. GLOBAL AI IN DEFENSE INFORMATION PROCESSING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

20. GLOBAL AI IN DEFENSE FOR OTHERS APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

21. GLOBAL AI IN DEFENSE MARKET SHARE BY REGION, 2023 VS 2031 (%)

22. US AI IN DEFENSE MARKET SIZE, 2023-2031 ($ MILLION)

23. CANADA AI IN DEFENSE MARKET SIZE, 2023-2031 ($ MILLION)

24. UK AI IN DEFENSE MARKET SIZE, 2023-2031 ($ MILLION)

25. FRANCE AI IN DEFENSE MARKET SIZE, 2023-2031 ($ MILLION)

26. GERMANY AI IN DEFENSE MARKET SIZE, 2023-2031 ($ MILLION)

27. ITALY AI IN DEFENSE MARKET SIZE, 2023-2031 ($ MILLION)

28. SPAIN AI IN DEFENSE MARKET SIZE, 2023-2031 ($ MILLION)

29. REST OF EUROPE AI IN DEFENSE MARKET SIZE, 2023-2031 ($ MILLION)

30. INDIA AI IN DEFENSE MARKET SIZE, 2023-2031 ($ MILLION)

31. CHINA AI IN DEFENSE MARKET SIZE, 2023-2031 ($ MILLION)

32. JAPAN AI IN DEFENSE MARKET SIZE, 2023-2031 ($ MILLION)

33. SOUTH KOREA AI IN DEFENSE MARKET SIZE, 2023-2031 ($ MILLION)

34. REST OF ASIA-PACIFIC AI IN DEFENSE MARKET SIZE, 2023-2031 ($ MILLION)

35. REST OF THE WORLD AI IN DEFENSE MARKET SIZE, 2023-2031 ($ MILLION)

36. LATIN AMERICA AI IN DEFENSE MARKET SIZE, 2023-2031 ($ MILLION)

37. MIDDLE EAST AND AFRICA AI IN DEFENSE MARKET SIZE, 2023-2031 ($ MILLION)