Artificial Intelligence (AI) in Diagnostics Market

Artificial Intelligence (AI) in Diagnostics Market Size, Share & Trends Analysis Report by Type (Vitro Diagnostics, and Diagnostic Imaging), by Application (Cardiology, Oncology, Neurology, Obstetrics and Gynecology, and Others), and by End User (Hospitals, Diagnostics Imaging Centers, and Diagnostics Laboratories), Forecast Period (2023-2030) Update Available - Forecast 2025-2035

AI in diagnostics market is anticipated to grow at a CAGR of 23. 5% during the forecast period (2023–2030). The expansion of the market is driven by the global reduction in healthcare expenses. The implementation of AI for early disease detection contributes to significant financial savings. As the early detection has the potential to reduce the necessity for expensive therapies and can hamper the progression of diseases. Medical costs can also be reduced by employing AI technology in that manner.

In line with this trend, industry stakeholders are introducing novel offerings to meet the growing demand for AI-based disease detection solutions. For instance, in May 2023, Aegis and Northwell collaboratively launched Optain with $12 million for AI-powered disease detection. Optain is the brainchild of Ascertain, which is also the first company to introduce Ascertain. Ascertain is a company creation platform that launched in 2022 with $100 million as a joint venture between Aegis Ventures and Northwell Holdings. Ascertain's upcoming projects will revolve exclusively around joining the potential of AI to enhance healthcare accessibility and elevate the caliber of care provided. As far as Optain is concerned, it is an AI tool which will identify initial indications of diseases solely through images of a patient's eye.

Segmental Outlook

The global AI in diagnostics Market is segmented by type, application, and end-user. Based on type, the market is sub-segmented into in vitro diagnostics and diagnostic imaging. Based on the application, the market is sub-segmented into cardiology, oncology, neurology, obstetrics and gynecology, and others. Further, on the basis of end user, the market is sub-segmented into hospitals, diagnostic imaging centers, and diagnostic laboratories. Among the type segment, the in vitro diagnostics sub-segment is anticipated to hold a considerable share of the market owing to the fact that the medical and healthcare industries are increasingly utilizing AI solutions to reduce the potential for human errors and enhance treatment outcomes.

The Neurology Sub-Segment is Anticipated to Hold a Considerable Share of the Global Artificial Intelligence (AI) in Diagnostics Market

Among the applications, the neurology sub-segment is expected to hold a considerable share of the global artificial intelligence in diagnostics market. A neurologist is a physician who focuses on identifying and treating diseases affecting the brain, spinal cord, and nerves. Considering both common and difficult neurological diseases, they can assist in determining the cause of symptoms and developing a treatment strategy. Instruments, including lights and reflex hammers, can be used during a neurological exam to evaluate the nervous system. AI-based tools have the potential to transform health care, enabling faster and more accurate diagnosis, personalized treatment plans, new therapeutic approaches and effective disease monitoring. Thus, the primary factor supporting the market growth includes the increased demand for more precise and accurate diagnosis and results, globally. Neuroimaging data can be analyzed using AI algorithms to identify abnormalities and patterns that the human eye can overlook. This can result in earlier and more precise diagnoses, further propelling market players to develop AI-based solutions for diagnosing neurological disorders. For instance, in April 2023, TeraRecon launched the AI-Powered Neuro Suite. Radiologists can utilize a number of AI-powered neuroimaging modalities from top neurology suppliers, such as Combinostics, Imaging Biometrics, and Cercare Medical, using the Neuro Suite platform.

Regional Outlook

The global artificial intelligence in diagnostics market is further segmented based on geography, including North America (the US and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and the Rest of Asia), and the Rest of the World (the Middle East and Africa, and Latin America). Among these, the Asia-Pacific is anticipated to hold a prominent share of the market across the globe, owing to the increased public and private initiatives to promote the use of AI-based diagnostic solutions. Additionally, the development of entrepreneurs along with the growing investment and awareness have promoted the expansion of the regional market.

Global Artificial Intelligence (AI) in Diagnostics Market Growth by Region 2023-2030

The North America Region is Expected to Grow at a Significant CAGR in the Global Artificial Intelligence in Diagnostics Market

Among all regions, North America is anticipated to grow at a considerable CAGR over the forecast period. The regional growth is attributed to the rising prevalence of chronic diseases within the country and the expanding integration of advanced technology in healthcare systems. AI in Diagnostics has emerged as a potential tool to navigate the analysis of extensive medical data, leading to the early detection of chronic diseases and the capacity to develop individualized treatments.

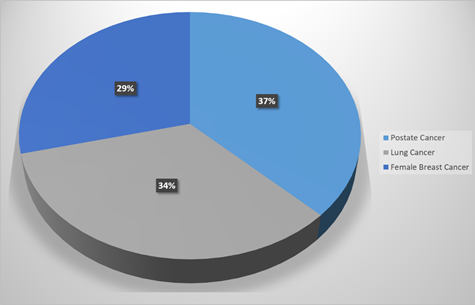

The increasing prevalence of chronic diseases across the region has created a favorable environment for market expansion. For instance, in January 2022, the American Cancer Society reports that the US is projected to witness the diagnosis of approximately 1.9 million new cancer cases. Out of which, prostate cancer cases are projected to reach 186,670, lung cancer cases to total 169,870, and female breast cancer cases to amount 144,490 in the upcoming year. Accurate diagnosis and treatment have grown more important as the prevalence of cancer and other chronic diseases rises. It is anticipated that such actions can promote the utilization of AI for early diagnosis, resulting in market growth.

Numbers of Cancer Cases in US, 2022 (%)

Market Players Outlook

The major companies serving the AI in diagnostics market include Aidoc Medical Ltd., Digital Diagnostics Inc., IMAGEN, InformAI, LLC, Nano-x Imaging Ltd., and others. The market players are considerably contributing to market growth through the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in August 2022, Indica Labs and The Industrial Centre for AI Research in Digital Diagnostics (iCAIRD) signed an agreement to collaborate on creating a digital pathology system powered by AI that can identify cancer in lymph nodes after colorectal surgery.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global AI in diagnostics market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. AliveCor, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. GE HealthCare Technologies Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Siemens Healthineers

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Artificial Intelligence (AI) in Diagnostics Market by Type

4.1.1. Vitro Diagnostics

4.1.2. Diagnostic Imaging

4.2. Global Artificial Intelligence (AI) in Diagnostics Market by Application

4.2.1. Cardiology

4.2.2. Oncology

4.2.3. Neurology

4.2.4. Obstetrics and Gynecology

4.2.5. Others (Ophthalmology, Specialty, Radiology)

4.3. Global Artificial Intelligence (AI) in Diagnostics Market by End User

4.3.1. Hospitals

4.3.2. Diagnostics Imaging Centers

4.3.3. Diagnostics Laboratories

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Aidoc Medical Ltd.

6.2. Digital Diagnostics Inc.

6.3. IMAGEN

6.4. InformAI, LLC

6.5. Nano-x Imaging Ltd.

6.6. Northwell Health

6.7. NovaSignal Corp.

6.8. Riverain Technologies

6.9. Silicon Mechanics

6.10. VUNO Inc.

1. GLOBAL AI IN DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

2. GLOBAL AI IN VITRO DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

3. GLOBAL AI IN DIAGNOSTIC IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL AI IN DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

5. GLOBAL AI IN DIAGNOSTICS FOR CARDIOLOGY MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

6. GLOBAL AI IN DIAGNOSTICS FOR ONCOLOGY MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

7. GLOBAL AI IN DIAGNOSTICS FOR NEUROLOGY MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

8. GLOBAL AI IN DIAGNOSTICS FOR OBSTETRICS AND GYNECOLOGY MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

9. GLOBAL AI IN DIAGNOSTICS FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

10. GLOBAL AI IN DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY END USER, 2022-2030 ($ MILLION)

11. GLOBAL AI IN DIAGNOSTICS FOR HOSPITALS MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

12. GLOBAL AI IN DIAGNOSTICS FOR DIAGNOSTICS IMAGING CENTERS MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

13. GLOBAL AI IN DIAGNOSTICS FOR DIAGNOSTICS LABORATORIES MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

14. GLOBAL AI IN DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. NORTH AMERICAN AI IN DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

16. NORTH AMERICAN AI IN DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

17. NORTH AMERICAN AI IN DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

18. NORTH AMERICAN AI IN DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY END USER, 2022-2030 ($ MILLION)

19. EUROPEAN AI IN DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

20. EUROPEAN AI IN DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

21. EUROPEAN AI IN DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

22. EUROPEAN AI IN DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY END USER, 2022-2030 ($ MILLION)

23. ASIA- PACIFIC AI IN DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

24. ASIA- PACIFIC AI IN DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

25. ASIA- PACIFIC AI IN DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

26. ASIA- PACIFIC AI IN DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY END USER, 2022-2030 ($ MILLION)

27. REST OF THE WORLD AI IN DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

28. REST OF THE WORLD AI IN DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

29. REST OF THE WORLD AI IN DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

30. REST OF THE WORLD AI IN DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY END USER, 2022-2030 ($ MILLION)

1. GLOBAL AI IN DIAGNOSTICS MARKET SHARE BY TYPE, 2022 VS 2030 (%)

2. GLOBAL AI IN VITRO DIAGNOSTICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL AI IN DIAGNOSTIC IMAGING MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL AI IN DIAGNOSTICS MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

5. GLOBAL AI IN DIAGNOSTICS FOR CARDIOLOGY MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL AI IN DIAGNOSTICS FOR ONCOLOGY MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL AI IN DIAGNOSTICS FOR NEUROLOGY MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL AI IN DIAGNOSTICS FOR OBSTETRICS AND GYNECOLOGY MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL AI IN DIAGNOSTICS FOR OTHER APPLICATIONS MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL AI IN DIAGNOSTICS MARKET SHARE ANALYSIS BY END USER, 2022-2030 ($ MILLION)

11. GLOBAL AI IN DIAGNOSTICS FOR HOSPITALS MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL AI IN DIAGNOSTICS FOR DIAGNOSTICS IMAGING CENTERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL AI IN DIAGNOSTICS FOR DIAGNOSTICS LABORATORIES MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. GLOBAL AI IN DIAGNOSTICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. US AI IN DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

16. CANADA AI IN DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

17. UK AI IN DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

18. FRANCE AI IN DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

19. GERMANY AI IN DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

20. ITALY AI IN DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

21. SPAIN AI IN DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

22. REST OF EUROPE AI IN DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

23. INDIA AI IN DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

24. CHINA AI IN DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

25. JAPAN AI IN DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

26. SOUTH KOREA AI IN DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

27. REST OF ASIA-PACIFIC AI IN DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

28. REST OF THE WORLD AI IN DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)