AI in Drug Discovery Market

AI in Drug Discovery Market Size, Share & Trends Analysis Report by Component (Software and Services), by Therapeutic Area (Oncology, Infectious Diseases, Neurology, Metabolic Diseases, Cardiovascular Diseases, Immunology, and others), by Application (Drug Optimization and Repurposing, Preclinical Testing and Drug Screening) and by End-Users (Pharmaceutical & Biotechnology Companies, Contract Research Organizations (CROs) and Research Centers and Academic & Government Institutes), Forecast Period (2024-2031)

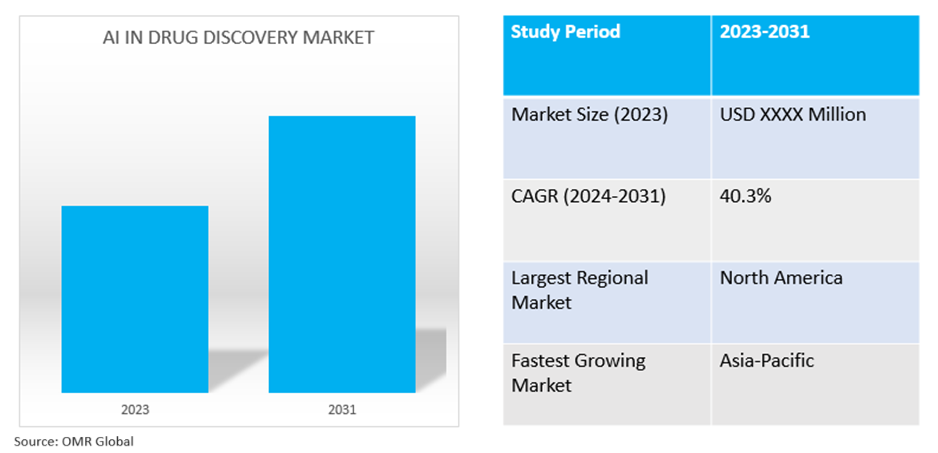

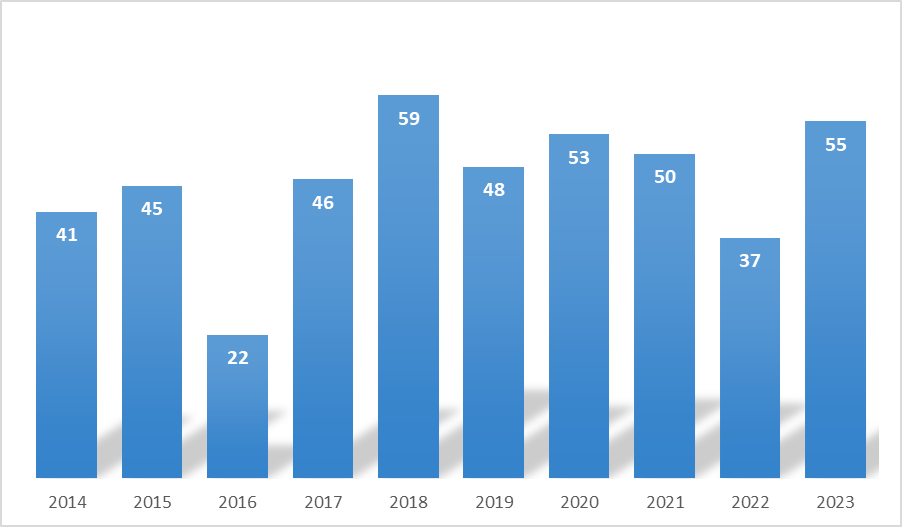

AI in drug discovery market is anticipated to grow at an exponential CAGR of 40.3% during the forecast period (2024-2031). The market growth is attributed to the increased demand for drug optimization, impactful target emphasis, and virtual screening, Al speeds up research by encouraging more diverse testing globally. According to the US Food and Drug Administration (FDA) Center for Drug Evaluation and Research (CDER), in 2023, 55 novel drugs were approved and marketed in the US. In 2023, 28 of 55, or 51.0% of novel drug approvals received orphan drug designation as they target rare diseases, including degenerative disease that damages the nervous system, Candidemia, and invasive candidiasis, which are serious and life-threatening fungal infections, Rett syndrome, a genetic, neurological disorder that affects brain development.

Market Dynamics

Increasing Role of Machine Learning (ML) in Predicting Drug Efficacy and Toxicity

Predicting the toxicity and efficacy of possible therapeutic molecules is one of the main uses of AI in medicinal chemistry. Traditional drug development methods frequently depend on labor-intensive and time-consuming experiments to evaluate a compound's possible effects on the human body. These restrictions can be solved by AI methods such as machine learning. ML algorithms can spot patterns and trends that human researchers would miss based on the examination of copious amounts of data. In comparison to employing traditional techniques, this can allow the proposal of new bioactive substances with minimal side effects in a significantly faster manner.

Center for Drug Evaluation and Research (CDER), Annual Novel Drug Approvals (2014–2023)

Source: US Food and Drug Administration, (US FDA)

Integration of AI in Drug Discovery Process and Potential Cost Savings

Developing new molecules with characteristics and functions is another important way that AI is being used in medication discovery. Conventional techniques frequently rely on the labor- and slow-intensive process of identifying and modifying already-existing molecules. On the other hand, AI-based methods can make it possible to build new compounds quickly and effectively with desired characteristics and activities. For instance, to propose new therapeutic drug molecules with desirable properties such as solubility and activity, a deep learning (DL) algorithm was recently trained on a dataset of known drug compounds and their corresponding properties. This shows the potential of these methods for the quick and effective design of new drug candidates.

Market Segmentation

- Based on the component, the market is segmented into software and services.

- Based on the therapeutic area, the market is segmented into oncology, infectious diseases, neurology, metabolic diseases, cardiovascular diseases, immunology, and other (inflammatory diseases).

- Based on the application, the market is segmented into drug optimization and repurposing, preclinical testing, and drug screening.

- Based on the end-users, the market is segmented into pharmaceutical & biotechnology companies, contract research organizations (CROs) and research centers, and academic & government institutes.

Oncology is Projected to Hold the Largest Segment

The oncology segment is expected to hold the largest share of the market. The primary factors supporting the growth include enhancing current AI systems that are made to sift through massive data sets and derive insight. AI can be leveraged to provide patients with individualized treatments. In addition to providing patient histories and genetic sequences, scans can be used to establish a pattern for early cancer detection and patient-specific medication delivery. For instance, in April 2024, the National Institutes of Health (NIH) developed an artificial intelligence (AI) tool that uses data from individual cells inside tumors to predict whether a person’s cancer will respond to a specific drug. In the new study, the researchers investigated whether they could use a machine learning technique called transfer learning to train an AI model to predict drug responses using widely available bulk RNA sequencing data, but then fine-tune that model using single-cell RNA sequencing data.

Drug Optimization and Repurposing Segment to Hold a Considerable Market Share

The drug optimization and repurposing segment is expected to hold a considerable share of the market. Drug efficacy, as well as side effects, can be researched using innovative AI systems such as Deep Learning (DL) and drug modeling. The development of AI technology has also facilitated the study, comparison, and repurposing of medications into more efficient forms, reducing adverse effects and increasing overall efficacy. For instance, in January 2024 Accenture announced it has made a strategic investment, through Accenture Ventures, in QuantHealth, an AI-powered clinical trial design company that simulates clinical trials in the cloud, allowing pharmaceutical and biotech companies to more quickly and cost-effectively develop treatments for patients. By simulating trials at scale, QuantHealth’s platform can lower risks, and expedite, and optimize drug development.

Regional Outlook

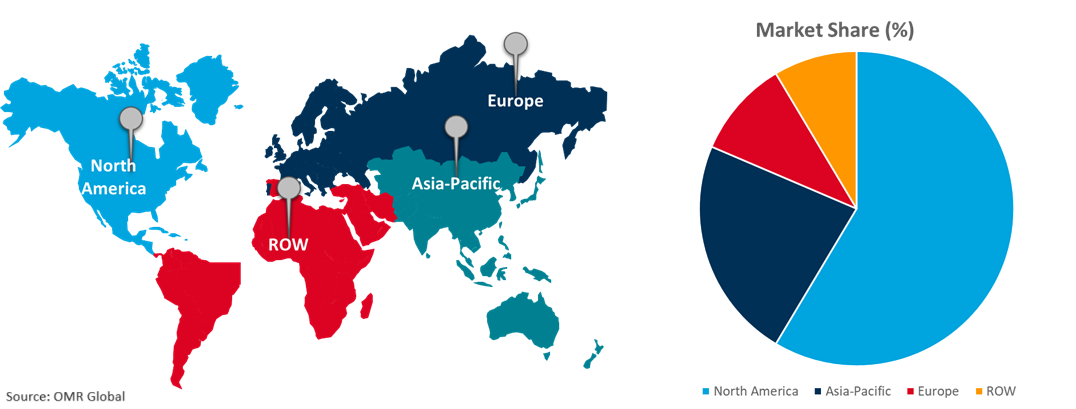

Global AI in drug discovery market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Research and Pharmaceutical & Biotechnology Companies in Asia-Pacific

- The Asia-Pacific market is expected to grow as a result of rising government financing for research and precision medicine programs in countries such as South Korea, China, and India, as well as a rise in the use of Al-based technologies in drug discovery research and development by significant pharmaceutical businesses operating in the area. The region's standing in the Al drug discovery market is further strengthened by its commitment to promoting innovation through partnerships between industry, academia, and technology providers.

- According to the India Brand Equity Foundation, Biotechnology Presentation Industry Report, in December 2023, the Indian biotechnology industry is expected to reach $150.0 billion by 2025. India's vaccine industry can grow from $2.0 billion to $5.0 billion, as new Indian and global pharmaceutical companies are including vaccines as a key part of their portfolios. India has 665 FDA-approved plants in the US. 44.0% of the global abbreviated new drug applications (ANDA) and more than 1,400 manufacturing plants are compliant with (World Health Organization) WHO requirements. The Department of Biotechnology has 1,484 ongoing projects.

Global AI in Drug Discovery Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds a significant share owing to numerous prominent AI in drug discovery companies and providers such as NuMedii, Inc., NVIDIA Corp., Recursion Pharmaceuticals Inc., Schrödinger, Inc., and XtalPi Inc. in the region. The market growth is attributed to increasing medication research, design, and repurposing, major US IT corporations have collaborated with esteemed institutes. AI is also being used to analyze diseases and draw relevant conclusions that can help with disease management. According to the US Food and Drug Administration (US FDA), in March 2024, a significant increase in the number of drug and biologic application submissions using AI/ML components over the past few years, with more than 100 submissions reported in 2021. Healthcare organizations in the drug development area are implementing generative AI to open up new business potential for physicians, pharmaceutical companies, and hospitals. These include developing smarter digital assistants, collecting better patient data to support early disease identification, and searching for billions of pharmacological molecules to advance medicine. For instance, in March 2024, NVIDIA Healthcare introduced generative AI Microservices to advance drug discovery, MedTech, and Digital Health. Additionally, NVIDIA accelerated software development kits and tools, including Parabricks®, MONAI, NeMo™, Riva, and Metropolis, can now be accessed as NVIDIA CUDA-X™ microservices to accelerate healthcare workflows for drug discovery, medical imaging, and genomics analysis.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the AI in drug discovery market include Merck KGaA, NVIDIA Corp., Recursion Pharmaceuticals Inc., Schrödinger, Inc., and Tencent Holdings Ltd., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Development

- In April 2024, Odyssey Therapeutics, Inc., a biotechnology company pioneering next-generation precision medicines, announced it entered a strategic research collaboration with Janssen Pharmaceutica NV, a Johnson & Johnson company, to jointly discover and optimize small molecule medicines against select therapeutic targets. The companies will combine their expertise in artificial intelligence (AI), machine learning (ML), computational chemistry, and drug discovery to unlock difficult-to-drug targets.

- In February 2024, QIAGEN introduced an AI-derived biomedical knowledge base to accelerate data-driven drug discovery. QIAGEN Biomedical KB-AI contains over 640 million biomedical relationships, including gene, disease, and drug causal relationships, to aid in data-driven drug discovery.

- In November 2023, Almirall and Absci announced an AI drug discovery partnership aimed at developing and commercializing AI-designed therapeutics to fight chronic and debilitating dermatological diseases. The partnership combines Absci’s Integrated Drug Creation™ platform with Almirall’s dermatological expertise to deliver life-changing medicines to patients, marking another step forward in AI drug creation.

- In October 2023, Fujitsu and RIKEN collaborated to develop AI drug discovery technology utilizing generative AI to predict structural changes in proteins. An AI drug discovery technology that can predict structural changes of proteins from electron microscope images as a 3D density map in a wide range by utilizing generative AI.

- In September 2022, Merck announced two new strategic drug discovery collaborations aimed at harnessing powerful artificial intelligence (AI)-driven design and discovery capabilities, further advancing the company’s research efforts. The partnerships, with BenevolentAI, London, UK, and Exscientia, Oxford, UK, are expected to generate several novel clinical development drug candidates with first-in-class and best-in-class potential in key therapeutic areas of oncology, neurology, and immunology.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the AI in drug discovery market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Merck KGaA

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. NVIDIA Corporation

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Recursion Pharmaceuticals Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Schrödinger, Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Tencent Holdings Ltd.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global AI in Drug Discovery Market by Component

4.1.1. Software

4.1.2. Services

4.2. Global AI in Drug Discovery Market by Therapeutic Area

4.2.1. Oncology

4.2.2. Infectious Diseases

4.2.3. Neurology

4.2.4. Metabolic Diseases

4.2.5. Cardiovascular Diseases

4.2.6. Immunology

4.2.7. Other (Inflammatory Diseases)

4.3. Global AI in Drug Discovery Market by Application

4.3.1. Drug Optimization and Repurposing

4.3.2. Preclinical Testing

4.3.3. Drug Screening

4.4. Global AI in Drug Discovery Market by End-Users

4.4.1. Pharmaceutical & Biotechnology Companies

4.4.2. Contract Research Organizations (CROs)

4.4.3. Research Centers and Academic & Government Institutes

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. AiCure, LLC

6.2. Atomwise Inc.

6.3. BenevolentAI Group

6.4. BioXcel Therapeutics Inc.

6.5. BPGbio Inc.

6.6. Cloud Pharmaceuticals

6.7. Cyclica Inc.

6.8. Deep Genomics Inc.

6.9. Envisagenics

6.10. Euretos Services BV

6.11. Exscientia Plc.

6.12. Healx Ltd.

6.13. Iktos

6.14. Insilico Medicine

6.15. Lantern Pharma Inc.

6.16. NuMedii Inc.

6.17. Pepticom Ltd.

6.18. PHARNEXT SCA

6.19. Predictive Oncology Inc.

6.20. Turbine Ltd.

6.21. Valo Health Inc.

6.22. XtalPi Inc.

1. GLOBAL AI IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

2. GLOBAL AI SOFTWARE IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL AI SERVICES IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL AI IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY THERAPEUTIC AREA, 2023-2031 ($ MILLION)

5. GLOBAL AI IN ONCOLOGY DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL AI IN INFECTIOUS DISEASES DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL AI IN NEUROLOGY DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL AI IN METABOLIC DISEASES DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL AI IN CARDIOVASCULAR DISEASES DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL AI IN IMMUNOLOGY DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL AI IN OTHER THERAPEUTIC AREA DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL AI IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

13. GLOBAL AI IN DRUG OPTIMIZATION AND REPURPOSING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL AI IN DRUG PRECLINICAL TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL AI IN DRUG SCREENING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL AI IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

17. GLOBAL AI IN DRUG DISCOVERY FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL AI IN DRUG DISCOVERY FOR CONTRACT RESEARCH ORGANIZATIONS (CROS) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL AI IN DRUG DISCOVERY FOR RESEARCH CENTERS AND ACADEMIC & GOVERNMENT INSTITUTES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. GLOBAL AI IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. NORTH AMERICAN AI IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. NORTH AMERICAN AI IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

23. NORTH AMERICAN AI IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY THERAPEUTIC AREA, 2023-2031 ($ MILLION)

24. NORTH AMERICAN AI IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

25. NORTH AMERICAN AI IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

26. EUROPEAN AI IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

27. EUROPEAN AI IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

28. EUROPEAN AI IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY THERAPEUTIC AREA, 2023-2031 ($ MILLION)

29. EUROPEAN AI IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

30. EUROPEAN AI IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC AI IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

32. ASIA-PACIFIC AI IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

33. ASIA-PACIFIC AI IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY THERAPEUTIC AREA, 2023-2031 ($ MILLION)

34. ASIA-PACIFIC AI IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

35. ASIA-PACIFIC AI IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

36. REST OF THE WORLD AI IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

37. REST OF THE WORLD AI IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

38. REST OF THE WORLD AI IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY THERAPEUTIC AREA, 2023-2031 ($ MILLION)

39. REST OF THE WORLD AI IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

40. REST OF THE WORLD AI IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

1. GLOBAL AI IN DRUG DISCOVERY MARKET SHARE BY COMPONENT, 2023 VS 2031 (%)

2. GLOBAL AI SOFTWARE IN DRUG DISCOVERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL AI SERVICES IN DRUG DISCOVERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL AI IN DRUG DISCOVERY MARKET SHARE BY THERAPEUTIC AREA, 2023 VS 2031 (%)

5. GLOBAL AI IN ONCOLOGY DRUG DISCOVERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL AI IN INFECTIOUS DISEASES DRUG DISCOVERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL AI IN NEUROLOGY DRUG DISCOVERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL AI IN METABOLIC DISEASES DRUG DISCOVERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL AI IN CARDIOVASCULAR DISEASES DRUG DISCOVERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL AI IN IMMUNOLOGY DRUG DISCOVERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL AI IN OTHER THERAPEUTIC AREA DRUG DISCOVERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL AI IN DRUG DISCOVERY MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

13. GLOBAL AI IN DRUG OPTIMIZATION AND REPURPOSING MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL AI IN DRUG PRECLINICAL TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL AI IN DRUG SCREENING MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL AI IN DRUG DISCOVERY MARKET SHARE BY END-USERS, 2023 VS 2031 (%)

17. GLOBAL AI IN DRUG DISCOVERY FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL AI IN DRUG DISCOVERY FOR CONTRACT RESEARCH ORGANIZATIONS (CROS) MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

19. GLOBAL AI IN DRUG DISCOVERY FOR RESEARCH CENTERS AND ACADEMIC & GOVERNMENT INSTITUTES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

20. GLOBAL AI IN DRUG DISCOVERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

21. US AI IN DRUG DISCOVERY MARKET SIZE, 2023-2031 ($ MILLION)

22. CANADA AI IN DRUG DISCOVERY MARKET SIZE, 2023-2031 ($ MILLION)

23. UK AI IN DRUG DISCOVERY MARKET SIZE, 2023-2031 ($ MILLION)

24. FRANCE AI IN DRUG DISCOVERY MARKET SIZE, 2023-2031 ($ MILLION)

25. GERMANY AI IN DRUG DISCOVERY MARKET SIZE, 2023-2031 ($ MILLION)

26. ITALY AI IN DRUG DISCOVERY MARKET SIZE, 2023-2031 ($ MILLION)

27. SPAIN AI IN DRUG DISCOVERY MARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF EUROPE AI IN DRUG DISCOVERY MARKET SIZE, 2023-2031 ($ MILLION)

29. INDIA AI IN DRUG DISCOVERY MARKET SIZE, 2023-2031 ($ MILLION)

30. CHINA AI IN DRUG DISCOVERY MARKET SIZE, 2023-2031 ($ MILLION)

31. JAPAN AI IN DRUG DISCOVERY MARKET SIZE, 2023-2031 ($ MILLION)

32. SOUTH KOREA AI IN DRUG DISCOVERY MARKET SIZE, 2023-2031 ($ MILLION)

33. REST OF ASIA-PACIFIC AI IN DRUG DISCOVERY MARKET SIZE, 2023-2031 ($ MILLION)

34. REST OF THE WORLD AI IN DRUG DISCOVERY MARKET SIZE, 2023-2031 ($ MILLION)

35. LATIN AMERICA AI IN DRUG DISCOVERY MARKET SIZE, 2023-2031 ($ MILLION)

36. MIDDLE EAST AND AFRICA AI IN DRUG DISCOVERY MARKET SIZE, 2023-2031 ($ MILLION)