AI in food & beverages Market

AI in food & beverages Market Size, Share & Trends Analysis Report by Application (AI in Food Sorting, Consumer Engagement, Quality Control & Safety Compliance, Production and Packaging, Maintenance, and Other (Trend Analysis)), by End-User (Hotels & Restaurants, Food Processing Industry, and Beverage Industry) Forecast Period (2024-2031) Update Available - Forecast 2025-2035

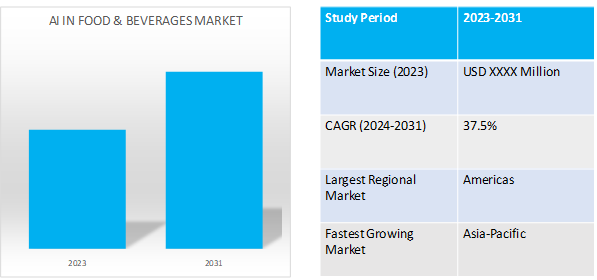

AI in food & beverages market is anticipated to grow at an exponential CAGR of 37.5% during the forecast period (2024-2031). The global market is driven by the growing demand for AI in food & beverage industry for food sorting, quality maintenance, and supply chain management. Growing investments in this field along with software advancement are further aiding the market growth.

Market Dynamics

Growing Investment in Food & Beverage Industry Infrastructure

The significant investments in the food and beverage infrastructure are key factors driving the market growth. This new infrastructure will create demand for AI to fulfill the increasing need of improving supply chain operational efficiency and the widespread adoption of automated services to sort diverse food and beverage products. In July 2023, catering enterprise Foodlink F&B Holdings India announced its plans to invest Rs 70 crore to Rs 100 crore ($8.4 million-12.0 million) across luxury catering, banquets and restaurants verticals to its foray into Hyderabad market. The rapid expansions of the hotels, restaurants, and quick service restaurants (QSRs) have facilitated the demand for AI in food beverage units which is further aiding to the market growth.

Market Segmentation

Our in-depth analysis of the global AI in food & beverages market includes the following segments by product type, and application:

- Based on application, the market is sub-segmented into AI in food sorting, consumer engagement, quality control & safety compliance, production and packaging, maintenance, and other (trend analysis).

- Based on end-user, the market is sub-segmented into Hotels & Restaurants, Food Processing Industry, and Beverage Industry.

Beverage Industry Sub-segment to Exhibit Highest CAGR

The growing adoption of AI in beverage industry is a key factor driving the growth of this market segment. For instance, in July 2023, HELL ENERGY, Budapest, Hungary, unveiled its first energy drink entirely powered by AI. Every aspect of the energy drink has been crafted by advanced AI systems from the design, recipe, tasting and taste evaluation, predictive intelligence, security measures and marketing elements to meet the growing demand. Additionally, in September 2023, Coca-Cola launched an “AI-powered” Coca-Cola Y3000 to meet the growing demand for enhanced taste of the product.

Regional Outlook

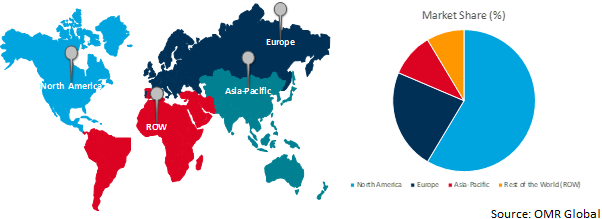

The global AI in food & beverages market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

China to Hold Major Share in Asia-Pacific Region

China attracts the major share of global investments in AI and caters a large food processing market that is 10 times the volume of its US counterpart. China's food processing industry has seen sustained growth in recent years. Sales, production, and income in the sector increased in 2020, according to the Chinese Ministry of Industry and Information Technology (MIIT). China's major food processing companies recorded combined profits of 620.66 billion yuan (about $97.0 billion) in 2020, up 6.8% from the same period in 2019.

Global AI in Food & Beverages Market Growth by Region 2024-2031

North America Holds Major Market Share

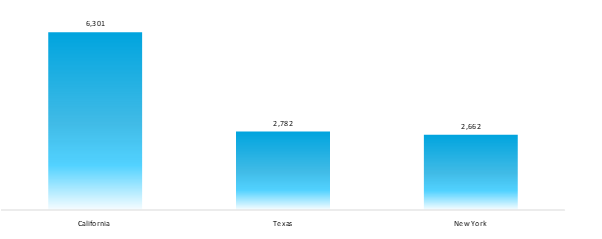

Among all the regions, North America holds a significant share due to the existence of a large user base of this technology. Food processing is one of the major manufacturing sectors in the US. According to the US Department of Commerce, there were 41,080 food and beverage processing plants in the US in 2021. The high adoption rate of AI in these food processing plants is anticipated to make a major contribution to high share of the regional market. The presence of key market players and their service offering is further aiding the market share.

Number of Food Processing Plants in US, by State in 2021

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global AI in food & beverages market include ABB Ltd., Honeywell International Inc., Key Technology Inc., Rockwell Automation Inc. and TOMRA Sorting Solutions AS among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, February 2022 Kraft Heinz entered partnership with Chilean food tech startup NotCo, which has developed a proprietary AI called “Giuseppe,” to pursue plant-based food research with AI.

Startup Funding

- In March 2023, Burger Index, a Spanish food tech startup, has announced it has raised $1.3 million in seed funding to initiate its expansion in the GCC region.

- In March 2022, Tastewise, an artificial intelligence-powered platform that helps food brands bring products to market based on consumer data, raised $17 million in a Series A funding round. The company will use its latest funding to expand into new markets, including Canada, Australia, Germany, France, and India.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global AI in food & beverages market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. ABB, Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Honeywell International, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Key Technology, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Rockwell Automation, Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global AI in Food & Beverage Market by Application

4.1.1. Food Sorting

4.1.2. Consumer Engagement

4.1.3. Quality Control & Safety Compliance

4.1.4. Production and Packaging

4.1.5. Maintenance

4.1.6. Other (Trend Analysis)

4.2. Global AI in Food & Beverage Market by End-User

4.2.1. Hotels & Restaurants

4.2.2. Food Processing Industry

4.2.3. Beverage Industry

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Advent Machine Company

6.2. GEP

6.3. GREEFA

6.4. Martec of Whitell Ltd.

6.5. Publicis Sapient

6.6. Raytech Vision SpA

6.7. Sesotec GmbH

6.8. Sight Machine Inc.

6.9. TOMRA Sorting Solutions AS

1. GLOBAL AI IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

2. GLOBAL AI IN FOOD SORTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL AI IN CONSUMER ENGAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL AI FOR QUALITY CONTROL & SAFETY COMPLIANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL AI FOR PRODUCTION & PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL AI FOR MAINTENANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL AI FOR OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL AI IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

9. GLOBAL AI IN HOTELS & RESTAURANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL AI IN FOOD PROCESSING INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL AI IN BEVERAGE INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL AI IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN AI IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN AI IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN AI IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

16. EUROPEAN AI IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. EUROPEAN AI IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

18. EUROPEAN AI IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

19. ASIA- PACIFIC AI IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. ASIA- PACIFIC AI IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. ASIA- PACIFIC AI IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

22. REST OF THE WORLD AI IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. REST OF THE WORLD AI IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

24. REST OF THE WORLD AI IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL AI IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023 VS 2031 (%)

2. GLOBAL AI IN FOOD SORTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL AI IN CONSUMER ENGAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL AI FOR QUALITY CONTROL & SAFETY COMPLIANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL AI FOR PRODUCTION & PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

6. GLOBAL AI FOR MAINTENANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBAL AI FOR OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL AI IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023 VS 2031 (%)

9. GLOBAL AI IN HOTELS & RESTAURANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

10. GLOBAL AI IN FOOD PROCESSING INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

11. GLOBAL AI IN BEVERAGE INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

12. GLOBAL AI IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

13. US AI IN FOOD & BEVERAGE MARKET SIZE, 2023-2031 ($ MILLION)

14. CANADA AI IN FOOD & BEVERAGE MARKET SIZE, 2023-2031 ($ MILLION)

15. UK AI IN FOOD & BEVERAGE MARKET SIZE, 2023-2031 ($ MILLION)

16. FRANCE AI IN FOOD & BEVERAGE MARKET SIZE, 2023-2031 ($ MILLION)

17. GERMANY AI IN FOOD & BEVERAGE MARKET SIZE, 2023-2031 ($ MILLION)

18. ITALY AI IN FOOD & BEVERAGE MARKET SIZE, 2023-2031 ($ MILLION)

19. SPAIN AI IN FOOD & BEVERAGE MARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF EUROPE AI IN FOOD & BEVERAGE MARKET SIZE, 2023-2031 ($ MILLION)

21. INDIA AI IN FOOD & BEVERAGE MARKET SIZE, 2023-2031 ($ MILLION)

22. CHINA AI IN FOOD & BEVERAGE MARKET SIZE, 2023-2031 ($ MILLION)

23. JAPAN AI IN FOOD & BEVERAGE MARKET SIZE, 2023-2031 ($ MILLION)

24. SOUTH KOREA AI IN FOOD & BEVERAGE MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF ASIA-PACIFIC AI IN FOOD & BEVERAGE MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF THE WORLD AI IN FOOD & BEVERAGE MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA AI IN FOOD & BEVERAGE MARKET SIZE, 2023-2031 ($ MILLION)

28. THE MIDDLE EAST & AFRICA AI IN FOOD & BEVERAGE MARKET SIZE, 2023-2031 ($ MILLION)