AI in Oil and Gas Market

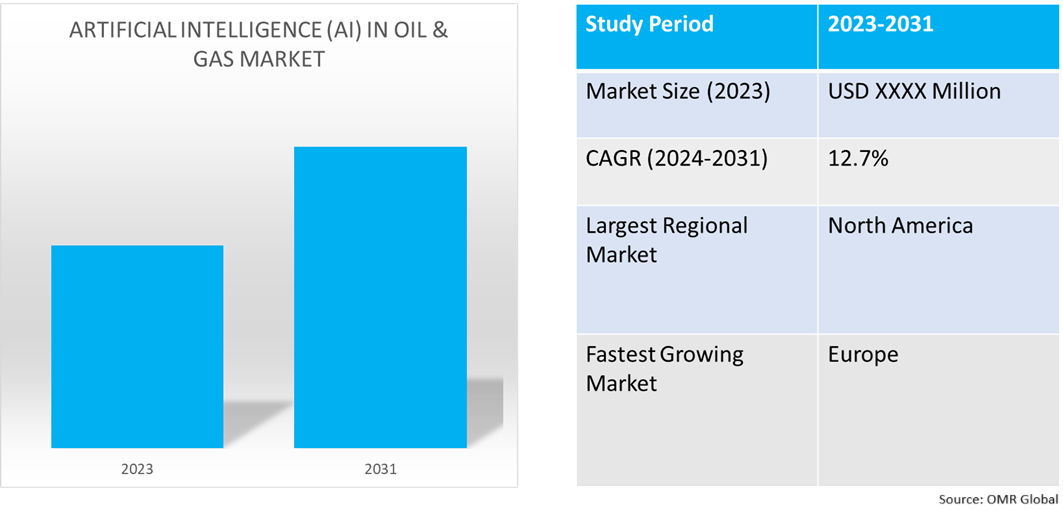

AI in Oil and Gas Market Size, Share & Trends Analysis Report by Application (Exploration and Production, Drilling and Well Completion, Production Optimization, Reservoir Management, Predictive Maintenance, Supply Chain Management, Health, Safety, and Environment (HSE) Management), by Technology (Machine Learning, Natural Language Processing (NLP), Computer Vision, Robotics Process Automation (RPA) and Deep Learning) and by End-User (Upstream, Midstream and Downstream) Forecast Period (2024-2031)

Artificial intelligence (AI) in oil & gas market is anticipated to grow at a significant CAGR of 12.7% during the forecast period (2024-2031). The market growth is attributed to pivotal factors such as the rising investments in AI technologies, operational efficiency, and cost reduction, data analytics and decision-making, and increased adoption of AI-powered robotics. According to the International Trade Administration, in 2021, AI global funding doubled to $66.8 billion, and a record 65 AI companies reached $1B+ valuations, up 442.0% from the previous year. Each year, more and more companies and governments worldwide adopt AI solutions.

Market Dynamics

Increasing Demand for Exploration and Production Optimization

The increasing demand for exploration and production optimization enables AI technology companies to analyze vast datasets more efficiently, resulting in improved decision-making and enhanced operational performance. Through predictive analytics and machine learning, AI helps in identifying new drilling opportunities and optimizing production processes. Additionally, AI applications are aiding in the reduction of operational costs and improving safety by predicting equipment failures and minimizing downtime. As a result, the integration of AI is essential for achieving greater efficiency in the oil and gas industry.

Growing Adoption in Supply Chain Optimization

AI technologies are enabling enhanced predictive analytics, allowing companies to anticipate and mitigate supply chain disruptions. By improving demand forecasting, AI helps streamline inventory management and reduce operational costs. The implementation of AI-driven automation enhances logistics and transportation efficiency, minimizing delays and improving decision-making processes. Additionally, AI enables real-time tracking of assets, ensuring optimal resource allocation. This transformative role of AI in supply chain optimization contributes significantly to increased profitability and operational resilience in the oil and gas industry.

Market Segmentation

- Based on the application, the market is segmented into exploration and production, drilling and well completion, production optimization, reservoir management, predictive maintenance, supply chain management, health, safety, and environment (HSE) management.

- Based on the technology, the market is segmented into machine learning, natural language processing (NLP), computer vision, robotics process automation (RPA), and deep learning.

- Based on the end-user, the market is segmented into upstream, midstream, and downstream.

Predictive Maintenance Segment is Projected to Hold the Largest Market Share

The primary factors supporting the growth include the growing adoption of predictive maintenance technologies that enable companies to anticipate equipment failures before they occur, thereby minimizing downtime and reducing maintenance costs. By leveraging machine learning algorithms and data analytics, organizations can analyze vast amounts of operational data to identify patterns and anomalies. This proactive approach enhances operational efficiency and safety, leading to optimized asset utilization and contributing to the expansion of the AI in oil & gas market. Artificial Intelligence (AI), with its proven effectiveness in predictive maintenance, optimizes the operations of oil and gas facilities by reducing downtime and enhancing asset reliability. For instance, FAT FINGER Inc. offers artificial intelligence in predictive maintenance for oil and gas facilities. FAT FINGER’s effectiveness in predictive maintenance is its use in oil and gas facilities. By integrating AI and IoT devices, FAT FINGER can predict potential equipment failures, allowing for timely intervention and reducing downtime. This not only increases operational efficiency but also significantly reduces maintenance costs.

Upstream to Hold a Considerable Market Share

The factors supporting segment growth include the Upstream operations, which include exploration and production activities, are benefiting from AI technologies to optimize decision-making, improve operational efficiency, and reduce costs. AI-powered solutions enhance the accuracy of seismic data analysis, reservoir management, and drilling processes, resulting in more efficient resource extraction. The integration of AI in predictive maintenance and real-time monitoring also helps to minimize equipment downtime and operational risks, further boosting its appeal in the upstream sector. Artificial Intelligence (AI) in the oil and gas industry drives optimized operations and scale efficiencies, enabling companies to streamline processes, reduce costs, and maximize output through advanced data analytics and predictive maintenance. For instance, AVEVA?Group Ltd. offers Optimized upstream operations for performance, safety, and sustainability. The company offers Optimized operations and scale efficiencies across the entire oil and gas value chain. The Oil, gas, and energy companies depend on AVEVA software to optimize their operations and create a safe, sustainable future.

Regional Outlook

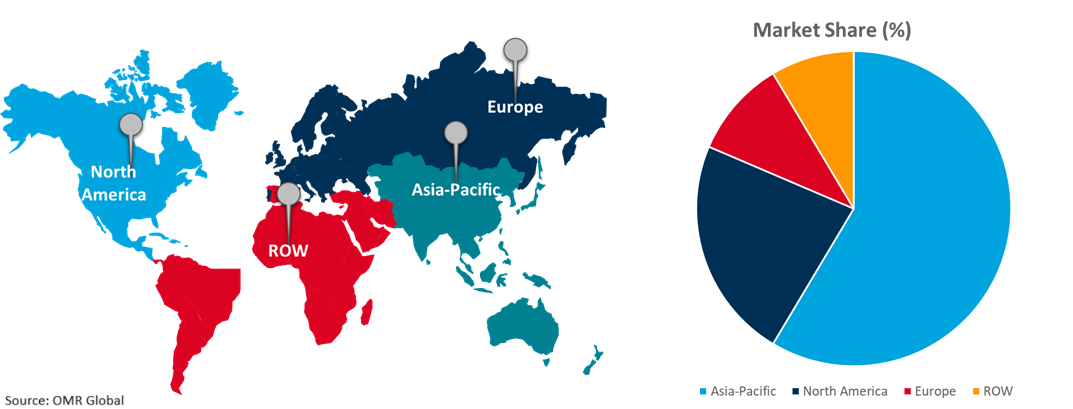

The global AI in oil & gas market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Adoption of AI in Oil & Gas in Europe

The regional growth is attributed to the increasing demand for energy efficiency and optimization in exploration, production, and refining processes has spurred the adoption of AI technologies. Companies are leveraging AI-driven predictive analytics, automation, and machine learning to enhance operational efficiency, reduce costs, and improve decision-making in complex upstream and downstream activities further fueling market growth. According to the International Energy Agency (IEA), in 2023, there was also ongoing growth in oil and gas investments, which reached over $30 billion in 2023. Investment in liquified natural gas (LNG) reached nearly 7 billion, while Europe added more than 50 bcm/year of extra LNG import capacity to switch away from Russian gas, mainly via Floating Storage Regasification Units (FSRUs). The Netherlands, Italy, Finland, Greece, and Germany have all acquired or leased FSRUs.

Global AI in Oil & Gas Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds a significant share owing to the presence of AI in oil & gas offering companies such as Baker Hughes Co., Honeywell International Inc., IBM Corp., Microsoft Corp., Oracle Corp., and others. The market growth is attributed to the growing emphasis on safety and risk management is prompting the industry to implement AI solutions that can predict equipment failures and analyze safety hazards, thereby minimizing accidents and environmental impacts. Moreover, the integration of AI with the Internet of Things (IoT) facilitates better monitoring and management of assets, further contributing to operational excellence drive the growth of the market. According to the National Center for Biotechnology Information (NCBI), in March 2023, the US government invested around $52.9 billion in incorporating AI in different industrial segments in 2021. Market players offering AI in Oil & Gas are transforming the industry by enhancing drilling optimization and improving the efficiency of engineering projects, enabling faster decision-making, reducing operational risks, and driving cost-effective solutions. For instance, IBM Corp. offers AI in oil, gas & energy including drilling optimization and engineering projects. IBM AI platform in natural resources is part of the IBM industry platforms unit.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the AI in oil & gas market include Baker Hughes Co., Honeywell International Inc., IBM Corp., Microsoft Corp., and Siemens AG among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Development

- In October 2023, AIQ, a technology focused on driving artificial intelligence-powered transformation across industries, and Halliburton, a provider of services and products to the energy industry, have joined with ADNOC to successfully launch an AI-enabled Autonomous Well Control solution, RoboWell, across the energy giant’s North East Bab (NEB) asset in Abu Dhabi, UAE. The RoboWell system utilizes real-time data to continuously react to changing oil field dynamics, optimize production processes, as well as ensure operation within safety parameters to minimize well instability and reduce the risk of stoppages or other incidents.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global AI in oil & gas market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Market Trends

2.2.1.1. Predictive Maintenance and Equipment Monitoring

2.2.1.2. Enhanced Safety and Risk Management

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Baker Hughes Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Honeywell International Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. IBM Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Microsoft Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Siemens AG

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global AI in Oil & Gas Market by Application

4.1.1. Exploration and Production

4.1.2. Drilling and Well Completion

4.1.3. Production Optimization

4.1.4. Reservoir Management

4.1.5. Predictive Maintenance

4.1.6. Supply Chain Management

4.1.7. Health, Safety, and Environment (HSE) Management

4.2. Global AI in Oil & Gas Market by Technology

4.2.1. Machine Learning

4.2.2. Natural Language Processing (NLP)

4.2.3. Computer Vision

4.2.4. Robotics Process Automation (RPA)

4.2.5. Deep Learning

4.3. Global AI in Oil & Gas Market by End-User

4.3.1. Upstream

4.3.2. Midstream

4.3.3. Downstream

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Accenture PLC

6.2. Aspen Technology, Inc.

6.3. Beyond Limits Inc.

6.4. C3.ai, Inc.

6.5. Cisco Systems, Inc.

6.6. DataRobot, Inc.

6.7. Earth Science Analytics AS

6.8. Ernst & Young Global Ltd.

6.9. General Electric Co.

6.10. Infosys Ltd.

6.11. oPRO.ai Inc.

6.12. Oracle Corp.

6.13. Rockwell Automation, Inc.

6.14. SAP SE

6.15. Saudi Arabian Oil Co.

6.16. Schlumberger Ltd.

6.17. Schneider Electric SE (AVEVA?Group Ltd.)

6.18. SparkCognition, Inc.

6.19. TATA Consultancy Services Ltd.

6.20. TotalEnergies SE

6.21. Weatherford International plc

1. Global AI in Oil & Gas Market Research And Analysis By Application, 2023-2031 ($ Million)

2. Global AI in Oil & Gas Exploration and Production Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global AI in Oil & Gas Drilling and Well Completion Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global AI in Oil & Gas Production Optimization Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global AI in Oil & Gas Reservoir Management Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global AI in Oil & Gas Predictive Maintenance Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global AI in Oil & Gas Supply Chain Management Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global AI in Oil & Gas Health, Safety, and Environment (HSE) Management Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global AI in Oil & Gas Market Research And Analysis By Technology, 2023-2031 ($ Million)

10. Global Machine Learning In Oil & Gas Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Natural Language Processing (NLP) In Oil & Gas Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Computer Vision In Oil & Gas Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global Robotics Process Automation (RPA) In Oil & Gas Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Global Deep Learning In Oil & Gas Market Research And Analysis By Region, 2023-2031 ($ Million)

15. Global AI In Oil & Gas Market Research And Analysis By End-User, 2023-2031 ($ Million)

16. Global AI In Oil & Gas For Upstream Market Research And Analysis By Region, 2023-2031 ($ Million)

17. Global AI In Oil & Gas For Midstream Market Research And Analysis By Region, 2023-2031 ($ Million)

18. Global AI In Oil & Gas For Downstream Market Research And Analysis By Region, 2023-2031 ($ Million)

19. Global AI in Oil & Gas Market Research And Analysis By Region, 2023-2031 ($ Million)

20. North American AI In Oil & Gas Market Research And Analysis By Country, 2023-2031 ($ Million)

21. North American AI In Oil & Gas Market Research And Analysis By Application, 2023-2031 ($ Million)

22. North American AI In Oil & Gas Market Research And Analysis By Technology, 2023-2031 ($ Million)

23. North American AI In Oil & Gas Market Research And Analysis By End-User, 2023-2031 ($ Million)

24. European AI In Oil & Gas Market Research And Analysis By Country, 2023-2031 ($ Million)

25. European AI In Oil & Gas Market Research And Analysis By Application, 2023-2031 ($ Million)

26. European AI In Oil & Gas Market Research And Analysis By Technology, 2023-2031 ($ Million)

27. European AI In Oil & Gas Market Research And Analysis By End-User, 2023-2031 ($ Million)

28. Asia-Pacific AI In Oil & Gas Market Research And Analysis By Country, 2023-2031 ($ Million)

29. Asia-Pacific AI In Oil & Gas Market Research And Analysis By Application, 2023-2031 ($ Million)

30. Asia-Pacific AI In Oil & Gas Market Research And Analysis By Technology, 2023-2031 ($ Million)

31. Asia-Pacific AI In Oil & Gas Market Research And Analysis By End-User, 2023-2031 ($ Million)

32. Rest Of The World AI In Oil & Gas Market Research And Analysis By Region, 2023-2031 ($ Million)

33. Rest Of The World AI In Oil & Gas Market Research And Analysis By Application, 2023-2031 ($ Million)

34. Rest Of The World AI In Oil & Gas Market Research And Analysis By Technology, 2023-2031 ($ Million)

35. Rest Of The World AI In Oil & Gas Market Research And Analysis By End-User, 2023-2031 ($ Million)

1. Global AI In Oil & Gas Market Research And Analysis By Application, 2023 Vs 2031 (%)

2. Global AI in Oil & Gas Exploration and Production Market Share By Region, 2023 Vs 2031 (%)

3. Global AI in Oil & Gas Drilling and Well Completion Market Share By Region, 2023 Vs 2031 (%)

4. Global AI in Oil & Gas Production Optimization Market Share By Region, 2023 Vs 2031 (%)

5. Global AI in Oil & Gas Reservoir Management Market Share By Region, 2023 Vs 2031 (%)

6. Global AI in Oil & Gas Predictive Maintenance Market Share By Region, 2023 Vs 2031 (%)

7. Global AI in Oil & Gas Supply Chain Management Market Share By Region, 2023 Vs 2031 (%)

8. Global AI in Oil & Gas Health, Safety, and Environment (HSE) Management Market Share By Region, 2023 Vs 2031 (%)

9. Global AI In Oil & Gas Market Research And Analysis By Technology, 2023 Vs 2031 (%)

10. Global Machine Learning In Oil & Gas Market Share By Region, 2023 Vs 2031 (%)

11. Global Natural Language Processing (NLP) In Oil & Gas Market Share By Region, 2023 Vs 2031 (%)

12. Global Computer Vision In Oil & Gas Market Share By Region, 2023 Vs 2031 (%)

13. Global Robotics Process Automation (RPA) In Oil & Gas Market Share By Region, 2023 Vs 2031 (%)

14. Global Deep Learning In Oil & Gas Market Share By Region, 2023 Vs 2031 (%)

15. Global AI In Oil & Gas Market Research And Analysis By End-User, 2023 Vs 2031 (%)

16. Global AI In Oil & Gas For Upstream Market Share By Region, 2023 Vs 2031 (%)

17. Global AI In Oil & Gas For Midstream Market Share By Region, 2023 Vs 2031 (%)

18. Global AI In Oil & Gas For Downstream Market Share By Region, 2023 Vs 2031 (%)

19. Global AI In Oil & Gas Market Share By Region, 2023 Vs 2031 (%)

20. US AI In Oil & Gas Market Size, 2023-2031 ($ Million)

21. Canada AI In Oil & Gas Market Size, 2023-2031 ($ Million)

22. UK AI In Oil & Gas Market Size, 2023-2031 ($ Million)

23. France AI In Oil & Gas Market Size, 2023-2031 ($ Million)

24. Germany AI In Oil & Gas Market Size, 2023-2031 ($ Million)

25. Italy AI In Oil & Gas Market Size, 2023-2031 ($ Million)

26. Spain AI In Oil & Gas Market Size, 2023-2031 ($ Million)

27. Rest Of Europe AI In Oil & Gas Market Size, 2023-2031 ($ Million)

28. India AI In Oil & Gas Market Size, 2023-2031 ($ Million)

29. China AI In Oil & Gas Market Size, 2023-2031 ($ Million)

30. Japan AI In Oil & Gas Market Size, 2023-2031 ($ Million)

31. South Korea AI In Oil & Gas Market Size, 2023-2031 ($ Million)

32. Rest Of Asia-Pacific AI In Oil & Gas Market Size, 2023-2031 ($ Million)

33. Latin America AI In Oil & Gas Market Size, 2023-2031 ($ Million)

34. Middle East And Africa AI In Oil & Gas Market Size, 2023-2031 ($ Million)