AI in Telecommunication Market

AI in Telecommunication Market Size, Share & Trends Analysis Report by Component (Solution, and Service), by Application (Network Security, Network Optimization, Customer Analytics, Virtual Assistance, Self-Diagnostics, and Others)by Vertical (Machine Learning (ML), Natural Language Processing (NLP), Deep Learning (DL), and Others) Forecast Period (2024-2031)

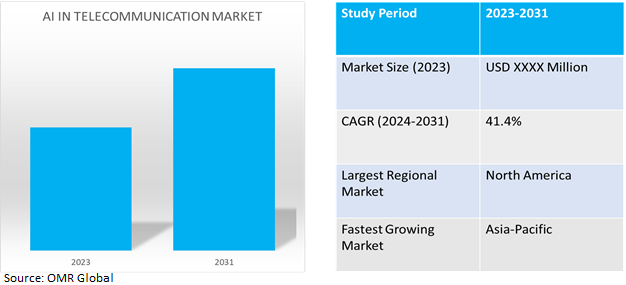

AI in the telecommunication market is anticipated to grow at a significant CAGR of 41.4% during the forecast period (2024-2031). The global AI in the Telecommunication market is expanding due to network optimization, automation, predictive maintenance, enhanced customer experience, network security, 5G network deployment, data analytics, and regulatory compliance. AI also serves as a competitive differentiator, enabling efficient, reliable, and personalized services. Collaborations between companies, technology vendors, and startups further accelerate AI adoption.

Market Dynamics

Exponential increase in data volumes

The telecommunication industry is experiencing exponential growth in data volumes owing to digital devices, IoT sensors, and online services. AI technologies, such as Machine Learning (ML), help analyze and make data-driven decisions. According to the Telecom Regulatory Authority of India, in July, the exponential rise in data, the development of cloud and edge computing, advances in internet technology, and rising processing power are all responsible for AI's explosive rise. The AI market is expected to reach $500.0 billion by the year 2020, and is expanding quickly. The world is changing due to the emergence of AI and ML technologies, and businesses need to adopt these technologies quickly to remain competitive in the current digital era.

Growing prevalence of AI-powered devices and models

The market's expansion is fuelled by the rise of AI-enabled devices and models, which enhance communication and provide personalized services. According to the Microsoft, in April 2023, the growth of AI-enabled smartphones, hyper-scale computers, and huge language models like GPT-3, the global AI market for telecom is anticipated to reach $38.8 billion by 2021. 88.0% of consumers reported having a minimum of one chat with a chatbot in the year prior, indicating the growing popularity of these devices. Businesses are adopting chatbots more rapidly as a result of the $11.0 billion in overall cost benefits from the implementation in 2022. GPT-3 and other large language models can respond in a manner that is similar to the behavior of a human, increasing customer service effectiveness and personalization.

Market Segmentation

Our in-depth analysis of the global AI in the telecommunicationmarket includes the following segments by component and application:

- Based on components, the market is sub-segmented into solutions and services.

- Based on application, the market is bifurcated into network security, network optimization, customer analytics, virtual assistance, self-diagnostics, and others (quality of service (QoS) enhancement, and network planning and optimization).

Customer Analyticsis Projected to Emerge as the Largest Segment

Based on the application, the global AI in the telecommunication market is sub-segmented into network security, network optimization, customer analytics, virtual assistance, self-diagnostics, and others. Among these, the customer analytics sub-segment is expected to hold the largest share of the market. This is attributed to the ability of customer analytics to provide insights into connection changes, inefficient data speeds, and difficulties with connectivity, and helps telecom providers detect problems with the mobile network through usage patterns, feedback, and service quality measurements. For instance, in August 2023, TPG Telecom and Ericsson partnered to deliver an Australian-first cloud-native and AI-powered analytics tool to pinpoint and improve mobile network performance for customers. It uses smart data collection and embedded intelligence to gain insights from its 4G and 5G subscribers, enabling real-time prediction and resolution of performance issues.

Solutions Sub-segment to Hold a Considerable Market Share

The growing prevalence of solutions utilizes AI algorithms to securely and efficiently process telecom data, enhancing customer care, sales, and digital operations, aligning with the global AI in the telecommunication market's emphasis on data utilization. For instance, in September 2023, Netcracker Technology introduced its GenAI Telco Solution, enabling communications service providers to allow secure and controlled use of the telecom data and knowledge for various roles, including care assistants, agent partners, sales assistants, catalog assistants, and digital operations technicians, addressing the challenges of constantly changing telco data.

Regional Outlook

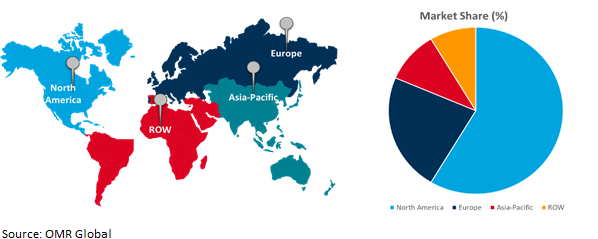

The globalAI in telecommunication market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Consumer Demand For 5G Network in the Aisa-Pacific Region

The rapid adoption of this technology, resulting in demands for higher speeds, lower latency, and dependable connectivity for a wide range of applications, has led to an increase in consumer demand for 5G connectivity in the across-the-globe AI telecommunications market. According to the GSMA Intelligence, in February 2023, it predicts that 5G connections will double in the next two years owing to technological innovations and network deployments in over 30 countries. Consumer connections reached $1.0 billion in 2022, increasing to $1.5 billion 2023 year and $2.0billion by 2025, making 5G the fastest generational roll-out.

Global AI in TelecommunicationMarket Growth by Region 2024-2031

North AmericaHolds Major Market Share

The telecom sector significantly contributes to national GDP and job creation, with AI technologies enhancing network efficiency, service delivery, and innovation in the industry. According to the report by PricewaterhouseCoopers (PwC), in November 2023, Canada's telecom sector is investing billions of dollars annually to meet increasing expectations for network quality, coverage, and resiliency. The telecoms in Canada invested $13.3 billion in 2022 to expand and strengthen their wireless and broadband networks. The sector has invested an average of $12.1 billion in network infrastructure over the past five years, representing 18.6% of average revenues. PwC estimates that the sector contributed up to $76.7 billion to the national GDP and supported 724,000 Canadians.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global AI in the telecommunicationmarket includeAT&T Inc. Ericsson AB, Huawei Technologies Co. Ltd., and IBM Corp.Nokia Corp., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance,in January 2024, GSMA and IBM partnered to promote AI adoption in the telecom industry through GSMA Advance's AI Training program and GSMA Foundry Generative AI program. The training aims to equip telecom leaders with skills to effectively leverage Gen AI technologies, using IBM's Watsonx AI platform.

- In February 2024, Rakuten Group and OpenAI partnered to develop advanced AI tools for the telecommunications industry. The platform includes solutions for customer service, network optimization, predictive maintenance, enhancing real-time issue detection and resolution.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global AI in telecommunicationmarket. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. AT&T Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.2.5. Telefonaktiebolaget LMEricsson Overview

3.2.6. Financial Analysis

3.2.7. SWOT Analysis

3.2.8. Recent Developments

3.3. Huawei Technologies Co. Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Key Strategy Analysis

4. Market Segmentation

4.1. Global AI in Telecommunication Market by Component

4.1.1. Solution

4.1.2. Service

4.2. Global AI in Telecommunication Market by Application

4.2.1. Network Security

4.2.2. Network Optimization

4.2.3. Customer Analytics

4.2.4. Virtual Assistance

4.2.5. Self-Diagnostics

4.2.6. Others(Quality of Service (QoS) Enhancement, and Network Planning and Optimization)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. China Mobile Ltd.

6.2. Cisco Systems, Inc.

6.3. Google LLC

6.4. IBM Corp.

6.5. Infosys Ltd.

6.6. Intel Corp.

6.7. KT Corp.

6.8. Microsoft Corp.

6.9. Nokia Corp.

6.10. NTT Communications Corp.

6.11. Nuance Communications, Inc.

6.12. NVIDIA Corp.

6.13. Orange SA

6.14. Salesforce, Inc.

6.15. SK Telecom Co., Ltd.

6.16. Telstra Group Ltd.

6.17. Vodafone Group Plc

1. GLOBAL AI IN TELECOMMUNICATION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

2. GLOBAL AI IN TELECOMMUNICATION SOLUTION MARKET SOLUTIONS RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL AI IN TELECOMMUNICATION SERVICE MARKET SERVICES RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL AI IN TELECOMMUNICATIONMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

5. GLOBAL AI IN TELECOMMUNICATION IN NETWORK SECURITY MARKET BY LARGE ENTERPRISES RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL AI IN TELECOMMUNICATION IN NETWORK OPTIMIZATION MARKET BY SMES RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL AI IN TELECOMMUNICATION IN CUSTOMER ANALYTICS MARKET BY SMES RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL AI IN TELECOMMUNICATION IN VIRTUAL ASSISTANCE MARKET BY SMES RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL AI IN TELECOMMUNICATION IN SELF-DIAGNOSTICS MARKET BY SMES RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL AI IN TELECOMMUNICATION IN OTHER APPLICATION MARKET BY SMES RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL AI IN TELECOMMUNICATIONMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN AI IN TELECOMMUNICATIONMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN AI IN TELECOMMUNICATIONMARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

14. NORTH AMERICAN AI IN TELECOMMUNICATIONMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN AI IN TELECOMMUNICATIONMARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

16. EUROPEAN AI IN TELECOMMUNICATIONMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. EUROPEAN AI IN TELECOMMUNICATIONMARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

18. EUROPEAN AI IN TELECOMMUNICATIONMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

19. EUROPEAN AI IN TELECOMMUNICATIONMARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC AI IN TELECOMMUNICATIONMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. ASIA-PACIFICAI IN TELECOMMUNICATIONMARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC AI IN TELECOMMUNICATIONMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC AI IN TELECOMMUNICATIONMARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

24. REST OF THE WORLD AI IN TELECOMMUNICATIONMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

25. REST OF THE WORLD AI IN TELECOMMUNICATIONMARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

26. REST OF THE WORLD AI IN TELECOMMUNICATIONMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD AI IN TELECOMMUNICATIONMARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

1. GLOBAL AI IN TELECOMMUNICATIONMARKETSHARE BY COMPONENT, 2023 VS 2031 (%)

2. GLOBAL AI IN TELECOMMUNICATION MARKET SOLUTIONS SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL AI IN TELECOMMUNICATION MARKET SERVICES SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL AI IN TELECOMMUNICATIONMARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

5. GLOBAL AI IN TELECOMMUNICATION MARKET IN NETWORK SECURITY SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL AI IN TELECOMMUNICATION MARKET IN NETWORK OPTIMIZATION SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL AI IN TELECOMMUNICATION MARKET IN CUSTOMER ANALYTICS SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL AI IN TELECOMMUNICATION MARKET IN VIRTUAL ASSISTANCE SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL AI IN TELECOMMUNICATION MARKET IN SELF-DIAGNOSTICS SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL AI IN TELECOMMUNICATION MARKET IN OTHER APPLICATION SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL AI IN TELECOMMUNICATIONMARKETSHARE BY REGION, 2023 VS 2031 (%)

12. US AI IN TELECOMMUNICATIONMARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA AI IN TELECOMMUNICATIONMARKET SIZE, 2023-2031 ($ MILLION)

14. UK AI IN TELECOMMUNICATIONMARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE AI IN TELECOMMUNICATIONMARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY AI IN TELECOMMUNICATIONMARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY AI IN TELECOMMUNICATIONMARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN AI IN TELECOMMUNICATIONMARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE AI IN TELECOMMUNICATIONMARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA AI IN TELECOMMUNICATIONMARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA AI IN TELECOMMUNICATIONMARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN AI IN TELECOMMUNICATIONMARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA AI IN TELECOMMUNICATIONMARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC AI IN TELECOMMUNICATIONMARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA AI IN TELECOMMUNICATIONMARKET SIZE, 2023-2031 ($ MILLION)

26. MIDDLE EAST AND AFRICA AI IN TELECOMMUNICATIONMARKET SIZE, 2023-2031 ($ MILLION)