Air Cargo Market

Air Cargo Market Size, Share & Trends Analysis Report by Type (Belly Cargo, and Freighter), and by End-user (Manufacturing, FMCG & Retail, Pharmaceuticals and Chemicals, and Others), Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Air cargo market is anticipated to grow at a considerable CAGR of 5.6% during the forecast period. The air cargo market is a sector of the aviation industry that provides transportation services for goods, freight, and mail by air. Air cargo services are typically provided by cargo airlines that operate a fleet of aircraft dedicated to transporting goods. The air cargo market has experienced steady growth over the past few years, driven by globalization, e-commerce, and the increasing demand for just-in-time delivery. The market has also been impacted by changes in consumer behavior, with consumers increasingly expecting fast and reliable delivery of goods. Additionally, the growth of the market is led by the expansion of leading market players to new regions. For instance, in January 2023, Amazon launched Amazon Air, its dedicated air cargo fleet, in India as the e-commerce giant bulks up its logistics infrastructure in the key overseas market. The retailer has partnered with the Bengaluru-based cargo airline Quikjet to launch its maiden air freight service in the country.

Segmental Outlook

The global air cargo market is segmented based on its type and end-user. Based on its type, the market is segmented into belly cargo and freighter. Based on the end-user, the market is categorized into manufacturing, FMCG and retail, pharmaceuticals and chemicals, and others. Among the end-user segment, the retail sub-segment is anticipated to hold a prominent market share.

Among the type segment, the freighter sub-segment is anticipated to register significant growth for the forecast period. Under the freighter sub-segment, cargo airlines operate a fleet of aircraft designed specifically for transporting goods, such as the Boeing 747-8F, Airbus A330-200F, and others. These aircraft are typically owned by the airlines themselves or leased by leasing companies. The air freighter market has been growing in recent years due to the increase in e-commerce, global trade, and expansion of air cargo capacity. For instance, in September 2022, Airbus expanded its outsized air cargo capabilities with a new loading system for the Beluga A300-600ST aircraft for military cargo.

Regional Outlooks

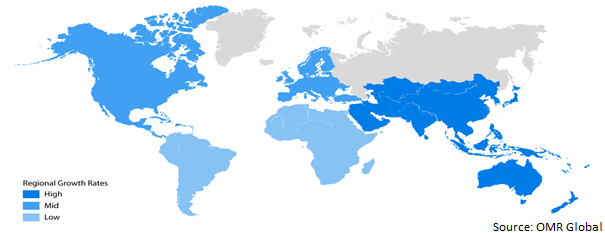

The global air cargo market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, the nPRT market in North America is anticipated to cater to prominent growth over the forecast period. However, the Europe region is projected to experience considerable growth in the air cargo market. The growth of the market in Europe is attributed to globalization and the growing manufacturing and logistics business in Europe.

Global Air Cargo Market Growth, by Region 2023-2030

The Asia-Pacific Region is anticipated to Hold a Significant Share of the Global Air Cargo Market

Among these regions, the Asia-Pacific region is anticipated to account for a significant share of the air cargo market during the forecast period. The growth of the air cargo market in Asia-pacific is primarily attributed to the expansion of the e-commerce business which has led to increased demand for imported goods. Other factors driving the growth of the Asia-Pacific air cargo market include the development of new airports and expansion of existing ones, increasing investment in the logistics sector, and the growth of the manufacturing industry in the Asia-Pacific. For instance, Cainiao Network, the logistics arm of Chinese technology heavyweight Alibaba Group, has increased the number of its overseas distribution centers to 15 to reinforce its global logistics network. It is focusing on last-mile deliveries and smart lockers to improve and localize its services in destination countries. For instance, in February 2023, Cainiao Network, the logistics arm of Chinese technology heavyweight Alibaba Group, increased the number of its overseas distribution centers to 15 to reinforce its global logistics network. The company is focusing on last-mile deliveries and smart lockers to improve and localize its services in destination countries.

Market Players Outlook

The major companies serving the global air cargo market include American Airlines Inc., FedEx Corp., IAG Cargo, Korean Air Lines Co. Ltd., Bollore Logistics, CAL Cargo Air Lines Ltd, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in August 2022, Freighter airline Atlas Air Worldwide was acquired by investment funds led by Apollo Global Management in an all-cash deal that valued the company at $5.2 billion. Atlas Air is a large operator of Boeing, It provides outsourced freight transportation for large clients such as Amazon and DHL Express, as well as 3PLs and individual retailers and manufacturers such as HP. The buyout signifies a strong endorsement of future growth prospects for the air cargo industry.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global air cargo market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. American Airlines Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Bolloré Logistics

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. China Airlines Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. China Southern Airlines Co. Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Air Cargo Market by Type

4.1.1. Belly Cargo

4.1.2. Freighter

4.2. Global Air Cargo Market by End-user

4.2.1. Manufacturing

4.2.2. FMCG and Retail

4.2.3. Pharmaceuticals and Chemicals

4.2.4. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Air France KLM Martinair Cargo

6.2. CAL Cargo Air Lines Ltd.

6.3. Cargolux Airlines International SA

6.4. Cathay Pacific Airways Ltd.

6.5. Delta Air Lines Inc.

6.6. Deutsche Post AG

6.7. Emirates SkyCargo

6.8. Etihad Airways PJSC

6.9. Expeditors International of Washington Inc.

6.10. FedEx Corp.

6.11. IAG Cargo

6.12. Korean Air Lines Co. Ltd.

6.13. Lufthansa Cargo

6.14. Nippon Express Holdings

6.15. Qatar Airways Cargo

6.16. Saudi Airlines Cargo Co.

6.17. Singapore Airlines Cargo

1. GLOBAL AIR CARGO MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

2. GLOBAL BELLY CARGO MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL AIR CARGO FREIGHTER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL AIR CARGO MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

5. GLOBAL AIR CARGO FOR MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL AIR CARGO FOR FMCG AND RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL AIR CARGO FOR PHARMACEUTICALS AND CHEMICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL AIR CARGO FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. EUROPEAN AIR CARGO MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

10. EUROPEAN AIR CARGO MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

11. EUROPEAN AIR CARGO MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

12. ASIA-PACIFIC AIR CARGO MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

13. ASIA-PACIFIC AIR CARGO MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

14. ASIA-PACIFIC AIR CARGO MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

15. REST OF THE WORLD AIR CARGO MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

16. REST OF THE WORLD AIR CARGO MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

17. REST OF THE WORLD AIR CARGO MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

1. GLOBAL AIR CARGO MARKET SHARE BY TYPE, 2022 VS 2030 (%)

2. GLOBAL BELLY CARGO MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL AIR CARGO FREIGHTER MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL AIR CARGO MARKET SHARE BY END-USER, 2022 VS 2030 (%)

5. GLOBAL AIR CARGO FOR MANUFACTURING MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL AIR CARGO FOR FMCG AND RETAIL MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL AIR CARGO FOR PHARMACEUTICALS AND CHEMICALS MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL AIR CARGO FOR OTHERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL AIR CARGO MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. US AIR CARGO MARKET SIZE, 2022-2030 ($ MILLION)

11. CANADA AIR CARGO MARKET SIZE, 2022-2030 ($ MILLION)

12. UK AIR CARGO MARKET SIZE, 2022-2030 ($ MILLION)

13. FRANCE AIR CARGO MARKET SIZE, 2022-2030 ($ MILLION)

14. GERMANY AIR CARGO MARKET SIZE, 2022-2030 ($ MILLION)

15. ITALY AIR CARGO MARKET SIZE, 2022-2030 ($ MILLION)

16. SPAIN AIR CARGO MARKET SIZE, 2022-2030 ($ MILLION)

17. REST OF EUROPE AIR CARGO MARKET SIZE, 2022-2030 ($ MILLION)

18. INDIA AIR CARGO MARKET SIZE, 2022-2030 ($ MILLION)

19. CHINA AIR CARGO MARKET SIZE, 2022-2030 ($ MILLION)

20. JAPAN AIR CARGO MARKET SIZE, 2022-2030 ($ MILLION)

21. SOUTH KOREA AIR CARGO MARKET SIZE, 2022-2030 ($ MILLION)

22. REST OF ASIA-PACIFIC AIR CARGO MARKET SIZE, 2022-2030 ($ MILLION)

23. REST OF THE WORLD AIR CARGO MARKET SIZE, 2022-2030 ($ MILLION)