Air Core Drilling Market

Global Air Core Drilling Market Size, Share & Trends Analysis Report by Application (Dust Drilling, Mist Drilling, Aerated Fluid Drilling, and Others), and by End-Use Industry (Oil & Gas, Mining, and Construction) Forecast Period (2021-2027) Update Available - Forecast 2025-2031

The global air core drilling market is anticipated to grow at a significant CAGR of 5.3% during the forecast period. The rising demand for energy has increased the investment in exploration and production activities for various non-conventional energy sources. This has increased the use of drilling to drill the holes into unconsolidated ground. The increasing production of natural gas globally to meet the growing energy demand has surged the adoption of air core drilling machines. For instance, as per the US Energy Information Administration, the natural gas production (dry gas) reached 33.97 trillion cubic feet (Tcf) in 2019. The US annual dry natural gas production has outdone its consumption, in both heat and volume content, since 2017. More coherent drilling and production approaches have resulted in the rise of natural gas production from tight and shale geologic formations. The rise in production has contributed to the declination of the natural gas prices, which in turn has fuelled in the rise of the use of natural gas by the electric power and industrial sectors. Hence drives the market growth. Moreover, technological adavancments such as video surveillance and X-ray scanner for automated field tests and real-time monitoring of remote observation of operations is offering significant opportunities to the market.

Impact of COVID-19 Pandemic on Global Air Core Drilling Market

The COVID-19 pandemic has impacted most industries, negatively, due to the lockdown, transportation restrictions, workers’ unavailability, and governmental norms to stop the spread of the virus. This affected most of the industries economically and led them to shut down the business during the restrictions across the globe. However, as the situation got normal, the air core drilling market has witnessed significant recovery, as industrial operations such as exploring various non-conventional energy sources were reopened and labor was available.

Segmental Outlook

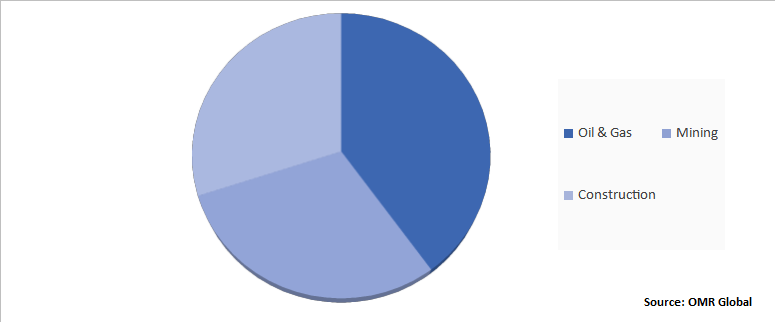

The global air core drilling market is segmented based on the application and end-use industry. Based on the application, the market is segmented into dust drilling, mist drilling, aerated fluid drilling, and others. The other applications of air core drillings are foam drilling and nitrogen membrane drilling. Among application segment, dust drilling segment held the highest share in 2021. The segment is anticipated to hold significant share in the makret during the forecast period owing to its wide adoption for consolidated hard rock formations without formation water in end-user industries. Based on the end-use industry, the market is sub-segmented into oil & gas, mining, and construction.

Global Air Core Drilling Market Share by End-Use Industry, 2020 (%)

The Nitrogen Membrane Drilling Segment is anticipated to be the Fastest Growing While Other Segments Grow Significantly in the Global Air Core Drilling Market

Based on end-user industry, nitrogen membrane drilling is projected to be the fastest-growing segment during the forecast period, as it reduces the opportunities for downhole fire. Membrane components decreases the functioning costs when compared with cryogenic nitrogen drilling. It also eliminates the transportation problems which is related to liquid nitrogen. Weatherford, the possessor of the US patent for nitrogen membrane drilling, allows the permit for this method and has the highest numbers of locally created nitrogen manufacturing units. Furthermore, aerated fluid drilling segment is likely to show notable growth in the market. Aerated liquid drilling technology is used to lower the heaviness of mud to reintegrate circulation in normal mud for functioning and reducing force emergences. This is increasing its demand for structured excavation methods, resulting segment growth. . In addition, growing R&D activities in air core drilling technology are creating significant possibilities in the global market of air core boring. Strict product identifications coupled with surging demand for high-value ore grades are contributing this development and expected to boost the market growth during the forecast period.

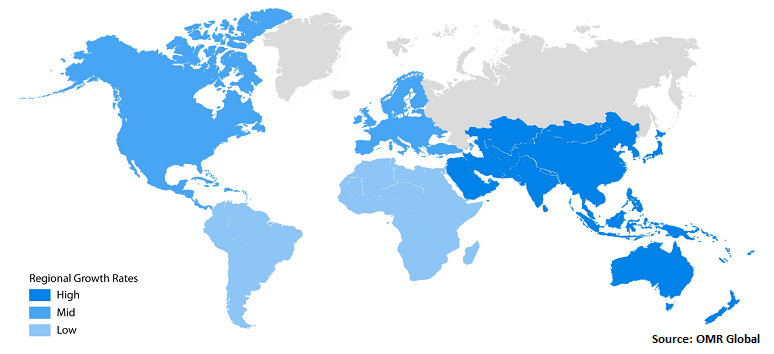

Regional Outlooks

The global air core drilling market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). Asia-Pacific is projected to be the fastest-growing region in global air core drilling market. The regional growth is backed by the rapid development of construction and mining industries and upcoming oil & gas plant projects in major economies of the region.

Global Air Core Drilling Market Growth, by Region 2021-2027

The North America Region Holds the Major Share in the Global Air Core Drilling Market

North America held the major share in the market in 2021, and is anticipated to dominate the global air core drilling market during the forecast period. The growing demand for effective production process to extract loose hydrocarbon soil regions is thrusting the market growth in North America region. Innovations and technological advancements in air core drilling market is also a factor behind the growth of air core drilling market in the region. Furthermore, rising consumption of energy in the major cities of North America is creating profitable opportunities for the growth of the global air core drilling market. As per U.S. Energy Information Administration, US consumption of Biofuels reached to 1,067 Mb/d in 2019, which is more than 40% of total consumption of the Biofuel globally, 2,566 Mb/d in 2019.

Market Players Outlook

The major companies serving the global air core drilling market include Baker Hughes Inc., Halliburton Energy Services, Inc., San Antonio Global Ltd., Schlumberger Ltd., Weatherford International Inc., Allis Chalmers Corp., Archer, Atlas Copco (India) Ltd., AusDrill, Bostech Drilling Australia Pty Ltd., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, In March 2020, Bryah Resource Ltd. Begin a 5,000m air core drilling program at various anticipated locations at Bryah Basin Project in central Western Australia. It predicted to be the first stage of drilling in project location that the company has planned to tackle between March and June 2020. The focus of the air core drilling program is to test the huge geochemical abnormality located at Windalah East, and test for extensions to gold mineralization intersected in previous drilling programs at the Jupiter and Mars prospects.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the global air core drilling market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market-entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global AIR CORE DRILLING Market

• Recovery Scenario of Global AIR CORE DRILLING Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Baker Hughes Inc.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Halliburton Energy Services, Inc.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. San Antonio Global Ltd.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Schlumberger Ltd.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Weatherford International Inc.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Air Core Drilling Market by Application

4.1.1. Dust Drilling

4.1.2. Mist Drilling

4.1.3. Aerated Fluid Drilling

4.1.4. Others (Foam Drilling, and Nitrogen Membrane Drilling)

4.2. Global Air Core Drilling Market by End-Use Industry

4.2.1. Oil & Gas

4.2.2. Mining

4.2.3. Construction

5. Market Determinants

5.1. Motivators

5.2. Restraints

5.3. Opportunities

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Allis Chalmers Corp.

7.2. Archer

7.3. Atlas Copco (India) Ltd.

7.4. Bostech Drilling Australia Pty Ltd.

7.5. Brown Bros Drilling

7.6. Chicago Pneumatic

7.7. DAL Mining

7.8. Edge Drilling

7.9. Geodrill

7.10. Haljohn-San Antonio Inc.

7.11. Harisan

7.12. Master drilling

7.13. Perenti Global Ltd. (Perenti)

7.14. Precision Drilling

7.15. Premier Ltd.

7.16. RANGER DRILLING

7.17. Superior Energy Services, Inc.

7.18. TESCOS.A.

7.19. Three Rivers Drilling

7.20. Wallis Drilling

1. GLOBAL AIR CORE DRILLING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

2. GLOBAL DUST DRILLING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL MIST DRILLING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL AERATED FLUID DRILLING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL AIR CORE DRILLING MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2020-2027 ($ MILLION)

7. GLOBAL AIR CORE DRILLING IN OIL & GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL AIR CORE DRILLING IN MINING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL AIR CORE DRILLING IN CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL AIR CORE DRILLING IN OTHER END-USER INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL AIR CORE DRILLING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

12. NORTH AMERICAN AIR CORE DRILLING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

13. NORTH AMERICAN AIR CORE DRILLING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

14. NORTH AMERICAN AIR CORE DRILLING MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2020-2027 ($ MILLION)

15. EUROPEAN AIR CORE DRILLING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

16. EUROPEAN AIR CORE DRILLING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

17. EUROPEAN AIR CORE DRILLING MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2020-2027 ($ MILLION)

18. ASIA-PACIFIC AIR CORE DRILLING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

19. ASIA-PACIFIC AIR CORE DRILLING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

20. ASIA-PACIFIC AIR CORE DRILLING MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2020-2027 ($ MILLION)

21. REST OF THE WORLD AIR CORE DRILLING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

22. REST OF THE WORLD AIR CORE DRILLING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

23. REST OF THE WORLD AIR CORE DRILLING MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL AIR CORE DRILLING MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL AIR CORE DRILLING MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL AIR CORE DRILLING MARKET, 2021-2027 (%)

4. GLOBAL AIR CORE DRILLING MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

5. GLOBAL AIR CORE DRILLING MARKET SHARE BY END-USE INDUSTRY, 2020 VS 2027 (%)

6. GLOBAL DUST DRILLING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL MIST DRILLING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL AERATED FLUID DRILLING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL OTHER APPLICATIONS OF AIR CORE DRILLING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL AIR CORE DRILLING IN OIL & GAS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL AIR CORE DRILLING IN MINING MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

12. GLOBAL AIR CORE DRILLING IN CONSTRUCTION MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL AIR CORE DRILLING IN OTHER END-USER INDUSTRY MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

14. US AIR CORE DRILLING MARKET SIZE, 2020-2027 ($ MILLION)

15. CANADA AIR CORE DRILLING MARKET SIZE, 2020-2027 ($ MILLION)

16. UK AIR CORE DRILLING MARKET SIZE, 2020-2027 ($ MILLION)

17. FRANCE AIR CORE DRILLING MARKET SIZE, 2020-2027 ($ MILLION)

18. GERMANY AIR CORE DRILLING MARKET SIZE, 2020-2027 ($ MILLION)

19. ITALY AIR CORE DRILLING MARKET SIZE, 2020-2027 ($ MILLION)

20. SPAIN AIR CORE DRILLING MARKET SIZE, 2020-2027 ($ MILLION)

21. REST OF EUROPE AIR CORE DRILLING MARKET SIZE, 2020-2027 ($ MILLION)

22. INDIA AIR CORE DRILLING MARKET SIZE, 2020-2027 ($ MILLION)

23. CHINA AIR CORE DRILLING MARKET SIZE, 2020-2027 ($ MILLION)

24. JAPAN AIR CORE DRILLING MARKET SIZE, 2020-2027 ($ MILLION)

25. SOUTH KOREA AIR CORE DRILLING MARKET SIZE, 2020-2027 ($ MILLION)

26. REST OF ASIA-PACIFIC AIR CORE DRILLING MARKET SIZE, 2020-2027 ($ MILLION)

27. REST OF THE WORLD AIR CORE DRILLING MARKET SIZE, 2020-2027 ($ MILLION)