Air Purification Systems Market

Global Air Purification Systems Market Size, Share & Trends Analysis Report by Product Type (Dust Collectors, Fume, and Smoke Collectors, Vehicle Exhaust, Mist Eliminators, and Fire and Emergency Exhaust), By Technology (HEPA, Activated Carbon, Electrostatic Precipitators, Ionic Filters, and Others), and By End-User (Residential, Commercial, and Industrial) Forecast, 2019-2025 Update Available - Forecast 2025-2031

The global air purification system market is estimated to grow at a CAGR of over 7% during the forecast period. Poor air quality is one of the major reasons for mortality across the globe. According to the World Health Organization, poor quality air caused an estimated 4.2 million premature mortality across the globe. In addition, air pollution leads to higher rates of heart diseases, strokes, cancer and respiratory diseases such as asthma. Apart from these severe diseases, long time exposure to poor quality air causes short term problems such as coughing and sneezing, headaches, eye irritation, and even dizziness. The key reasons behind the decline in air quality include a warming climate, high numbers of wildfires, and others.

To overcome such issues peoples are taking initiatives to safeguard against such issues by increasing ventilation, using exhaust fans, increasing use of air purification systems in homes and offices. Thus, this leads to increased adoption of air purification systems and create lucrative opportunities for the same in the near future. Moreover, the increasing use of air purification systems in various industries including automotive, healthcare, building & construction, manufacturing & energy utility surge the growth of the air purification system market. However, the high prices of the system may challenge the market growth during the forecast period.

Segmental Outlook

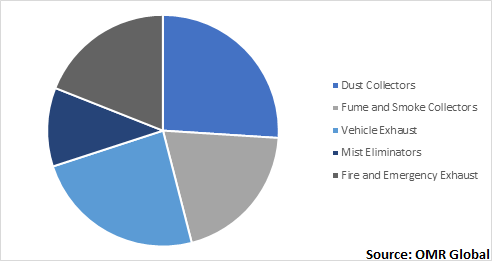

The global air purification system market is segmented on the basis of product type, technology, and end-user. Based on the product type, the market is segmented into dust collectors, fume and smoke collectors, vehicle exhaust, mist eliminators, and fire and emergency exhaust. Based on the technology, the market is segmented as HEPA, activated carbon, electrostatic precipitators, ionic filters, and others such as UV light purifiers. Based on the end-user, the market is segmented into residential, commercial, and industrial.

Global Air Purification Systems Market by Product Type, 2018 (%)

Dust collector segment to hold a considerable share in the market

Based on the product type segment of the air purification system market, the dust collector segment holds the most significant share in the market. This is attributed to the increased demand for making the indoor and ambient air dust-free, which is the primary concern of the population and government in this era. Dust collectors improve the quality of air discharged from commercial and industrial processes by collecting dust, impurities, and other allergen particles from the air. It eliminates solid granule impurities from exhaust gases before venting out in the atmosphere and also recovers valuable solid or powder granules from process streams. Thus, owing to such air-purifying qualities possessed by the dust collector, it holds a significant share in the air purification system market during the forecast period.

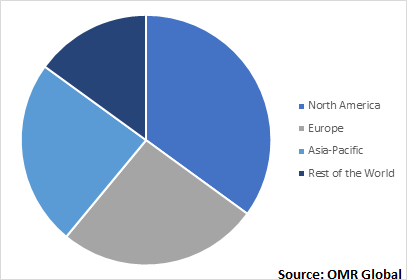

Regional Outlook

The global air purification systems market is geographically segmented into North America, Europe, Asia-Pacific and Rest of the World. North America is estimated to hold the most significant share in the global air purification system market. This is attributed to the presence of large manufacturers such as Honeywell International Inc., 3M Company, Sharp Corp. and many others. According to the American Lung Association in 2019, there are around 40% of peoples affected and are at high risks of diseases and death due to air pollution. Thus, the increased awareness regarding health and lifestyle creates lucrative opportunities for the air purification systems market in the region.

Global Air Purification Systems Market, by Region 2018 (%)

Market Players Outlook

The prominent players functioning in the global air purification system market include Daikin Industries Ltd., Clean Teq Holding Ltd., Mann+Hummel GmbH, Honeywell International Inc., 3M Company, Panasonic Corp., and LG Electronics Inc, among others. These manufacturers adopt several growth strategies such as innovations in products, new product launches, several mergers and acquisitions, among others in order to sustain in such a competitive environment. For instance, in March 2019, Sharp Corp. launched the new KC-G40M Air Purifier with Humidifier. The new KC-G40M Air Purifier is a combination of humidifier and air purifier specially designed for summers. It uses Passive HEPA and PANDAA filters to reduce pollutants such as toluene, pollen, ethylbenzene, HAZE, PM2.5 compounds among others. With the launch of this novel product, the company aims to enhance its product offerings and strengthen its position in the global market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global air purification system market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Daikin Industries Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Mann+Hummel GmbH

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Clean Teq Holdings Ltd.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Clarcor Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Panasonic Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Air Purification System Market by Product Type

5.1.1. Dust Collectors

5.1.2. Fume and Smoke Collectors

5.1.3. Vehicle Exhaust

5.1.4. Mist Eliminators

5.1.5. Fire and Emergency Exhaust

5.2. Global Air Purification System Market by Technology

5.2.1. HEPA

5.2.2. Activated Carbon

5.2.3. Electrostatic Precipitators

5.2.4. Ionic Filters

5.2.5. Others (UV Light Purifiers, Ozone Generators)

5.3. Global Air purification system Market by End-User

5.3.1. Residential

5.3.2. Commercial

5.3.3. Industrial

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Air Products and Chemicals Inc.

7.2. Alfa Laval AB

7.3. Blueair AB

7.4. Clean Teq Holding Ltd.

7.5. Daikin Industries Ltd.

7.6. Eureka Forbes Ltd.

7.7. Fumex Inc.

7.8. Honeywell International Inc.

7.9. HSIL Ltd.

7.10. Kent RO Systems Ltd.

7.11. Koninklijke Philips N.V.

7.12. Livpure Pvt. Ltd.

7.13. LG Electronics, inc.

7.14. Mann+Hummel GmbH

7.15. Panasonic Corp.

7.16. Sharp Electronics Corp.

7.17. SPX Flow, Inc.

7.18. The 3M Company

7.19. The Camfil Group

1. GLOBAL AIR PURIFICATION SYSTEM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

2. GLOBAL DUST COLLECTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL FUME AND SMOKE COLLECTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL VEHICLE EXHAUST MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL MIST ELIMINATORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL FIRE AND EMERGENCY EXHAUST MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL AIR PURIFICATION SYSTEM MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

8. GLOBAL HEPA TECHNOLOGY OF AIR PURIFICATION SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL ACTIVATED CARBON TECHNOLOGY OF AIR PURIFICATION SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL ELECTROSTATIC PRECIPITATORS TECHNOLOGY OF AIR PURIFICATION SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL IONIC FILTERS TECHNOLOGY OF AIR PURIFICATION SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL OTHER TECHNOLOGIES OF AIR PURIFICATION SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL AIR PURIFICATION SYSTEM MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

14. GLOBAL AIR PURIFICATION SYSTEM IN RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

15. GLOBAL AIR PURIFICATION SYSTEM IN COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

16. GLOBAL AIR PURIFICATION SYSTEM IN INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

17. GLOBAL AIR PURIFICATION SYSTEM MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

18. NORTH AMERICAN AIR PURIFICATION SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

19. NORTH AMERICAN AIR PURIFICATION SYSTEM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

20. NORTH AMERICAN AIR PURIFICATION SYSTEM MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

21. NORTH AMERICAN AIR PURIFICATION SYSTEM MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

22. EUROPEAN AIR PURIFICATION SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

23. EUROPEAN AIR PURIFICATION SYSTEM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

24. EUROPEAN AIR PURIFICATION SYSTEM MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

25. EUROPEAN AIR PURIFICATION SYSTEM MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

26. ASIA-PACIFIC AIR PURIFICATION SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

27. ASIA-PACIFIC AIR PURIFICATION SYSTEM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

28. ASIA-PACIFIC AIR PURIFICATION SYSTEM MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

29. ASIA-PACIFIC AIR PURIFICATION SYSTEM MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

30. REST OF THE WORLD AIR PURIFICATION SYSTEM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

31. REST OF THE WORLD AIR PURIFICATION SYSTEM MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

32. REST OF THE WORLD AIR PURIFICATION SYSTEM MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL AIR PURIFICATION SYSTEM MARKET SHARE BY PRODUCT TYPE, 2018 VS 2025 (%)

2. GLOBAL AIR PURIFICATION SYSTEM MARKET SHARE BY TECHNOLOGY, 2018 VS 2025 (%)

3. GLOBAL AIR PURIFICATION SYSTEM MARKET SHARE BY END -USER, 2018 VS 2025 (%)

4. GLOBAL AIR PURIFICATION SYSTEM MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US AIR PURIFICATION SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA AIR PURIFICATION SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

7. UK AIR PURIFICATION SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE AIR PURIFICATION SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY AIR PURIFICATION SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY AIR PURIFICATION SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN AIR PURIFICATION SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE AIR PURIFICATION SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA AIR PURIFICATION SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA AIR PURIFICATION SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN AIR PURIFICATION SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC AIR PURIFICATION SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD AIR PURIFICATION SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)