Air Taxi Market

Global Air Taxi Market Size, Share & Trends Analysis Report by Propulsion Type (Electric, Parallel Hybrid, Turboshaft, and Turboelectric), By Operation (Autonomous and Piloted) and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global market for air taxi is projected to have considerable CAGR of around 26.5% during the forecast period. The growth of the air taxi market is attributed to the rising investments from various private organizations to enhance the consumer flying experience by providing UAM for commercial applications including air taxi. The rapid urbanization along with increased road congestion has led the manufacturers and service providers to offer efficient and cost-effective transportation and goods-delivery system, which has resulted in the growth of the air taxi services. Further, extensive R&D investments in the air taxi market, with many startups and aerospace players actively contributing to the market are creating enormous growth opportunities in the market. Adding to this, increasing demand for autonomous flight technology coupled with the developed communication system tends to increase the market share of air taxi.

Segmental Outlook

The global air taxi market is segmented based on propulsion type, and operation. Based on the propulsion type, the market is further classified into electric, parallel hybrid, turboshaft, and turboelectric. The electric segment is projected to have considerable growth owing to the significant rise in adoption of electric vehicles. On the basis of operation the market is further segregated into autonomous and piloted.

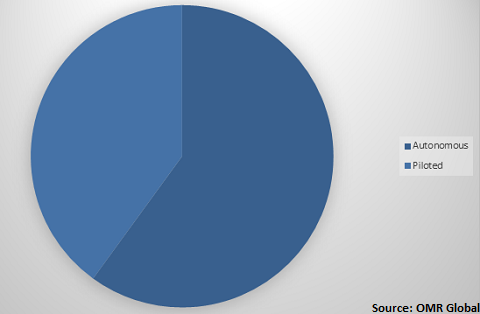

Global air taxi Market Share by Operation, 2019(%)

Global air taxi market to be driven by piloted operation

Among operation, the pilot segment held a considerable share in the market owing to the increased investment by private and public organizations for the development of advanced transportation system. The development of the novel air vehicles that are introduced firstly as pilot-operated further contribute in the market. For instance, in June 2017, Workhorse Group Inc., an American technology manufacturer that is centered on providing sustainable and cost-effective solutions to the commercial transportation sector, introduced its Surefly helicopter concept at the Paris Air Show 2017 and it also released specifications. The Surefly includes various features such as safer and more stable, redundant design including four propeller arms, a backup battery to drive the electric motors in the event of engine failure, two fixed contra-rotating propellers on each arm and a ballistic parachute for safety.

Regional Outlook

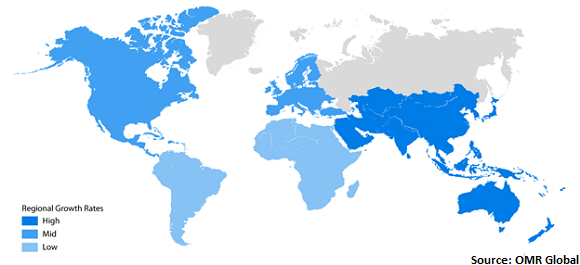

Geographically, the global air taxi market is further classified into North America, Europe, Asia-Pacific and the Rest of the World. Asia-Pacific is estimated to have considerable growth in the air taxi market during the forecast period owing to increasing urbanization coupled with rising traffic congestion in China, Japan, Singapore, India and other countries. The government initiatives and programs for the air vehicles is also contributing to the growth of the market. For instance, in October 2018, the government of Japan started a Project by the partnership with Subaru, Uber, and Boeing to commercialize flying vehicles by 2020.

Global air taxi Market Growth, by Region 2020-2026

North America to hold a considerable share in the global air taxi market

Geographically, North America is projected to hold a significant share in the global air taxi market during the forecast period. The US is the largest economy and has most of the large market players making North America the largest market across the globe. Major US-based global players in the UAM market include Kitty Hawk Corp., Lockheed Martin Corp., Uber Technologies, Inc., Bell Textron, Inc., and Honeywell International, Inc. that hold a significant market share. High disposable income, a large proportion of high-income people, and various product launch in the country related to the market, are some of the major factors which will provide a significant opportunity to the market in the region.

Market Players Outlook

The key players in the air taxi market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include Airbus SE, Lilium GmbH, Kitty Hawk Corp., The Boeing Co., Uber Technologies, Inc., and others. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. For instance, In October 2019, Uber has taken a big step in air taxi and has introduced helicopter taxi service, The Uber Copter in New York. It transports passengers from lower Manhattan to John F. Kennedy (JFK) International Airport within eight-minutes.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global air taxi market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Airbus SE

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Lilium GmbH

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Kitty Hawk Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. The Boeing Co.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Uber Technologies, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Air Taxi Market by Propulsion Type

5.1.1. Electric

5.1.2. Parallel Hybrid

5.1.3. Turboshaft

5.1.4. Turboelectric

5.2. Global Air Taxi Market by Operation

5.2.1. Autonomous

5.2.2. Piloted

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Airbus SE

7.2. Airspace Experience Technologies, Inc.

7.3. The Boeing Co.

7.4. Bell Textron, Inc.

7.5. EHang Intelligent Technology Co. Ltd.

7.6. FACC AG

7.7. Fly Aeolus

7.8. Embraer SA

7.9. Honeywell International, Inc.

7.10. Hoversurf

7.11. Kitty Hawk Corp.

7.12. Neva Aerospace, Ltd.

7.13. Nurol Aviation Inc.

7.14. Lockheed Martin Corp.

7.15. Lilium GmbH

7.16. Skyway Air Taxi, LLC

7.17. Uber Technologies, Inc.

7.18. Volocopter GmbH

1. GLOBAL AIR TAXI MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2019-2026 ($ MILLION)

2. GLOBAL ELECTRIC AIR TAXI MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL PARALLEL HYBRID AIR TAXI MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL TURBOSHAFT AIR TAXI MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL TURBOELECTRIC AIR TAXI MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL AIR TAXI MARKET RESEARCH AND ANALYSIS BY OPERATION, 2019-2026 ($ MILLION)

7. GLOBAL AUTONOMOUS AIR TAXI MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL PILOTED AIR TAXI MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL AIR TAXI MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

10. NORTH AMERICAN AIR TAXI MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN AIR TAXI MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2019-2026 ($ MILLION)

12. NORTH AMERICAN AIR TAXI MARKET RESEARCH AND ANALYSIS BY OPERATION, 2019-2026 ($ MILLION)

13. EUROPEAN AIR TAXI MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. EUROPEAN AIR TAXI MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2019-2026 ($ MILLION)

15. EUROPEAN AIR TAXI MARKET RESEARCH AND ANALYSIS BY OPERATION, 2019-2026 ($ MILLION)

16. ASIA-PACIFIC AIR TAXI MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC AIR TAXI MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC AIR TAXI MARKET RESEARCH AND ANALYSIS BY OPERATION, 2019-2026 ($ MILLION)

19. REST OF THE WORLD AIR TAXI MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2019-2026 ($ MILLION)

20. REST OF THE WORLD AIR TAXI MARKET RESEARCH AND ANALYSIS BY OPERATION, 2019-2026 ($ MILLION)

1. GLOBAL AIR TAXI MARKET SHARE BY PROPULSION TYPE, 2019 VS 2026 (%)

2. GLOBAL AIR TAXI MARKET SHARE BY OPERATION, 2019 VS 2026 (%)

3. GLOBAL AIR TAXI MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US AIR TAXI MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA AIR TAXI MARKET SIZE, 2019-2026 ($ MILLION)

6. UK AIR TAXI MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE AIR TAXI MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY AIR TAXI MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY AIR TAXI MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN AIR TAXI MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE AIR TAXI MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA AIR TAXI MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA AIR TAXI MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN AIR TAXI MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC AIR TAXI MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD AIR TAXI MARKET SIZE, 2019-2026 ($ MILLION)