Aircraft Carrier Ship Market

Global Aircraft Carrier Ship Market Size, Share & Trends Analysis Report, by Type (Catapult-Assisted Take-off Barrier arrested-recovery (CATOBAR), Short Take-off but Arrested Recovery (STOBAR), Short Take-off but Vertical Recovery (STOVL)), By Propulsion Technology (Conventional Powered, and Nuclear Powered) and Forecast, 2020-2026 Update Available - Forecast 2025-2031

The aircraft carrier ship market is expected to show a modest growth rate during the forecast period. An aircraft carrier ship is defined as a warship with a flight deck on which aircraft and helicopters can be launched and landed as per requirements. The driver to the aircraft carrier ship market includes the strategic advantage to a nation as it offers a mobile base to deploy its military equipment. Moreover, the countries showcase their dominance over sea area by deploying aircraft carrier ship. Rising concentration on maritime security and high usage of nuclear energy are also augmenting the market. One of the major restraints associated with the aircraft carrier ship market is the cost and maintenance associated with it. The cost of an aircraft carrier ship is in billions and the countries has to spend million to meet the daily expenses of an aircraft carrier, due to which some countries restrain themselves to buy an aircraft carrier ship. For instance, countries such as Germany, Canada have no commissioned or under construction aircraft carrier ship as of May 2020.

Market Segmentation

The global aircraft carrier ship market is segmented based on type and propulsion technology. By type of takeoff and landing method, the market is further segmented into Catapult-Assisted Take-off Barrier arrested-recovery (CATOBAR), Short Take-off but Arrested Recovery (STOBAR), Short Take-off but Vertical Recovery (STOVL). CATOBAR technology is used by earlier French and US aircraft carrier ships. STOBAR technology is mainly used by Russian and Asian aircraft carrier ships which include China, and India. Most of the latest aircraft carrier ship carrier uses STOVL technology, which is used by Australia, Italy, UK, and the US. A quite similar technology that is VTOL is used by the helicopter carriers of Egypt, France, Japan, Brazil, and Russia.

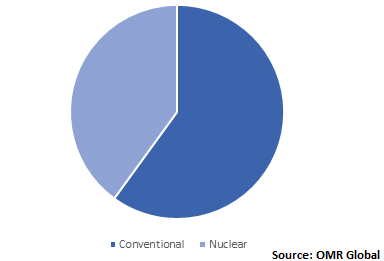

By propulsion technology, the market is segmented into conventional powered and nuclear-powered aircraft carrier ship. As of now, only the US and France have the capability to run their aircraft carrier on nuclear fuel and China is constructing an aircraft carrier on nuclear propulsion. Other than this, all the countries are still depending on the conventional fuel for their operations.

Global Aircraft Carrier Ship Market Share by Propulsion Technology, 2019 (%)

Regional Outlook

The global aircraft carrier ship market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World (RoW). North America is expected to hold a significant market share as the US has the largest aircraft carrier fleet all across the globe. Three aircraft carriers are expected to be commissioned during the forecast period in the US. Europe is also expected to hold a considerable market share. In December 2019, UK has commissioned Queen Elizabeth class aircraft carrier ship named Prince of Wales. Italy is planning to commission its third aircraft carrier in 2020. In the rest of the World, Turkey is also planning to commission its first aircraft carrier ship.

Asia-Pacific is expected to show significant growth in the market. China has commissioned Type 002 class aircraft carrier ship Shandong in December 2019. China is also preparing to commission three aircraft carrier ships during the forecast period whereas South Korea and India are planning to commission three and one aircraft carrier ship respectively during the forecast period. Out of three aircraft carrier of South Korea, one aircraft carrier ship named Marado is undergoing sea trails.

Global Aircraft Carrier Ship Market Growth, by Region 2020-2026

Market Players Outlook

The aircraft carrier ship market is the highly consolidated market and very few players are working in the market due to high investment associated with it. Some of the major players operating in the market include Dalian Shipbuilding Industry Co., BAE Systems plc, Sedef Shipbuilding, Inc., Huntington Ingalls Industries Ltd., Cochin Shipyard Ltd., Navantia, S.A., S.M.E, and others. The companies on collaborating with the government under Public Private Partnerships (PPP) to upgrade the aircraft carrier ship as per requirements. For instance, in May 2020, the Italian Aircraft Carrier ‘Cavour’ completed its 16 months upgrade and now is able to operate F-35B joint Strike Fighter. Cavour is a March 2008 commissioned STOVL type conventional fuel-based aircraft carrier ship.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global aircraft carrier ship market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdowns

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Huntington Ingalls Industries Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Fincantieri S.p.A.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Dalian Shipbuilding Industry Co.(DSIC)

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Cochin Shipyard Ltd.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Aircraft Carrier Ship Market by Type

5.1.1. Catapult-Assisted Take-off Barrier arrested-recovery (CATOBAR)

5.1.2. Short Take-off but Arrested Recovery (STOBAR)

5.1.3. Short Take-off but Vertical Recovery (STOVL)

5.2. Global Aircraft Carrier Ship Market by Propulsion Technology

5.2.1. Conventional Powered

5.2.2. Nuclear Powered

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Rest of North America

6.2. Europe

6.2.1. UK

6.2.2. Italy

6.2.3. France

6.2.4. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Babcock International Group PLC

7.2. BAE Systems plc

7.3. Cochin Shipyard Ltd.

7.4. Dalian Shipbuilding Industry Co.(DSIC)

7.5. Fincantieri S.p.A.

7.6. General Atomics

7.7. Hanjin Heavy Industry Co. Ltd.

7.8. Huntington Ingalls Industries Ltd.

7.9. Leonardo S.p.A.

7.10. Navantia, S.A., S.M.E

7.11. Northrop Grumman Corp.

7.12. Sedef Shipbuilding, Inc.

7.13. Thales Group

1. GLOBAL AIRCRAFT CARRIER SHIP MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL CATOBAR MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

3. GLOBAL STOBAR MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

4. GLOBAL STOVL MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

5. GLOBAL AIRCRAFT CARRIER SHIP MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2019-2026 ($ MILLION)

6. GLOBAL CONVENTIONAL POWERED MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2019-2026 ($ MILLION)

7. GLOBAL NUCLEAR POWERED MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2019-2026 ($ MILLION)

8. NORTH AMERICAN AIRCRAFT CARRIER SHIP MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

9. NORTH AMERICAN AIRCRAFT CARRIER SHIP MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

10. NORTH AMERICAN AIRCRAFT CARRIER SHIP MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2019-2026 ($ MILLION)

11. EUROPEAN AIRCRAFT CARRIER SHIP MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. EUROPEAN AIRCRAFT CARRIER SHIP MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

13. EUROPEAN AIRCRAFT CARRIER SHIP MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2019-2026 ($ MILLION)

14. ASIA PACIFIC AIRCRAFT CARRIER SHIP MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. ASIA PACIFIC AIRCRAFT CARRIER SHIP MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

16. ASIA PACIFIC AIRCRAFT CARRIER SHIP MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2019-2026 ($ MILLION)

17. REST OF THE WORLD AIRCRAFT CARRIER SHIP MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

18. REST OF THE WORLD AIRCRAFT CARRIER SHIP MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2019-2026 ($ MILLION)

1. GLOBAL AIRCRAFT CARRIER SHIP MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL AIRCRAFT CARRIER SHIP MARKET SHARE BY PROPULSION TECHNOLOGY, 2019 VS 2026 (%)

3. GLOBAL AIRCRAFT CARRIER SHIP MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US AIRCRAFT CARRIER SHIP MARKET SIZE, 2019-2026 ($ MILLION)

5. REST OF NORTH AMERICA AIRCRAFT CARRIER SHIP MARKET SIZE, 2019-2026 ($ MILLION)

6. UK AIRCRAFT CARRIER SHIP MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE AIRCRAFT CARRIER SHIP MARKET SIZE, 2019-2026 ($ MILLION)

8. ITALY AIRCRAFT CARRIER SHIP MARKET SIZE, 2019-2026 ($ MILLION)

9. REST OF EUROPE AIRCRAFT CARRIER SHIP MARKET SIZE, 2019-2026 ($ MILLION)

10. INDIA AIRCRAFT CARRIER SHIP MARKET SIZE, 2019-2026 ($ MILLION)

11. CHINA AIRCRAFT CARRIER SHIP MARKET SIZE, 2019-2026 ($ MILLION)

12. JAPAN AIRCRAFT CARRIER SHIP MARKET SIZE, 2019-2026 ($ MILLION)

13. REST OF ASIA-PACIFIC AIRCRAFT CARRIER SHIP MARKET SIZE, 2019-2026 ($ MILLION)

14. REST OF WORLD AIRCRAFT CARRIER SHIP MARKET SIZE, 2019-2026 ($ MILLION)