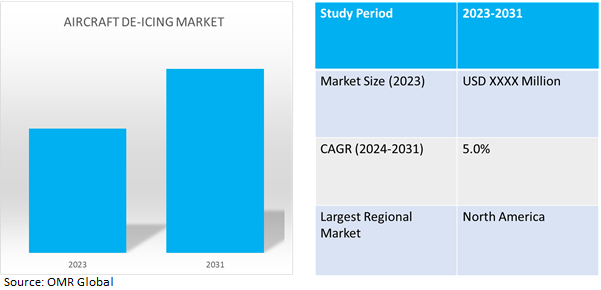

Aircraft De-icing Market

Aircraft De-icing Market Size, Share & Trends Analysis Report by Offerings (De-icing chemicals and Fluids and De-icing Equipment), and by Application (Commercial and Military) Forecast Period (2024-2031)

Aircraft de-icing market is anticipated to grow at a CAGR of 5.0% during the forecast period (2024-2031). Aircraft de-icing solution is a mixture of propylene glycol and water, heated to around 150 degrees, and sprayed under pressure to the wings of an aircraft. It helps to remove the ice from the aircraft making it suitable for take-off.

Market Dynamics

Increased focus on building centralized network facilities

The airline and airport operations business models have undergone substantial changes, which has resulted in rapid expansion of the global aviation sector. Consequently, airline companies and airport authorities are employing innovative and enhanced methods to oversee the intricate aviation operations environment. Furthermore, several airline companies have created an agile, shared infrastructure that enables quick and easy information sharing amongst many stakeholders. Additionally, by giving airline operators and airport authorities access to a converged network architecture, this efficient airport infrastructure guarantees a better customer experience and shortens airline operators' turnaround times. Hence, such factors are positively impacting the market which in turn drives the market growth.

Demand for effective and efficient de-icing solutions

Globally, strict guidelines are enforced by aviation authorities concerning the safety of flight operations, particularly during inclement weather. To reduce the danger of accidents and guarantee that aircraft surfaces are free of ice and snow, these regulations frequently require the use of de-icing techniques. For instance, title 14 of the Code of Federal Regulations (14 CFR), describes the numerous safety requirements for aviation in the US. Airworthiness regulations for transport category aircraft, including specifications for ice protection equipment, are addressed in detail in Part 25. The need to comply with these regulations drives the demand for effective and efficient de-icing solutions, thus creating robust industry growth.

Market Segmentation

Our in-depth analysis of the global aircraft de-icing market includes the following segments by method, offerings, and application:

- Based on offerings, the market is bifurcated into de-icing chemicals and fluids and de-icing equipment.

- Based on application, the market is augmented into commercial and military.

De-icing Chemicals and Fluids is Projected to Emerge as the Largest Segment

Based on offerings, the global aircraft de-icing market is sub-segmented into de-icing chemicals and fluids and de-icing equipment. Among these, the de-icing chemicals and fluids sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the imperative of maintaining flight safety during winter and adverse weather conditions. Aviation regulations demand specialized de-icing solutions for removing ice and snow from aircraft surfaces, driven by rising global travel trends, passenger safety, and operational efficiency. This market growth drives innovation.

Commercial Sub-segment to Hold a Considerable Market Share

The requirement to maintain flight safety in inclement weather is driving the demand for de-icing systems in commercial aircraft. The use of efficient de-icing techniques is influenced by regulatory requirements requiring the removal of snow and ice from aircraft surfaces. As aviation travel grows globally, so does the likelihood of experiencing difficult weather, which makes effective de-icing techniques necessary. Technological developments, such as novel de-icing fluids and methods, also fuel market expansion as airports and airlines look for cost-effective, environmentally friendly ways to preserve operational integrity and passenger safety. Additionally, consumers demand reliable, safe air travel, and airlines aim to minimize winter weather disruptions by introducing efficient de-icing procedures, meeting passenger expectations, and maintaining a positive reputation.

Regional Outlook

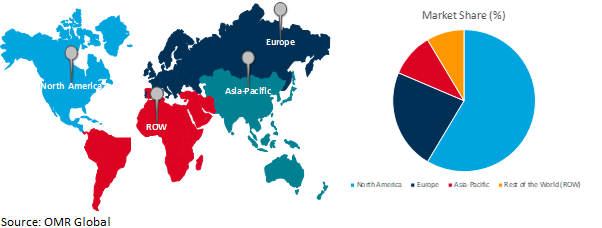

The global aircraft de-icing market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

European countries to invest in aircraft de-icing market

- The UK is developing advanced products using new methods and techniques which lead to huge investments in the aircraft de-icing market.

Global Aircraft De-icing Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the cold climates and frequent snowfall that require de-icing to ensure the safe operation of flights. Strong de-icing procedures are required to guarantee safe air flight in the area due to the varied and difficult winter weather conditions that the area encounters. Aviation authorities have set strict regulations, which further emphasize the need for efficient de-icing technologies. Furthermore, the demand for trustworthy de-icing technologies has increased because of the rise in flight traffic at airports throughout North America.

The region's increasing flight and passenger counts highlight the critical need for prompt and effective de-icing operations. For instance, as per the Airlines for America (A4A), the U.S. airlines operate, more than 26,000 flights carrying 2.6 million passengers to/from nearly 80 countries and 61,000 tons of cargo to/from more than 220 countries daily. North American airlines are enhancing their de-icing procedures to reduce winter weather disruptions and ensure timely departures, driving product demand and promoting safety and operational efficiency.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global aircraft de-icing market include LyondellBasell Industries N.V., The Dow Company, CLARIANT, and General Atomics, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in June 2023, Equivu Capital Holdings, Salvatore C. Calvino's private investment firm, launched NextGen Deicing, an aircraft deicing company. NextGen Deicing is focused on reducing the Airline's winter operations costs and flight delays by using less deicing fluid.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global aircraft de-icing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Clariant AG

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Shell Group of Companies (AeroShell)

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. The DOW Company

1.1.1. Overview

1.1.2. Financial Analysis

1.1.3. SWOT Analysis

1.1.4. Recent Developments

3.5. LyondellBasell Industries N.V.

1.1.5. Overview

1.1.6. Financial Analysis

1.1.7. SWOT Analysis

1.1.8. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Aircraft De-icing Market by Offerings

4.1.1. De-icing Chemicals and Fluids

4.1.2. De-icing Equipment

4.2. Global Aircraft De-icing Market by Application

4.2.1. Commercial

4.2.2. Military

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Aircraft Deicing Inc.

6.2. Aviation Laboratories

6.3. CAV Systems Ltd. (TKS)

6.4. Cryotech Deicing Technology (General Atomics International Services Corp. (GA-ISC))

6.5. Global Ground Support LLC

6.6. Ground Support Specialists

6.7. Kilfrost Inc

6.8. Mallaghan GSE

6.9. Oshkosh Corp.

6.10. Textron Ground Support Equipment Inc.

6.11. Vestergaard Co.

1. GLOBAL AIRCRAFT DE-ICING MARKET RESEARCH AND ANALYSIS BY OFFERINGS, 2023-2031 ($ MILLION)

2. GLOBAL AIRCRAFT DE-ICING CHEMICALS AND FLUIDS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL AIRCRAFT DE-ICING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL AIRCRAFT DE-ICING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

5. GLOBAL AIRCRAFT DE-ICING FOR COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL AIRCRAFT DE-ICING FOR MILITARY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL AIRCRAFT DE-ICING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. NORTH AMERICAN AIRCRAFT DE-ICING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

9. NORTH AMERICAN AIRCRAFT DE-ICING MARKET RESEARCH AND ANALYSIS BY METHOD, 2023-2031 ($ MILLION)

10. NORTH AMERICAN AIRCRAFT DE-ICING MARKET RESEARCH AND ANALYSIS BY OFFERINGS, 2023-2031 ($ MILLION)

11. NORTH AMERICAN AIRCRAFT DE-ICING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

12. EUROPEAN AIRCRAFT DE-ICING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. EUROPEAN AIRCRAFT DE-ICING MARKET RESEARCH AND ANALYSIS BY METHOD, 2023-2031 ($ MILLION)

14. EUROPEAN AIRCRAFT DE-ICING MARKET RESEARCH AND ANALYSIS BY OFFERINGS, 2023-2031 ($ MILLION)

15. EUROPEAN AIRCRAFT DE-ICING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

16. ASIA-PACIFIC AIRCRAFT DE-ICING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. ASIA-PACIFIC AIRCRAFT DE-ICING MARKET RESEARCH AND ANALYSIS BY METHOD, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC AIRCRAFT DE-ICING MARKET RESEARCH AND ANALYSIS BY OFFERINGS, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC AIRCRAFT DE-ICING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

20. REST OF THE WORLD AIRCRAFT DE-ICING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. REST OF THE WORLD AIRCRAFT DE-ICING MARKET RESEARCH AND ANALYSIS BY METHOD, 2023-2031 ($ MILLION)

22. REST OF THE WORLD AIRCRAFT DE-ICING MARKET RESEARCH AND ANALYSIS BY OFFERINGS, 2023-2031 ($ MILLION)

23. REST OF THE WORLD AIRCRAFT DE-ICING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL AIRCRAFT DE-ICING MARKET SHARE BY OFFERINGS, 2023 VS 2031 (%)

2. GLOBAL AIRCRAFT DE-ICING CHEMICALS AND FLUIDS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL AIRCRAFT DE-ICING EQUIPMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL AIRCRAFT DE-ICING MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

5. GLOBAL AIRCRAFT DE-ICING FOR COMMERCIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL AIRCRAFT DE-ICING FOR MILITARY MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL AIRCRAFT DE-ICING MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. US AIRCRAFT DE-ICING MARKET SIZE, 2023-2031 ($ MILLION)

9. CANADA AIRCRAFT DE-ICING MARKET SIZE, 2023-2031 ($ MILLION)

10. UK AIRCRAFT DE-ICING MARKET SIZE, 2023-2031 ($ MILLION)

11. FRANCE AIRCRAFT DE-ICING MARKET SIZE, 2023-2031 ($ MILLION)

12. GERMANY AIRCRAFT DE-ICING MARKET SIZE, 2023-2031 ($ MILLION)

13. ITALY AIRCRAFT DE-ICING MARKET SIZE, 2023-2031 ($ MILLION)

14. SPAIN AIRCRAFT DE-ICING MARKET SIZE, 2023-2031 ($ MILLION)

15. REST OF EUROPE AIRCRAFT DE-ICING MARKET SIZE, 2023-2031 ($ MILLION)

16. INDIA AIRCRAFT DE-ICING MARKET SIZE, 2023-2031 ($ MILLION)

17. CHINA AIRCRAFT DE-ICING MARKET SIZE, 2023-2031 ($ MILLION)

18. JAPAN AIRCRAFT DE-ICING MARKET SIZE, 2023-2031 ($ MILLION)

19. SOUTH KOREA AIRCRAFT DE-ICING MARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF ASIA-PACIFIC AIRCRAFT DE-ICING MARKET SIZE, 2023-2031 ($ MILLION)

21. LATIN AMERICA AIRCRAFT DE-ICING MARKET SIZE, 2023-2031 ($ MILLION)

22. MIDDLE EAST AND AFRICA AIRCRAFT DE-ICING MARKET SIZE, 2023-2031 ($ MILLION)