Aircraft Lighting Market

Aircraft Lighting Market Size, Share & Trends Analysis Report by Type (Commercial Aircraft, Military Aircraft and Others (Helicopters, Unmanned Aerial Vehicles (UAVs)) by Light Type (Interior light and Exterior light) and by Technology (Light Emitting Diode(LED), Fluorescent Lighting and Others (OLED (Organic Light Emitting Diode), Laser Lighting)) Forecast Period (2024-2031) Update Available - Forecast 2025-2031

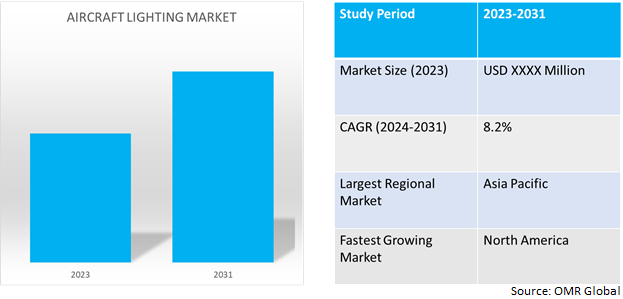

Aircraft lighting market is anticipated to grow at a CAGR of 8.2% during the forecast period. Aircraft lighting consists of landing lights, position lights (wing and tail), formation lights, cabin lights (dome and worktable), indicator lamps, bomb-release signal lights, inter-aircraft control-lamp assemblies, and instrument lights.

Market Dynamics

Increased Demand for Non-electrical Floor Path Lighting and Customized Lighting is Driving Market Growth

Next-generation non-electrical floor path marking systems, which consist of photoluminescent lighting strips installed on the cabin floor to guide passengers to emergency exits in case of cabin lighting failure, are witnessing increased demand. For instance, Lufthansa Technik, and major aircraft lighting company, produces the GuideU non-electrical floor path-making system for aircraft, which can be deployed in aircraft models without needing power. In recent years, Original Equipment Manufacturer (OEMs) and airlines have directed their focus toward the improvement of visually pleasing lighting. This trend is further accelerated mainly by the growing demand for private air fleets and customizations along with growing safety importance.. For instance, in July 2022, Virgin Atlantic unveiled its new Airbus A330neo, aiming to offer a premium and personalized experience for passengers. The Upper-Class cabin features a new seat design, an updated social space, and the introduction of The Retreat Suite, the airline's largest suite to date. The aircraft also promises increased connectivity options for passengers throughout the cabin.

Rising Aircraft Refurbishment Drive Market Growth by Extending Lifespan of Older Aircraft

In recent times, there has been an increase in the requirement for refurbishment and restoration of aging airplanes and corporate jets. Given that a significant number of aircraft are retired and overhauled annually, there exists a necessity to renovate and refurbish older airplanes as either cargo or passenger airplanes. Several operators and airlines have initiated the process of renewing with advanced lighting solutions as a modernization measure.

Additionally, airline operators globally heavily invest in aircraft modernization programs and increase contracts with OEMs to upgrade traditional cabin interiors and aircraft lighting systems, as the airline industry mainly focuses on enhancing passenger experience and comfort by installing advanced aircraft interior systems. Growing expenditure on the aviation sector and growing spending on the development and design of advanced aircraft lighting drive market growth.

Market Segmentation

Our in-depth analysis of the global aircraft lighting market includes the following segments by type of battery and end-user industry:

- Based on aircraft type, the market is sub-segmented into commercial aircraft, military aircraft, and others (helicopters, Unmanned Aerial Vehicles (UAVs))

- Based on the light type, the market is sub-segmented into interior light and exterior light

- Based on technology, the market is sub-segmented into Light Emitting Diode(LED), fluorescent lighting, and Others (OLED (Organic Light Emitting Diode), laser lighting)

The Commerical Aircraft Segment is Expected to Grow Significantly in the Forecast Period

Among the aircraft types, the commercial aircraft segment contributes the highest share. According to the data from Boeing, between 2022 to 2042 world passenger traffic in Revenue Passenger Kilometers(RPK) is expected to grow from $6 trillion to $20 trillion. Similarly global cargo traffic in terms of Revenue Tonne Kilometers(RTK) is expected to grow from $260 billion to $630 billion. To capitalize on this growth, the global airline industry is investing in the expansion of its air fleet to stay competitive. As per the same source, between 2022 to 2042, the global air fleet is expected to double from 24,510 aircraft to 48,575 aircraft. This is driving demand for aircraft lighting market and also opportunities for market expansion.

Interior lights Hold the Highest Share in the global aircraft lighting market

Among light types, interior lights hold the highest share in the global aircraft lighting market. With the growth of air passenger travel and competition among airline companies, airlines are prioritizing improving the overall passenger experience and comfort during flights. Additionally, interior lighting is also used beyond aesthetics, contributing significantly to passenger safety by providing illumination during emergencies and facilitating movement within the cabin. The adoption of LED technology further accelerates the growth of this segment, offering benefits such as energy efficiency and reduced maintenance.

Apart from this, regulatory initiatives aimed at enhancing passenger comfort and safety standards also drive the adoption of innovative interior lighting solutions in both commercial and private aircraft segments. For instance, The Federal Aviation Administration(FAA) has mandated that an airplane must be able to be evacuated of all passengers in 90 seconds in the case of an emergency, for which emergency proximity lightings are used to guide passengers toward exits when in smoke-filled cabins.

Overall, the dominance of the interior lights segment underscores its crucial role in shaping the passenger experience and ensuring operational efficiency and safety in modern aircraft cabins.

Regional Outlook

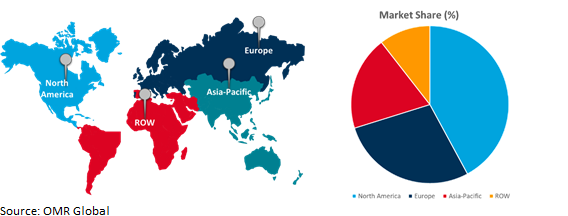

The global aircraft lighting market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Holds Highest Share In Global Aircraft Lighting Market

North America dominates the aircraft lighting market primarily due region's robust aerospace industry, which includes major players like Boeing and Airbus, fostering innovation and competition in the development of advanced lighting solutions. Additionally, North America's extensive air transportation network, encompassing commercial airlines, cargo carriers, and private aviation, stringent regulatory standards set by aviation authorities such as the Federal Aviation Administration (FAA) underlines the importance of reliable lighting systems for safe operations, particularly during night flights and adverse weather conditions.

Moreover, North America's technological advancement and higher adoption of advanced aerospace technologies further accelerate market growth, with a focus on improving efficiency, reducing energy consumption, and improving passenger experience through lighting solutions.

On the supply side, with growing competition and air traffic, regional airline industries are increasingly investing in the expansion of air fleets. According to the data from the International Air Transport Association(IATA), a total of 1,540 aircraft were scheduled to be delivered in 2023. Out of which, North America (primarily the US) is expected to be the recipient of 32.0% of the deliveries. To summarize, these factors collectively establish North America as a key leader in the global aircraft lighting market.

Global Aircraft Lighting Market Growth by Region 2024-2031

Asia Pacific is the Fastest Growing Aircraft Lighting Market

The region has the presence of major airline markets mainly in major economies such as China and India. In recent years, the overall volume of air passengers has grown significantly owing to growing disposable income, growing access, and affordability of air travel among others. To capitalize on this demand, regional airline industries are increasingly investing in the expansion of air fleets, eventually driving demand for aircraft lighting in the region. As per IATA, in 2023, the Asia Pacific region accounted for 24.0% of total aircraft deliveries with the majority contribution of China and India. Additionally, the growing number of Original Equipment Manufacturers(OEM) in the region, and growing government support for the development of the domestic aircraft manufacturing ecosystem, are further contributing to overall market growth.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global aircraft lighting market are Cobham Aerospace Communications, Aveo Engineering Group, Collins Aerospace Systems, and Luminator Technology Group among others. With growing demand, market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global aircraft lighting market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Astronics Corporation

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Collins Aerospace Systems

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Honeywell International Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Safran

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Aircraft Lighting Market by Aircraft Type

4.1.1. Commercial Aircraft

4.1.2. Military Aircraft

4.1.3. Others (Helicopters, Unmanned Aerial Vehicles (UAVs))

4.2. Global Aircraft Lighting Market by Light Type

4.2.1. Interior light

4.2.2. Exterior light

4.3. Global Aircraft Lighting Market by Technology

4.3.1. Light Emitting Diode (LED)

4.3.2. Fluorescent Lighting

4.3.3. Others (OLED (Organic Light Emitting Diode), laser lighting)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.4. Rest of Asia-Pacific

5.5. Rest of the World

6. Company Profiles

6.1. AeroLEDs LLC

6.2. Aveo Engineering Group

6.3. Beadlight Ltd.

6.4. Bruce Aerospace Inc.

6.5. Cobham Aerospace Communications

6.6. Diehl Aerospace GmbH

6.7. Luminator Technology Group

6.8. Oxley Developments Company Ltd.

6.9. Oxley Inc.

6.10. Precise Flight Inc.

6.11. Soderberg Manufacturing Company Inc.

6.12. STG Aerospace Limited (subsidiary of Heads-Up Technologies, Inc.)

6.13. TKH Airport Solutions

6.14. UTC Aerospace Systems

6.15. Vision Systems Aeronautics

6.16. Whelen Engineering Company Inc.

1. GLOBAL AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL COMMERCIAL AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL MILITARY AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL OTHER AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY LIGHT TYPE, 2023-2031 ($ MILLION)

6. GLOBAL INTERIOR AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL EXTERIOR AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

9. GLOBAL LED AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL FLUORESCENT AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL OTHER AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE, 2023-2031 ($ MILLION)

15. NORTH AMERICAN AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY LIGHT TYPE, 2023-2031 ($ MILLION)

16. NORTH AMERICAN AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

17. EUROPEAN AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. EUROPEAN AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE, 2023-2031 ($ MILLION)

19. EUROPEAN AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY LIGHT TYPE, 2023-2031 ($ MILLION)

20. EUROPEAN AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

21. ASIA- PACIFIC AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. ASIA- PACIFIC AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE, 2023-2031 ($ MILLION)

23. ASIA- PACIFIC AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY LIGHT TYPE, 2023-2031 ($ MILLION)

24. ASIA- PACIFIC AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

25. REST OF THE WORLD AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

26. REST OF THE WORLD AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE, 2023-2031 ($ MILLION)

27. REST OF THE WORLD AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY LIGHT TYPE, 2023-2031 ($ MILLION)

28. REST OF THE WORLD AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

1. GLOBAL AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE, 2023 VS 2031 (%)

2. GLOBAL COMMERICIAL AIRCRAFT LIGHITING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL MILITARY AIRCRAFT LIGHITING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL OTHER AIRCRAFT LIGHITING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY LIGHT TYPE, 2023 VS 2031 (%)

6. GLOBAL INTERIOR AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBAL EXTERIOR AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023 VS 2031 (%)

9. GLOBAL LED AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

10. GLOBAL FLUORESCENT AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

11. GLOBAL OTHER AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

12. GLOBAL AIRCRAFT LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

13. US AIRCRAFT LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

14. CANADA AIRCRAFT LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

15. UK AIRCRAFT LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

16. FRANCE AIRCRAFT LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

17. GERMANY AIRCRAFT LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

18. ITALY AIRCRAFT LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

19. SPAIN AIRCRAFT LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF EUROPE AIRCRAFT LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

21. INDIA AIRCRAFT LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

22. CHINA AIRCRAFT LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

23. JAPAN AIRCRAFT LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

24. SOUTH KOREA AIRCRAFT LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF ASIA-PACIFIC AIRCRAFT LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF THEWORLD AIRCRAFT LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)