Aircraft Seating Market

Global Aircraft Seating Market Size, Share & Trends Analysis Report, By Aircraft Type (Narrow Body Aircraft (NBA), Wide Body Aircraft (VBA), Very Large Aircraft (VLA), and Others (Regional Aircrafts and Jets)) Market, By Class (Premium Class, Business Class, Economy Class, and First Class), By installation (Line-fit, Retro-Fit) Forecast Period, 2021-2027 Update Available - Forecast 2025-2035

The global aircraft seating market is anticipated to grow at a significant CAGR of nearly 7.2% during the forecast period. The major driving factor for the growth of the aircraft seating market is that passengers are now getting aware of the type of aircraft seats used by airline companies. Therefore, to enhance passenger experience companies are producing new airplane or aircraft seats with added features to provide comfort to passengers. For instance, in February 2020, Thompson Aero launched its new VantageSOLO seating for narrow-body aircraft. The seat offers a fully horizontal flatbed with direct aisle access for every seat. Jetblue is the first launch customer for Thompson Aero’s VantageSOLO Business class Seat for single-aisle aircraft. However, high costs and regulations associated with the installation of seats can affect the growth of the market.

Apart from this, in October 2020, STELIA Aerospace offered its new business class passenger seat OPERA which is specially designed for single-aisle aircraft. The seat offers widebody comfort with ample foot space, a fully integrated door for privacy, a large, stable meal table and adjustable armrests, and ambient lights. Additionally, the rise in the number of aircraft is also contributing to the growth of the market. According to Indian Aviation Industry Report, 2021, the number of airplanes is expected to reach 1,100 planes by 2027. In 2019, according to Federal Aviation Administration, the general aviation industry recorded an increase of 1.4% in US-manufactured aircraft. The increase in the manufacturing of aircraft is anticipated to leverage the demand for aircraft seats during the forecast period.

Impact of COVID-19 Pandemic on the Global Aircraft Seating Market

The global aircraft seating market was adversely affected by the COVID-19 outbreak. The government banned air transport to limit the spread of COVID-19. In the second quarter of 2020, COVID-19 led to suspensions of the majority of air traffic worldwide, which resulted in extensive downtime and postponement of maintenance events. For instance, Lufthansa Technik AG reduces its workforce including its external staff. The number of employees has declined by more than 3,000 due to the pandemic. Additionally, due to the COVID-19 pandemic, the company’s revenue decreased by 40% which was $4493 in 2020 as compared to $7881.4 in 2019.

In addition, due to COVID-19, the airlines are now focusing on reducing passenger seats and increase cargo capacity in their flights. JAMCO group in its new project PROJECT BLUE SKY offered a quick conversion service that converts seats into cargo cabins. In addition, the companies are now focusing on providing clear and hygienic cabins to passengers due to COVID-19. For instance, in November 2020, 3M and Safran partnered to design cleaner aircraft interiors to restore passenger’s confidence and focusing on enhancing cleaning and protection features of aircraft cabin equipment and the capability to improve the removal of bacteria and viruses as the passengers now choose their fights considering the hygiene assurance. In addition, many company’s plants were closed due to the pandemic including BOXMARK. In April 2020, BOXMARK updated that its plants in Europe were closed for a long time and production was stopped due to the pandemic.

Segmental Outlook

The global aircraft seating market is segmented based on aircraft type, class, and installation. Based on the aircraft type, it is further classified into narrow-body aircraft (NBA), wide-body aircraft (WBA), very large aircraft (VLA), and others. Based on the class, it is further classified into premium class, business class, economy class, and first-class. Based on the installation, it is classified into line fit and retrofit.

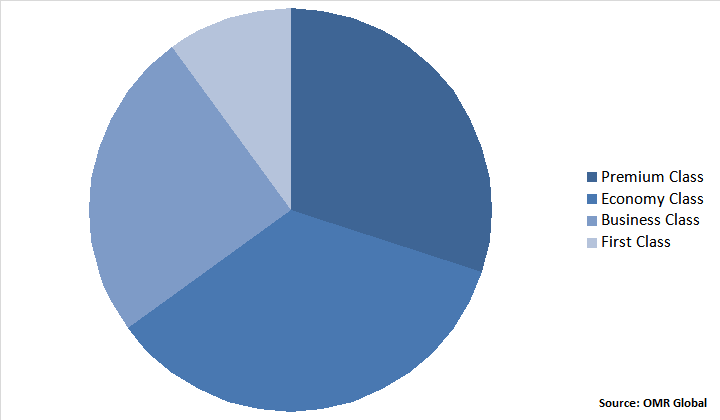

Global Aircraft Seating Market Share by Class, 2020 (%)

Economy Class Segment Holds Significant Share in the Market

Among the aircraft seating market by class, the economy class segment holds the highest share in 2020 and is also anticipated to grow during the forecast period. The innovations and design for seats of economy class are expected to drive the growth of the market. Companies are constantly focusing on providing luxury seats for premium and economy classes. For instance, in December 2020, Recaro aircraft seating launched its luxury seats for the first premium economy cabin. The seat offers a wider backrest with side support, six-way adjustable headrests to provide sleeping comfort and additional storage compartments. The seat was a result of Recaro’s partnership with Emirates in 2019, to provide Emirates with luxury seats to meet its standards of premium economy class experience.

Regional Outlook

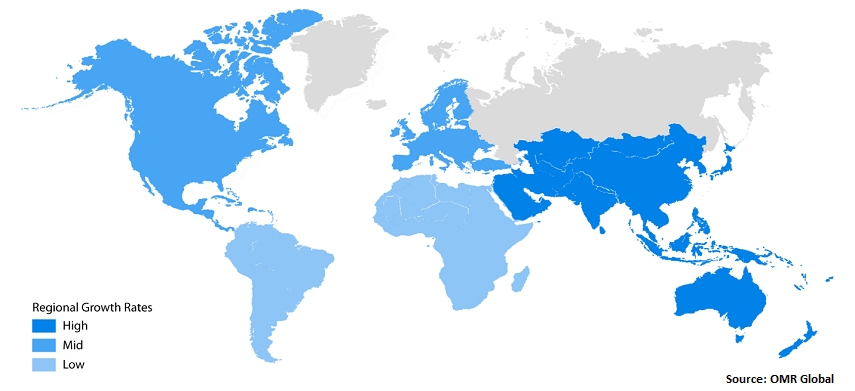

The global aircraft seating market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, and Others, and the Rest of the World (the Middle East and Africa, and Latin America). North America is expected to have a considerable market share in the market. This is mainly due to the presence of large airline market players such as Boeing, Gulfstream Aerospace, Textron Aviation, and Bombardier. Asia-Pacific is considered to witness significant market growth in the global aircraft seating market during the forecast period.

Global Aircraft Seating Market Growth, by Region 2021-2027

Asia-Pacific is Projected to Have a Considerable Share in the Global Aircraft Seating Market

The market is expected to grow considerably in the Asia-Pacific region. The increase in demand for designer and comfortable seats with added features to enhance passenger experience is contributing to the growth of the aircraft seat market in the region. In addition, in December 2019, Recaro seating expanded its production facility in Qingdao, China. The production facility measured 7,500 square meters. The company, through its new expanding facility, propels market opportunities and contributes to the further growth in the Asia-Pacific Region as it accommodated up to five new assembly lines which increased the maximum production capacity of Recaro’s China plant to 60,000 seats per year and meet the need of consumers in both the Asia-pacific and rest of the world.

Market Players Outlook

Major market players operating in the market include Safran Group, Collins Aerospace, Inc., Geven S.p.A., RECARO Aircraft Seating GmbH & Co. KG, JAMCO Corp., and among others. These companies adopt several strategies such as acquisition, partnership & collaborations, finding a new market, or product innovations in their core competency to stay competitive in the market. For instance, in April 2021, the Causeway Air Group acquired Pitch Aircraft Seating Systems for an undisclosed sum.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global aircraft seating market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Aircraft Seating Industry

• Recovery Scenario of Global Aircraft Seating Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Aircraft Seating Market by Aircraft type

5.1.1. Narrow-Body Aircraft (NBA)

5.1.2. Wide-Body Aircraft (WBA)

5.1.3. Very Large Aircraft (VRA)

5.1.4. Others(Regional Aircrafts and Jets)

5.2. Global Aircraft Seating Market by Class

5.2.1. Premium Class

5.2.2. Business Class

5.2.3. Economy Class

5.2.4. First Class

5.3. Global Aircraft seating Market by Installation

5.3.1. Line Fit

5.3.2. Retro Fit

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ACRO Aircraft Seating, Ltd.

7.2. AirGo Design, Pte Ltd.

7.3. Aviointeriors S.p.A.

7.4. BOXMARK Leather GmbH & Co KG

7.5. ETI Tech, Inc.

7.6. Expliseat SAS

7.7. GEVEN SpA

7.8. Hong Kong Aircraft Engineering Co., Ltd. (HKAECO)

7.9. Ipeco Holdings, Ltd.

7.10. JAMCO Corp.

7.11. Lufthansa Technik AG

7.12. Martin-Baker Aircraft, Co. Ltd.

7.13. Mirus Aircraft Seating Ltd.

7.14. Pitch Aircraft Seating SystemsLtd.

7.15. Raytheon Technologies Corp.

7.16. RECARO Aircraft Seating GmbH & Co. KG

7.17. Safran Group

7.18. STELIA Aerospace

7.19. Thompson Aero Seating, Ltd.

7.20. ZIM Aircraft Seating GmbH

1. GLOBAL AIRCRAFT SEATING MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE, 2020-2027($ MILLION)

2. GLOBAL NARROW-BODY AIRCRAFT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

3. GLOBAL WIDE-BODY AIRCRAFT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

4. GLOBAL VERY LARGE AIRCRAFT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

5. GLOBAL OTHER AIRCRAFT TYPE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

6. GLOBAL AIRCRAFT SEATING MARKET RESEARCH AND ANALYSIS BY CLASS, 2020-2027($ MILLION)

7. GLOBAL AIRCRAFT SEATING FOR PREMIUM CLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

8. GLOBAL AIRCRAFT SEATING FOR BUSINESS CLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

9. GLOBAL AIRCRAFT SEATING FOR ECONOMY CLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

10. GLOBAL AIRCRAFT SEATING FOR FIRST-CLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

11. GLOBAL AIRCRAFT SEATING MARKET RESEARCH AND ANALYSIS BY INSTALLATION, 2020-2027($ MILLION)

12. GLOBAL LINE-FIT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION

13. GLOBAL RETRO-FIT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

14. GLOBAL AIRCRAFT SEATING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027($ MILLION)

15. NORTH AMERICAN AIRCRAFT SEATING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027($ MILLION)

16. NORTH AMERICAN AIRCRAFT SEATING MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE, 2020-2027($ MILLION)

17. NORTH AMERICAN AIRCRAFT SEATING MARKET RESEARCH AND ANALYSIS BY CLASS, 2020-2027($ MILLION)

18. NORTH AMERICAN AIRCRAFT SEATING MARKET RESEARCH AND ANALYSIS BY INSTALLATION, 2020-2027($ MILLION)

19. EUROPEAN AIRCRAFT SEATING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027($ MILLION)

20. EUROPEAN AIRCRAFT SEATING MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE, 2020-2027($ MILLION)

21. EUROPEAN AIRCRAFT SEATING MARKET RESEARCH AND ANALYSIS BY CLASS, 2020-2027($ MILLION)

22. EUROPEAN AIRCRAFT SEATING MARKET RESEARCH AND ANALYSIS BY INSTALLATION, 2020-2027($ MILLION)

23. ASIA-PACIFIC AIRCRAFT SEATING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027($ MILLION)

24. ASIA-PACIFIC AIRCRAFT SEATING MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE 2020-2027($ MILLION)

25. ASIA-PACIFIC AIRCRAFT SEATING MARKET RESEARCH AND ANALYSIS BY CLASS, 2020-2027($ MILLION)

26. ASIA-PACIFIC AIRCRAFT SEATING MARKET RESEARCH AND ANALYSIS BY INSTALLATION, 2020-2027($ MILLION)

27. REST OF THE WORLD AIRCRAFT SEATING MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE, 2020-2027($ MILLION)

28. REST OF THE WORLD AIRCRAFT SEATING MARKET RESEARCH AND ANALYSIS BY CLASS, 2020-2027($ MILLION)

29. REST OF THE WORLD AIRCRAFT SEATING MARKET RESEARCH AND ANALYSIS BY INSTALLATION, 2020-2027($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL AIRCRAFT SEATING MARKET, 2020-2027($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL AIRCRAFT SEATING MARKET BY SEGMENT, 2020-2027($ MILLION)

3. RECOVERY OF GLOBAL AIRCRAFT SEATING MARKET, 2021-2027(%)

4. GLOBAL AIRCRAFT SEATING MARKET SHARE BY AIRCRAFT TYPE, 2020 VS 2027 (%)

5. GLOBAL AIRCRAFT SEATING MARKET SHARE BY CLASS, 2020 VS 2027 (%)

6. GLOBAL AIRCRAFT SEATING MARKET SHARE BY INSTALLATION, 2020 VS 2027 (%)

7. GLOBAL AIRCRAFT SEATING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL NARROW BODY AIRCRAFT (NBA) MARKET SHARE BY REGION, 2020 VS 2027 (%)

9. GLOBAL WIDE BODY AIRCRAFT (WBA) MARKET SHARE BY REGION, 2020 VS 2027 (%)

10. GLOBAL VERY LARGE AIRCRAFT (VLA) MARKET SHARE BY REGION, 2020 VS 2027 (%)

11. GLOBAL OTHERS (REGIONAL AIRCRAFT AND JETS) IN AIRCRAFT MARKET SHARE BY REGION, 2020 VS 2027 (%)

12. GLOBAL PREMIUM CLASS AIRCRAFT SEATING MARKET SHARE BY REGION, 2020 VS 2027 (%)

13. GLOBAL BUSINESS CLASS AIRCRAFT SEATING MARKET SHARE BY REGION, 2020 VS 2027 (%)

14. GLOBAL ECONOMY CLASS AIRCRAFT SEATING MARKET SHARE BY REGION, 2020 VS 2027 (%)

15. GLOBAL FIRST CLASSAIRCRAFT SEATING MARKET SHARE BY REGION, 2020 VS 2027 (%)

16. GLOBAL LINE FIT IN AIRCRAFT SEATING MARKET SHARE BY REGION, 2020 VS 2027 (%)

17. GLOBAL RETROFIT IN AIRCRAFT SEATING MARKET SHARE BY REGION, 2020 VS 2027 (%)

18. US AIRCRAFT SEATING MARKET SIZE, 2020-2027 ($ MILLION)

19. CANADA AIRCRAFT SEATING MARKET SIZE, 2020-2027 ($ MILLION)

20. UK AIRCRAFT SEATING MARKET SIZE, 2020-2027 ($ MILLION)

21. FRANCE AIRCRAFT SEATING MARKET SIZE, 2020-2027 ($ MILLION)

22. GERMANY AIRCRAFT SEATING MARKET SIZE, 2020-2027 ($ MILLION)

23. ITALY AIRCRAFT SEATING MARKET SIZE, 2020-2027 ($ MILLION)

24. SPAIN AIRCRAFT SEATING MARKET SIZE, 2020-2027 ($ MILLION)

25. REST OF EUROPE AIRCRAFT SEATING MARKET SIZE, 2020-2027 ($ MILLION)

26. INDIA AIRCRAFT SEATING MARKET SIZE, 2020-2027 ($ MILLION)

27. CHINA AIRCRAFT SEATING MARKET SIZE, 2020-2027 ($ MILLION)

28. JAPAN AIRCRAFT SEATING MARKET SIZE, 2020-2027 ($ MILLION)

29. SOUTH KOREA AIRCRAFT SEATING MARKET SIZE, 2020-2027 ($ MILLION)

30. REST OF ASIA-PACIFIC AIRCRAFT SEATING MARKET SIZE, 2020-2027 ($ MILLION)

31. REST OF THE WORLD AIRCRAFT SEATING MARKET SIZE, 2020-2027 ($ MILLION)