Alfalfa Seeds Market

Alfalfa Seeds Market Size, Share & Trends Analysis Report by Application (Agriculture, Health Food and Others) Forecast Period (2024-2031)

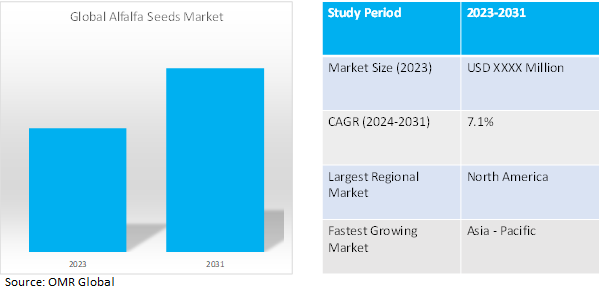

Alfalfa seeds market is anticipated to grow at a considerable CAGR of 7.1% during the forecast period (2024-2031).Rich in protein and vitamins, alfalfa seeds are the starting point for alfalfa hay, a prized food source for livestock like cattle, horses, sheep, and goats. These dehydrated seeds from the Medicago sativa plant can also be sprouted or eaten raw for their potential health benefits.

Market Dynamics

Growing Demand for High-Performance Animal Feed

The growing demand for high performance animal feed is a key factor driving the growth of the global alfalfa seeds market. According to The University of Nevada, Renobeef producers often refer to "high-quality forage" as feed with high protein and low fiber. Early cut alfalfa typically contains 16 to 20% crude protein, while late cut alfalfa ranges from 12 to 15%. Alfalfa hays have fiber content ranging from 20 to 28%, contrasting with grass hay's 8.4% crude protein and 31.4% fiber. Alfalfa's ruminal passage rate is faster due to lower fiber content, aiding high feed consumption.This translates directly to improved animal health, growth rates, and ultimately, the quality of the meat and dairy products derived from them. As consumer preferences shift towards healthier and ethically sourced animal products, the demand for high-quality feed like alfalfa grows alongside it.

Growing Emphasize on Sustainable Agriculture Practices

The growing emphasis on sustainable agriculture practices drives the demand for alfalfa seeds. Unlike many conventional crops, alfalfa can naturally "fix" nitrogen from the air, enriching the soil and reducing reliance on chemical fertilizers.According to Pioneer Trademarks of Corteva Agriscience, alfalfa surpasses other legume crops in nitrogen fixation. A single stand has the potential to fix up to 300 pounds of nitrogen per acre annually. This nitrogen is predominantly utilized by the plant to produce protein, which growers can subsequently harvest and feed to their livestock. This not only saves costs but also minimizes fertilizer runoff and pollution. Alfalfa's deep taproots improve soil structure, drainage, water retention, and nutrient availability for subsequent crops. With environmental consciousness rising, farmers increasingly favor sustainable practices, making alfalfa seeds a valuable asset for cultivating healthy, productive land while reducing environmental impact. This alignment with sustainable principles enhances the appeal of alfalfa seeds in agriculture.

Market Segmentation

Our in-depth analysis of the global alfalfa seeds includes the following segment by application:

- Based on application, the market is bifurcated into agriculture, health food and others.

Alfalfa Seeds: A Nutritional Powerhouse Driving Sustainable Livestock Production

The foundation of the alfalfa seed market lies in its role as a critical agricultural input. Alfalfa seeds nutritional profile, boasting high protein content and essential vitamins and minerals, makes it ideal for animal feed. For instance, alfalfa serves as a significant protein source, containing approximately 15.0–22.0% crude protein, alongside carbohydrates and crude fiber. Additionally, it provides essential vitamins (A, B, C, E, and K) and minerals like calcium, phosphorus, copper, and potassium. These nutrients are crucial for the well-being of livestock and dairy industries, supporting their growth and productivity directly or indirectly. As the global demand for high-quality meat and dairy products continues to rise, so does the demand for livestock that are well-fed and produce optimally. This direct connection between animal feed requirements and alfalfa's core function as a forage crop fuels the growth of the alfalfa seed market. The more we require high-quality animal products, the more alfalfa seeds we need to cultivate and sustain the livestock industry.

Regional Outlook

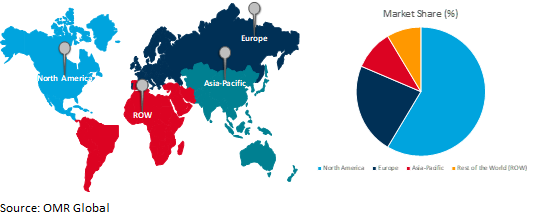

The global alfalfa seeds is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Dominance of North America in the Global Alfalfa Seeds Market

The prominence of North America in the alfalfa seed market is deeply rooted in its large livestock industry, particularly in dairy and beef cattle production. Given the indispensable nature of alfalfa in meeting the dietary requirements of livestock, the region experiences a pronounced demand for alfalfa seeds to sustain agricultural operations. For instance, according to the North American Alfalfa Improvement CouncilAlfalfa, known as the "Queen of the Forages," ranks as the fourth most valuable field crop in the United States, with a total worth of $8.8 billion. According to the USDA National Agricultural Statistics Service (NASS), the combined value of alfalfa hay and haylage production in the U.S. amounts to $8.8 billion annually. This reliance underscores North America's dominant position in the global alfalfa seed market, reflecting its pivotal role in supporting the vitality and growth of the livestock sector.

Global Alfalfa Seeds Market Growth by Region 2024-2031

Alfalfa: Fueling the Rise of Asia's Livestock Industry

The expanding livestock industry in countries like China and India is driven by multifaceted factors including population growth, urbanization, and rising disposable incomes. As these economies continue to develop, there is a notable surge in the consumption of meat and dairy products. This escalating demand necessitates a parallel increase in livestock production to meet consumer needs. For instance, according to the Press Information Bureau of India, In 2019, the country's livestock population grew to 536.76 million, a 4.8% rise since 2012. Rural areas housed 95.78% (514.11 million), with urban areas at 4.22% (22.65 million). Consequently, there is a growing reliance on alfalfa as a crucial component in animal feed formulations due to its high nutritional value and benefits for livestock health and productivity. This heightened demand for alfalfa seeds in the Asia-Pacific region reflects the pivotal role it plays in sustaining the burgeoning livestock industry, aligning with broader agricultural trends and economic developments in the region.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global alfalfa seeds market include Corteva Agriscience, DLF International Seeds, and S&W Seed Co.among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in September 2023, DLF, a significant entity in forage and turf seed, has acquired Corteva Agriscience's alfalfa breeding program, which includes germplasm, trademarks, commercial varieties, and personnel. This acquisition strengthens DLF's presence in alfalfa breeding and sales, incorporating valuable genetics and expanding market reach. DLF emphasizes a commitment to delivering quality forage products and services while ensuring a smooth transition for customers and partners.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global alfalfa seeds market based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Corteva Agriscience

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. DLF International Seeds

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. S&W Seed Co.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Alfalfa Seeds by Mode of Application

4.1.1. Agriculture

4.1.2. Health Food

4.1.3. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Afica

6. Company Profiles

6.1. Alforex Seeds LLC

6.2. Allied Seed LLC

6.3. Dyna-Gro Seed (Loveland Products Inc. )

6.4. Forage Genetics International, LLC

6.5. Great Basin Seeds

6.6. Lacrosse Seed

6.7. LG Seeds (AgReliant Genetics, LLC)

6.8. RAGT SEMENCES

6.9. Royal Barenbrug Group

6.10. W-L Alfalfas

1. GLOBAL ALFALFA SEEDS MARKET RESEARCH AND ANALYSIS BYAPPLICATION, 2023-2031 ($ MILLION)

2. GLOBAL ALFALFA SEEDS FOR AGRICULTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL ALFALFA SEEDSFOR HEALTH FOODMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL ALFALFA SEEDS FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. NORTH AMERICAN ALFALFA SEEDS RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

6. NORTH AMERICAN ALFALFA SEEDS RESEARCH AND ANALYSIS BYAPPLICATION 2023-2031 ($ MILLION)

7. EUROPEAN ALFALFA SEEDS RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

8. EUROPEAN ALFALFA SEEDS RESEARCH AND ANALYSIS BYAPPLICATION2023-2031 ($ MILLION)

9. ASIA-PACIFIC ALFALFA SEEDS RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

10. ASIA-PACIFICALFALFA SEEDS RESEARCH AND ANALYSIS BYAPPLICATION, 2023-2031 ($ MILLION)

11. REST OF THE WORLD ALFALFA SEEDS RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

12. REST OF THE WORLD ALFALFA SEEDS RESEARCH AND ANALYSIS BYAPPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL ALFALFA SEEDS RESEARCH AND ANALYSIS BY APPLICATION, 2023 VS 2031 (%)

2. GLOBALALFALFA SEEDS FOR AGRICULTUREMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBALALFALFA SEEDS FOR HEALTH FOOD MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL ALFALFA SEEDSMARKET FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL ALFALFA SEEDS RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

6. US ALFALFA SEEDS MARKET SIZE, 2023-2031 ($ MILLION)

7. CANADA ALFALFA SEEDSMARKET SIZE, 2023-2031 ($ MILLION)

8. UK ALFALFA SEEDS MARKET SIZE, 2023-2031 ($ MILLION)

9. FRANCE ALFALFA SEEDS MARKET SIZE, 2023-2031 ($ MILLION)

10. GERMANY ALFALFA SEEDSMARKET SIZE, 2023-2031 ($ MILLION)

11. ITALY ALFALFA SEEDS MARKET SIZE, 2023-2031 ($ MILLION)

12. SPAIN ALFALFA SEEDSMARKET SIZE, 2023-2031 ($ MILLION)

13. REST OF EUROPE ALFALFA SEEDS MARKET SIZE, 2023-2031 ($ MILLION)

14. INDIA ALFALFA SEEDSMARKET SIZE, 2023-2031 ($ MILLION)

15. CHINA ALFALFA SEEDS MARKET SIZE, 2023-2031 ($ MILLION)

16. JAPAN ALFALFA SEEDS MARKET SIZE, 2023-2031 ($ MILLION)

17. SOUTH KOREA ALFALFA SEEDS MARKET SIZE, 2023-2031 ($ MILLION)

18. REST OF ASIA-PACIFIC ALFALFA SEEDS MARKET SIZE, 2023-2031 ($ MILLION)

19. LATIN AMERICA ALFALFA SEEDS MARKET SIZE, 2023-2031 ($ MILLION)

20. THE MIDDLE EAST & AFRICA ALFALFA SEEDS MARKET SIZE, 2023-2031 ($ MILLION)