Alkaline Battery Market

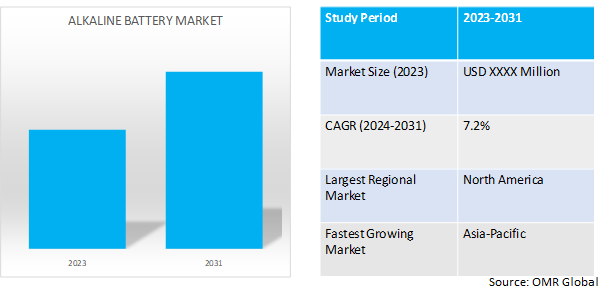

Alkaline Battery Market Size, Share & Trends Analysis Report by Type (Primaryand Secondary),by Size (AA,AAA,9 Volt, and Other), by End-User (Consumer Electronics, Industrial, Medical, Military) Forecast Period (2024-2031) Update Available - Forecast 2025-2035

Alkaline battery market is anticipated to grow at a considerable CAGR of 7.2% during the forecast period. The growing demand for alkaline battery from end-user industries is a key factor driving the growth of the global market. However, the high cost of these batteries may restrain its market growth.

Market Dynamics

Technological advancements are driving overall market growth

Although alkaline batteries provide various advantages such as higher energy density and longer shelf life compared to their acidic counterparts, it has certain limitations which negatively affect overall market growth. Alkaline batteries often face challenges in sustaining their performance when used in high-drain applications or under continuous usage, leading to a significant reduction in their lifespan.

Additionally, they are generally not rechargeable. Although there are some rechargeable alkaline batteries available, they are not as prevalent as other rechargeable variants like lithium-ion or nickel-metal hydride.To overcome these challenges, various private, and public organizations and academic institutions increasingly focus on R&D in battery technology and material science, primarily to improve performance and reliability. For instance, in September 2023, researchers from Worcester Polytechnic Institute (WPI)developed rechargeable iron alkaline batteries using chloride ions, an approach that utilizes the abundance of iron and seawater. They discovered a new redox chemistry that improves the battery's stability and performance. A lab-scale prototype has been developed, paving the way for potential industrial-scale production.

Additionally, market players are increasingly investing in technological innovations catering to increase their foothold in the sustainability market such as Electric Vehicle(EV), and renewable energy, eventually driving overall market growth. Although the R&D activities in alkaline batteries have grown in recent years, it is still at an early stage which presents opportunities for market players to gain a competitive edge.

Growth and expansion of the consumer electronics market are driving demand for alkaline batteries

Alkaline batteries are generally used in low-drain applications such as flashlights, portable radios, alarm clocks, remote controls, and toys among others as they offerbetter performance with a shallow replacement rate. In recent years, the overall consumer electronics market has seen significant expansion due to growing disposable income and product portfolio expansion mainly in IoT devices segments. Additionally, the growth of other end-user segments such as medical, defense, and military in terms of both sales and product portfolio expansion is driving demand for alkaline batteries.

Market Segmentation

Our in-depth analysis of the global alkaline batterymarket includes the following segments by type of battery and end-user industry:

- Based on type, the market is sub-segmented into primary and secondary.

- Based on the size, the market is sub-segmented into AA, AAA,9 Volt, and other.

- Based on end-user industry, the market is sub-segmented into consumer electronics, industrial, medical, and military.

The Secondary Alkaline Battery Segment is Expected to Grow Significantly in the Forecast Period

Among the types of batteries,the secondary battery segment is expected to grow significantly in the forecasting period mainly due to technologicaladvancements,mainly to improve the durability and efficiency of secondary alkaline batteries. These batteries offer improved energy density, longer lifespans, and enhanced performance, which aligns with the growingneeds of consumers and industries. For instance, in July 2022, a research team at the Hong Kong University of Science and Technology developed an electrode design that provides recharging capabilities to alkaline zinc batteries. Under this, development, they have developed a nanoporous zinc metal electrode that is capable of stabilizing the electrochemical transition between zinc and zinc oxide, successfully turning an alkaline zinc-air coin cell into a rechargeable battery stable for over 80 hours.

Additionally, a growing focus on environmental sustainability has driven a shift towards rechargeable battery solutions, such as secondary alkaline batteries, which can be reused multiple times, thus reducing waste and minimizing environmental impact. Also, the expanding adoption of electronic devices, electric vehicles(EV), and renewable energy systems has further acceleratedthedemand for reliable energy storage solutions, contributing to the growth of the secondary alkaline battery market. With the changing market landscape, manufacturers are focusing on R&D initiatives to enhance battery technology and production processes to meet the growing demand for secondary alkaline batteries.

Consumer Electronics Industry Holds Highest Share Among End-User Industries

Among end-user industries, the consumer electronics segment holds the highest share in the global alkaline battery market. Alkaline batteries are generally used in low-drain applications such as alarm clocks, remote controls, and flashlights among others.Additionally, the rising popularity of wireless electronic products such as keyboards, and gaming controllers contributes to the demand for alkaline batteries. Additionally, the preference for simple battery replacement over rechargeable options, especially for on-the-go devices, and ongoing advancements in consumer electronics, resulting in devices with improved energy efficiency and longer battery life, are further contributing to the growing demand for alkaline batteries. Overall, these factors collectively contribute to the growing demand for alkaline batteries in the consumer electronics market.

Regional Outlook

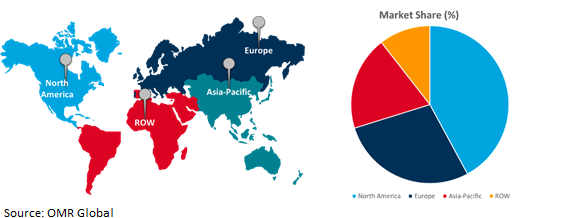

The globalalkaline batterymarket is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia Pacificis the Fastest Growing Alkaline Battery Market

- The region has the presence of major consumer electronics markets such as China, India, and Japan. This is expected to grow further in the forecast period with growing disposable income of region, and government support for end-user industries.

- Additionally, with growing demand, market players are increasingly investing in product portfolio expansion, and R&D activities, further accelerating overall market growth. For instance, in September 2023, Everyday Industries India, Ltd. launched a range of ultima alkaline batteries, to cater to modern and high-end applications and devices.

Global Alkaline BatteryMarket Growth by Region 2024-2031

North America Holds Highest Share In Global Alkaline Battery Market

Among the regions, North America holds the largest share in the global alkaline battery market. One of the key factors is a sizable and technologically advanced consumer electronics sector, which is driving significant demand for alkaline batteries to power a wide array of devices. Additionally, the growth of disposable consumer culture in the region contributes growing demand for alkaline batteries, given their convenience and widespread availability for single-use applications. Additionally, the region's well-developed distribution network and stringent environmental regulations, increasing have led to the growing adoption of alkaline batteries. Apart from this, the significant presence of other end-user industries such as military, medical, and industrial are also contributing to North America’s position in the global alkaline battery market.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global alkaline battery market are Toshiba Corp., Duracell Inc., andGP Batteries International Ltd. among others. With growing demand, market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global alkaline batterymarket. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Energizer Brands, LLC

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Maxell Holdings Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Panasonic Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Toshiba Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Varta AG

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Alkaline BatteryType

4.1.1. Primary

4.1.2. Secondary

4.2. Global Alkaline BatterySize

4.2.1. AA

4.2.2. AAA

4.2.3. 9 Volt

4.2.4. Others (N cell, button cell, and other)

4.3. Global Alkaline BatteryMarket by End-User

4.3.1. Consumer electronics

4.3.2. Industrial

4.3.3. Medical

4.3.4. Military

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Ansmann Energy GmbH

6.2. Duracell Inc.

6.3. EBL Technology Co., Ltd.

6.4. Eveready Industries India Ltd.

6.5. Exide Technologies

6.6. Fujitsu Ltd.

6.7. GP Batteries International Ltd.

6.8. Maxell Ltd.

6.9. PKCELL Battery Co., Ltd.

6.10. Rayovac (subsidiary of Spectrum Brands Holdings, Inc.)

6.11. Sony Group Corp.

6.12. Spectrum Brands Holdings, Inc.

6.13. Tianjin Lishen Battery Joint-Stock Co., Ltd.

6.14. Ultralife Corp.

6.15. Zhejiang Mustang Battery Co., Ltd.

1. GLOBAL ALKALINE BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBALPRIMARYALKALINE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL SECONDARY ALKALINE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL ALKALINE BATTERY MARKET RESEARCH AND ANALYSIS BY SIZE, 2023-2031 ($ MILLION)

5. GLOBAL AA SIZE ALKALINE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL AAA SIZE ALKALINE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL 9 VOLTSIZE ALKALINE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL OTHER SIZE ALKALINE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL ALKALINE BATTERY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

10. GLOBAL ALKALINE BATTERY FOR CONSUMER ELECTRONICSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBALALKALINE BATTERY FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL ALKALINE BATTERY FOR MEDICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL ALKALINE BATTERY FOR MILITARY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL ALKALINE BATTERYMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN ALKALINE BATTERYMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN ALKALINE BATTERYMARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

17. NORTH AMERICAN ALKALINE BATTERY MARKET RESEARCH AND ANALYSIS BY SIZE, 2023-2031 ($ MILLION)

18. NORTH AMERICAN ALKALINE BATTERYMARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

19. EUROPEAN ALKALINE BATTERYMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. EUROPEAN ALKALINE BATTERYMARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

21. EUROPEAN ALKALINE BATTERY MARKET RESEARCH AND ANALYSIS BY SIZE, 2023-2031 ($ MILLION)

22. EUROPEAN ALKALINE BATTERY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC ALKALINE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC ALKALINE BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC ALKALINE BATTERY MARKET RESEARCH AND ANALYSIS BY SIZE, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC ALKALINE BATTERY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

27. REST OF THE WORLD ALKALINE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

28. REST OF THE WORLD ALKALINE BATTERYMARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

29. REST OF THE WORLD ALKALINE BATTERY MARKET RESEARCH AND ANALYSIS BY SIZE, 2023-2031 ($ MILLION)

30. REST OF THE WORLD ALKALINE BATTERYMARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL ALKALINE BATTERY MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL PRIMARY ALKALINE BATTERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL SECONDARY ALKALINE BATTERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL ALKALINE BATTERY MARKET SHARE BY SIZE, 2023 VS 2031 (%)

5. GLOBAL AA SIZE ALKALINE BATTERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL AAA SIZE ALKALINE BATTERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL 9 VOLT SIZE ALKALINE BATTERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL OTHER SIZE ALKALINE BATTERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL ALKALINE BATTERY MARKET SHARE BY END-USER, 2023 VS 2031 (%)

10. GLOBAL ALKALINE BATTERY FOR CONSUMER ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL ALKALINE BATTERY FOR INDUSTRIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL ALKALINE BATTERY FOR MEDICAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL ALKALINE BATTERY FOR MILITARY MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL ALKALINE BATTERYMARKETSHARE BY REGION, 2023 VS 2031 (%)

15. US ALKALINE BATTERYMARKET SIZE, 2023-2031 ($ MILLION)

16. CANADA ALKALINE BATTERYMARKET SIZE, 2023-2031 ($ MILLION)

17. UK ALKALINE BATTERYMARKET SIZE, 2023-2031 ($ MILLION)

18. FRANCE ALKALINE BATTERYMARKET SIZE, 2023-2031 ($ MILLION)

19. GERMANY ALKALINE BATTERYMARKET SIZE, 2023-2031 ($ MILLION)

20. ITALY ALKALINE BATTERYMARKET SIZE, 2023-2031 ($ MILLION)

21. SPAIN ALKALINE BATTERYMARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF EUROPE ALKALINE BATTERYMARKET SIZE, 2023-2031 ($ MILLION)

23. INDIA ALKALINE BATTERYMARKET SIZE, 2023-2031 ($ MILLION)

24. CHINA ALKALINE BATTERYMARKET SIZE, 2023-2031 ($ MILLION)

25. JAPAN ALKALINE BATTERYMARKET SIZE, 2023-2031 ($ MILLION)

26. SOUTH KOREA ALKALINE BATTERYMARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF ASIA-PACIFIC ALKALINE BATTERYMARKET SIZE, 2023-2031 ($ MILLION)

28. LATIN AMERICA ALKALINE BATTERYMARKET SIZE, 2023-2031 ($ MILLION)

29. MIDDLE EAST AND AFRICA ALKALINE BATTERYMARKET SIZE, 2023-2031 ($ MILLION)