Alkylamines Market

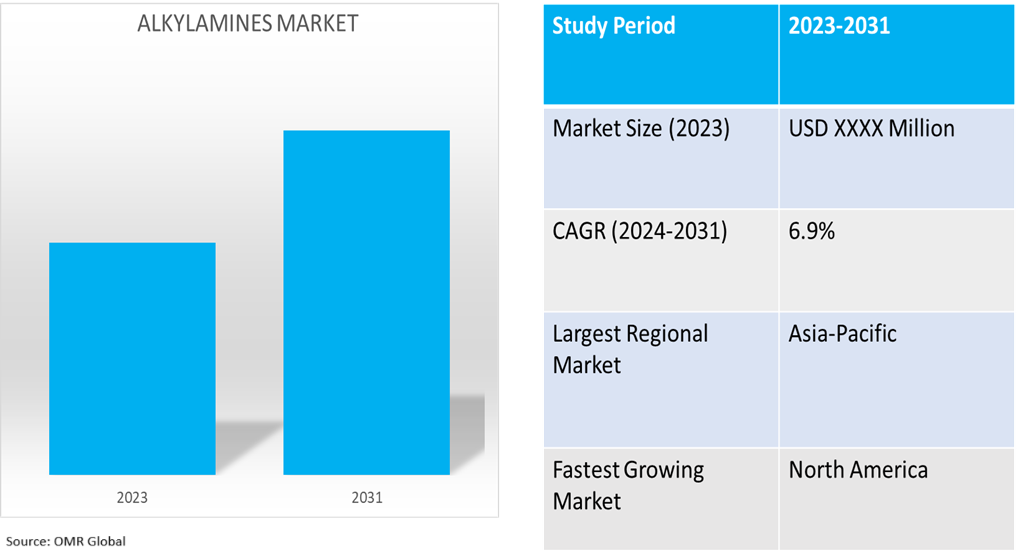

Alkylamines Market Size, Share & Trends Analysis Report by Product Type (Methylamines, Ethylamines, Propylamines, Butylamines, and Cyclohexylamines), and by Application (Solvents, Agrochemicals, Rubber Processing, Water Treatment, Feed Additives, Paper Chemicals, Pharmaceuticals, and Others) Forecast Period (2024-2031)

Alkylamines market is anticipated to grow at a CAGR of 6.9% during the forecast period (2024-2031). Alkylamines are utilized in many businesses, such as agrochemicals, pharmaceuticals, water treatment, rubber processing additives, personal care, industrial and chemical applications, and other end-user industries. There is an increasing need to ensure increased agricultural output as the demand for food increases globally. Alkylamines are vital ingredients in the manufacturing of insecticides and herbicides, therefore they play an essential role in this. Alkylamines contribute to improved yields and more productive farming by shielding crops from diseases, weeds, and pests. Regional trends include Asia-Pacific with its rapid industrialization, and North America and Europe, which have the highest demand.

Market Dynamics

Growing Need for Gas Treatment

The growth in natural gas processing and treatment applications is mainly driven by the growing demand. As per the US Energy Information Administration, in November 2023, US production of associated natural gas increased by 7.9% compared to 2022, at an average of 17.1 billion cubic feet per day (Bcf/d). This natural gas, primarily produced from oil wells, mainly originated from five key regions: the Permian, Bakken, Eagle Ford, Anadarko, and Niobrara. The Permian Basin, responsible for 46% of US crude oil production, was the largest contributor to associated gas production, accounting for 11.5 Bcf/d, with approximately two-thirds of the US total coming from this region, similar to the previous year.

Expanding Water Treatment Industry

Alkylamines are crucial for the water treatment industry, helping to address increasing demands for clean and safe water globally. It is utilized in various water purification processes owing to its chemical properties. According to a report Water Diplomat Org. released in March 2023, the global water treatment market is expected to grow at a compound annual growth rate of around 7% between 2023 and 2028. In 2022, this market was valued at $303 billion, and it is expected to reach $460 billion by 2028. Some factors driving this growth include urbanization, where 57% of the global population lives in cities and urban areas.

Market Segmentation

- Based on the product type, the market is segmented into Methylamines, Ethylamines, Propylamines, Butylamines, and Cyclohexylamines.

- Based on the application, the market is segmented into solvents, agrochemicals, rubber processing, water treatment, feed additives, paper chemicals, pharmaceuticals, and others.

Agrochemicals Segment is projected to Hold the Largest Market Share

The Indian government has implemented various initiatives in terms of the Production Linked Incentive Scheme, subsidies, and credit facilities to promote the production of agrochemicals, reducing dependency on imports. According to the India Brand Equity Foundation (IBEF), in May 2024, The Indian agrochemicals industry is expected to witness significant growth from FY25 to FY28 with support from the government, increased production capacities, and growth in both domestic and export demand and the introduction of innovative products. As a result, the market size would be approximately $14.5 billion by FY28 while as of now the market size is around $10.3 billion.

Methylamines Segment to Hold a Considerable Market Share

Methylamines are the simplest alkylamines derived from ammonia and methanol. It is applied in agriculture, pharmaceuticals, chemical manufacturing, water treatment, personal care, rubber, and plastics. Major types of methylamines include monomethylamine (MMA), dimethylamine (DMA), and trimethylamine (TMA). It is further used in fungicides, surfactants, and intermediates, and also in rubber processing and polymer production.

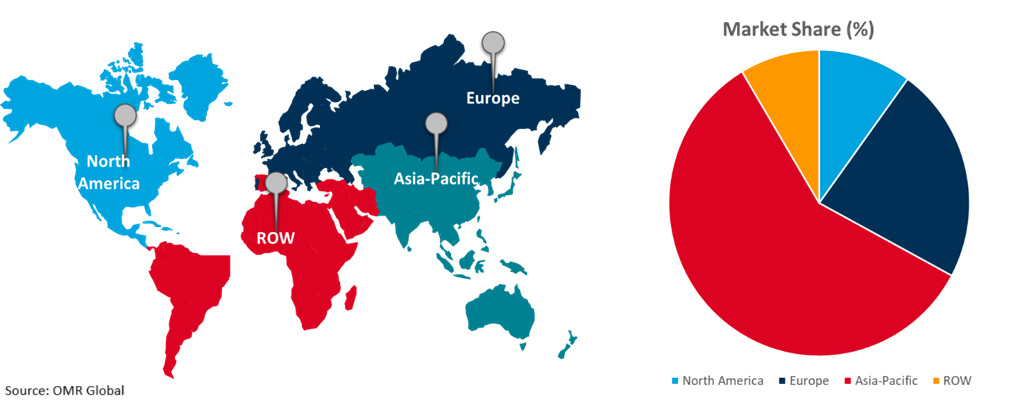

Regional Outlook

The global alkylamines market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Germany, France, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Expansion of Textile Industry In the North America Region

The textile industry is expanding In the North American region owing to the use of alkylamines in dye and fabric softener production, driven by rising consumer demand for modern textiles and disposable income. According to the US textile industry, in 2023 from textile fibers to apparel and sewn products, there were 501,755 employees. Government estimates additionally indicate that each textile manufacturing job supports three more jobs and the industry shipped products worth $64.8 billion in 2023. Moreover, the US is ranked as the second-largest exporter of textile-related products globally, with combined fiber, textile, and apparel exports reaching $29.7 billion in 2021. The US also leads in textile research and development, supplying over 8,000 textile products to the US military, working on innovations such as conductive fabrics, electronic textiles for health monitoring, antimicrobial fibers, body armor, and climate-adaptive fabrics.

Global Alkylamines Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific holds a significant share owing to the pharmaceutical industry experiencing market growth, with alkylamines being an essential intermediate in drug synthesis, particularly for treating chronic diseases. India, a leading destination for biotechnology, accounted for 3-5% of the global industry in 2022, with its bioeconomy valued at $137 billion and aiming for $300 billion by 2030. The healthcare sector in India, valued at over $370 billion in 2022, is anticipated to grow to over $610 billion by 2026, with the country supplying roughly 20% of global generic drug exports. According to CRISIL from FY18 to FY23, the pharmaceutical industry in India experienced a CAGR of 6-8%, driven by export and domestic market growth, with expected sales growth of 8-10% in FY 2023-24.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the alkylamines market include Arkema, BASF SE, Dow Chemical Co., Eastman Chemical Co., Mitsubishi Gas Chemical Company Inc., and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Developments

- In September 2024, BASF opened a new production plant for alkyl ethanolamines at its Verbund site in Antwerp, Belgium. With this, the company boosts its global annual production capacity by almost 30% to over 140,000 tons per year, part of its global portfolio. The new plant is one of the key components in the production network of the company including sites in Ludwigshafen, Antwerp, Geismar, Louisiana, and Nanjing, China. Alkyl ethanolamines have been versatile precursors for such applications as gas treatment chemicals, water treatment flocculants, pigment-resin binders, fabric softeners, metalworking fluid additives, and polyurethanes.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global alkylamines market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Arkema S.A.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. BASF SE

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Dow Chemical Co.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Eastman Chemical Co.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Alkylamines Market by Product Type

4.1.1. Methylamines

4.1.2. Ethylamine

4.1.3. Propylamines

4.1.4. Butylamines

4.1.5. Cyclohexylamines

4.2. Global Alkylamines Market by Application

4.2.1. Solvents

4.2.2. Agrochemicals

4.2.3. Rubber Processing

4.2.4. Water Treatment

4.2.5. Feed Additives

4.2.6. Paper Chemicals

4.2.7. Pharmaceuticals

4.2.8. Others (Rubber and Plastics, and Textile Industry)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. A B Enterprises

6.2. Albemarle Corp.

6.3. Alkyl Amines Chemicals Ltd.

6.4. Balaji Amines Ltd.

6.5. Celanese Corp.

6.6. Daicel Corp.

6.7. Huntsman International LLC

6.8. Kao Corp.

6.9. Mitsubishi Gas Chemical Company Inc.

6.10. QC Chemicals GmbH

6.11. Shandong Feicheng Acid Chemicals Co.Ltd.

6.12. Tosoh Bioscience LLC

6.13. Univar Solutions USA, LLC

1. Global Alkylamines Market Research And Analysis By Product Type, 2023-2031 ($ Million)

2. Global Methylamines Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Ethylamine Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Propylamines Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Butylamines Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Cyclohexylamines Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Alkylamines Market Research And Analysis By Application, 2023-2031 ($ Million)

8. Global Alkylamines For Solvents Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Alkylamines For Agrochemicals Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Alkylamines For Rubber Processing Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Alkylamines For Agrochemicals Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Alkylamines For Water Treatment Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global Alkylamines For Feed Additives Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Global Alkylamines For Paper Chemicals Market Research And Analysis By Region, 2023-2031 ($ Million)

15. Global Alkylamines For Pharmaceuticals Market Research And Analysis By Region, 2023-2031 ($ Million)

16. Global Alkylamines For Other Application Market Research And Analysis By Region, 2023-2031 ($ Million)

17. Global Alkylamines Market Research And Analysis By Region, 2023-2031 ($ Million)

18. North American Alkylamines Market Research And Analysis By Country, 2023-2031 ($ Million)

19. North American Alkylamines Market Research And Analysis By Product Type, 2023-2031 ($ Million)

20. North American Alkylamines Market Research And Analysis By Application, 2023-2031 ($ Million)

21. European Alkylamines Market Research And Analysis By Country, 2023-2031 ($ Million)

22. European Alkylamines Market Research And Analysis By Product Type, 2023-2031 ($ Million)

23. European Alkylamines Market Research And Analysis By Application, 2023-2031 ($ Million)

24. Asia-Pacific Alkylamines Market Research And Analysis By Country, 2023-2031 ($ Million)

25. Asia-Pacific Alkylamines Market Research And Analysis By Product Type, 2023-2031 ($ Million)

26. Asia-Pacific Alkylamines Market Research And Analysis By Application, 2023-2031 ($ Million)

27. Rest Of The World Alkylamines Market Research And Analysis By Region, 2023-2031 ($ Million)

28. Rest Of The World Alkylamines Market Research And Analysis By Product Type, 2023-2031 ($ Million)

29. Rest Of The World Alkylamines Market Research And Analysis By Application, 2023-2031 ($ Million)

1. Global Alkylamines Market Share By Product Type, 2023 Vs 2031 (%)

2. Global Methylamines Alkylamines Market Share By Region, 2023 Vs 2031 (%)

3. Global Ethylamine Alkylamines Market Share By Region, 2023 Vs 2031 (%)

4. Global Propylamines Alkylamines Market Share By Region, 2023 Vs 2031 (%)

5. Global Butylamines Alkylamines Market Share By Region, 2023 Vs 2031 (%)

6. Global Cyclohexylamines Alkylamines Market Share By Region, 2023 Vs 2031 (%)

7. Global Alkylamines Market Share By Application, 2023 Vs 2031 (%)

8. Global Alkylamines For Solvents Market Share By Region, 2023 Vs 2031 (%)

9. Global Alkylamines For Agrochemicals Market Share By Region, 2023 Vs 2031 (%)

10. Global Alkylamines For Rubber Processing Market Share By Region, 2023 Vs 2031 (%)

11. Global Alkylamines For Water Treatment Market Share By Region, 2023 Vs 2031 (%)

12. Global Alkylamines For Feed Additives Market Share By Region, 2023 Vs 2031 (%)

13. Global Alkylamines For Paper Chemicals Market Share By Region, 2023 Vs 2031 (%)

14. Global Alkylamines For Pharmaceuticals Market Share By Region, 2023 Vs 2031 (%)

15. Global Alkylamines For Other Application Market Share By Region, 2023 Vs 2031 (%)

16. Global Alkylamines Market Share By Region, 2023 Vs 2031 (%)

17. US Alkylamines Market Size, 2023-2031 ($ Million)

18. Canada Alkylamines Market Size, 2023-2031 ($ Million)

19. UK Alkylamines Market Size, 2023-2031 ($ Million)

20. France Alkylamines Market Size, 2023-2031 ($ Million)

21. Germany Alkylamines Market Size, 2023-2031 ($ Million)

22. Italy Alkylamines Market Size, 2023-2031 ($ Million)

23. Spain Alkylamines Market Size, 2023-2031 ($ Million)

24. Rest Of Europe Alkylamines Market Size, 2023-2031 ($ Million)

25. India Alkylamines Market Size, 2023-2031 ($ Million)

26. China Alkylamines Market Size, 2023-2031 ($ Million)

27. Japan Alkylamines Market Size, 2023-2031 ($ Million)

28. South Korea Alkylamines Market Size, 2023-2031 ($ Million)

29. Rest Of Asia-Pacific Alkylamines Market Size, 2023-2031 ($ Million)

30. Latin America Alkylamines Market Size, 2023-2031 ($ Million)

31. Middle East And Africa Alkylamines Market Size, 2023-2031 ($ Million)