Allergic Diagnostics and Therapeutics Market Size

Allergic Diagnostics and Therapeutics Market Size, Share & Trends Analysis Report, By Product (Instruments and Consumables), By Drug Class (Antihistamines, Decongestants, Corticosteroids, Mast Cell Stabilizers, Leukotriene Inhibitors, Nasal Anticholinergic, Immunomodulators, Auto-Injectable Epinephrine and Immunotherapy), By End-User (Diagnostic Labs, Hospitals and Academic Research Institutions), Forecast, 2019-2025 Update Available - Forecast 2025-2031

The global allergy diagnostics and therapeutics market are estimated to grow at a CAGR of11.9% during the forecast period. The major factors contributing to the growth of the market include significant incidences of allergic diseases and emerging demand for innovative in-vitro diagnostic equipment. With the growing prevalence of food allergies coupled with sedentary lifestyle habits are leading to increasing demand for diagnostic tools and treatment to diagnose reaction and thereby recommending treatment to the patients. For instance, as per the Food Allergy Research & Education (FARE), in the US, the treatment of severe food allergy reactions increased by nearly 400% during the period, 2007 to 2016. Additionally, laboratory service costs to diagnose such reactions have also increased over the 10 years, surging by over 5,000%.

The number of food allergy reactions that require emergency treatment is increased substantially over the years, with a 377% growth in individually listed medical procedures or claim lines which is associated with anaphylaxis, a severe, life-threatening allergic reaction caused by food. Milk allergy is associated with the highest average costs and services per patient in 2016. This accounted for annual charges which surpass $1,000 per year in the US. Allergy to milk is concerned with toddlers and infants, who are usually prescribed a specialized formula to stimulate their growth and nutrition. Blood test and skin test is often recommended to determine the food allergy. This involves taking a blood sample to send to a laboratory for analysis. This, in turn, contributes to the demand for food allergy testing kits across laboratories.

Segmentation

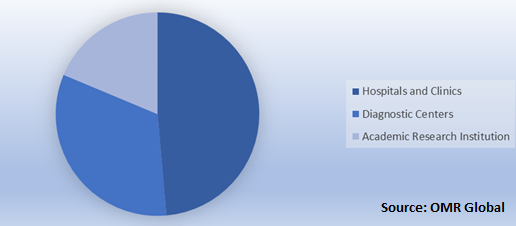

The global allergy diagnostics and therapeutics market are segmented on the basis of product, drug class, and end-user. Based on the product, the market is classified into instruments and consumables. Based on drug class, the market is classified into antihistamines, decongestants, corticosteroids, mast cell stabilizers, leukotriene inhibitors, nasal anticholinergic, immunomodulators, auto-injectable epinephrine, and immunotherapy. Based on end-user, the market is classified into diagnostic labs, hospitals and clinics, and academic research institutions.

Global Allergy Diagnostics and TherapeuticsMarket: By End-User

Hospital and clinic segment is anticipated to hold the major share in the market in 2018 owing to an increasing number of hospitals across several countries. For instance, in 2015, the number of hospitals increased to 196,312 and the number of sub-centers reached 156,926 in India. Furthermore, the increasing number of multi-specialty hospitals have witnessed across the countries. There are an in-house diagnostic laboratory and medical pharmacies in several hospitals that provide convenience to the patients. Additionally, the availability of skilled professionals in hospitals ensures patients for accurate treatment of the condition, which in turn, is contributing to the demand for allergy drugs and diagnostic tests in hospitals and clinics.

Global Allergy Diagnostics and Therapeutics Market Share by End-User, 2018 (%)

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Thermo Fisher Scientific, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Stallergenes Greer PLC

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Siemens AG

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. bioMerieux SA

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Hitachi Chemical Diagnostics, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Allergy Diagnostics and Therapeutics Market by Product

5.1.1. Instruments

5.1.2. Consumables

5.2. Global Allergy Diagnostics and Therapeutics Market by Drug Class

5.2.1. Antihistamines

5.2.2. Decongestants

5.2.3. Corticosteroids

5.2.4. Mast Cell Stabilizers

5.2.5. Leukotriene Inhibitors

5.2.6. Nasal Anticholinergic

5.2.7. Immunomodulators

5.2.8. Auto Injectable Epinephrine

5.2.9. Immunotherapy

5.3. Global Allergy Diagnostics and Therapeutics Market by End-User

5.3.1. Diagnostic Labs

5.3.2. Hospitals and Clinics

5.3.3. Academic Research Institutions

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Allergan PLC

7.2. Allergy Therapeutics PLC

7.3. bioMérieux SA

7.4. Danaher Corp.

7.5. HAL Allergy Group

7.6. Hitachi Chemical Diagnostics, Inc.

7.7. HOB Biotech GroupCorp., Ltd.

7.8. Hycor Biomedical, LLC

7.9. Lincoln Diagnostics, Inc.

7.10. Omega Diagnostics Group PLC

7.11. PerkinElmer, Inc.

7.12. Quest Diagnostics, Inc.

7.13. Siemens AG

7.14. Stallergenes Greer PLC

7.15. Thermo Fisher Scientific, Inc.

- GLOBAL ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

- GLOBAL ALLERGY DIAGNOSTICS AND THERAPEUTICSINSTRUMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL ALLERGY DIAGNOSTICS AND THERAPEUTICS CONSUMABLES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2018-2025 ($ MILLION)

- GLOBAL ANTIHISTAMINES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL DECONGESTANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL CORTICOSTEROIDS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL MAST CELL STABILIZERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL LEUKOTRIENE INHIBITORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL NASAL ANTICHOLINERGIC MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL IMMUNOMODULATORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL AUTO-INJECTABLE EPINEPHRINE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL IMMUNOTHERAPY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

- GLOBAL ALLERGY DIAGNOSTICS AND THERAPEUTICSIN DIAGNOSTIC LABS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL ALLERGY DIAGNOSTICS AND THERAPEUTICS IN HOSPITALSAND CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL ALLERGY DIAGNOSTICS AND THERAPEUTICS IN ACADEMIC RESEARCH INSTITUTIONSMARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

- NORTH AMERICAN ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- NORTH AMERICAN ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

- NORTH AMERICAN ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2018-2025 ($ MILLION)

- NORTH AMERICAN ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

- EUROPEAN ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- EUROPEAN ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

- EUROPEAN ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2018-2025 ($ MILLION)

- EUROPEAN ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

- ASIA-PACIFIC ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- ASIA-PACIFIC ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

- ASIA-PACIFIC ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2018-2025 ($ MILLION)

- ASIA-PACIFIC ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY END-USER 2018-2025 ($ MILLION)

- REST OF THE WORLD ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

- REST OF THE WORLD ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2018-2025 ($ MILLION)

- REST OF THE WORLD ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

- GLOBAL ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET SHARE BY PRODUCT, 2018 VS 2025 (%)

- GLOBAL ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET SHARE BY DRUG CLASS, 2018 VS 2025 (%)

- GLOBAL ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET SHARE BY END-USER, 2018 VS 2025 (%)

- GLOBAL ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

- US ALLERGY DIAGNOSTICS AND THERAPEUTICSMARKET SIZE, 2018-2025 ($ MILLION)

- CANADA ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET SIZE, 2018-2025 ($ MILLION)

- UK ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET SIZE, 2018-2025 ($ MILLION)

- FRANCE ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET SIZE, 2018-2025 ($ MILLION)

- GERMANY ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET SIZE, 2018-2025 ($ MILLION)

- ITALY ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET SIZE, 2018-2025 ($ MILLION)

- SPAIN ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET SIZE, 2018-2025 ($ MILLION)

- ROE ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET SIZE, 2018-2025 ($ MILLION)

- INDIA ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET SIZE, 2018-2025 ($ MILLION)

- CHINA ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET SIZE, 2018-2025 ($ MILLION)

- JAPAN ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET SIZE, 2018-2025 ($ MILLION)

- REST OF ASIA-PACIFIC ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET SIZE, 2018-2025 ($ MILLION)

- REST OF THE WORLD ALLERGY DIAGNOSTICS AND THERAPEUTICS MARKET SIZE, 2018-2025 ($ MILLION)