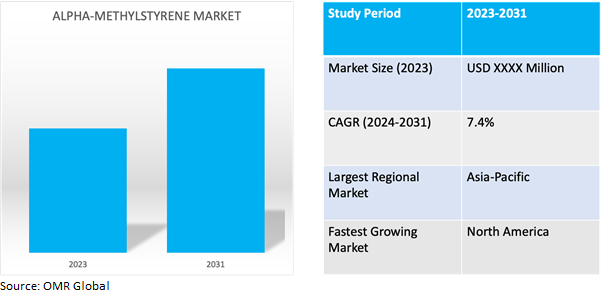

Alpha-Methylstyrene Market

Alpha-Methylstyrene Market Size, Share & Trends Analysis Report by Purity (95%-99% and >99.5%). and by End-Use (Automotive, Electronics, Chemical Manufacturing, and Personal Care & Cosmetics). Forecast Period (2024-2031).

Alpha-methylstyrene market is anticipated to grow at a CAGR of 7.4% during the forecast period (2024-2031). Alpha-methylstyrene is a colorless liquid organic compound with a distinctive aromatic odor. It is derived from styrene through a process called alpha-methylation. Alpha-methylstyrene is primarily used as a monomer in the production of resins, plastics, and specialty chemicals. It possesses several desirable properties, including high heat resistance, chemical stability, and compatibility with various solvents. Due to these characteristics, alpha-methylstyrene finds applications in a wide range of industries, including the manufacture of synthetic rubbers, thermoplastics, adhesives, coatings, and specialty resins.

Market Dynamics

Alpha-Methylstyrene's Essential Role in Resin Production Across Diverse Industries

Demand drivers are the catalysts that stimulate the need for alpha-methylstyrene (AMS) in various industries. Primarily, the demand for AMS stems from its critical role in the production of resins, particularly ABS and SAN resins. These resins find wide-ranging applications in industries such as automotive, electronics, and construction. AMS serves as a crucial component in these resin formulations, imparting desirable properties like strength, durability, and heat resistance. As industries evolve and consumer preferences shift towards lightweight and durable materials, the demand for AMS-based resins continues to grow.

Alpha-Methylstyrene's Key Applications Across Automotive, Electronics, and Construction Industries

End-user industries play a pivotal role in shaping the demand for alpha-methylstyrene (AMS) and its derivatives. The automotive sector, for instance, relies heavily on AMS-based ABS resins for manufacturing lightweight components that improve fuel efficiency and reduce emissions. Similarly, the electronics industry utilizes AMS-derived resins in the production of casings and components for various devices due to their electrical insulation properties and mechanical strength. Additionally, the construction sector utilizes AMS-based SAN resins in applications such as pipes, fittings, and insulation materials.

Market Segmentation

Our in-depth analysis of the global alpha-methylstyrene market includes the following segments by purity and end-use:

- Based on purity, the market is segmented into 95%-99% and >99.5%.

- Based on end-use, the market is segmented into automotive, electronics, chemical manufacturing, and personal care & cosmetics.

Automotive is Projected to Emerge as the Largest Segment

The automotive segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the increasing demand for lightweight materials to enhance fuel efficiency and reduce emissions in vehicles. Alpha-methylstyrene-based resins, particularly acrylonitrile-butadiene-styrene (ABS), are widely used in the automotive industry for manufacturing lightweight components such as bumpers, interior trims, and panels. These ABS components offer a favorable strength-to-weight ratio, impact resistance, and design flexibility, making them ideal for automotive applications.

>99.5% Segment to Hold a Considerable Market Share

The >99.5% purity segment commands a significant market share in the global alpha-methylstyrene (AMS) market due to its assurance of high-quality, consistent performance, and regulatory compliance. Industries such as automotive, electronics, and healthcare prioritize AMS with stringent purity requirements to ensure superior product performance, reliability, and safety. The exceptional purity level of >99.5% AMS enhances process efficiency, reduces waste, and meets the demanding standards of critical applications. End-users favor high-purity AMS for its reliability, driving its dominance in the market as the preferred choice for diverse industrial applications.

Regional Outlook

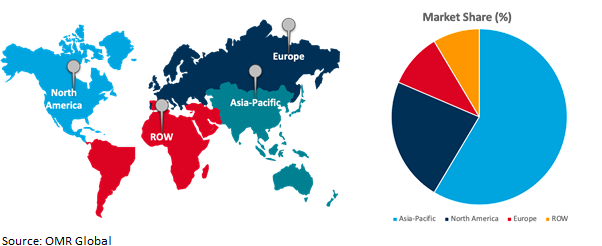

The global alpha-methylstyrene market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Emerges as Hub of Growth and Innovation in the AMS Market

North America leads as the fastest-growing market in the global alpha-methylstyrene (AMS) market due to a combination of factors such as increasing demand from thriving industries that include automotive and electronics propels the need for AMS-based resins, particularly for lightweight and eco-friendly applications. Technological advancements and strategic investments in capacity expansions and research further accelerate market growth. Additionally, North America's focus on sustainability and stringent environmental regulations drive the adoption of AMS as a greener alternative, fostering market expansion. With stable economic conditions and a conducive business environment, North America emerges as a lucrative hub for AMS market growth and innovation.

Global Alpha-Methylstyrene Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, North America holds a significant share due to the region's burgeoning industrial sectors, including automotive, electronics, and construction, driving significant demand for AMS-based resins. Rapid urbanization and industrialization fuel the need for lightweight, durable materials, where AMS plays a crucial role. Additionally, Asia-Pacific's manufacturing prowess and cost-effective production processes make it a key production hub for AMS and its derivatives.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global alpha-methylstyrene market include Mitsubishi Chemical Corp., Solvay, AdvanSix, Mitsui Chemicals, Inc., and INEOS AG, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, In May 2023, AdvanSix announced the expansion of its AMS production facility in the US. The expansion will increase the company's AMS production capacity by 50.0%.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global alpha-methylstyrene market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Mitsubishi Chemical Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Solvay SA

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. AdvanSix

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Alpha-Methylstyrene Market by Purity

4.1.1. 95%-99%

4.1.2. >99.5%

4.2. Global Alpha-Methylstyrene Market by End-use

4.2.1. Automotive

4.2.2. Electronics

4.2.3. Chemical Manufacturing

4.2.4. Personal Care & Cosmetics

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

7. Altivia Corporation

8. Cepsa

9. Changzhou Qidi Chemical Co., Ltd.

10. Deepak

11. Domo Chemicals

12. ENI S.P.A.

13. INEOS Group Holdings S.A.

14. Jinzhou Petrochemical Co, Ltd.

15. Kraton Corporation

16. Kumho P&B Chemicals

17. Mitsui Chemicals, Inc.

18. Prasol Chemicals Ltd.

19. Rosneft

20. Seqens

21. SI Group, Inc.

22. Taiwan Prosperity Chemical Corp. (TPCC)

23. Yangzhou Lida Chemical Co., Ltd.

1. GLOBAL ALPHA METHYLSTYRENE MARKET RESEARCH AND ANALYSIS BY PURITY, 2023-2031 ($ MILLION)

2. GLOBAL 95%-99% ALPHA METHYLSTYRENE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL >99.5% ALPHA METHYLSTYRENE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL ALPHA METHYLSTYRENE MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

5. GLOBAL ALPHA METHYLSTYRENE FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL ALPHA METHYLSTYRENE FOR ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL ALPHA METHYLSTYRENE FOR CHEMICAL MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL ALPHA METHYLSTYRENE FOR PERSONAL CARE & COSMETICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL ALPHA METHYLSTYRENE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. NORTH AMERICAN ALPHA METHYLSTYRENE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

11. NORTH AMERICAN ALPHA METHYLSTYRENE MARKET RESEARCH AND ANALYSIS BY PURITY, 2023-2031 ($ MILLION)

12. NORTH AMERICAN ALPHA METHYLSTYRENE MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

13. EUROPEAN ALPHA METHYLSTYRENE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. EUROPEAN ALPHA METHYLSTYRENE MARKET RESEARCH AND ANALYSIS BY PURITY, 2023-2031 ($ MILLION)

15. EUROPEAN ALPHA METHYLSTYRENE MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

16. ASIA-PACIFIC ALPHA METHYLSTYRENE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. ASIA-PACIFIC ALPHA METHYLSTYRENE MARKET RESEARCH AND ANALYSIS BY PURITY, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC ALPHA METHYLSTYRENE MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

19. REST OF THE WORLD ALPHA METHYLSTYRENE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. REST OF THE WORLD ALPHA METHYLSTYRENE MARKET RESEARCH AND ANALYSIS BY PURITY, 2023-2031 ($ MILLION)

21. REST OF THE WORLD ALPHA METHYLSTYRENE MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

1. GLOBAL ALPHA METHYLSTYRENE MARKET SHARE BY PURITY, 2023 VS 2031 (%)

2. GLOBAL 95%-99% ALPHA METHYLSTYRENE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL >99.5% ALPHA METHYLSTYRENE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL ALPHA METHYLSTYRENE MARKET SHARE BY END-USE, 2023 VS 2031 (%)

5. GLOBAL ALPHA METHYLSTYRENE FOR AUTOMOTIVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL ALPHA METHYLSTYRENE FOR ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL ALPHA METHYLSTYRENE FOR CHEMICAL MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL ALPHA METHYLSTYRENE FOR PERSONAL CARE & COSMETICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL ALPHA METHYLSTYRENE MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. US ALPHA METHYLSTYRENE MARKET SIZE, 2023-2031 ($ MILLION)

11. CANADA ALPHA METHYLSTYRENE MARKET SIZE, 2023-2031 ($ MILLION)

12. UK ALPHA METHYLSTYRENE MARKET SIZE, 2023-2031 ($ MILLION)

13. FRANCE ALPHA METHYLSTYRENE MARKET SIZE, 2023-2031 ($ MILLION)

14. GERMANY ALPHA METHYLSTYRENE MARKET SIZE, 2023-2031 ($ MILLION)

15. ITALY ALPHA METHYLSTYRENE MARKET SIZE, 2023-2031 ($ MILLION)

16. SPAIN ALPHA METHYLSTYRENE MARKET SIZE, 2023-2031 ($ MILLION)

17. REST OF EUROPE ALPHA METHYLSTYRENE MARKET SIZE, 2023-2031 ($ MILLION)

18. INDIA ALPHA METHYLSTYRENE MARKET SIZE, 2023-2031 ($ MILLION)

19. CHINA ALPHA METHYLSTYRENE MARKET SIZE, 2023-2031 ($ MILLION)

20. JAPAN ALPHA METHYLSTYRENE MARKET SIZE, 2023-2031 ($ MILLION)

21. SOUTH KOREA ALPHA METHYLSTYRENE MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF ASIA-PACIFIC ALPHA METHYLSTYRENE MARKET SIZE, 2023-2031 ($ MILLION)

23. LATIN AMERICA ALPHA METHYLSTYRENE MARKET SIZE, 2023-2031 ($ MILLION)

24. MIDDLE EAST AND AFRICA ALPHA METHYLSTYRENE MARKET SIZE, 2023-2031 ($ MILLION)