Alternative Tourism Market

Alternative Tourism Market Size, Share & Trends Analysis Report by Tourism Type (Ecotourism, Dark Tourism, Volunteer Tourism, Rural Tourism, and Others), and by Tour Package (Independent Traveller, Tour Group, and Package Traveller) Forecast Period (2023-2029) Update Available - Forecast 2025-2035

Alternative tourism market is anticipated to grow at a considerable CAGR of 6.9% during the forecast period. The growth of the market is attributed to factors such as a surge in new and innovative tour packages that cater to the evolving demands and interests of travelers. As per the travel agency EaseMyTrip, in 2020, there has been a 60% increase in demand for holy destinations or spiritual or wellness tour packages. And, women aged between 30-35 are leading the search. The growth of the market is attributed to the surge in new and innovative tour packages that cater to the evolving demands and interests of travelers. Also, the growing funding from the government and other organizations to support the tourism industry is anticipated to drive the market for alternative tourism. For instance, in March 2022, the US destination marketing body, Brand USA received $250 million in funding from the US Government to promote inbound travel in key markets. The grant, which falls under the Restoring Brand USA Act, marks an important milestone in the US travel and tourism industry’s recovery following the country’s opening to international travelers.

Segmental Outlook

The global alternative tourism market is segmented based on its tourism type, and tour package. Based on its tourism type, the market is segmented into ecotourism, dark tourism, volunteer tourism, rural tourism, and others. based on the tour package, the market is categorized into independent travelers, tour groups, and package travelers. Among the tour package, the package traveler is anticipated to hold a prominent market share. The growth of the sub-segment is attributed to launches of attractive and discount packages from market players.

Among the tourism type segment, the ecotourism sub-segment is anticipated to register significant growth for the forecast period. Ecotourism is a form of alternative tourism that focuses on sustainable travel to natural areas, to promote conservation, support local communities, and minimize negative impacts on the environment. The growth of the ecotourism sub-segment is attributed to the factors such as a rise in disposable income and growing initiatives to fund and support eco-tourism and sustainable tourism practices. For instance, in February 2023, a new multi-million fund has been established to help support travel industry start-ups that are working to address the critical sustainability challenges faced by the tourism industry. The new initiative, labeled the Reset Tourism Fund, was launched by the UnTours Foundation. In addition to UnTours, the new fund is backed by some of the industry’s heaviest hitters and well-known names, including Expedia Group, TUI Care Foundation, Adventure Travel Trade Association (ATTA), Flywire, and B Tourism. Such funds are anticipated to promote ecotourism and sustainable tourism practices. Also, the growing launches of new and attractive packages from the key market players are anticipated to drive the subsegment of the market. For instance, in December 2021, KKday Australia a travel agency launched an ecotourism category. By partnering with ECO Certified suppliers, the company makes it easy for travelers to find tour operators who are committed to eco-friendly, sustainable, and responsible practices.

Regional Outlooks

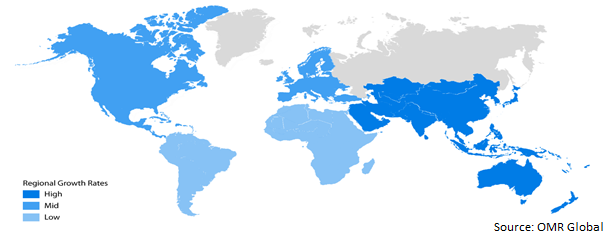

The global Alternative Tourism market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, the North American market is anticipated to cater to prominent growth over the forecast period. However, the Europe region is projected to experience considerable growth in the alternative tourism market. The growth of the market is attributed to rising disposable income and the proliferation of key market players in the region.

Global Alternative Tourism Market Growth, by Region 2023-2029

The Asia-Pacific Region is anticipated to Hold a Significant Share in the Global Alternative Tourism Market

Among these regions, the Asia-Pacific region is anticipated to account for a significant share of the Alternative Tourism market during the forecast period. The Asia-Pacific region is known for its rich cultural diversity, with many different ethnic groups, religions, and traditions. This diversity makes it an attractive destination for travelers who want to experience new and unique cultures. The region is also equipped with natural attractions, such as beaches, mountains, rainforests, and wildlife travel, and is often more affordable compared to other destinations. All these factors combined are anticipated to propel the demand for alternative tourism in the Asia-Pacific region.

Market Players Outlook

The major companies serving the global alternative tourism market include Expedia, Inc., priceline.com LLC, China Cyts Tours, American Express Global Business Travel, Carlson Wagonlit Travel, Bcd Travel (BCD Group), and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in January 2020, Lonely Planet teamed up with Intrepid Travel to launch Lonely Planet Experiences, a series of tours designed to positively impact local communities. The experiences are designed to have a low environmental footprint while having a positive impact on local communities. All tours will have a maximum of 16 travelers and be led by a local leader, use local transportation, and support local owned businesses.

The Report Covers

- Market value data analysis of 2023 and forecast to 2029.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Alternative Tourism market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Alternative Tourism Market by Tourism Type

4.1.1. Ecotourism

4.1.2. Dark Tourism

4.1.3. Volunteer Tourism

4.1.4. Rural Turism

4.1.5. Others

4.2. Global Alternative Tourism Market by Tour Package

4.2.1. Independent Traveller

4.2.2. Tour Group

4.2.3. Package Traveller

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Expedia, Inc.

6.2. priceline.com LLC

6.3. China Cyts Tours

6.4. American Express Global Business Travel

6.5. Carlson Wagonlit Travel

6.6. Bcd Travel (BCD Group)

6.7. Hrg North America

6.8. Travel Leaders Group

6.9. Fareportal

6.10. Aaa Travel

6.11. Corporate Travel Management

6.12. Travel And Transport

6.13. Altour

6.14. Direct Travel

6.15. World Travel Inc.

6.16. Omega World Travel

6.17. Frosch

6.18. Jtb Americas Group

6.19. Ovation Travel Group

1. GLOBAL ALTERNATIVE TOURISM MARKET RESEARCH AND ANALYSIS BY TOURISM TYPE, 2021-2029 ($ MILLION)

2. GLOBAL ECOTOURISM MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

3. GLOBAL DARK TOURISM MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

4. GLOBAL VOLUNTEER TOURISM MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

5. GLOBAL ALTERNATIVE TOURISM MARKET RESEARCH AND ANALYSIS BY TOUR PACKAGE, 2021-2029 ($ MILLION)

6. GLOBAL ALTERNATIVE TOURISM FOR INDEPENDENT TRAVELLER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

7. GLOBAL ALTERNATIVE TOURISM FOR TOUR GROUP MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

8. GLOBAL ALTERNATIVE TOURISM FOR PACKAGE TRAVELLER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

9. GLOBAL ALTERNATIVE TOURISM MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

10. NORTH AMERICAN ALTERNATIVE TOURISM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2029 ($ MILLION)

11. NORTH AMERICAN ALTERNATIVE TOURISM MARKET RESEARCH AND ANALYSIS BY TOURISM TYPE, 2021-2029 ($ MILLION)

12. NORTH AMERICAN ALTERNATIVE TOURISM MARKET RESEARCH AND ANALYSIS BY TOUR PACKAGE, 2021-2029 ($ MILLION)

13. EUROPEAN ALTERNATIVE TOURISM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2029 ($ MILLION)

14. EUROPEAN ALTERNATIVE TOURISM MARKET RESEARCH AND ANALYSIS BY TOURISM TYPE, 2021-2029 ($ MILLION)

15. EUROPEAN ALTERNATIVE TOURISM MARKET RESEARCH AND ANALYSIS BY TOUR PACKAGE, 2021-2029 ($ MILLION)

16. ASIA-PACIFIC ALTERNATIVE TOURISM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2029 ($ MILLION)

17. ASIA-PACIFIC ALTERNATIVE TOURISM MARKET RESEARCH AND ANALYSIS BY TOURISM TYPE, 2021-2029 ($ MILLION)

18. ASIA-PACIFIC ALTERNATIVE TOURISM MARKET RESEARCH AND ANALYSIS BY TOUR PACKAGE, 2021-2029 ($ MILLION)

19. REST OF THE WORLD ALTERNATIVE TOURISM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2029 ($ MILLION)

20. REST OF THE WORLD ALTERNATIVE TOURISM MARKET RESEARCH AND ANALYSIS BY TOURISM TYPE, 2021-2029 ($ MILLION)

21. REST OF THE WORLD ALTERNATIVE TOURISM MARKET RESEARCH AND ANALYSIS BY TOUR PACKAGE, 2021-2029 ($ MILLION)

1. GLOBAL ALTERNATIVE TOURISM MARKET SHARE BY TOURISM TYPE, 2021 VS 2028 (%)

2. GLOBAL ALTERNATIVE TOURISM FOR ECOTOURISM MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL DARK TOURISM MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL VOLUNTEER TOURISM BY MARKET SHARE REGION, 2021 VS 2028 (%)

5. GLOBAL RURAL TURISM TOURISM BY MARKET SHARE REGION, 2021 VS 2028 (%)

6. GLOBAL OTHERS TOURISM BY MARKET SHARE REGION, 2021 VS 2028 (%)

7. GLOBAL ALTERNATIVE TOURISM MARKET SHARE BY TOUR PACKAGE, 2021 VS 2028 (%)

8. GLOBAL ALTERNATIVE TOURISM FOR INDEPENDENT TRAVELLER MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL ALTERNATIVE TOURISM FOR TOUR GROUP MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL ALTERNATIVE TOURISM FOR PACKAGE TRAVELLER MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL ALTERNATIVE TOURISM MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. US ALTERNATIVE TOURISM MARKET SIZE, 2021-2029 ($ MILLION)

13. CANADA ALTERNATIVE TOURISM MARKET SIZE, 2021-2029 ($ MILLION)

14. UK ALTERNATIVE TOURISM MARKET SIZE, 2021-2029 ($ MILLION)

15. FRANCE ALTERNATIVE TOURISM MARKET SIZE, 2021-2029 ($ MILLION)

16. GERMANY ALTERNATIVE TOURISM MARKET SIZE, 2021-2029 ($ MILLION)

17. ITALY ALTERNATIVE TOURISM MARKET SIZE, 2021-2029 ($ MILLION)

18. SPAIN ALTERNATIVE TOURISM MARKET SIZE, 2021-2029 ($ MILLION)

19. REST OF EUROPE ALTERNATIVE TOURISM MARKET SIZE, 2021-2029 ($ MILLION)

20. INDIA ALTERNATIVE TOURISM MARKET SIZE, 2021-2029 ($ MILLION)

21. CHINA ALTERNATIVE TOURISM MARKET SIZE, 2021-2029 ($ MILLION)

22. JAPAN ALTERNATIVE TOURISM MARKET SIZE, 2021-2029 ($ MILLION)

23. SOUTH KOREA ALTERNATIVE TOURISM MARKET SIZE, 2021-2029 ($ MILLION)

24. REST OF ASIA-PACIFIC ALTERNATIVE TOURISM MARKET SIZE, 2021-2029 ($ MILLION)

25. REST OF THE WORLD ALTERNATIVE TOURISM MARKET SIZE, 2021-2029 ($ MILLION)